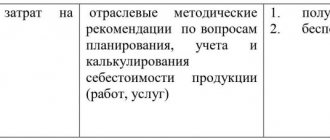

Read about the principles for drawing up regulations in the article “Regulations on accounting policies for accounting purposes.”

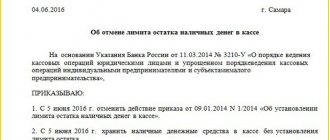

P R I K A Z

“EDUCATIONAL POLITICAL POLITICS FOR 2014.”

Voronezh 12/31/2013

I order:

1 . Approve the accounting policy of the organization in the form of the following Provisions, which are an integral part of this Order:

Regulation No. 1. “On accounting policies for accounting purposes for 2014.”

Regulation No. 2. “On accounting policy for tax accounting purposes for 2014.”

2. Reflection of the facts of economic activity should be carried out using the principle of temporal certainty, which implies that the facts of economic activity relate to the reporting period in which they took place, regardless of the actual time of receipt or payment of funds associated with these facts.

3. Accounting in 2014 should be carried out using the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

4. Use in your work primary accounting documents that are presented in albums of unified forms of primary documentation developed by the State Statistics Committee of the Russian Federation.

5. Responsibility for organizing work on maintaining records, storing and issuing work books and writs of execution shall be assigned to the director.

6. Provide for changes to the accounting policy for 2011 in the event of changes in the legislation of the Russian Federation.

11. Provide for the possibility of introducing clarifications into the organization’s accounting policy for 2011 in connection with the emergence of business transactions, the reflection of which in accounting and tax accounting is provided for by several methods, the choice of which is assigned by law to the organization.

Director of Berezka LLC __________________/Petrov Yu.I. /

Sample order on adoption of accounting policies for 2021

Sample order for adoption of an organization's accounting policy for 2016

An up-to-date sample order for the adoption of an organization’s accounting policy for 2021 with the possibility of adaptation to your specific needs for LLC, PJSC, JSC, NPO.

For any organization, we can draw up an individual package of documents on the adoption of accounting policies for 2021. Order No. __ dated “___”_________________2016

on the adoption of accounting policies at the enterprise for accounting and tax purposes

I order:

In accordance with the Federal Law dated December 6, 2011 N 402-FZ (as amended on November 4, 2014) “On Accounting”, the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by the Order of the Ministry of Finance of the Russian Federation dated October 6 2008 No. 106n, and the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, I order the approval of the accounting policy for 2016, I establish the following:

- Maintain accounting records in full in connection with the application of the simplified taxation system in accordance with the Law of the Russian Federation of December 6, 2011 No. 402-FZ (as amended on November 4, 2014) “On Accounting.”

- When assessing the items in the financial statements, ensure compliance with the assumptions and requirements stipulated by the Accounting Regulations “Accounting Policy of the Organization”, approved by Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n. (as amended on 04/06/2015)

- The facts of economic activity are reflected using the principle of temporal certainty, which implies that the facts of economic activity relate to the reporting period in which they took place, regardless of the actual time of receipt or payment of funds associated with these facts.

- Accounting in 2021 should be carried out using the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

- Accounting in 2021 should be carried out using the specialized accounting program 1C “Accounting” using a journal order form in electronic form. Analytical and synthetic accounting registers should be drawn up automatically (Article 10 of Law No. 129-FZ). Keep accounting documents at the enterprise in electronic form, ensuring their protection.

- The acquisition and procurement of materials in accounting is reflected using account 10 “Materials”, which forms the actual cost of materials and reflects their movement.

- When releasing inventories into production and otherwise disposing of them, they are assessed by the organization (except for goods accounted for at sales/retail cost) at the cost of each unit.

- When calculating depreciation of fixed assets in accounting, the linear method is used.

- For newly acquired fixed assets, apply the Classification of fixed assets included in depreciation groups, approved by the Decree of the Government of the Russian Federation “On the Classification of fixed assets included in depreciation groups” dated January 1, 2002 No. 1. For items acquired before 2002, depreciation is calculated in the order , provided for by Resolution of the Council of Ministers of the USSR of October 22, 1990 No. 1072 “On uniform standards of depreciation charges for the complete restoration of fixed assets of the national economy of the USSR.” If an item cannot be classified into any of the depreciation groups, the organization has the right to independently determine its useful life.

- Assets in respect of which the conditions are met that serve as the basis for their acceptance for accounting as fixed assets, costing no more than 40,000 (or a lesser limit) rubles per unit are reflected in accounting and reporting as part of inventories.

- Establish the following groups of homogeneous objects of fixed assets (buildings; structures; working and power machines and equipment; measuring and control instruments and devices; computer technology; vehicles; tools, production and household equipment; other objects).

- There is no revaluation of homogeneous fixed assets at the end of 2015.

- The costs of repairing fixed assets are included in the cost of products (works, services) of the reporting period.

- The useful life of intangible assets is determined based on the expected period of use of the asset, during which it is expected to receive economic benefits (or use them in activities aimed at achieving the goals of creating a non-profit organization).

- Depreciation of intangible assets is carried out using the following method of calculating depreciation charges in accounting: the straight-line method.

- Depreciation charges for intangible assets are reflected in accounting by accumulating the corresponding amounts in a separate account (05 - “Amortization of intangible assets”).

- Tourist vouchers purchased for sale should be accounted for in off-balance sheet account 004 as commission goods.

- When selling (dispensing) goods, their value (in the context of a particular group) is written off at the cost of each unit.

- Selling and administrative expenses are recognized in full in the reporting year as expenses for ordinary activities.

- Accounting for the output of finished products (works, services) should be carried out without using account 40 “Output of products (works, services).

- Goods shipped, work delivered and services rendered, for which revenue is not recognized, are reflected in the prepared annual balance sheet for 2015 at actual full cost.

- Administrative expenses, accounted for in the debit of account 26 “General business expenses”, at the end of the reporting period are not distributed among the objects of calculation and, as conditional constants, are written off directly to the debit of account 90 “Sales”. Revenue from the sale of goods (work, services) is recognized in accounting in the usual manner.

- In accounting and tax accounting, revenue is recognized as the agent's remuneration from the sale of vouchers.

- Revenue from the performance of work, provision of services, and sale of products with a long manufacturing cycle is recognized as the work, service, or product is ready.

- Do not create reserves for upcoming expenses and payments.

- Do not create a reserve for doubtful debts.

- Transfer long-term accounts payable (for loans and borrowings) into short-term ones from the moment when, according to the terms of the agreement, 365 days remain until the repayment of the principal amount of the debt. (Clause 6 PBU 15/01).

- Recognize all borrowing costs as other expenses.

- The accounting regulation “Accounting for income tax calculations” (for an organization - a small business entity and a non-profit organization) should not be applied.

- The accounting provision “Information on related parties” does not apply.

- The consequences of changes in accounting policies that have had or are capable of having a significant impact on the financial position of the organization, the financial results of its activities and (or) cash flows are reflected in the financial statements (for an organization that is a small business entity, with the exception of issuers of publicly placed securities) prospectively, for except in cases where a different procedure is established by the legislation of the Russian Federation and (or) a regulatory legal act on accounting.

- Use in your work primary accounting documents that are presented in albums of unified forms of primary documentation developed by the State Statistics Committee of the Russian Federation.

- Responsibility for the organization and state of accounting at the enterprise should be assigned to the head of LLC "____________" full name.

- The manager personally maintains the accounting records of the organization LLC "_____________".

- An inventory of fixed assets, materials, and goods in the organization’s warehouse is carried out annually in December. In addition, carry out an inventory in cases provided for by law.

- Provide for changes to the accounting policy for 2021 in the event of changes in the legislation of the Russian Federation and (or) regulatory legal acts on accounting; development of new methods of accounting in order to more accurately represent the facts of economic activity in accounting and reporting or make the accounting process less labor intensive without reducing the degree of reliability of information; significant change in business conditions (reorganization, change in types of activities, etc.).

- Provide for the possibility of introducing clarifications into the organization’s accounting policy for 2021 in connection with the emergence of facts of economic activity that are essentially different from the facts that occurred previously, or arose for the first time in the organization’s activities.

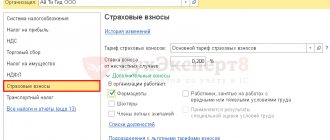

- Tax accounting of the organization LLC "____________" is carried out in accordance with Chapter. 26.2 “Simplified taxation system” of the Tax Code of the Russian Federation.

Head _________ Full name

It is possible that the sample order for the adoption of accounting policies for 2016, in some points, does not correspond to your situation, so we recommend that you place an order specifically for your conditions.

We offer preparation of the necessary set of documents by the employees of the accounting company Project-KM, within 1 business day after the transfer of the necessary documents.

For information:

Sample working chart of accounts for accounting policies for 2016.

Accounting for interest on debt obligations

According to paragraph 1 of Art. 269 of the Tax Code of the Russian Federation as amended in 2014, taxpayers could determine the maximum amount of interest on debt obligations taken into account in expenses in one of two ways:

- based on the refinancing rate established by the Central Bank of the Russian Federation;

- based on the average interest rate on debt obligations.

The organization should have recorded the chosen method in its accounting policy for tax purposes. And when choosing the second method, organizations also indicated in their accounting policies the criteria for the comparability of debt obligations.

Such provisions should be excluded from the accounting policy for tax purposes for 2015. Let's explain why. The fact is that in paragraph 1 of Art. 269 of the Tax Code of the Russian Federation Federal Law No. 420-FZ dated December 28, 2013 “On Amendments to Article 27.5-3 of the Federal Law “On the Securities Market” and Parts One and Two of the Tax Code of the Russian Federation” (hereinafter referred to as Law No. 420-FZ) were changes have been made that came into force on January 1 of this year. Now, the treatment of interest on debt obligations in income or expenses depends on whether the transaction is controlled. Let us recall that transactions between related parties, as well as some other transactions (clause 1 of Article 105.14 of the Tax Code of the Russian Federation) are considered controlled if the conditions specified in Art. 105.14 Tax Code of the Russian Federation.

So, if the transaction as a result of which the obligation arose is not recognized as controlled, then interest on the debt obligation is taken into account in the amount of actual amounts.

In relation to controlled transactions, the procedure for accounting for interest depends on the bank's participation in such a transaction.

If the obligation arose as a result of a controlled transaction without the participation of the bank, then when determining income and expenses, interest is recognized, calculated based on the actual rate, but taking into account the provisions of Section V.1 of the Tax Code of the Russian Federation.

If the transaction as a result of which the obligation arose is recognized as controlled and one of its participants is a bank, interest is taken into account in the manner prescribed by clauses 1.1-1.3 of Art. 269 of the Tax Code of the Russian Federation. At the same time, in paragraphs 1.1-1.3 of Art. 269 of the Tax Code of the Russian Federation provides clear rules for determining the maximum amount of interest depending on the type of currency and some other conditions.

Thus, according to the new provisions of Art. 269 of the Tax Code of the Russian Federation, the taxpayer is not given the right to choose. Therefore, it is not necessary to indicate in the accounting policy the procedure for accounting for interest on debt obligations.

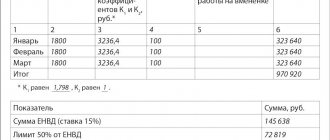

Example 1

Vesna LLC took out a loan from a bank in the amount of 1,000,000 rubles. The interest rate under the loan agreement is 25% per annum, the loan repayment period is July 1, 2015. On January 31, 2015, the company paid interest for 31 days of using the loan. What amount can be taken into account in expenses if the bank and the organization are not interdependent persons in accordance with Art. 105.1 Tax Code of the Russian Federation?

Since the bank and the organization are not interdependent persons, the transaction as a result of which the debt obligation arose will not be controlled (Article 105.14 of the Tax Code of the Russian Federation). Therefore, Vesna LLC can take into account the entire amount of interest paid - 21,233 rubles. (RUB 1,000,000 x 25%: 365 days x x 31 days).

Rationing of losses from assignment of the right of claim

The changes affected the rules for accounting for losses from the assignment of claims. Let us recall that the procedure for writing off losses depends on when the assignment of the right of claim was made: before or after the due date for payment under the contract. The accounting of losses received upon assignment of the right of claim before the due date for payment under the contract is stated in paragraph 1 of Art. 279 of the Tax Code of the Russian Federation, on the reflection of losses arising from the assignment of the right of claim after the due date for payment under the contract - in clause 2 of Art. 279 Tax Code of the Russian Federation. Both paragraphs have been amended and entered into force on January 1, 2015. But first things first.

The assignment was made before the due date for payment under the agreement

Changes to paragraph 1 of Art. 279 of the Tax Code of the Russian Federation were introduced by Law No. 420-FZ. In 2014, the maximum amount of losses from the assignment of the right of claim made before the due date of payment under the contract, accepted for taxation, was calculated in this manner. It was defined as the amount of interest that the organization would pay, taking into account the requirements of Art. 269 of the Tax Code of the Russian Federation for a debt obligation equal to the income from the assignment of the right of claim for the period from the date of assignment to the date of payment stipulated by the agreement.

Now the rules for determining the amount of interest have been clarified. According to the new edition of paragraph 1 of Art. 279 of the Tax Code of the Russian Federation, it is calculated in one of the following ways (at the taxpayer’s choice):

1) based on the maximum interest rate established for the corresponding type of currency (clause 1.2 of Article 269 of the Tax Code of the Russian Federation);

2) at a rate confirmed in accordance with the methods established by section V.1 of the Tax Code of the Russian Federation for the specified debt obligation.

And the method of accounting for losses must be enshrined in the taxpayer’s accounting policy (paragraph 2, paragraph 1, article 279 of the Tax Code of the Russian Federation). The calculation of the amount of loss taken into account for tax purposes is given in example 2.

Example 2

Sapphire LLC assigned the right of claim under the goods purchase and sale agreement on January 10, 2015. According to the terms of the sale and purchase agreement, the buyer was required to repay the debt for goods in the amount of RUB 555,000 on January 20, 2015. For the assigned right of claim, Sapphire LLC will receive 550,000 rubles from the new creditor. The accounting policy of Sapphire LLC states that the interest rate for accounting for losses upon assignment of the right of claim ahead of the period specified in the agreement is calculated in accordance with clause 1.2 of Art. 269 of the Tax Code of the Russian Federation. What amount of loss from the assignment of the right of claim will Sapphire LLC be able to take into account for tax purposes?

The actual amount of loss from the assignment of the right of claim amounted to 5,000 rubles. (RUB 555,000 – RUB 550,000). Let's calculate the maximum amount of loss in accordance with clause 1.2 of Art. 269 of the Tax Code of the Russian Federation. The right of claim is expressed in rubles, so the maximum interest rate will be equal to 180% of the refinancing rate of the Central Bank of the Russian Federation (subclause 1, clause 1.2, article 269 of the Tax Code of the Russian Federation). From September 14, 2012, a refinancing rate of 8.25% per annum is applied (directive of the Central Bank of the Russian Federation dated September 13, 2012 No. 2873-U). Let's assume that as of January 10, 2015, the refinancing rate remained the same. Then the maximum interest rate will be 14.85% (8.25 x 180%). According to the terms, the payment deadline under the contract is January 20, and the demand was conceded on January 10, that is, ten days ahead of schedule. If the organization received a debt obligation equal to the income from the assignment of the right of claim, then for ten days of using borrowed funds the amount of interest calculated at the maximum interest rate would be 2238 rubles. (RUB 550,000 x 14.85%: 365 days x 10 days). This is less than the amount of damages from the assignment of the claim. Thus, Sapphire LLC will be able to take into account losses in the amount of 2,238 rubles when calculating income tax. The remaining loss in the amount of RUB 2,762. (5000 rubles – 2238 rubles) will be lost for tax purposes.

The assignment was made after the due date for payment under the agreement

According to paragraph 2 of Art. 279 of the Tax Code of the Russian Federation as amended in 2014, losses from the assignment of the right of claim had to be taken into account in two stages: 50% of the amount of loss - on the date of assignment of the right of claim and 50% - after 45 calendar days from the date of assignment of the right of claim.

From January 1, 2015, amendments to paragraph 2 of Art. 279 of the Tax Code of the Russian Federation, introduced by Law No. 81-FZ. In accordance with them, organizations using the accrual method have the right to take into account the loss from the assignment of the right of claim, made after the due date of payment under the contract, in full on the date of assignment of the right of claim. Since the procedure for accounting for losses from the assignment of a claim made after the due date for payment under the contract does not provide for accounting options, it does not need to be specified in the accounting policy.