If a working citizen falls ill, the employer is obliged to pay him a special allowance for sick days. In the article we will talk about how sick leave is paid in 2021; we will discuss changes and innovations separately.

In accordance with the current labor legislation, as well as with Law No. 255-FZ, any employed citizen is guaranteed not only the preservation of his job during the period of illness, but also a cash benefit. The procedure for calculating benefits for a certificate of incapacity for work is the same, that is, it applies regardless of the cause of the illness. However, legislators have established a number of limiting factors that directly affect sick pay in 2018.

Payment period

Such insurance payments can be assigned after a person presents a sick leave certificate. For their timely accrual, the responsible person is given 10 calendar days. The payment itself is made on the day the salary is paid, which will be after the benefits are assigned (regulated by the provisions of Federal Law No. 255-F3 on compulsory social insurance).

Taking into account the fact that a special scheme has been launched and continues to operate in a number of regions, payment for sick leave in 2021 has undergone minor changes. Thus, in the case of timely submission of comprehensive data to the Social Insurance Fund by the responsible person for the assignment of benefits (within 5 calendar days) and the Social Insurance Fund makes a positive decision, the minimum period for transferring funds in 2021 is 15 calendar days (regulated by the provisions of Government Resolution No. 294 of April 21. 2011).

For employers, compliance with legally established deadlines remains very important, since delay will entail an obligation to pay compensation to their employee (Article 236 of the Labor Code of the Russian Federation).

How long can you stay on sick leave?

Of course, this depends on the disease and its severity. Unless medical specialists believe that a person needs to receive disability, they can issue sick leave for such a period as is necessary to return the person to a working condition.

However, the law provides for some restrictions:

- paramedics and dentists can issue sick leave for no longer than 10 days,

- other doctors can independently issue sick leave for up to 15 days; for a longer period, a medical commission has the right to issue a document.

Who pays

Law No. 255-FZ of December 29, 2006 states that the obligation regarding payment of sick leave lies with the employer. He must perform calculations, assign and transfer the required amount to the employee who provided a correctly completed document of the established type (in accordance with Order No. 624n of the domestic Ministry of Health and Social Development). Only after this can you apply to the Social Insurance Fund to receive compensation for sick leave in 2021, except for the first 3 days of the employee’s illness. For the specified period, funds are not reimbursed.

In regions where the Social Insurance Fund continues the pilot project, the employer will pay sick leave according to the usual scheme. That is, payments are made for the first 3 days of illness. The remaining amount is reimbursed by the FSS representative of this region - for the period from the 4th to the last day, which is indicated on the certificate of incapacity for work.

The FSS also pays insurance amounts for pregnancy and childbirth, as well as for caring for a temporarily disabled family member - from the 1st to the last day of illness (articles of Law No. 255-F3 and the provisions of Order No. 1012n of the Ministry of Health and Social Development).

How is the calculation of the certificate of incapacity for work carried out?

In 2021, sick leave must be paid after the employee returns to his permanent place of work. The paper is submitted to the accounting department, where detailed calculations are made. After this, the employee can receive his disability payment for the period specified in the sheet from the hospital, clinic or sanatorium.

Many workers believe that the amount of compensation for a certificate of incapacity for work directly depends on the length of service of the specialist. In practice, it turns out that the amount of payments is more influenced by the average salary rather than the employee’s length of service.

Nowadays, enterprises make detailed calculations immediately after an employee brings a sheet to the accounting department. The employee must understand that the average salary is subject to special requirements. For example, if the difference in the amount of payments in recent years is too large, then the calculation will be made based on the maximum wage limit in the enterprise. The days that the employee did not actually spend at work will be taken into account. The first day of illness is considered to be the date indicated on the sick leave certificate. Any discrepancies in the days of the worksheet and sick leave can be regarded as absenteeism. Therefore, if any health problems arise in 2021, employees must urgently seek qualified medical help.

Video on how to calculate sick leave

How is it paid?

The procedure for paying sick leave to the Social Insurance Fund in 2021 has not been changed. That is, the amount of the benefit is calculated based on the person’s average earnings, which he received over the last two years before the occurrence of the insured event. Namely – illness, pregnancy, etc.

It is worth noting that the maximum payments for a certificate of incapacity for work in 2021 are limited. But the employer can initiate additional monetary compensation - an additional payment up to average earnings. In this case, the indicated restrictions will not affect the person.

Domestic legislation determines the minimum amount of payment for sick leave in 2021. Or more precisely, the minimum value of average earnings, which is calculated based on the minimum wage. A similar value is used to calculate insurance if, for example, the average monthly salary of a worker is below the minimum wage. Other situations are also possible that require calculation based on the “minimum wage” values.

The federal minimum wage for 2021 is 9,489 rubles. obtained by calculation. Based on the provisions of the Ministry of Labor bill, the minimum wage for the next year is determined as 85% of the cost of living for the 2nd quarter of 2021 (RUB 11,163 × 85%). The average earnings for sick leave are calculated using the formula (clause 15.3 of the Regulations, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375): Average daily earnings for payment on a certificate of incapacity = minimum wage × 24 ÷ 730

Knowing that from January 1, the minimum wage for sick leave is 9,489 rubles, you can calculate the average daily earnings. It will be 311.97 rubles.

Also see “Sick leave from the minimum wage in 2021“.

How many days of sick leave is paid per year to an employee when caring for a child?

If it is necessary to care for several minor children, sick leave is issued for the care of each of them and is paid independently.

Employees raising minor children have the right to ask a health worker to issue a sick leave certificate for sick leave in order to care for a sick child. This period is also paid. At the same time, the law limits the possible number of days of stay with the child:

- up to 90 days during an illness , if the illness is serious and indicated in a special list of the Ministry of Health;

- with children under 7 years old, in general, you can spend up to 60 days ;

- is allocated to care for a disabled child under 18 years of age .

All days mentioned above must be paid. An employee has the right to care not only for his own children, but also for grandchildren, younger sisters/brothers, as well as stepsons/stepdaughters, adopted and taken into custody children.

New calculation in 2021

To calculate sick leave correctly, you need to take into account the main changes from 2021:

- New billing period – 2021 and 2021;

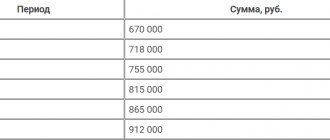

- Maximum earnings – 1,473,000 rubles (2016 – 718,000 rubles, 2021 – 755,000 rubles);

- The new minimum wage as of January 1, 2021 is 9,489 rubles;

- The number of days in the billing period is 730, for maternity leave – 731.

Calculation example

In 2021, the employee brought a certificate of incapacity for work, the period of illness was from March 12 to 22, 2021. Income subject to contributions to the Social Insurance Fund in 2021 amounted to 713,500 rubles, in 2021 - 748,300 rubles. Experience – 5 years.

- Billing period – 2016-2017, 730 days. The number of days of incapacity for work is 11.

- Let's calculate the average daily earnings and compare them with the minimum: Average daily earnings = (713,500 + 748,300) / 730 = 2002.46 rubles. The employee’s income for 2021 and 2021 is less than the limit (RUB 713,000 < RUB 718,000, RUB 748,300 < RUB 755,000). Therefore, we must take into account the actual earnings for 2016-2017 in the amount of 2002.46 rubles.

- Let's determine the percentage of sick leave payment based on length of service: Experience is 5 years, so you need to pay 80% of average earnings.

- Let's calculate the sick leave benefit: 2002.46 x 11 days. x 80% = 17,621.65 rub.

- Let's calculate the amount that the employee will receive after withholding personal income tax at a rate of 13%: The amount of sick leave tax will be: RUB 17,621.65. x 13% = 2291 rub. Amount of sick leave payable to the employee: RUB 17,621.65. – 2291 rub. = 15,330.65 rub.

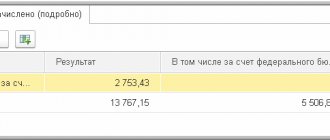

- Let's determine the source of sick leave payments: The first three days of illness are paid at the expense of the employer (RUB 4,805.90). The remaining 8 days are subject to reimbursement from the Social Insurance Fund. In the calculation of 4-FSS we will show 12,815.75 rubles. is the amount to be reimbursed.

Maternity leave: features of payments and calculation of sick leave

In the Russian Federation, pregnant women are given leave, which is equal to 140 days.

To determine when it is necessary to go on maternity leave, you need to contact the antenatal clinic, where they will indicate the expected date of birth.

The leave begins 70 days before the expected birth and ends the same number of days after.

If a pregnant woman is planning to give birth to 2 or more children, then the vacation begins 84 days before the birth and then 110 days of rest. The total is 194 days.

Childbirth with complications or caesarean section will give an additional 84 days of leave, instead of 70.

back to menu ↑

How to obtain a certificate of incapacity for work and apply for sick leave?

After the doctor determines the approximate time frame, he needs several days to draw up a work ability sheet (it may be ready in 2 days, in private clinics it may be earlier).

When a woman comes to receive a certificate of incapacity for work, she must have her passport and SNILS with her.

Next, the doctor writes out a sick leave certificate and sends it to the employer.

The woman writes an application to the employer for leave, to which she attaches the received document.

Example.

The approximate due date is November 7. Subtracting 70 days, it turns out that on August 30, Thursday, the woman begins her vacation. Let's assume that the birth occurred exactly on time and without complications. We add another 70 days to the 7th day and we get that on January 16, Wednesday, the woman must go to work.

back to menu ↑

Vacation benefits.

- For early production – 613 rubles.

- After birth – 16,350 rubles.

back to menu ↑

Birth benefits: documents

To apply for benefits, you must bring the following documents to the employer:

- Divorce certificate if the marriage was dissolved.

- A certificate from the husband’s place of work, which will confirm that he did not receive benefits.

- Child's birth certificate. If there are several children, the benefit is given to each one.

- Application for granting benefits.

back to menu ↑

What determines the increased benefit amount?

- Job. If a pregnant woman has worked for 6 months or more, then the benefit amount is 100% of average earnings.

- There is insurance experience. If you have insurance coverage from previous places of work, the amount of payments will be at least 34 thousand rubles.

- Student. If the expectant mother is a full-time student, the benefit will be equal to a scholarship.

back to menu ↑

Which mothers receive benefits?

- University students.

- Officially employed.

- Unemployed due to the liquidation of the company over the past year.

back to menu ↑

Calculation example.

Katya earned 980,000 rubles in 2016-17.

- We get the average daily earnings.

Divide 980,000 by 730 days = 1342 rubles.

- We calculate the benefit.

We multiply 1342 rubles by 140 days = 190.630 rubles.

back to menu ↑

Electronic sick leave certificates in 2018

In 2021, employees can bring not only paper sick leave certificates for payment, but also electronic sick leave numbers. The latter can be issued by those medical organizations that have connected to the information interaction system with the FSS. In this case, the doctor does not fill out the paper version, but enters the data into an electronic database or electronic medical record when opening a sick leave. An electronic certificate of incapacity for work is equivalent to a paper document.

To work with electronic sheets, an organization will need a personal account at cabinets.fss.ru. Here the accountant sees the employee’s sick leave and fills out his part of the sheet.

Fake sick leave: consequences

No matter how serious the condition, it is better to call a doctor or visit a clinic.

If your documents start being checked, which is quite natural, then you may have serious problems.

The following situations often occur: accountants notice inaccuracies in a document, and in order to correct them, they contact the clinic where the document was issued.

If the document is official, the problem is resolved; otherwise, it is sent to the FSS, then to the prosecutor’s office, where a criminal case is initiated.

Part 3 of Article 327 of the Criminal Code of the Russian Federation states that the use of false documents is punishable by criminal liability.

If there are circumstances mitigating the sentence, you can get off with a fine. An employer has every right to fire someone for absenteeism.

In some cases, it is possible to reach an agreement and an administrative leave is issued.

In cases where it is problematic to get sick leave, try to talk openly with the employer and solve the problem without buying fake documents.

back to menu ↑

Sick leave pay after dismissal

In order to receive payment after dismissal, a number of conditions must be met. Firstly, an illness or other insured event must occur no later than a month after the official termination of the employment relationship. Secondly, the right to appropriate compensation remains for up to six months.

In a situation where these deadlines were missed, the citizen has no right to count on receiving payments from the employer.

At the same time, part of the funds is paid by the employer, and the other part by the compulsory social insurance fund (FSS).