Accounts receivable and accounts payable represent, respectively, the property and financial obligations of an organization. According to the current Regulations regulating the maintenance of accounting and reporting, approved by Order No. 34-n dated July 29, 1998 of the Ministry of Finance (clause 27), conducting an inventory of payments is a mandatory procedure when preparing annual reporting and in some other cases. In addition to the mandatory one, an inventory can also be carried out in accordance with production, management and other needs by decision of management.

Question: As part of the inventory, accounts payable with an expired statute of limitations were identified - an unclaimed amount of wages. How should unwithheld personal income tax from deposited wages be taken into account in tax accounting for the purposes of calculating income tax? View answer

The timing of the inventory of calculations and the frequency are fixed in the Accounting Policy and in other regulatory acts of the organization in accordance with clause 2.1 of the Methodological Instructions for Inventory from the Ministry of Finance, model 1995 (approved by Order No. 49 of 13-06-95).

Question: Are accounts receivable with an expired statute of limitations, identified during the inventory, written off in income tax expenses as a bad debt if no attempts were made to contact the debtor? View answer

LEGAL REQUIREMENTS REGARDING INVENTORY OF ACCOUNTS RECEIVABLE

It is necessary to timely inventory accounts receivable for a number of important reasons. Firstly , this is a legal requirement. According to paragraph 1 of Art. 11 of Federal Law No. 402-FZ dated December 6, 2011 (as amended on November 28, 2018) “On Accounting” (hereinafter referred to as Federal Law No. 402-FZ), assets and liabilities are subject to inventory.

Secondly , current data is needed for management accounting purposes. It is impossible to draw the right conclusions and make the right decisions if you have outdated information. Thirdly , inventory as one of the forms of control over the amount of accounts receivable is very important in order to maintain the required amount of working capital of the enterprise.

It would be irrational to make different inventories for different purposes. One for accounting, the second for management, etc. The inventory results must be impeccably documented so that they are recognized by third parties - counterparties, tax authorities, courts.

For whatever reasons an inventory of payments is carried out, it is important to know and comply with the legal requirements in this regard. Therefore, let us familiarize ourselves with the relevant provisions of regulations.

According to clause 27 of the Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n (as amended on April 11, 2018) “On approval of the Regulations on accounting and financial reporting in the Russian Federation,” inventory is mandatory :

- when transferring property for rent, redemption, sale;

- when transforming a state or municipal unitary enterprise;

- before drawing up annual financial statements (except for property, the inventory of which was carried out no earlier than October 1 of the reporting year);

- when changing financially responsible persons (on the day of acceptance and transfer of cases);

- when facts of theft, abuse or damage to property are revealed (immediately upon establishment of such facts);

- in the event of a natural disaster, fire or other emergency situations caused by extreme conditions (immediately after the end of the fire or natural disaster);

- during reorganization or liquidation of the organization;

- in other cases provided for by the legislation of the Russian Federation.

Similar norms are contained in clause 1.5 of the Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49 (as amended on November 8, 2010) “On approval of the Methodological Guidelines for the Inventory of Property and Financial Liabilities.”

An important point: inventory is carried out not only in cases established by regulatory legal acts. Inventory at an enterprise can be carried out in other cases, as well as at other times.

The cases, timing and procedure for conducting an inventory, as well as the list of objects subject to inventory, are determined by the economic entity, with the exception of the mandatory inventory (Article 11 of Federal Law No. 402-FZ).

The manager, due to the specifics of the activities of his enterprise and the characteristics of the production process, determines with what frequency and in what time frame it is advisable to carry out inventories, as well as the procedure for their implementation.

This point is specified in the order on the accounting policy of the enterprise. This is a legal requirement. Clause 4 of the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n (as amended on April 28, 2017) instructs an economic entity, when developing an accounting policy, to provide for the procedure for conducting an inventory of assets and obligations.

To carry out inventory, the enterprise creates a permanent (working) inventory commission, the composition of which is approved by the head of the organization. The commission may include accounting and administrative staff, economists, representatives of the internal audit service or independent audit organizations.

NOTE

To carry out an inventory, the presence of all members of the inventory commission is necessary. The absence of at least one member of the commission serves as grounds for declaring the inventory results invalid.

The inventory is preceded by the issuance of an order to conduct an inventory. Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 (as amended on May 3, 2000) “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results” approved a special form of such an order - No. INV-22 .

An important point: from 01/01/2013, the forms of primary accounting documents contained in albums of unified forms of primary accounting documentation are not mandatory for use. In this regard, the enterprise can issue an order (decree, instruction) to conduct an inventory in any form. The main thing is to comply with legal requirements regarding the availability of mandatory document details.

The order under consideration appoints the chairman and members of the inventory commission, indicates the specific object of the inventory, the timing of its implementation and the date of submission of materials to the accounting department.

The order (resolution, instruction) is signed by the head of the organization and handed over to the chairman of the inventory commission. It must be registered in the Logbook for monitoring the implementation of orders (decrees, instructions) on inventory ( form No. INV-23 ).

FEATURES OF INVENTORY OF ACCOUNTS RECEIVABLE

The main purpose of inventory of accounts receivable is to check the validity of the amounts in the accounting accounts. Accounts receivable can arise and be accounted for in the following accounting accounts:

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers”;

- 68 “Calculations for taxes and fees”;

- 69 “Calculations for social insurance and security”;

- 70 “Settlements with personnel for wages”;

- 71 “Settlements with accountable persons”;

- 73 “Settlements with personnel for other operations”;

- 75 “Settlements with founders”;

- 76 “Settlements with various debtors and creditors.”

Arrears must be confirmed by primary documents: contracts, invoices, certificates of work performed (services rendered), universal transfer documents ( UTD ), salary statements, payment orders, cash receipts and debit orders, advance reports, accounting statements, etc. .

Accounts payable

Accounts 76, 60, 62. The organization's debt to suppliers (contractors) for supplies, advances from buyers (customers), and other debts to counterparties.

Accounts 68,69. Debt on taxes, payment of obligatory amounts to the Funds.

Accounts 70, 71, 73. Debt in terms of wages for personnel, compensation payments to employees, overexpenditures on advance reports of individual accountable persons.

Scores 66.67. Unpaid amounts on bank loans and interest on them.

Account 75. Dividends not paid to the founders.

INVENTORY OF ACCOUNTS RECEIVABLE FOR WAGES AND ACCOUNTABLE PERSONS

During the inventory of receivables for wages, in addition to confirming the validity of the amounts listed, the reasons for the overpayment are established. They check the primary documents that served as the basis for the payment. In this case, there is no need to carry out an inventory of receivables for wages with a complete check of labor calculations. Accruals and payments are verified only to the extent necessary to confirm the validity and reality of the debts.

It is necessary to find out whether there are any debts owed by dismissed employees, to assess the reality of the amounts listed and the possibility of repaying them by returning funds from the employee or offsetting them with accruals for the reporting period.

Accountable persons control the dates of payments and the intended purpose. They check whether the dismissed employees have any outstanding debts. Find out whether accountable advances are overdue. The debt will be overdue if the deadline for submitting the advance report has expired.

According to clause 6.3 of the Bank of Russia Directive No. 3210-U dated March 11, 2014 (as amended on June 19, 2017) “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses,” the accountable entity is obliged to , not exceeding three working days after the expiration date for which cash was issued on account, or from the date of going to work, present to the chief accountant or accountant (in their absence - to the manager) an advance report with attached supporting documents. An important point: the deadline for the report is set by the head of the enterprise.

The commission examines the availability of documents confirming the intended use of the amounts issued, payments to the employee and refunds, if any.

INVENTORY OF ACCOUNTS RECEIVABLES OF SUPPLIERS AND BUYERS

For advances to suppliers, the relevant documents are checked - the basis for such payments (invoices, contracts, memos). It is advisable to check the availability of all necessary approvals at the enterprise in accordance with internal regulations regarding payments made.

The process of confirming the validity of amounts for suppliers and buyers will involve the formation of special documents - reconciliation reports in the context of the calculations being carried out.

The reconciliation report indicates in chronological order all transactions for a given partner, an agreement with him, or another basis. Then the total settlement amounts for the reconciled period are displayed. For suppliers, these are the amounts of payments and the receipt of goods, works, services; for buyers, these are payments and shipment of products, performance of work, provision of services. Based on this data, the final amount of debt is derived in favor of one or the other party.

The reconciliation report is signed by the head of the enterprise, and by proxy - by any person authorized by him. Having a power of attorney for an authorized person is very important. Thus, in the Determination of the Supreme Arbitration Court of the Russian Federation dated August 21, 2013 No. VAS-11147/13 in case No. A67-6327/2012 it is stated that by virtue of Art. 53 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the chief accountant is not a person entitled to act on behalf of the enterprise without a power of attorney. The reconciliation act can be signed as authorized persons by the sole executive body of the defendant or by a representative acting on the basis of a power of attorney issued by such body, which contains the authority to perform a particular action.

If there is no power of attorney in the file confirming the authority of the chief accountant to acknowledge the debt, his signature on the reconciliation act does not constitute an acknowledgment of the debt by the defendant; the act itself is a basis for interrupting the limitation period.

If the counterparty agrees with the data given in the reconciliation report, he also signs this document. If there are discrepancies, the partner indicates his data and his results. In this case, you have to check the validity of its amounts and clarify whether an error has crept into your own accounting.

In a similar way, an inventory of the amounts of “receivables” listed on account 76 “Settlements with various debtors and creditors” is carried out.

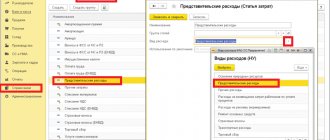

It is advisable to highlight debt incurred in connection with the sale of goods, performance of work, and provision of services. The fact is that only for such debt the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) allows the creation of a reserve for doubtful debts. For the purpose of possible formation of such a reserve, it is better to provide in advance for the separate allocation of such debts.

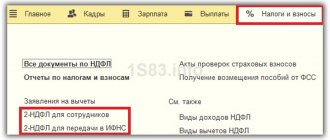

Inventory of settlements with suppliers and customers in 1C: Accounting ed. 3.0

Published 03/02/2020 14:48 Author: Administrator In anticipation of the submission of annual financial statements, we continue a series of publications on the topic of inventory. Today we’ll talk about carrying out this procedure in relation to suppliers and buyers.

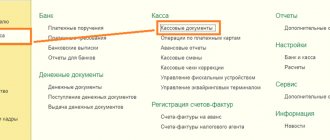

To carry out an inventory of settlements with counterparties in 1C: Accounting ed. 3.0, special documents are provided. They are located in the sections “Purchases” or “Sales” - “Calculation Inventory Acts”.

In previous publications it has already been said that the inventory procedure must begin with the issuance of an order. For more information on how to do this, read the article Inventory of goods and materials in 1C: Accounting.

Before carrying out an inventory, it is necessary to reconcile mutual settlements with counterparties. The timing of the start of the reconciliation procedure with counterparties can also be reflected in the inventory order.

When conducting an inventory with counterparties, it should be taken into account that the annual inventory must be carried out as of December 31 inclusive (letter of the Ministry of Finance of Russia dated January 9, 2013 No. 07-02-18/01). Accordingly, in order for the data to be relevant, it is better to conduct an inventory at the end of December with the registration of the inventory results in the first half of January of the next year. Then you will have time to send reconciliation reports to counterparties and receive signed documents from them.

For example, the order can indicate the following dates for the inventory:

The procedure for inventorying settlements with counterparties involves reconciling mutual settlements, checking the presence/absence of primary documents, and identifying overdue debts.

The reconciliation report is drawn up for each counterparty in two copies (for each party). The legislation does not provide for a unified form of the reconciliation report. Therefore, each company develops it independently (letter of the Ministry of Finance of Russia dated February 18, 2005 No. 07-05-04/2).

In the 1C program: Accounting ed. 3.0 there is already a reconciliation report form that contains all the necessary details and complies with the requirements of Law No. 402-FZ of December 6, 2011 “On Accounting”. This act is located in the “Purchases/Sales” section, subsection “Settlements with counterparties”, then the document “Act of Reconciliation of Settlements”.

To generate a new reconciliation report, click on the “Create” button:

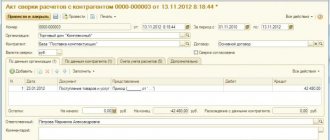

Fill out the header of the reconciliation report, indicating the counterparty, agreement, reconciliation period and currency.

Please note that if several agreements have been concluded with a counterparty and they are entered into the program, then you can generate a reconciliation report for all agreements. To do this, click on the cross in the “Agreement” field; this field will become “empty”. Next, click the “Fill” button to generate a general reconciliation report for all contracts.

Then select accounts for accounting settlements with the counterparty.

On the "Advanced" tab, fill in the signatories.

Please note that the reconciliation report must be signed by an authorized person of the counterparty on both sides. We recommend checking the authority of the signatory, especially if there is a debt. Otherwise, when going to court, this act may be challenged.

To fill out the table section, click on the “Fill” button.

When you click on the “Fill” button, you will be given the right to choose: fill out the tabular part only for your company, or for your company and counterparty. In the second case, the tabular parts of both sides will be filled in, according to your accounting.

Before sending the document for printing, carefully check the completed tabular part. In case of inaccuracies (for example, incomplete reflection of documents), it can be corrected.

Print out the completed reconciliation report in two copies, sign on your part and send to the counterparty with accompanying text approximately as follows: We are sending you a reconciliation report of mutual settlements as of “___”_______20__. We ask you to sign and return to us one copy of the act, or disagreements regarding the reconciliation act, with the attachment of supporting documents (acts, invoices, invoices) within ... a day. In case of failure to receive the signed act within the specified period, or if there are disagreements regarding it, we will consider the settlement balance confirmed.

After the signed reconciliation act has been returned to you, you must again enter the previously created reconciliation act and check the “Reconciliation approved” checkbox.

This action will make the document inactive, i.e. The user will no longer be able to edit the document.

After receiving the reconciliation reports, data on receivables/payables is entered into a certificate, which is an appendix to the report in form No. INV-17.

The standard 1C: Accounting 3.0 program does not provide for the generation of a certificate for the INV-17 act. Therefore, you will have to fill it out manually.

The certificate shall indicate the name, address and telephone number of the debtor/creditor, the date and reason for the debt, the amount of the debt, and details of the supporting document.

We also recommend that you indicate in the certificate the payment term under the contract. It will be needed to subsequently determine what amounts to include in the reserve for doubtful debts.

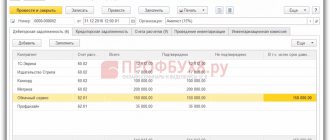

Based on the certificate, an inventory report of settlements with buyers, suppliers and other debtors and creditors is drawn up in form No. INV-17. It is located in the “Purchases/Sales” section, subsection “Settlements with counterparties”, then “Settlements Inventory Act”.

Let's start filling out the tabs of this document from the end. We filled out the first two immediately before the inventory, when we drew up the order to carry it out:

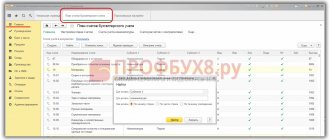

On the “Settlement Accounts” tab, click on the “Fill” button and the tabular part will be filled with accounting accounts. All you have to do is check and adjust the list of accounts for which the inventory of settlements with counterparties is carried out:

Next, you need to fill in the debt information directly. There are two ways to go here:

1) Click the “Fill” button in the document header. In this case, information will be selected on the corresponding (receivable/payable) debt (counterparty, settlement account, amount) as of the date of the document.

2) Click the “Fill” button on the corresponding “Accounts Receivable/Accounts Payable” tab. In this case, the information will be filled in only on this tab.

In the “Not confirmed” column, you should indicate the amount of debt for which there is no documentary evidence (if any). In the column “Incl. the statute of limitations has expired" indicate the amount of debt for which the statute of limitations has expired - it will subsequently be subject to write-off.

The act is drawn up in two copies and signed by members of the inventory commission. The commission keeps one copy of the act for itself, and transfers the second to the accounting department.

The inventory results are presented to the manager for approval, and he makes a decision on creating reserves for doubtful debts and writing off debts with an expired statute of limitations. An example of an order is attached below.

Order to write off bad receivables

Next, the organization can write off the identified debt with an expired statute of limitations using the Debt Adjustment document. Read how to do this in our article Using the document “Debt Adjustment” in 1C: Enterprise Accounting 8

Author of the article: Anna Kulikova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Olga Yushkina 03/17/2021 14:27 After filling out, all debt becomes confirmed. those. it is assumed that there is already an agreed and signed reconciliation report with all spacecraft. If there are few debtors and creditors, then it is quite possible that at the time the inventory report is generated, all AS will be signed, discrepancies will be identified, etc. But when there are a lot of debtors and creditors, the process of signing an agreement is certainly delayed. As practice shows, ACs are often not returned and not all ACs are reconciled. Therefore, it is reasonable to unload the debt into UNCONFIRMED and then make changes to this act as the reconciliation acts are signed. In my opinion, this is more logical than unloading it, then moving it like a monkey to an unconfirmed page, etc.

Quote

Update list of comments

JComments

INVENTORY OF ACCOUNTS RECEIVABLE OF THE FTS OF THE RF AND OFF-BUDGETARY FUNDS

It is impossible to get by with formal confirmation of the validity of the amounts taken into account for these entities. It is necessary to assess the reasons for the overpayment, whether it is possible to return it from the budget or offset it against other taxes, whether it is worth starting a long process of return or whether the overpayment will be taken into account in the reporting tax liabilities.

To reconcile with the budget, you can use certificates issued by the tax authority (the form of a certificate on the status of settlements for taxes, fees, penalties, fines, interest of organizations and individual entrepreneurs is given in Order of the Federal Tax Service of Russia dated December 28, 2016 No. ММВ-7-17 / [email protected ] “On approval of forms of certificates on the status of settlements for taxes, fees, insurance premiums, penalties, fines, interest, the procedure for filling them out and formats for submitting certificates in electronic form”). You can also order a reconciliation report.

INVENTORY OF OTHER ACCOUNTS RECEIVABLE

During the inventory, the validity of the debts of the organization’s personnel for issued loans, for compensation for various material damage caused to the organization, the debt of LLC participants (joint-stock shareholders) for payment of shares (shares), for the amounts of overpaid dividends, etc. is checked.

The timing of the formation of these amounts, the reasons and reality of existing debts, as well as the possibility of collecting them are clarified. As a result, the inventory commission, through a documentary check, must establish the correctness and validity of :

- the amount of accounts receivable listed in the accounting records, including debt for shortages and thefts;

- amounts of receivables, including amounts of “receivables” with an expired statute of limitations.

FOR YOUR INFORMATION

The general limitation period is three years (Article 196 of the Civil Code of the Russian Federation), and the limitation period begins from the day when the person learned or should have learned about the violation of his right and who is the proper defendant in the claim for the protection of this right ( Article 200 of the Civil Code of the Russian Federation).

It is important to take into account that in accordance with Art. 203 of the Civil Code of the Russian Federation, the limitation period is interrupted by the obligated person taking actions indicating recognition of the debt.

In paragraph 20 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated September 29, 2015 No. 43 (as amended on February 7, 2017) “On some issues related to the application of the norms of the Civil Code of the Russian Federation on the limitation period” it is stated that actions indicating the recognition of a debt in order to interrupt the limitation period, may include: recognition of the claim; a change in the contract by an authorized person, from which it follows that the debtor acknowledges the existence of a debt, as well as a request from the debtor for such a change in the contract (for example, a deferment or installment plan); act of reconciliation of mutual settlements, signed by an authorized person.

A response to a claim that does not contain an indication of the acknowledgment of a debt does not in itself indicate an acknowledgment of a debt. Recognition of a part of the debt, including by paying part of it, does not indicate recognition of the debt as a whole, unless otherwise agreed by the debtor.

After the break, the limitation period begins anew; the time elapsed before the break does not count towards the new term.

Thus, the following fact must be taken into account: by approving the reconciliation act and fulfilling the legal requirements regarding the inventory, the organization resets the already expired statute of limitations.

NOTE

If the debtor is excluded from the Unified State Register of Legal Entities, then all his obligations at the moment have been terminated, and therefore there are no legal grounds for calculating the limitation period after this date (Resolution of the Arbitration Court of the Moscow District dated November 7, 2017 No. F05-16302/2017 in case No. A40-106253/2016).

In addition to formal confirmation of the validity of the debt amounts recorded during the inventory, it is necessary to highlight doubtful accounts receivable . Signs of such debt:

- lack of contact with the counterparty;

- significant delay in fulfillment of contractual obligations;

- the appearance in the extract from the Unified State Register of Legal Entities of information about the unreliability of data;

- large amounts of debt to the Federal Tax Service of Russia;

- blocking of current accounts;

- signs ;

- lack of property, etc.

In order to control the limitation period, it is important to identify the start date of the limitation period, the expired limitation period, taking into account the interruption in the running of the period.

EXAMPLE OF INVENTORY OF ACCOUNTS RECEIVABLE

According to accounting data, Universal LLC includes the following amounts of accounts receivable in the context of synthetic accounting accounts (Table 1).

| Table 1. Extract from the balance sheet of the enterprise as of 04/30/2019 | |

| Account | Debit balance, rub. |

| 60 “Settlements with suppliers and contractors” | 1 720 165 |

| 62 “Settlements with buyers and customers” | 4 757 874 |

| 68 “Calculations for taxes and fees” | 310 000 |

| 69 “Calculations for social insurance and security” | 302 |

| 70 “Settlements with personnel for wages” | 18 475 |

| 71 “Settlements with accountable persons” | 94 000 |

| Total | 6 900 816 |

On 05/06/2019, the director of the enterprise, Ivanov R.I., issued an order according to which, from May 6 to May 10, 2021, the working inventory commission must conduct an inventory of settlements in relation to the amounts of the enterprise’s receivables. Documents must be submitted to the accounting department on May 10, 2019.

Fulfilling this order, the accountant prepared reconciliation reports with each counterparty.

Based on reconciliation reports and primary documentation, the following was established. According to settlements with suppliers and contractors, there are errors in accounting data . The accounting department did not reflect the invoice presented by the supplier in April 2019 in the amount of RUB 74,590. for the supplied materials necessary for Universal LLC to provide services.

It was also revealed that the debt in the amount of 168,575 rubles. is real, but it was not possible to obtain signed reconciliation reports with suppliers for various technical reasons. Debt in the amount of 203,450 rubles. was classified as unreal (due to the expiration of the statute of limitations for one enterprise, or the exclusion of an organization from the Unified State Register of Legal Entities - in another way).

Another 303,000 rubles. were recognized as a doubtful debt, since it was possible to establish that the debtor was overdue for the fulfillment of his obligations under the contract. According to open sources, he has significant tax arrears.

When taking inventory of debtors from the category of buyers and customers, it turned out that the amount of 1,710,000 rubles, which was expected to be received in June 2021 (it was planned for the purchase of an additional volume of inventory), most likely will not arrive within this time frame. The fact is that this consumer was sued by a third party in the amount of 33 million rubles, and his current account was blocked.

When taking inventory of settlements with accountable persons, it turned out that 4800 rubles. hanging behind a fired employee. During a telephone conversation, this debtor rudely refused to pay off the debt. Taking into account his antisocial lifestyle and lack of permanent work, the commission members concluded that it was inappropriate to collect this debt through the court and proposed to write it off.

The generalized working materials of the inventory commission are presented in table. 2.

| Table 2. Generalized working materials of the inventory commission | ||||||

| Account | Accounts receivable, rub. | Differences subject to adjustment in accounting | ||||

| Registered | Actually revealed | From the amount actually revealed | ||||

| the debt is real, but not confirmed by debtors | debt unrecoverable | doubtful debt | ||||

| Settlements with suppliers and contractors | 1 720 165 | 1 645 575 | 168 575 | 203 450 | 303 000 | 278 040 |

| Settlements with buyers and customers | 4 757 874 | 4 757 874 | 0 | 0 | 1 710 000 | 0 |

| Calculations for taxes and fees | 310 000 | 310 000 | 0 | 0 | 0 | 0 |

| Calculations for social insurance and security | 302 | 302 | 0 | 0 | 0 | 0 |

| Payments to personnel regarding wages | 18 475 | 18 475 | 0 | 0 | 0 | 0 |

| Calculations with accountable persons | 94 000 | 94 000 | 0 | 0 | 4800 | 4800 |

| Total | 6 900 816 | 6 826 226 | 168 575 | 203 450 | 2 017 800 | 282 840 |

Overdue and bad debts

After the expiration of the repayment period for a particular debt, it is called overdue - receivable or payable. Inventory of payments in this case performs an important function in identifying such amounts. The possibility of debt collection exists for 3 years from the date of its occurrence, after which receivables are classified as non-operating expenses, and payables are classified as income.

Moreover, if an organization regularly checks with its debtor, then this fact interrupts the statute of limitations, returning it to the starting point and over and over again pushing back the opportunity to include receivables in the expense part of the income tax calculation after 3 years (see explanations of the Federal Tax Service RF in a letter dated 17-07-15 No. SA-4-7/12693).

A debt should be considered hopeless if it:

- not repaid within 3 years;

- the debtor is liquidated or bankrupt;

- not recovered even after going to court.

Briefly

- Inventory of debts is an important procedure that identifies reserves and problems of organizations that arise when working with counterparties.

- It can be either mandatory or voluntary.

- Inventory of debts must be carried out in strict accordance with the law.

- Violation of legal norms may result in penalties, and negligence during the procedure may result in its invalidation.

- External auditors may be involved in conducting an inventory of debts.

- Inventory allows you to identify debts in a timely manner and avoid financial losses due to missing legal deadlines that make it possible to claim them.

REGISTRATION OF DEBT INVENTORY RESULTS

For inventoried debts, a certificate is drawn up, which is the basis for drawing up an act in form No. INV-17 with the results of an inventory of settlements with buyers, suppliers and other debtors and creditors. The act is drawn up in two copies and signed by the responsible persons of the inventory commission. One copy of the act is transferred to the accounting department, the second remains with the commission.

Based on the results of the inventory and the results identified, Universal LLC prepared the relevant documentation.

Results

An inventory of settlements requires a detailed analysis of settlements with each counterparty in the context of each individual basis (for example, a supply agreement, a loan provided, etc.). To do this, the company's accounting service checks the balances on the relevant accounts. Reconciliation of settlements with counterparties and the budget helps to obtain an objective idea of the volume of available RD and CP.

It is imperative to remember that expired contracts and contracts must be written off and such write-offs must be taken into account properly when taxing profits.

In addition, it is important to correctly draw up documents that will reflect the results of the inventory. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.