Taxpayer category code in the 3-NDFL declaration: what does it mean

This code takes the following values depending on the category of the payer submitting the 3-NDFL declaration (approved by Order of the Federal Tax Service of Russia dated October 3, 2018 N ММВ-7-11/ [email protected] ):

| Taxpayer category in 3-NDFL | Code |

| An individual registered as an individual entrepreneur | 720 |

| Notary engaged in private practice, as well as other persons engaged in private practice | 730 |

| Lawyer who established a law office | 740 |

| Arbitration manager | 750 |

| Another individual declaring income subject to personal income tax or submitting a 3-personal income tax declaration in order to obtain deductions or for another purpose | 760 |

| An individual registered as an individual entrepreneur and who is the head of a peasant (farm) enterprise | 770 |

That is, for example, an ordinary “physicist” (not an individual entrepreneur) declaring income from the sale of an apartment must put “760” in the “Taxpayer Category Code” field.

Directory

Appendix No. 1 to the Procedure for filling out the tax return form for personal income tax (form 3-NDFL), approved by order of the Federal Tax Service of December 24, 2014 No. ММВ-7-11/ [email protected]

(as amended by Order of the Federal Tax Service of Russia dated November 25, 2015 N ММВ-7-11/ [email protected] )

Directory “Taxpayer Category Codes”

| 720 | an individual registered as an individual entrepreneur |

| 730 | a notary engaged in private practice, and other persons engaged in private practice in accordance with the procedure established by current legislation |

| 740 | lawyer who established a law office |

| 750 | arbitration manager |

| 760 | another individual declaring income in accordance with Articles 227.1 and 228 of the Code, as well as for the purpose of obtaining tax deductions in accordance with Articles 218-221 of the Code or for another purpose |

| 770 | an individual registered as an individual entrepreneur and who is the head of a peasant (farm) enterprise |

Appendix No. 6 Directory “Codes of persons claiming property tax deductions”

Assistance in filling out tax returns 3-NDFL

Detailed information can be obtained by calling (495) 764-04-31, 210-82-31

Source: //nalog7.ru/instr2014-17

What it is

The taxpayer category code in the 3-NDFL declaration is a digital designation that is written on the title side of the 3-NDFL declaration.

Tax reporting in form 3-NDFL is prepared and submitted by individuals and individual entrepreneurs upon receipt during the reporting period and to obtain a state tax deduction for income tax.

You can submit reports in person at a tax office branch or remotely by mail or via the Internet.

The document can also be brought by a relative or friend of the taxpayer. To do this, you need a power of attorney certified by a notary. The 3-NDFL declaration form is available.

And relatives can do this for the taxpayer by providing a document that confirms the relationship.

What do the largest taxpayers need to know about checkpoints?

The largest taxpayers are assigned an additional tax at the place of registration as the largest taxpayer. The first digits of this checkpoint are 99, they show that the company is registered with the interregional inspectorate for the largest taxpayers.

The checkpoint of the largest taxpayer is indicated in documents related to federal tax payments.

VAT is a federal tax, so invoices indicate the KPP of the largest taxpayer. If the checkpoint at the location of the organization is indicated on the invoice, this will not be an error and will not prevent the receipt of a deduction from the counterparty.

The checkpoint at the location of the organization is indicated in documents related to other payments to the budget and other settlements.

Decoding common numbers

The code takes the value of the category of each individual citizen of the Russian Federation.

- 720

– indicates a person who is a tax entrepreneur. - 730

– a category of citizens who are engaged in private practice. - 740

– a lawyer who owns an office. - 750

– code of the arbitration manager. - 760

– an individual whose activities are subject to tax or a citizen submitting a declaration in order to obtain a deduction. - 770

the code corresponds to an individual entrepreneur whose head is the owner of the farm.

Filling out a document using code 760

A larger number of taxpayers who prepare a declaration go under code 760. This includes the following categories of citizens:

- those who received income not from a tax agent, but for any other reason (rent, legal or employment contract, etc.);

- persons who executed the document after the sale of the property;

- those who received income outside the country;

- winners of lotteries, various gambling games and their organizers;

- individuals who fill out a certificate in order to apply for the right to standard, social and other deductions.

Where is the taxpayer category code filled in in the 3-NDFL declaration?

Structurally, the 3-NDFL certificate can be divided into two parts: the first will include sections that are required to be completed for each person; the second includes those sheets that need to be completed in individual cases. Thus, each individual who submits a tax return to the Federal Tax Service of Russia fills out the title page and sections I and II. Other sheets (A, B, C, D, D1, D2, E1, E2, G, G, I) are filled in optionally.

The 3-NDFL certificate opens with the title file, which includes basic data about the taxpayer: last name, first name and patronymic, registration address, identification document details - series and passport number. An important point is that the declaration is supplied with a signature, which certifies the completeness and accuracy of the data presented. In addition, the title page indicates:

- code of the Federal Tax Service - the local tax office to which 3-NDFL is submitted;

- taxpayer country code;

- code of the type of document certifying the identity of the payer;

- taxpayer category code.

We will dwell in more detail on the main codes indicated in the tax return. The Federal Tax Service Inspectorate code hides a specific tax office to which an individual submits documents at the place of residence or registration. For example, for inspection No. 25 in Moscow, the code “7725” is used. The country code indicates the state of which the taxpayer is a citizen. The Republic of Belarus owns the combination of numbers “112”, Kazakhstan – “398”; Russians enter the code “643” in their declaration.

Types of taxpayer codes

Another code to be filled out in the certificate indicates the category of the individual paying the tax. There are six such categories in total, and every taxpayer filling out 3-NDFL can include himself in them.

The table below shows the characteristics of a taxpayer with their corresponding numeric code:

For example, a tutor is a person who gives private lessons and is subject to registration as an individual entrepreneur. When filling out a tax return in form 3-NDFL, the tutor enters the code “720”. As for paying tax on additional income, in 3-NDFL the taxpayer category code is “760”. The same numerical value is indicated by persons claiming tax deductions.

Author: Mainfin.ru Team

Related terms

- How to fill out the 3-NDFL declaration - instructions, sample filling

- 3 Personal income tax in 2021 - sample of filling out a declaration

- How to submit a 3rd personal income tax return through State Services

- Certificate 2-NDFL - what is it and why is it needed?

- Income codes in personal income tax certificate 2 in 2021

- How to fill out a 2-NDFL certificate - sample and procedure

16:03 09/03/2020 Credit card Certificates Installment plans Deposits Loans Current account Microloans Banks Benefits Salaries Mortgage Debit card Money transfers

Subscribe to Yandex.Zen

Taxpayer category code

July 27, 2021

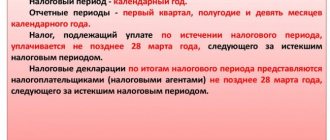

The Tax Code establishes the obligation of persons calculating and paying taxes to submit a declaration at the specified time.

Sample 3-NDFL (13%) with standard tax deductions

This requirement applies to both individuals and organizations.

Citizens reporting income tax provide a declaration form 3-NDFL. Taxpayer category code is a digital designation that is indicated on the title page. Let's look further at what it means.

//www.youtube.com/watch?v=aePEQXr-dSc

When completing the first sheet of the declaration, the person submitting the document must indicate which category it is included in. The legislation provides for 6 digital designations. For clarity, we present the codes of taxpayer categories in the table.

| A citizen registered as an individual entrepreneur. |

| Private notary, another person conducting private practice. |

| The person who established the law office (lawyer). |

| Arbitration manager. |

| Another person reporting for taxes subject to personal income tax, counting on receiving a deduction, or submitting a declaration for another purpose. |

| A citizen registered as an individual entrepreneur and who is the head of a peasant farm (peasant farm). |

Thus, an ordinary individual who does not operate as an individual entrepreneur, reporting income from the sale of his real estate, enters the number 760 in the “Taxpayer Category Code” field.

What other digital symbols are there on the title page?

In addition to the category code, the taxpayer indicates the following codes:

- Inspectorate of the Federal Tax Service.

- Countries.

- The type of document that verifies the identity of the declarant.

Federal Tax Service code

Here the subject must indicate the code of the tax office to which he submits the declaration. The document is submitted to the control authority at the person’s residence address/place of stay in the Russian Federation.

For example, when submitting a declaration according to f. 3-NDFL in Federal Tax Service No. 14 in Moscow, you need to indicate code 7714.

Country designation

The code is indicated based on the All-Russian Classifier. You need to indicate the country of which the payer is a citizen. If this is Russia, then you need to put the number 643.

Finance How to find out the Federal Tax Service code: three ways

The Federal Tax Service code is a strict sequence of numbers that identifies a specific tax office. The symbols in this cipher are four Arabic numerals. The combination of the first two is the code of the subject of the Russian Federation, and the last two are the number...

Business How to check a barcode for authenticity

Almost every day we come across the procedure of reading a barcode when making purchases in a store. It is this attribute that is the main element of product identification and provides sufficient information about them…

Computers How to decrypt a QR code on a computer?

One of the integral parts of everyday life, in particular the world of digital technology, has become the QR code, which not everyone can read. This kind of encryption can be found absolutely everywhere: on product packaging, on...

Law Obtaining TIN for different categories of taxpayers

A certificate of registration with the tax authority, commonly called simply TIN, is a document containing a unique identification number assigned to all taxpayers, be it an individual or...

Spiritual development Designation of cards in fortune telling. Fortune telling with 36 cards. Interpretation of card combinations

Fortune telling with cards is a simple and harmless way to quickly find out the future. It is better to guess at Christmas time, when, as Christians and representatives of other faiths believe, evil spirits are not capable of harming people. Prog…

Food and drinks Wine categories. By what criteria are wines divided into categories? Classification of wines by quality categories

As they said in Ancient Rome, In vino veritas, and it is impossible to disagree with this. Indeed, despite technological progress and the cultivation of new grape varieties, wine remains one of the most honest drinks. People can…

Computers “The Witcher 2” (“Lilies and Snakes”). Passage of a detective quest about a strange letter, an attack on a convoy and the children of Foltest

Detective stories will probably never go out of fashion. After all, they always contain what has interested humanity from time immemorial - intrigue, mystery and understatement. To get to the bottom of the truth...

Fashion Review of children's clothing with traditional markings from different countries. Size 2T: what age is it designed for?

Often, parents buying clothes for their children make mistakes in choosing the size. Because of the markings that show the age of the child, adults often get confused and buy larger or smaller items. This is…

Education Countries and nationalities in English: rules of use and a table with a list of geographical names

The topic “Countries and Nationalities” in English is one of the very first and easiest for beginners, as it allows you to practice the verb to be. Despite the ease, many make mistakes in using countries and nationalities...

Education: Is Algeria a city or a country? Largest cities in northern Algeria

Is Algeria a city or a country? Not everyone knows the answer to this question. Our article will answer it exhaustively. In addition, here you will find interesting information about the largest cities of the largest African region by area...

Taxpayer codes in the tax return

TAXATION 2021: new income tax payers and their codes.

The number of types of income tax payers has increased.

Some of them will have to indicate special codes taken from the list of the table “Codes for submitting a tax return for corporate income tax to the tax authority” (Appendix 1 to the procedure for filling out the declaration).

The codes in this table differ depending on which tax authority income tax return , and three new ones have been added to their list.

Now, if a declaration of profits and taxes is submitted at the place of registration of an organization that has received the status of a participant in a project for the implementation of research, development and commercialization of their results in accordance with the federal law of September 28.

2010 N 244-FZ “On the Skolkovo Innovation Center”, code 225 is indicated on the title page in the details “At location (registration)” (the procedure for filling out the declaration is supplemented by clause 1.6.1). For the participants of this innovative project, we will add one more. According to paragraph 1.

7 procedure for filling out a declaration, some organizations acting as tax agents submit declarations in a simplified form: title page (sheet 01), subsection 1.3 of section 1 and sheet 03.

In this case, in the title page (sheet 01), according to the details “At location (accounting)”, code 231 is indicated.

Now this also applies to participants in this project if they use the right to be exempt from the obligations of corporate income tax payers.

Changes for organizations applying a zero tax rate

If a tax return is submitted at the place of registration of an organization carrying out educational or medical activities, code 226 is indicated ( the procedure for filling out the declaration is supplemented by clause 1.6.2).

Here we mean only those of these organizations that, in accordance with Article 284.1 of the Tax Code of the Russian Federation, apply a zero rate for income tax. For such organizations, a technical clarification has been introduced in paragraph 5.6 of this procedure.

This paragraph deals with filling out lines 140-170 of sheet 02 of the declaration, which indicate the rates at which the taxpayer calculates income tax.

Income type codes in 3-NDFL

Now their number includes, of course, those provided for in Article 284.1 of the Tax Code of the Russian Federation.

Source: //accountingsys.ru/kod-kategorii-nalogoplatelshhika/

Detailed transcript (760, 720)

Each tax payer belongs to a certain group, which is determined by law.

Taxpayers often wonder when preparing their return what the symbols on the first page mean.

When drawing up the title page in 3-NDFL, the responsible person must register the CCI in the reporting. Information can take on different meanings.

This depends on the position of the person providing the declaration. KKN may have the following designation:

| 720 | A private person who is entered in the register as an individual entrepreneur. Individual entrepreneurs using a special regime do not file an income tax return, because VAT and personal income tax are replaced by one tax, which corresponds to a certain regime. Moreover, if an entrepreneur receives income from activities that do not fall under the special regime, then he must file an income tax return as an individual, taking into account the rules of Chapter. 23 Tax Code of the Russian Federation |

| 760 | Other persons who declare income that is subject to tax |

Rules for submitting form 3-NDFL

The document must be submitted to the tax office at the end of the year during which the funds subject to the interest rate were spent. If the form is submitted for the purpose of deducting social or other payments, it must be submitted at least once every 3 years, because After this time, the tax authority will not accrue the required benefits. If a taxpayer files a document claiming child care compensation, it can be submitted at any time.

Taxpayer category code in the 3-NDFL declaration

Taxpayer category code in the 3-NDFL declaration - what is it?

How to decipher a checkpoint?

The checkpoint is a sequence of 9 Arabic numerals.

- The first two characters correspond to the code of the subject of the Russian Federation in which the tax office that assigned the code is located. For interregional inspectorates for the largest taxpayers, the first two digits in the checkpoint are 99, for Moscow ones - 77.

- The third and fourth characters show the number of the tax office that registered the organization or separate division.

- Two signs in the fifth and sixth positions of the checkpoint indicate the reason for registration. These can be not only numbers, but also capital letters of the Latin alphabet from A to Z.

Code number 01 means that the Russian organization has registered as a taxpayer with the tax authority at its location.

Codes 02 - 05, 31, 32 mean that registration took place at the location of separate units.

Codes 06 – 08 mean that the Russian taxpayer organization is registered at the place of registration of its real estate (depending on the type of property).

Code 10 - 29 means registration at the location of the vehicles.

- The last three characters are the serial number that is given to the company when registering with the tax authority and on the appropriate basis.

Many companies have the same checkpoint. This means that they are registered with the same tax office for the same reasons.

Submission rules

There are certain rules that apply to all 3-NDFL tax returns:

- You can compose the form by hand or using computer typing.

- Information is entered into the document manually in black or blue ink.

- Each symbol must be entered in a separate cell.

- Numeric values are equal on the right side.

- Corrections are not allowed.

- Monetary amounts are rounded to the nearest ruble.

- Only those sheets that are needed are changed.

- Empty cells must include dashes.

There are three empty cells on the form for writing the taxpayer category. Since the codes that encrypt categories are usually three-digit, there should not be a single empty cell left.

The code itself must be entered into the document carefully and ensure that each digit is entered into the cell and does not go beyond its boundaries.

If an individual decides to complete the declaration manually, then the entire document must be filled out in ink of the same color.

It should be noted that if the tax payer mistakenly enters the wrong code, then corrections in the form are not allowed. In this situation, you need to print the page again and enter the correct KKN numbers.

Why is a checkpoint needed?

One legal entity can be registered with several tax inspectorates at once. For example, in one at the location of its location, in the second at the location of a separate division, in the third at the location of the real estate, and so on. To understand which inspection the taxpayer belongs to and why, a checkpoint is assigned.

It turns out that a company may have several checkpoints and they change under certain circumstances. For example, if an organization moved and registered with another tax office. But the TIN is unique, unique and forever. Therefore, the checkpoint paired with the Taxpayer Identification Number allows you to unambiguously identify not only the organization, but also each of its separate divisions.