The Federal State Statistics Service has posted updated forms of annual statistical reporting on its official website for review. The forms and the procedure for filling them out came into force on July 15, 2021 . The corresponding order dated July 15, 2020 No. 384 was published. When submitting reports for 2020, it will be necessary to use only new forms ; old forms from 2021 lose their validity and will not be accepted for consideration by statistical authorities.

Why do you need Form 11 in 2021?

Using this form, organizations report on the use of fixed assets (Fixed Assets) and other non-financial assets. The form shows information about their availability, receipt and disposal, and accrued depreciation.

In addition, the form reveals the distribution of PF by primary and secondary activities, their composition, age, as well as various types of accounting and residual values.

Fixed assets are manufactured assets that an organization uses not just once, but periodically over a year or longer period. They are used in production, for management or rental needs.

The form does not reflect the following information:

- about plots of land and environmental management facilities;

- contracts, agreements, trademarks, goodwill and other intangible assets;

- assets cheaper than 40,000 rubles apiece.

Form No. 11 (transaction)

As of the 2021 report, the previous form No. 11 (transaction), approved by Rosstat order No. 296 dated July 3, 2015, becomes invalid. The new form must be submitted by legal entities, including:

- small (without micro-enterprises) and medium-sized businesses;

- non-profit organizations of all types of economic activity,

having not only:

- fixed assets (tangible and intangible) in accounts for accounting for fixed assets and profitable investments in tangible assets;

- produced tangible and intangible exploration assets accounted for in the account “Investments in non-current assets”,

but also intangible fixed assets, the rights to which were obtained on the basis of a simple (non-exclusive) and exclusive license.

The deadline for submitting the new form is June 15 of the year following the reporting year. Now data is presented for the legal entity as a whole, taking into account data for all its separate divisions and assets located in other constituent entities of the Russian Federation.

Who submits Form 11 and where?

This report is submitted by almost all legal entities, regardless of their type of activity, form of ownership, organizational and legal form and departmental affiliation. The exceptions were two types of organizations:

- non-profit;

- small businesses.

They did not exclude simplifiers and legal entities in the bankruptcy process from the list of respondents.

Send the report to the territorial body of Rosstat at your location. It can be submitted by mail or in electronic document format. If you have separate units, the procedure for filling out and submitting depends on their location. For divisions that are located in a constituent entity of the Russian Federation other than the location of the legal entity, fill out a separate report. But if there are several separate units in one subject, then you can submit a summary report on them - only the fifth section needs to be filled out for each unit individually.

Other details of submission for legal entities with separate divisions are given in the general provisions for filling out the form.

Forms approved by order

The new order stipulates that by the end of 2021 it will be necessary to submit the relevant information on three updated forms.

Required information about due dates and who will provide the forms is given in the table below:

| Form number | Deadline | Who rents |

| № 11 | until April 1 | Legal entities, with the exception of small business entities and non-profit organizations |

| No. 11 (short) | until April 1 | Legal entities, non-profit, public, private institutions, charitable foundations, as well as associations and unions |

| No. 11 (deal) | until July 1 | Legal entities, with the exception of small businesses |

Completed forms must be submitted to the territorial statistics body in accordance with the address of the legal entity.

Zero report on Form 11

Failure or delay in submitting a report is punishable by a fine of 20 to 150 thousand rubles, depending on the type of violation and the frequency of repetition of such cases.

Keep in mind that Rosstat is waiting for a report even from those companies that did not operate in 2021 and do not have funds at all to report on. In this case, provide the statistics agency with a blank report with a completed title page and signatures. It can be replaced with an official letter that will inform Rosstat representatives about the absence of events observed in the form.

Instructions for filling out form 11

Detailed instructions for filling out are presented in Rosstat Order No. 717 dated November 29, 2019. When filling out the report, follow the principles of accounting for fixed assets: guidelines, PBU 6/01, PBU 14/2007, PBU 17/02, PBU 24/200, Management Regulations accounting and reporting in the Russian Federation, PBU 9/99, PBU 10/99, Chart of Accounts. Also take into account IFRS rules.

Let's look at the procedure for filling out the main report indicators.

Section I

The first section is the largest part of the reporting form. Line 01 reflects all fixed assets, except for unfinished assets - they are taken into account in the third section. Include in the report all funds that are your property, economic management, operational management or lease and are accounted for in accounts 01, 03 or 08. Intellectual property objects also fall here.

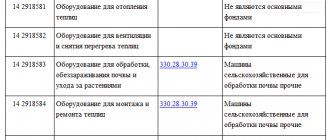

For lines 02–14, line 01 is detailed by type of OF, according to OKOF. We will not dwell on classification, but will analyze filling out the graphs, since this often causes difficulties.

Column 3 is intended to reflect how the full accounting value changed due to revaluation and impairment of assets.

Revaluation of material assets is carried out at the end of the year at replacement cost - the costs that the organization must make to replace the assets with similar new objects. Revaluation of intellectual property is carried out at the end of the year, recalculating their residual value into the current market value.

Column 4 shows information about the increase in the full accounting value during the year due to the inclusion in accounting of:

- new PF objects purchased, manufactured, contributed by the founders to the authorized capital, received as a gift and through other income;

- receipt of PF for imports, regardless of whether they were previously in operation in another country;

- completion, modernization and reconstruction of existing PF facilities.

FI and intangible assets are accepted for accounting based on the amount of costs for their receipt. For those received free of charge - at the current market value on the date of acceptance for accounting. And for those received as a contribution to the authorized capital at a cost agreed upon by the founders.

Column 5 also provides data on the increase in book value, but through the purchase of used PF objects. That is, purchase on the secondary market, transfer from another organization, contribution by the founders. The same applies to repurchased funds that were on the lessor’s balance sheet.

Columns 6–8 reflect the decrease in the full accounting value for the year, broken down by reasons:

- In column 6 - due to liquidation, that is, write-off of funds, which means the physical liquidation of funds or their sale for the purpose of liquidation. In this column there is no need to take into account the transfer or sale of PF to other legal entities, individuals or to the treasury for further use.

- Column 7 from column 6 identifies funds liquidated as a result of losses from natural disasters, man-made disasters, accidents, fires, etc.

- In column 8 - for reasons of sale or transfer to other entities for further use in activities. This also includes stolen, missing, or transferred during the reorganization of the PF.

Objects disposed of before the beginning of 2021, the absence of which was discovered during the inventory, are not reflected in the form.

In columns 9 and 10, indicate the availability of fixed income at the end of the year at the full book value and at the residual balance sheet, respectively. They differ in the degree of wear, which by the end of the year is usually in the range from 10 to 90%.

In column 11, reflect the accounting depreciation accrued according to the depreciation rate. Based on the useful life during the year the funds were owned by you. Do not take into account depreciation (depreciation) accrued by the previous owner on used funds.

In column 12 from column 11, highlight the depreciation accrued on the PF during the year when these funds belonged to your company

In column 13, reflect the accounting depreciation of the financial assets that you liquidated during the year, which was accumulated over the entire period of their use. As a rule, its value is 75-100% of column 6. If there is a significant deviation, Rosstat may require explanations.

In column 14 , indicate one of the codes that shows at what cost used fixed assets received during the reporting year and indicated in column 5 on lines 02, 04, 06, 07, 08, 10, 11, 12 and 13 were purchased. There are three acquisition options: Code “1” - current value; Code “2” - the full accounting value of the previous owner, taking into account accumulated depreciation; Code "3" - residual book value.

Section II

The second section in terms of columns is almost similar to the first. The main difference is in the lines. Here the funds are distributed not by type from OKOF, but by type of economic activity that corresponds to the sections of OKVED2. It is the sections that need analytics based on letter codes.

One line takes into account all structural divisions of the organization that perform one type of activity.

Please note that funds are distributed among primary and secondary activities by structural divisions of the organization based on the primary nature of their activities. Therefore, the funds of each division must completely belong to one of the single-letter OKVED2 codes.

On line 16, show the funds that are related to your main activity and auxiliary activities. The main type of activity is determined by the share of output volume for this type in the total output of the organization. Lines 17–18 reflect funds that belong to secondary types.

Section III

In the third section, show data on the presence and average age of the PF. In lines 19 - 23, distribute the funds by type and indicate how many thousand rubles are left at the end of the reporting year.

In line 24, indicate the average annual full accounting value of all PF from line 01.

In line 25, take into account the cost of the actual sale of the OF for further use in cases where the seller and buyer agreed among themselves and were guided by the current prices of similar objects.

In line 26, show data on work in progress of fixed assets that have a long production cycle.

On line 27, reflect the equipment that needs to be installed if it is intended for use by the manufacturer itself or the customer paid for its installation.

On line 28, take into account only those unfinished objects that are needed for the developer’s own use and those for which a user was found before construction was completed and paid for the work.

On lines 29–32, indicate the average age of buildings, structures, vehicles, inventory, and machinery and equipment. That is, the number of years that have passed from the date of manufacture to the end of the year on average, rounded to the nearest whole number. If the average age is less than six months, enter “0” in the line.

In lines 33–37, indicate in the prices of which year the OF is primarily taken into account. It could be:

- based on the results of revaluations of fixed assets in prices at the beginning of 1995, at the beginning of 1996–2011, at the end of 2011 and subsequent years, and based on the results of impairment;

- in purchase prices of 1997 and subsequent years when purchased at current market prices.

Section IV

In the fourth section, show how much fixed assets cost at the end of the year. But take into account only those for which by this time depreciation had ceased to accrue or had never been accrued, but depreciation was determined.

Column 3 takes into account the full accounting value of funds for which accounting does not provide for depreciation:

- objects for the implementation of the legislation of the Russian Federation on preparation for mobilization and mobilization itself;

- mothballed fixed assets;

- intangible fixed assets for which the useful life cannot be determined;

- 100% depreciated funds at the end of the year with zero residual value.

In column 4 from column 3, it is necessary to highlight the cost of funds that are 100% worn out (no depreciation is accrued according to accounting rules) and 100% depreciated.

Section V

In the fifth section there is only one indicator - the average annual full accounting value. Show this data both for the head unit and for separate units located in the same region. If they do not have PF, then indicate only their OKPO in column 1, and in column 3 put “0”.

If there are more than one divisions, then each will need a separate fifth section.

Check that when completed, the sum of lines 45 is equal to line 24.

After finishing filling out the form, carry out arithmetic and logical control of all indicators. The control ratios given in the Guidelines will help with this.

Form 11 Sample of filling out form 11

Forms No. 11 and No. 11 (short)

As of the 2021 report, the previous form No. 11 and form No. 11 (short), approved by Rosstat order No. 296 dated 07/03/2015, become invalid. The new forms must be submitted by the same persons as the previous forms. Form No. 11 will be submitted by all legal entities, regardless of the type of their economic activity, form of ownership and legal form, except:

- small businesses (including micro-enterprises);

- non-profit organizations.

Form No. 11 (short) will be submitted to:

- all non-profit organizations, regardless of the type of their economic activity;

- government bodies;

- local government bodies.

The deadline for submitting new forms is April 1. Let's talk about innovations in filling them out.

If the actual address of the organization does not coincide with the legal address, then the actual location of the organization (postal address) is indicated in the “postal address” line.

In the address part for separate divisions, the OKPO code (for a branch, representative office) or identification number (for a separate division that does not have the status of a branch or representative office) is indicated, which is established by the territorial bodies of Rosstat at the location of the separate division.

If a territorially isolated subdivision does not have an OKPO code, then in Section IV in the position “OKPO Code” an identification number is entered, which is filled in by the territorial body of Rosstat at the location of this subdivision.

Detailed instructions for filling out the indicators of forms No. 11 and No. 11 (short) are posted on the official website of Rosstat - www.gks.ru/Information for respondents/Federal statistical observation forms/Album of federal statistical observation forms, data collection and processing of which is carried out in the system Federal State Statistics Service/General economic performance indicators of organizations.