Who to include in the report

It is important to understand that as part of the SZV-M form for July 2021, inspectors from the Pension Fund of the Russian Federation should see information about all individuals who performed work on the basis of employment agreements from July 1 to July 31. And it doesn't matter:

- whether the company (IP) actually carried out activities in July;

- were there any accruals and payments to the “physicists” in July?

If individuals perform work (provide services) under civil law contracts, then do not get confused. In 2021, a clarification was issued (PFR letter No. LCH-08-19/10581 dated July 27, 2016) that data on such employees must be included while simultaneously meeting the following conditions:

- The performers were paid remuneration;

- Contributions are calculated on the amount of the reward.

However, as of mid-2021, the PFR authorities believe this: if in July 2021 you did not pay remuneration under a civil law contract and, accordingly, did not accrue contributions for it, then in the SZV-M form for July 2021, all such freelancers should also be turned on.

To understand whether or not to include a specific insured person in the SZV-M, you must proceed from the following:

- What type of contract has been concluded?

- Was the agreement valid in the reporting month (if at least 1 day, then it must be included in the SZV-M).

- It does not matter in the reporting period - July 2021 - the presence of facts of accrual and payment of salary (remuneration) under this agreement, as well as the accrual of contributions.

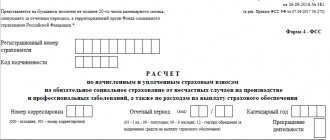

Form form: new or not

The appearance of the SZV-M report has not changed in any way since July 1, 2021. It is still necessary to use the form approved by Resolution of the Pension Fund Board of February 1, 2021 No. 83p:

Traditionally, the SZV-M form for July 2021 consists of 4 sections:

- Details of the policyholder.

- Reporting period.

- Form type.

- Information about the insured persons.

SZV M 2021 sample filling

This report can be compiled using specialized programs and Internet services, as well as by hand.

The document includes 4 sections.

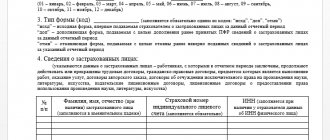

Section 1

In the first of them, immediately below the name of the form, the number of the organization or individual entrepreneur received when registering with the Pension Fund of Russia, the name of the business entity, the registration code with the tax authority, and for companies also the checkpoint.

Section 2

The second section contains the reporting period code, consisting of two digits, and the year the report was submitted. These fields must be filled in, and for those who have problems identifying the code, there is explanatory data below with this information.

Section 3

Next, indicates the type of form. According to the law, it can have three varieties:

“ISH” - initial, issued for the first time during the reporting period;

“ADP” is an additional one, submitted by policyholders as an attachment to the first one, if there is a need to correct information or add one more person after submitting the previous document. For example, when filling out an employee who was on vacation was missed. It must be submitted separately for the SZV-M for the same period;

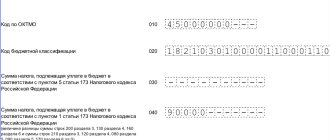

Electronic format

We can say that the relatively new form of SZV-M for July 2017 is only in part of its electronic form. Thus, since January 8, 2017, Resolution of the Pension Fund of December 7, 2016 No. 1077p has been in force, which approved a new electronic format for personalized accounting information in the SZV-M form. This fund regulatory document contains basic technical information to be sent to the SZV-M fund for July 2017 in electronic form.

A variant of a correctly formed file name for sending SZV-M is something like this:

| PFR_[registration number]_[TO code PFR]_SZV-M_[date of file creation]_[GUID].xml PFR_034-012-008111_145672_SZV-M_20170803_b26caf26-0c3c-4cf-b01-1f65f4540df0.xml |

Electronic SZV-M is created in XML format in UTF-8 encoding.

To prepare an electronic report, from the official website of the Pension Fund of Russia – www.pfrf.ru – in the “For Employers” section, download the verification module in its latest version for free. SZV-M for July 2021 can be analyzed using this software before sending it to the fund. Here is the exact link.

Zero form: does the Pension Fund’s position change?

Do I need to submit a zero SZV-M report for July 2021? Interesting question!

| Position 1 | Position 2 |

| There cannot be a zero SZV-M in principle. If not a single person is included in the July form, then submitting such an empty SZV-M loses all meaning. No one needs blank forms because they do not contain the necessary information. | The PFR branch in the Altai Territory on August 1, 2017 said this: even when there are no employees, the policyholder still submits the SZV-M. But without a list of insured persons. |

SZV-M if there are no employees

If an individual entrepreneur does not have hired employees and is not registered as an employer, then he does not need to submit this report. All other categories of business entities are required to submit this form, and it must contain at least one line. The concept of zero reporting SZV-M does not exist!

Even if the company does not operate and submits blank reports, including RSV-1, the form in question must contain one line for the director himself, who is usually also the only founder. It makes no difference whether any accruals were made on it in a given period or not. If the report is not submitted within the established time frame, the company will be subject to an appropriate minimum fine.

Also, it does not appear to be peasant farms, where, in addition to the head, members of his family work.

Should the CEO be included?

There is no need to include the only director - founder - in the SZV-M for July 2021. This is evidenced by the explanations of the Pension Fund dated 05/06/2016 No. 08-22/6356 and the Ministry of Labor dated 07/07/2016 No. 21-3/10/B-4587. But only if 2 conditions are met:

- There is no employment contract with him.

- He does not receive any payments from the organization.

That is: if in July an employment contract was not concluded with the director and he did not receive any payments, then the SZV-M form for July 2017 for such companies without staff need not be submitted at all.

Note that previously the Pension Fund insisted: the company is obliged to submit SZV-M to the sole founder, even if it did not enter into an employment or civil contract with him (letter dated 05/06/2016 No. 08-22/6356). Therefore, some accountants still prefer to play it safe and still take the SZV-M with one director. This is, in principle, not prohibited.

The Pension Fund branch is obliged to accept the SZV-M for July 2021, even if it shows only one director and there is no agreement with him.

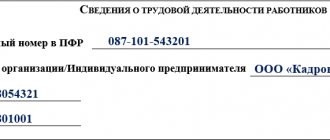

Filling out the form

Filling out the SZV-M form for July 2021 has no fundamental features. Only in the “Reporting period” field indicate the code – “07”. It shows that you are submitting the July report. Otherwise, everything is standard. The following is a sample of filling out this form for July 2021:

And here you can fill out this sample.

Also on our website you can read an article that discusses the features of filling out the fourth section of the SZV-M form for women on maternity leave, part-time workers, as well as individual entrepreneurs (See “SZV-M: filling out information about insured persons”).

Form submission technology

The SZV-M form for July 2021 can be submitted electronically or on paper (see table).

| Methods and conditions for passing SZV-M | |

| Situation | Delivery method |

| The number of people whose information is included in the report is 25 or more people | You must submit the form electronically. |

| The number of declared employees does not exceed 24 people | You can report on paper |

Can be submitted early

Submission of the SZV-M form for June 2021 may be submitted early. That is, already in June. It is not at all necessary to wait until the deadline for submitting the SZV-M for June.

However, keep in mind: if you send the SZV-M for June 2017 early, there is a possibility that the report already submitted to the Pension Fund will need to be clarified. For example, a new person will be hired on the last day of June, when the report has already been submitted.

For more information about this, see “SZV-M can be passed early.”

Copies to employees

Starting from 2021, the employer is obliged to issue copies of all reporting forms to the Pension Fund to individuals within the following terms (new edition of paragraph 4 of Article 11 of the Law “On personalized accounting of the Pension Fund of the Russian Federation” No. 27-FZ):

- no later than 5 calendar days from the date of the person’s application (this is a general case);

- on the day of dismissal or termination of a civil agreement.

Note that similar requirements for employers existed until 2021. However, it was established that employers are required to provide employees or contractors with copies of reports, regardless of whether they have applied for them. And copies had to be issued along with the submission of the appropriate reporting forms to the fund.

Thus, starting from 2021, you only need to issue copies of SZV-M for July 2017:

- When contacting employees directly.

- Their dismissal.

There is no need to give everyone a copy of the entire SZV-M form! The fact is that it contains the personal data of all colleagues included in the report. And disclosing them to third parties is prohibited. Therefore, in return, you can issue an extract for a specific person.

Report submission date

From 2021, the deadline for submitting SZV-M was shifted by 5 days: from the 10th to the 15th of the next month after the reporting period (Article 11 of the Law “On personalized accounting of the Pension Fund of Russia” No. 27-FZ).

As a result, the deadline for submitting the SZV-M for June 2021 falls on July 15, 2021. Meanwhile, this day is a day off - Saturday, so you need to submit the SZV-M report for June to the Pension Fund of Russia division no later than July 17 inclusive. It will be Monday.

For more details, see “SZV-M in 2017: new deadlines for submitting initial, corrective and updated reports.”

If the deadline for delivery of SZV-M for June is missed, the policyholder will be fined 500 rubles. Moreover, for each employee stated in the report.

Clarifying the form: how to do it

You need to clarify the SZV-M form for July 2021 if there are errors in the primary report (with the “original” type, code “ISHD”). For example, an incorrect SNILS or TIN is indicated. But the catch is that the law does not clearly state by what date policyholders can file amendment reports.

Thus, some territorial divisions of the Pension Fund of the Russian Federation believe that policyholders must submit information supplementing or canceling SZV-M no later than the main deadline. If later, there will be a fine: 500 rubles for each “physicist”.

The Pension Fund of the Russian Federation will not impose a fine if updated or corrected individual information is submitted within 5 working days from the date of receipt from the fund of a notice to eliminate discrepancies (clause 39 of Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n).

It turns out that before the deadline for submitting the SZV-M for July 2017 (i.e., before 08/15/2017 inclusive), it is advisable to submit not only the original form, but also a corrective version of the July information. If, of course, it is required. The main thing is to identify the error before the Pension Fund does it.

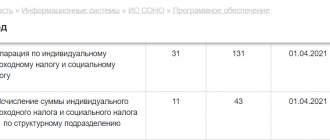

Frequency and deadline

In fact, you can create a report quite quickly, since the form is quite small. The report must be submitted monthly by the fifteenth day of each month . Accordingly, the law came into effect on April 1, 2021, and the first report had to be submitted by May 10 of this year.

If the report is not submitted by the appointed deadline, then an administrative fine of 500 rubles per employee . Thus, if the company has a large staff, for example, 100 employees, then the fine will be 50 thousand rubles, a rather large amount.