How are the terms of an on-site inspection calculated? Why might a check be suspended? Is it possible to cancel a decision just because deadlines are not met? What additional charges can be challenged in such cases? And when does delaying the audit period play into the hands of the taxpayer? Read the answers to these questions below.

To begin with, let us remind you how the Tax Code limits inspectors in terms of deadlines.

Deadlines for on-site tax audits in 2021

In fact, the maximum period for an on-site tax audit is 1 year. This is factual. And according to the law, the inspection cannot last longer than 6 months (or rather, the inspection can last 2 months, and then the period can be extended to 4, then to 6). This period is established by Art. 89 Tax Code of the Russian Federation. How does one get a year?

There is such a thing - suspension of an on-site tax audit. The tax office can suspend the audit as many times as desired. This is done so that inspection days are not wasted.

For example, the tax office has requested documents from counterparties and suspends the inspection until it receives a response: inspectors simply have nothing to do until a response is received from the counterparty. While the inspection is suspended, the inspection does not come to you for inspection, does not require documents, does not interrogate witnesses, etc. The total period of suspension of an on-site tax audit (maximum possible) is six months.

So it turns out: 6 months of the inspection itself, 6 months of suspension = 1 year. An on-site inspection can last exactly that long, and not a day more. The period is calculated from the date of the decision on the inspection until the date of drawing up the certificate of completion of the inspection.

Timing of scheduled on-site inspections of small businesses

In accordance with Art. 13 of Law No. 294-FZ, the total period for conducting scheduled on-site inspections in relation to one small business entity cannot exceed 50 hours per year for a small enterprise and 15 hours per year for a micro-enterprise. The criteria for classifying individuals as small and medium-sized businesses are given in the Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in the Russian Federation.”

What and when should the tax office do after the completion of the on-site audit?

After the audit is completed, other activities are carried out, and for each of them the Tax Code has prescribed deadlines:

- After drawing up a certificate of completion of the inspection, the inspectorate analyzes the information collected during the inspection and draws up an on-site inspection report. The tax office has up to 2 months to do this;

- delivery of the act to the taxpayer - up to 5 working days;

- making a decision on inspection - up to 10 working days;

- additional tax control measures - 1 month;

- sending a demand for payment of tax from the date of detection of arrears - 3 months;

- sending a request for payment of tax based on the results of the audit (that is, after a decision on it is made) - 20 working days.

How to prepare for the test

The visit of supervisory authorities does not mean that they can receive any data from any employees of the enterprise. The inspector, like the person being inspected, has certain rights and responsibilities. For example, a business can be inspected only in the presence of the owner or his authorized representative, and only they can give explanations on issues of financial and economic activities. Hired employees can answer inspectors only within the framework of their job descriptions - that is, only about their work, without giving an assessment or drawing conclusions about the enterprise as a whole.

According to statistics, during inspections of small businesses, seven main types of violations are most often identified. Accordingly, in order to prepare for an audit, you need to check the correct documentation and argumentation of such events:

- conclusion of a civil contract. It may not clearly state the responsibilities of the employer and employee;

- registration of an employment contract. Often employers draw up a document with errors or avoid concluding an agreement with employees;

- payment to the employee of a salary corresponding to the employment contract. An employee of an enterprise may receive less than what is required according to the documents;

- occupational safety and health training, medical examinations. Employees should be allowed to perform duties only after successfully testing their knowledge and providing the necessary certificates from the clinic;

- accounting of working time and payment when involving an employee to work on weekends and holidays, at night and overtime;

- dismissal of an employee at the initiative of the employer. Most violations are detected when staff numbers are reduced or an organization is liquidated;

- salary amount. It should not be lower than the minimum wage established by law.

For each violation detected, the supervisory authorities will set the amount of the fine. It corresponds to the significance of the offense; sometimes they can only issue a warning.

Is it possible to cancel a decision on an on-site audit only because the tax office violated deadlines?

The fact that the inspection often misses deadlines is not news. This can happen at any stage, but most often the tax office drags its feet on drawing up an inspection report and making a decision.

Companies wait months, or even years, for audit results. And this is reflected in her activities. How? For example, a counterparty may refuse to cooperate only because the company is still being checked. Nobody wants to work with the inspectorate and may become bankrupt due to additional charges.

And if, according to the results of the audit (which came late), additional charges are also rather large, then it’s “doubly offensive.” The companies are going to court to overturn the decision, citing violation of deadlines.

However, the courts refer to the position of the Constitutional Court of the Russian Federation: violation by the inspectorate of the deadlines for considering inspection materials does not prevent it from identifying non-payment of taxes and does not affect the legality of the decision. Therefore, this decision cannot be reversed simply because the verification deadlines were not met.

For example, in case No. A40-222695/2018, the tax authorities violated the deadline for making a decision on the audit. The company tried to overturn the decision through the court, but it didn’t work out. The three authorities were unanimous in their opinion: the tax authorities violated the deadlines because they were establishing all the circumstances of the violations.

Convenient for tax authorities, isn't it?

But if compliance with procedural deadlines were not important for protecting the rights of taxpayers, the law would not have established them. And in Letter No. ED-4-2/55 dated January 10, 2019, the inspectorate itself states: delaying inspection deadlines leads to inefficient use of tax office resources, an increase in complaints and harms the reputation of tax officials.

But things are still there... The conclusions of judicial practice are disappointing: the court, as a rule, does not overturn the tax decision only because of failure to meet deadlines.

Normative base

All areas of business activity are subject to control. The extensive list of supervisory structures includes: GIT, tax, Rostechnadzor, fire inspection, Rosfinnadzor. Each of them can come to the enterprise for an inspection, but this process is strictly regulated.

Main regulations:

- Regulations on state supervision, approved by Government Decree No. 875 of September 1, 2012 . At the beginning of 2021, significant adjustments were made to this act related to the risk-based approach to labor protection (Resolution No. 197 of February 16, 2017). These changes affected the frequency with which scheduled inspections of GIT are carried out.

- Law No. 294-FZ of December 26, 2008 , which regulates the timing and procedures of supervisory activities. This act ensures the protection of the rights of entrepreneurs in the process of state control.

| Federal Law No. 294-FZ covers most forms of control, but not all. For some events, special regulations apply. This is determined by Article 1 (clauses 3, 3.1, 4–4.2) of this law. |

Modern economic realities are changing rapidly and legislation reacts flexibly to this: changes and additions are periodically made to regulations. We recommend that you regularly monitor and study the latest editions in order to fully comply with the requirements of the law and successfully pass government audits.

What additional charges can be canceled if the on-site inspection deadlines are violated?

Let’s say that based on the results of an audit, you are charged: tax, penalties and a fine. It was not possible to challenge the decision (if you tried to do so). But there is a good chance to recoup some of the additional charges. We are talking about foam.

The longer the tax office delays the audit, the longer the taxpayer does not receive a request for payment of arrears. And the longer the company does not pay this arrears. This means that the period during which the penalty “drips” increases.

But in essence, penalties are compensation for material damage to the state. And it is not the company’s fault that the tax office violates the deadlines. In this case, damage to the treasury is indirectly caused by the inspection. And if the company pays penalties for the period when the deadlines were violated, then the budget will be illegally enriched.

Important! In case of inspection violations, it is necessary to calculate penalties not on the date of the decision made by the tax authorities in violation of the deadlines, but taking into account the deadlines that should have been met by the tax authority. That is, additional accrual of penalties for the period of an unreasonably prolonged inspection is unlawful. Otherwise, the inspection must prove the validity of the increase in the period provided for by law.

There is currently no extensive judicial practice on this issue. Apparently, not all taxpayers know and/or are ready to defend their rights. But if businesses start filing such claims en masse, then perhaps tax authorities will become more disciplined.

When violation of deadlines for an on-site tax audit is beneficial to the taxpayer

If above we talked about canceling the tax decision in case of violation of the audit deadlines, now we are talking about when there is no need to cancel the decision. And missed deadlines are an unexpected “trump card” for the company.

Namely: while the tax office is delaying deadlines, it may lose the right to forcibly collect arrears.

For example, in case No. A13-14512/2018, the tax service violated the deadlines for considering materials from an on-site tax audit, making a decision based on the results of the audit, sending a claim, and making a decision on collection.

The company went to court to overturn the decision on collection and won in three instances, because “...failure by tax authorities to comply with the deadlines provided for by the Tax Code does not increase the period for forced collection of arrears. This guarantees a certain time frame for possible government intervention in the taxpayer’s property sphere.”

But the fact that the inspectorate has lost the right to collect arrears by force does not deprive the inspection of the right to go to court for this arrears.

However, in our practice there is a case where, based on the results of an audit, we recognized the collection of tax debt from a taxpayer in violation of the statute of limitations for filing a lawsuit. Note that in that story it was a matter of violating the statute of limitations for going to court, and not of forced collection of arrears. But there have not been many such precedents recently.

What can cause an unscheduled inspection of a small business

If an enterprise is found to be in gross violation of legislation, the tax code or consumer rights, then inspections from various authorities cannot be avoided. In other cases, predicting an unscheduled inspection is quite difficult - many factors play a role here, including human ones.

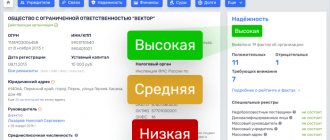

First of all, it should be alarming that tax authorities suddenly demanded from an individual entrepreneur or organization a full package of documents or any explanations regarding their business activities. You need to look at which counterparties transactions have been made with recently - perhaps among them there is an entity that has long been under suspicion by the Federal Tax Service.

Most often, tax audits occur for the following reasons:

- the tax base is formed with errors and contradictions;

- business tax contributions are lower than the industry average;

- in the reporting for this year there are significant differences in financial and economic indicators from last year’s values;

- The Federal Tax Service has received information that contradicts the entrepreneur’s testimony in his reporting;

- taxes are paid late, reporting is not submitted on time.

A conflict with a competitor can also provoke an unscheduled inspection - the owner of the enterprise can file a statement with serious charges to the prosecutor or other authorities.

conclusions

It is almost impossible to cancel the tax authorities’ decision on an on-site audit just because deadlines were missed. Court decisions in such cases are not in favor of business.

Tax officials do not have the right to artificially “increase” the arrears through penalties, violating the audit deadlines. When calculating penalties, only reasonable inspection periods are taken into account.

The company may benefit from tax authorities violating audit deadlines. Unlawfully delaying the inspection does not increase the period for collecting the arrears, which means that the inspection may “miss” the right of forced collection.

Source: website.