Filling out payment orders is a fairly common operation. For greater convenience of its registration and verification, unified forms were created. The Bank of Russia has created a sample of this document and drawn up the basic rules for filling it out in order to avoid any misunderstandings and disagreements between the parties. If the purpose of payment under the loan agreement and the basis for the transfer of funds are correctly indicated, such paper can subsequently be used as justification for the fact of making deductions.

Purpose of payment: corrected believe

The article from the magazine “MAIN BOOK” is current as of May 20, 2016.

Contents of magazine No. 11 for 2021 N.A. Martynyuk, tax expert

How to change an incorrect payment purpose in a payment order

The payment went to the bank, went through all the labyrinths of the banking system, and now the money is credited to the recipient’s account. Then it turns out that in field 24 “Purpose of payment” what is written is not exactly what is needed, or even not at all what is needed, or something is missing.

Here we do not consider errors in payments for the transfer of taxes and other obligatory payments.

This usually happens due to inattention or errors when copying data to fill out a payment order. For example, a non-existent contract or invoice is indicated, or even something that is not at all related to the recipient’s activities (instead of “tuition payment for May” - “utility payment for May”). The specified delivery is not the one against which this payment should be taken into account. VAT has been allocated, which should not exist; there is no indication of an advance payment or, on the contrary, “advance” is erroneously indicated. They indicated “salary” when transferring other amounts (dividends, remuneration under the GPA, money on account) or, conversely, when paying salaries they wrote something else (“loan repayment”, “reimbursement for overspending of accountable money”, etc.).

Let's see what the sender or recipient of the money can do to change the purpose of the payment. But first, let's look at questions common to all situations.

How to draw up a tripartite debt transfer agreement

- A statement that the parties will follow the provisions of current legislation in all cases that are not regulated by this agreement. The provisions of the original agreement, the results of negotiations and other documents are valid only if there is a direct indication of this;

- The parties to the agreement will make every effort to resolve disagreements through negotiations. Only if it is impossible to solve the existing problem in this way will they go to court;

- Persons undertake to maintain confidentiality and not transfer data received under the agreement to third parties. The same applies to information received during the fulfillment of an obligation;

- Final provisions.

It is also possible to issue a letter from the creditor with a request to indicate certain text in the “payment purpose” column. As a rule, the basis for the occurrence of the obligation is indicated (for example, payment for products under contract No. XX dated DD.MM.YYYY), as well as the basis - details of the tripartite agreement.

We recommend reading: What contributions must be paid for working pensioners

Why do you need to change the purpose of payment?

Firstly, because of the risk of a dispute with the counterparty - about the presence of debt or unfulfilled obligations under the contract and the penalties associated with all this. And even if now there are no disagreements between the payer and the recipient regarding the real purpose of the transferred money, they may arise later.

Here is an example from which it is clear what vicissitudes occur even due to a slight inaccuracy in the wording of the purpose of payment. An interest-free loan agreement was concluded between the two organizations with a repayment period in 2021. When transferring money to the borrower in the “payment purpose” field, a small error was made in the date of this agreement - instead of 07/19/2011 it was 07/19/2010. Time passed, and the lender demanded early repayment of the money. He referred to the fact that the payment order indicated the details of a non-existent agreement, which means that the money was not received as a loan at all, but as unjust enrichment, and must be returned immediately. And he won the dispute in the court of first instance. But the courts of subsequent instances decided that, despite the error in field 24, the money was still transferred under the loan agreement. Among other things, they referred to certificates from the payer’s and recipient’s banks stating that after sending the money, the payer clarified the purpose of the payment, indicating the correct date of the agreement. Resolution of the Moscow Region of June 23, 2015 No. A41-36454/14.

Of course, in some cases, when the error is obvious, it is possible to prove in court the actual purpose of the money sent without documents confirming its correction. Resolution of the AS SZO dated November 12, 2015 No. A21-2023/2014.

Thus, a tenant who had three lease agreements concluded with the landlord at once, when transferring money for one of them, mistakenly indicated the number of the other. When terminating the contracts, the lessor, citing the lack of payment receipts with the correct purpose, went to court to collect the amounts as unpaid. The court, having compared the amounts of rent in contracts, in monthly invoices issued for rent and in payment slips, recognized this money as repayment of debt under the correct agreement Resolution 6 of the AAS of October 16, 2015 No. 06AP-4489/2015.

Secondly, due to tax risks, the inspection may deduct expenses, deduct VAT, or charge additional taxes. For example:

- When transferring the prepayment, one contract is indicated, but the shipment was made under another. The inspectorate may insist on charging VAT on both prepayment and shipment without deducting advance VAT;

- The payment slip for the advance payment does not say “advance payment”. Minus advance VAT, the buyer will most likely have to go to court. 9 tbsp. 172 Tax Code of the Russian Federation; Resolution of the Federal Antimonopoly Service UO dated April 4, 2014 No. F09-114/14;

- on the contrary, “advance” was erroneously indicated when transferring postpayment. Tax authorities may try to charge additional advance VAT on this amount. 2 p. 1 art. 154 Tax Code of the Russian Federation;

- a taxpayer using the simplified tax system with the object “income minus expenses”, using the unified agricultural tax or using the cash method of calculating income tax, made a mistake in the purpose of the payment, the amount of which should go to his tax expenses. Expenses may be withdrawn because there is no document confirming that they were paid. For example, when transferring salaries to the director, they indicated “loan repayment”;

- if a non-existent agreement is indicated in the payment, the Federal Tax Service may regard the money received as received free of charge Resolution 6 AAS dated July 19, 2013 No. 06AP-3161/2013.

Keep in mind that tax authorities are well aware of the trick of turning an advance payment into a loan that is not closed with delivery at the end of the quarter or year. It is no secret to the inspectorate that such a change in the purpose of payment is often an attempt to:

- <or defer the accrual of VAT on this prepayment until the next quarter;

- <or stay on the simplified tax system if, as a result of receiving an advance, your income for the year exceeds the maximum limit allowed under the simplified system.

Although there are cases in which you should not be afraid of any additional charges and disputes with inspectors due to an error in the purpose of payment, although it is quite possible that you will have to communicate with the inspectors. After all, both the Federal Tax Service and the funds during inspections, including office ones, use the bank’s information about account transactions. 2 tbsp. 86 Tax Code of the Russian Federation; Part 6.1 Art. 24 of the Law of July 24, 2009 No. 212-FZ (hereinafter referred to as Law No. 212-FZ), in particular, on the assignment of outgoing and incoming payments, Appendix No. 4 to the Order of the Federal Tax Service of July 25, 2012 No. MMV-7-2 / [email protected] ; Appendix No. 4 to the Resolution of the Board of the Pension Fund of October 14, 2015 No. 377p. And due to the fact that for some payment it does not agree with the data in the reporting received from you, the inspectors naturally have questions. For example:

- the payment slip for transferring money to an individual incorrectly indicates the payment eligible for contributions. The funds will assume that contributions should be calculated from this amount, and the inspectorate will assume that personal income tax should be calculated and withheld from it (although in one special case, which we will discuss below, the inspectors will be right);

- in the purpose of the payment received by the special regime officer it is indicated “including VAT”. The Federal Tax Service will decide that an invoice with tax was issued and the special regime officer was obliged to pay this amount of VAT to the budget. 5 tbsp. 173 Tax Code of the Russian Federation. In fact, the special regime recipient mistakenly identified in the VAT payment, who did not issue tax invoices, should not pay Letter of the Ministry of Finance dated November 18, 2014 No. 03-07-14/58618;

- in the purpose of the payment received by the imputed person, something is indicated that is not fully or partially subject to UTII (for example, instead of “motor transport or “transport and forwarding services”, subparagraph 5, paragraph 2, article 346.26 of the Tax Code of the Russian Federation; Letter from the Ministry of Finance dated 02.12.2008 No. 03-11-04/3/541). Inspectors may assume that the company (IP) must have taxes and reporting under the general regime.

Based on a bank statement alone, neither the inspectorate nor the funds should add anything additional and have no right to do so. First of all, the inspectors are obliged to inquire about the reason for the discrepancy they discovered by sending you a request for an explanation. 3 tbsp. 88 Tax Code of the Russian Federation; Part 3 Art. 34 of Law No. 212-FZ. You will respond in writing that an error was made in the purpose of payment, and attach copies of all primary documents. If it is clear from them that there is an error in the purpose of the payment, then everything should end there.

Payment for transfer under a loan agreement

“You know, with such an appointment, I would also request copies of documents. Because, well, I don’t understand a damn thing what it is and what it’s eaten with. What if VP arises there? The bank ordered to specify what exactly these services are, but they cannot name the regulatory act, the Regulations on non-cash payments. 2-P. Nad.K 23.11.2009, 14:55 I didn’t ask why, I asked on what basis?

If you have any questions, you can consult free of charge via chat with a lawyer at the bottom of the screen or call 8 800 350-81-94 (consultation is free), we work around the clock.

ValyaChel 23.11.2009, 15:14 Demin I’m wildly sorry, but I didn’t find in the said Regulations that it is necessary to specifically describe goods and services.

How much time do you have to make changes?

There is no procedure in law for changing the purpose of payment. Therefore, the courts believe that the parties to the settlement have the right to determine for themselves how they will do this. Resolution of the Federal Antimonopoly Service dated 04/09/2013 No. A12-16731/2012; 1 AAS dated January 18, 2016 No. A79-8810/2014; 11 AAS dated December 9, 2014 No. 11AP-18750/2014.

Accordingly, the period during which this can be done is not defined by law. But it’s important not to delay. In the event of a dispute, a change in assignment may be declared invalid if, in the opinion of the court, too much time has passed from the date of payment to the date of change. In court decisions of recent years, “too much” is six months Resolution 12 AAS dated November 18, 2014 No. A12-23638/2014, 9 months Resolution AS ZSO dated 06/10/2015 No. F04-8740/2014, year Resolution 1 AAS dated 06/09/2015 No. A11- 9168/2014; 2 AAS dated February 19, 2013 No. A82-8699/2012; AS PO dated January 29, 2015 No. F06-19112/2013; AS VVO dated 06/09/2015 No. A79-5302/2014, 2 years Resolutions of AS PO dated 03/24/2015 No. F06-20843/2013, F06-21795/2013; 2 AAS dated December 21, 2013 No. A31-2631/2013 - it all depends on the specific circumstances. For example, in one case, the court recognized as lawful changes in the purpose of payments issued within a period of 10.5 months. up to one and a half years from the date of transfer of moneyResolution 17 AAS dated 06/05/2014 No. 17AP-5296/2014-AK.

It is unlikely that the court will agree with the changed appointment if the documents about it were drawn up after the initiation of the legal dispute or were presented for the first time only at the court hearing Resolution 1 of the AAS dated December 22, 2015 No. A43-17664/2015; 2 AAS dated March 24, 2016 No. A31-6990/2015, dated July 24, 2015 No. A31-11865/2014; FAS VVO dated October 7, 2013 No. A11-8352/2012; 7 AAS dated 08/29/2013 No. A67-8056/2012 - even if only a few months have passed since the payment; Resolution 1 AAS dated 11/13/2015 No. A11-6898/2015; 2 AAS dated December 20, 2013 No. A28-9248/2013.

If the purpose of payment does not indicate an assignment agreement

Banks can transfer funds based on customer orders. The sender formalizes his order in the form of a payment order. This document must also be drawn up in the case when the purpose of payment for the assignment is indicated.

Only from the amount of excess proceeds from the assignment of the claim over the original debt. As for the agreement on the transfer of debt, usually the amount of the transferred debt corresponds to the data of the supply agreement and invoices, that is, including VAT.

How to change the purpose of payment

The payment order itself with an error, regardless of its form - electronic or paper, after execution by the bank you, of course, will not correct it. Therefore, you need to draw up documents that:

- record that the payment indicated an erroneous purpose of payment;

- contain its correct wording;

- show that both parties to the calculations agree with the change in purpose and the payment is taken into account by them according to its actual purpose.

In some cases, the courts agreed that the payer could do without the consent of the counterparty, limiting himself to only one notification of a change in assignment (with proof of its delivery). These are cases when, due to an obvious technical error, a non-existent or no longer valid agreement (obligation) is indicated in the payment order (AS PO Resolution No. A72-4034/2013 of August 19, 2014); 3 AAS dated June 11, 2014 No. A33-22939/2013; 4 AAS dated November 1, 2013 No. A19-5299/2013; 6 AAS dated July 19, 2013 No. 06AP-3161/2013; FAS MO dated February 25, 2013 No. A40-32771/12-140-10; FAS VVO dated November 5, 2013 No. A43-16893/2011; 8 AAS dated July 24, 2015 No. 08AP-7366/2015; 13 AAS dated September 18, 2015 No. 13AP-19026/2015.

But it is safer not to rely on this and still obtain the consent of the counterparty to change the purpose - this will reduce the likelihood of a dispute both with him and with the tax authorities.

To do this you need to do the following.

Minimum Required

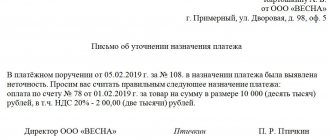

STEP 1. The interested party draws up a letter in two copies with information about the error in field 24 of the payment and with a request to agree to change the purpose of the payment to the correct one. Both copies are sent to the second party of the settlement. The second party makes a note of consent, sends one copy back, and keeps the other for itself.

Of course, there will be no mistake in a simple exchange of letters: one party proposes to change the assignment, the second agrees in a separate letter. But it is often more convenient for both the proposal and the consent to be in one document.

On the payer's side, the letter must be signed by the same persons whose signatures appear on the same payment slip. But if for some reason this is not possible (one of them has already been fired, on a long vacation, on sick leave, etc.), then the letter must be signed by those who currently have the right to sign payment orders in this bank (who is indicated on the bank card).

The letter must be signed by the legal representative of the organization (IP) from the recipient of the money:

- <if this is an organization, then a director or other person authorized to act on behalf of the company, including on the basis of the corresponding power of attorney of the director. 1 tbsp. 53, articles 185-187 of the Civil Code of the Russian Federation; Art. 40 of the Law of 02/08/98 No. 14-FZ; Art. 69 of the Law of December 26, 1995 No. 208-FZ;

- <if>this is an individual entrepreneur, then the individual entrepreneur himself or a person authorized by him.

Here is an example of such a letter.

Vira LLC

101000, Moscow, Prichalny lane, 1 Tel. INN 77011831155 OGRN 1127785195230

Ref. No. 253/A10 dated 04/06/2016

General Director of Maina LLC A.A. Lebedkin

Vira LLC, by payment order No. 146 dated April 4, 2016, transferred the amount of 165,000 rubles to the settlement account of Maina LLC No. 40702810838123459320 in the Port Bank of Moscow. Do not be lazy to provide all the information about the payment so that you can clearly identify it In the field 24 “Purpose of payment” of the specified payment order is erroneously stated “Under the contract for construction and installation work dated March 31, 2016 No. 179, including VAT (18%) - 25,169.49 rubles.”

We ask you to confirm your consent to change the erroneous purpose of payment to the following correct one: “Payment under the contract for the provision of transport services dated March 23, 2016 No. 164, including VAT (18%) - 25,169.49 rubles.” It is safer to fully state the correct purpose payment. There is no need to indicate only the part of the wording that should be replaced

General Director of Vira LLC B.B. Cargo

Agree:

| (position and name of organization) | (Full name.) | (signature) | (date of) |

| (position and name of organization) | (Full name.) | (signature) | (date of) |

Here, the authorized representative of the second party to the settlement must sign to confirm his consent. If the recipient sends the letter to the payer and there were two signatures on the payment slip, then two lines are needed here too

STEP 2. The parties draw up and sign a reconciliation report. Thus, they record that the payment was taken into account by both parties for the correct purpose. In case of a dispute, the reconciliation act may be an argument in favor of the correct purpose of payment. Resolution 2 of the AAS dated September 26, 2013 No. A17-1301/2012; 7 AAS dated July 31, 2015 No. 07AP-4343/2015.

Should I notify the bank about a change in payment purpose?

It's better to notify. But the bank may refuse to accept such a notice, and, most likely, this will not be a big problem. Here's the thing.

On the one hand, some courts mention the bank’s notes on acceptance of the bank’s notice or certificate about the client changing the purpose of payment among the evidence of the Resolution of the AS MO dated June 23, 2015 No. A41-36454/14; 1 AAS dated 04/10/2015 No. A39-2453/2014, dated 05/30/2013 No. A43-16893/2011, dated 12/22/2015 No. A43-17664/2015; 7 AAS dated March 27, 2014 No. A45-2953/2013. That is, in case of a dispute, this is an additional argument in favor of the validity of the changed assignment.

There are also court decisions in which notification of banks is already mentioned as a necessary condition for the changed purpose of payment to be considered valid. Resolutions of the AS SZO dated 04.08.2015 No. F07-6079/2015, dated 27.07.2015 No. F07-4213/2015; 14 AAS dated September 14, 2015 No. A05-3066/2015; 18 AAS dated 03/11/2016 No. 18AP-14179/2015, dated 02/11/2016 No. 18AP-461/2016; FAS PO dated February 27, 2014 No. A72-1735/2013. They indicate that after the parties have agreed to a change in the purpose of the payment, the payer should notify its bank in writing, which should inform the recipient's bank, and the recipient's bank - its client. The court can even send a request to the banks of the payer and the recipient whether they have information about the parties changing the purpose of the payment. Resolution 8 of the AAS dated June 23, 2015 No. 08AP-5044/2015.

On the other hand, in these decisions, failure to notify the bank was not the only basis for refusing to recognize the purpose of payment as changed. And when the whole problem was that the bank was not notified, the courts came to the conclusion: to correct the error, it is quite enough to agree on a change in the purpose of the payment with the recipient of the funds. AS ZSO dated June 30, 2015 No. F04-20496/2015; 18 AAS dated January 20, 2014 No. 18AP-13216/2013; 17 AAS dated January 29, 2014 No. 17AP-15967/2013-AK; FAS PO dated 04/09/2013 No. A12-16731/2012. And there are decisions in which the issue of notifying the bank was not even raised - the change in the purpose of the payment was recognized as such on the basis of correspondence between the parties, see, for example, Resolution of the FAS ZSO dated 09/02/2013 No. A67-4290/2012; AS UO dated August 21, 2015 No. F09-5554/15; AS PO dated December 15, 2015 No. F06-3939/2015; 11 AAS dated July 31, 2015 No. 11AP-8853/2015; 8 AAS dated November 25, 2013 No. A81-271/2013; 12 AAS dated May 22, 2013 No. A12-24896/12.

In addition, some banks refuse to accept such notifications, and when they receive them by mail or through Client-Bank, they simply ignore them. And even more so, they are not going to somehow record the corrected purpose of the payment, nor transfer information about it to the recipient’s bank. And there are reasons for this. The law establishes when the bank’s obligation to the client to fulfill his order to transfer money ceases (the so-called finality of the transfer) subsections. 9-11 art. 5 of Law No. 161-FZ of June 27, 2011 (hereinafter referred to as Law No. 161-FZ). This is the moment the money is credited to the account:

- <or>beneficiary - if the accounts of the payer and the recipient are in the same bank;

- <or>recipient's bank - if the recipient's account is opened in another bank.

At the same moment, the payer’s monetary obligation to the recipient also terminates. 17th century 7 of Law No. 161-FZ.

After this, the bank no longer has an obligation to the client regarding the transfer, including the obligation to somehow record the change in its purpose. Also, banks sometimes refer to the fact that, according to the rules established by the Central Bank, they do not interfere in the contractual relations of clients. 1.25 Regulations of the Central Bank of June 19, 2012 No. 383-P.

Despite all this, for additional security, it is better for the payer to send a notification about changing the purpose of payment to his bank, especially since this is not difficult. Attach the correspondence of the parties to the settlement to the notice. You should not be interested in the bank's reaction, but in receiving proof that you notified the bank. To do this you need:

- <or show up with a notification to the bank so that the bank puts an acceptance mark on your copy;

- <or>send a notification by mail with a list of the attachments;

- <or send it through “Client-Bank”. Print out the notice in two copies and attach it to the payment slip, as well as in the folder with outgoing correspondence.

If you realized it immediately after sending the payment to the bank, on the same day, then you need to act differently. Contact your bank as soon as possible. As long as the money has not been debited from your account, you have the right to withdraw the payment. 7 tbsp. 5, paragraph 14 art. 3 of Law No. 161-FZ; clause 2.14 of the Central Bank Regulations dated June 19, 2012 No. 383-P. And you can immediately issue a new one, with the correct purpose.

How to correctly fill out the column indicating the purpose of payment under a loan agreement

28.09.2020

Filling out payment orders is a fairly common operation. For greater convenience of its registration and verification, unified forms were created.

The Bank of Russia has created a sample of this document and drawn up the basic rules for filling it out in order to avoid any misunderstandings and disagreements between the parties.

If the purpose of payment under the loan agreement and the basis for the transfer of funds are correctly indicated, such paper can subsequently be used as justification for the fact of making deductions.

Why do you need to indicate the purpose of the payment?

Filling out accounting statements for the company's loans and borrowings requires mandatory indication of the purpose of payment. According to the current requirements, any payment documents that reflect the movement of funds in the bank account of its owner must be marked. It fully reveals the essence of the transfer or payment.

The purpose of payment must be indicated in field number 24. According to this section, there is an important note indicating that the purpose of payment column can contain no more than 210 characters. Such a limit obliges the filler to think carefully in order to formulate the essence of the financial transaction as succinctly as possible, but at the same time quite briefly.

When providing such information, it is also necessary to understand that all documents must be completed using competent and correct wording. Do not forget that bank employees monitor ongoing transactions and if the description of the purpose of the payment is dubious, the transfer may be blocked.

Important! Blocking an operation is far from the worst sanction. Due to a serious violation, the company may be denied service and be blacklisted. Strict requirements and strict restrictions oblige the accounting preparer to responsibly enter information into column 24.

If problems arise with the bank, data about the company is also transferred to higher levels, namely to the Central Bank, which in turn adds to the black list of companies undesirable for cooperation. Being included in such a list may result in other financial and credit organizations refusing to open accounts and cooperate as counterparties.

Correctly entering information about your payment is important, since making mistakes when entering data in this column can subsequently result in many unpleasant moments for a company or individual.

What information should be indicated in the payment purpose section?

The importance of correctly filling out the column containing information about the purpose of the payment cannot be denied. It is imperative that you ensure that the information provided is correct. Let's look at the basic information that should be entered in column number 24:

- Indication of the intended purpose of the financial transaction being carried out. Some difficulties may arise here, since it is not always clear how to formulate the purposes for which the payment is made. The most commonly used formulations are “issuance of a loan”, “the next loan payment”, “fulfillment of interest obligations under a loan agreement”. If you are unsure that you are indicating the intended purpose correctly, then you should look for examples and take the wording from there.

- A link to the document that serves as the basis for the financial transaction. Such a basis may be a loan agreement or a credit agreement. You should indicate not only the contract number, but also the date of its conclusion.

- In the case of indicating a loan transaction, the type of debt obligation should be noted. This means that you must indicate whether the agreement pays interest or whether the agreement is interest-free. In the case of signing a regular loan agreement, it is necessary to indicate the interest rate. An interest-free loan is issued based on a special document. If a regular contract does not specify an interest rate, it is calculated based on the key rate of the country’s Central Bank.

- Additionally, you must indicate important nuances regarding the document you are referring to. It should be noted for what period the agreement is concluded and on what grounds.

- At the end of the note you must make a note about the amount of VAT. If the financial transaction is not subject to tax, this is also indicated.

Important! You need to indicate a large amount of information in the column. All this information must be presented in 210 characters, including spaces. If this limit is exceeded, the document will not be accepted.

Rules for filling out payment instructions

To avoid annoying mistakes and incorrect wording in the “payment purpose” column, follow these recommendations:

- Indicating the VAT mark is mandatory even if you do not pay it. If your financial transaction does not require taxation, then at the very end the description of the payment should be written “without VAT” or “VAT exempt”. If tax is included in the amount you transfer to another account, its amount should be indicated.

- If you are paying taxes, you must indicate which tax you are covering and for what period of time. Additionally, the details of the policyholder are indicated.

- If you, as an individual entrepreneur, want to transfer funds from one account to another, then in the purpose of the payment you must indicate “replenishment of your own account.” Such wording is not prohibited by law and will not cause any suspicion among bank or tax officials.

- Replenishing an account has its own characteristics, since individual entrepreneurs are allowed to deposit funds into their accounts without restrictions or justification for the transfer. For a company, replenishing an account will be a more complex operation, since in order to deposit money into the account it is necessary to have a basis that is described in detail. The funds contributed must have a clear purpose, for example, financial assistance, payment for services or any category of goods, or any other needs. Organizations must indicate the founder of the payment.

- When conducting a financial transaction marked as payment for a product or service, you should always remember that the transferred amount corresponds to the scale of the enterprise or organization. If a small company makes too large transfers, this may cause some suspicion on the part of the bank, which will subsequently monitor the transactions more carefully. Be prepared for the fact that the bank may make a request for acts on the performance of paid services and reports on them.

- Payment of funds for rent should also be described in more detail. Include the details of the rental agreement, as well as information about the period of time you are paying for. Also, do not forget to indicate what exactly you are renting, since it can be not only real estate, but also other types of property.

What wording can be used to fill out the payment purpose column?

It is difficult for a person who is just delving into the intricacies of accounting or has never encountered this before to understand how to correctly fill out information about the purpose of payment. For convenience, let’s look at a few examples from which you can take suitable wording and use them when filling out your own payment orders:

Source: https://cabinet-bank.ru/naznachenie-platezha-po-dogovoru-zajma/

Special situation: erroneous assignment when transferring money to an individual - not an individual entrepreneur

Here, in most cases, it is enough to draw up an accounting certificate about the error in the payment in the “Purpose of payment” field. Please provide the correct wording in the certificate. In confirmation, list the documents on the basis of which the payment was calculated. For greater confidence, you can ask the recipient to write “True” or “I Agree” on the accounting certificate and put the date, signature and its transcript. This should be enough for inspectors from the Federal Tax Service and funds. And an individual who has received the money due to him on time is unlikely to have any reason to be dissatisfied.

But there is an exception: when transferring some amount not related to wages to an employee (for example, money for reporting, dividends to a director who is a member of the company, payment for renting property to an employee, etc.), you mistakenly indicated in the purpose of payment “salary for such - about a month."

The courts point out that the amounts mistakenly transferred with the purpose of “salary” are exactly that, see, for example, Appeal Rulings of the St. Petersburg City Court dated October 20, 2014 No. 33-16724/2014; Altai Regional Court dated June 10, 2015 No. 33-5232/2015; Moscow City Court dated July 28, 2014 No. 33-21786/2014; Determination of the St. Petersburg City Court dated April 24, 2014 No. 33-6616/2014. And the employer has the right to withhold the amount of overpaid wages from the employee only if the reason for the excess payment is a counting (that is, arithmetic Letter of Rostrud dated 01.10.2012 No. 1286-6-1; Ruling of the Supreme Court dated 20.01.2012 No. 59-B11-17) error Letter of Rostrud dated October 1, 2012 No. 1286-6-1; Ruling of the Supreme Court dated January 20, 2012 No. 59-B11-17. It is possible to recover it through the court if the overpayment was caused by the same accounting error or unlawful actions of the employee who received the money as established by the court. 137 Labor Code of the Russian Federation; clause 3 art. 1109 of the Civil Code of the Russian Federation.

It is clear that in our case there is neither one nor the other. It turns out that this amount should remain with the employee. And it can be counted against the payment, when transferring which you mistakenly indicated “salary,” only with his consent.

The situation is exactly the same if it is erroneously indicated in the purpose of payment that the amount paid is sick leave benefits (including maternity leave). 4 tbsp. 15 of the Law of December 29, 2006 No. 255-FZ; Part 2 Art. 19 of the Law of May 19, 1995 No. 81-FZ.

Therefore, in such a situation, your actions depend on whether the employee agrees to refuse the overpaid salary:

- If he agrees, he needs to formalize this consent in writing. That is, he wrote a statement that he agreed to offset the excess amount received to repay the debt for the payment that should have been transferred to him initially;

- If you do not agree, then it is safer to consider this amount as a “income” payment in favor of the employee and, therefore, charge insurance premiums on it. 1 tbsp. 7 of Law No. 212-FZ, as well as calculate personal income tax (it will have to be withheld from the next income paid to the employee, and if this is not the case, inform the inspectorate at the end of the year about the impossibility of withholding tax. 5, Article 226 of the Tax Code of the Russian Federation). And the money for what you were actually going to pay will have to be transferred again - with the correct destination.

***

A change in the purpose of payment is often formalized even when there were no errors in field 24 of the payment initially, but after the money was transferred, the initial intentions of the payment parties changed. That is, they paid for one thing, but then it turned out that it was necessary to take the payment into account as payment for another. Courts, as can be seen from the arbitration practice cited above, often agree with the transfer of payment by formalizing a change in its purpose. For more information about what to do if one of the parties wants to take money into account not in accordance with the purpose indicated in the payment, read in, 2021, No. 12, p. 65.

Other articles from the magazine "MAIN BOOK" on the topic "Banking Operations":

Purpose of payment when one person transfers a debt for another

- From the client who must pay (Debtor) - a letter stating that he asked another organization (Payer) to pay for himself.

- From the client who made the payment (Payer) - either a letter stating that he made the payment at the request of the Debtor or an indication in the purpose of payment “payment for the Debtor on such and such grounds”) or both of these documents (a letter and an indication of the purpose of payment ).

Here is a sample letter about the repayment of debt for a company by a third party to the General Director of Gamma LLC M.I. Sidorova 11326 Moscow st. Lyublinskaya, 9/2, office. 14From the General Director of Alpha LLC I.P. Ivanova125698, Moscow, st. Saratovskaya, 6, office. 12 (1) Ref.

Return of an interest-free loan to the founder on the card

Can a founder lend to his company?

Loan agreement with the founder: how to protect yourself from mistakes?

Loan repayment: what to consider first?

Returning an interest-free loan to the founder: which method to choose?

Loan repayment procedure: what other conditions should be taken into account and on which accounts should be reflected?

What to do if you can’t return the loan to the founder’s card?

Resolving the issue with a “stuck” loan

Results

Loan from the founder and upcoming tax consequences in 2021

To ensure that the transaction does not have unpleasant consequences for both parties, the loan agreement must be drawn up thoroughly. Video: the founder provides assistance to his company The founder can issue the following loans to his company: the loan will be such if the agreement clearly states that the funds are issued without interest. If there is no such reference, then the lender has the right to demand payment of interest at the key rate of the Central Bank of the Russian Federation for the day debt repayment.

The lender, that is, the founder, has the right to control the use of borrowed funds. If the money is used for other purposes, the contract can be terminated unilaterally.

Can a founder lend to his company?

The company and its founder, if necessary, can act as parties to a loan agreement - a mutual agreement on the transfer of funds or other property to the borrower from the lender into ownership.

Find out more about borrowed funds by going to.

Borrowing relationships with the founder allow the company to urgently receive money or other items at the lowest cost:

- for carrying out current business activities;

- expansion of the material base;

- introduction of new technologies;

- for other purposes (for making a deposit for participation in a tender, paying off debts, etc.).

There are no special regulatory restrictions in relation to the company (borrower) and the founder (lender). Therefore, the founder can lend his company:

- money or any other property that has common generic characteristics (model, color, variety, etc.) - clause 1 of Art. 807 Civil Code of the Russian Federation;

- borrowed funds in any amount and for any period;

- with or without interest.

The borrowing company can borrow from the founder:

- regardless of the size of its share in the authorized capital;

- for specific purposes (targeted loan) or without specifying the purpose of the loan;

- subject to the obligation to return the borrowed funds received and to formalize the loan agreement in writing (Article 808 of the Civil Code of the Russian Federation).

you can use the loan agreement with the founder.

Transferring funds to a bank card as a loan without drawing up a loan agreement

Hello!

A friend asked me to borrow money. Since he was in another region, I transferred the money to his card. I didn’t take any receipts from my friend, now he refuses to return the money he borrowed from me, saying that he didn’t receive any money. Will I be able to get the money sent through Sberbank online back in court?

If you ask the court to return the debt, the court will most likely reject the claim due to the following.

Clause 1 Art. 432 of the Civil Code of the Russian Federation provides that an agreement is considered concluded if an agreement is reached between the parties, in the form required in appropriate cases, on all the essential terms of the agreement.

Clause 1 of Art. 161 of the Civil Code of the Russian Federation establishes the types of transactions that must be concluded in simple written form, with the exception of transactions requiring notarization: 1) transactions of legal entities among themselves and with citizens; 2) transactions between citizens for an amount exceeding ten thousand rubles, and in cases provided for by law - regardless of the amount of the transaction.

At the same time, failure to comply with the simple written form of the transaction deprives the parties of the right in the event of a dispute to refer to witness testimony to confirm the transaction and its terms, but does not deprive them of the right to provide written and other evidence (clause 1 of Article 162 of the Civil Code of the Russian Federation).

According to paragraph 1 of Art.

807 of the Civil Code of the Russian Federation, under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality. The loan agreement is considered concluded from the moment the money or other things are transferred.

Thus, within the meaning of paragraph 1 of Art. 807 of the Civil Code of the Russian Federation, the condition on the repayment of funds is essential and the loan agreement must contain this condition.

Regarding the form of the loan agreement, clause 1, art. 808 of the Civil Code of the Russian Federation establishes that a loan agreement between citizens must be concluded in writing if its amount exceeds at least ten times the minimum wage established by law, and in the case where the lender is a legal entity, regardless of the amount.

In confirmation of the loan agreement and its terms, a receipt from the borrower or another document certifying the transfer by the lender of a certain amount of money or a certain number of things to him (clause 2 of Article 808 of the Civil Code of the Russian Federation) may be presented.

Thus, for a cash loan agreement, in the specific case under consideration, the law provides for a written form of the agreement.

In accordance with Part 1 of Article 56 of the Civil Code of the Russian Federation, each party must prove the circumstances to which it refers as the basis for its claims and objections, unless otherwise provided by federal law.

As follows from Art. 60 of the Code of Civil Procedure of the Russian Federation, the circumstances of the case, which in accordance with the law must be confirmed by certain means of proof, cannot be confirmed by any other evidence.

Thus, the fact of concluding a transaction, for which the law requires compliance with a written form, can be confirmed only by written evidence, namely directly by a document expressing the content of such a transaction and signed by the person or persons entering into the transaction, or persons duly authorized by them.

The transfer of funds to the card only certifies the fact of transfer of a certain amount, but does not contain the essential terms of the loan agreement, the purpose of payment and does not indicate the will of both parties to establish loan obligations.

The recipient of funds from you in court will say that he did not express any expression of will to conclude a loan agreement, there were no written or oral agreements that your friend was allegedly borrowing money, and he also did not make any requests to lend money. expressed.

Of course, the transfer of funds for banking transactions through Sberbank Online does not entail recognition of the loan agreement as concluded, since they cannot be considered as documents confirming the conclusion of the loan agreement, since they are primary accounting documents and indicate only the completion of a banking transaction for debiting funds from the payer's account.

Thus, reliable, admissible evidence consistent with the provisions of Art. 60 Code of Civil Procedure of the Russian Federation and Art. 808 of the Civil Code of the Russian Federation, confirming the fact of the conclusion of a loan agreement between the parties, you have not presented, there are no legal grounds for qualifying the relations of the parties as borrowed and collecting funds from the defendant.

You can contact us and the lawyers of the Consulting Company “Garant-Expert” in Cheboksary will advise you on how to competently substantiate your claims.

Sincerely, debt collection lawyer in Cheboksary

Source: https://www.pravotolc.ru/perevod-denezhnyh-sredstv-na-bankovskuyu-kartu-v-kachestve-zajma-bez-sostavlenie-dogovora-zajma/

Loan agreement with the founder: how to protect yourself from mistakes?

The return of money under the loan agreement is one of the final stages of the borrowing relationship. It is preceded by such important procedures as:

- agreeing on the terms of the loan;

- drawing up a loan agreement;

- transfer of borrowed funds from the founder to the company and preparation of a supporting document (transfer and acceptance certificate, receipt, etc.);

- reflection in accounting of operations to obtain borrowed funds.

If mistakes are made in these steps, problems may arise at the loan repayment stage. Therefore, check in advance:

- whether the property transferred under the loan agreement has individual characteristics (for example, a car with a title and identification number cannot be the subject of a loan);

- currency of the monetary obligation - according to Art. 317 of the Civil Code of the Russian Federation, such an obligation must be expressed in rubles (foreign currency may appear in the loan agreement, but only as an equivalent at the rate of the Central Bank of the Russian Federation);

- whether the loan agreement provides for all its essential (subject of the loan and its repayment) and additional (repayment period, interest-free condition, etc.) conditions.

IMPORTANT! If the loan agreement does not contain provisions on interest or the absence thereof, the loan is considered interest-bearing. Interest is calculated based on the refinancing rate (clause 1 of Article 809 of the Civil Code of the Russian Federation). The contract also cannot stipulate that the loan is irrevocable. According to paragraph 1 of Art. 807 of the Civil Code of the Russian Federation, the lender is a priori obliged to repay the loan to the lender.

Find out what conditions are necessarily included in the purchase and sale agreement for an apartment from the material “Essential terms of the purchase and sale agreement under the Civil Code of the Russian Federation.”

What is an interest-free CEO loan?

A loan from the director of the company can be provided interest-free. This means that you will not have to pay any interest for using the organization’s funds. But it is not enough to simply not indicate the interest rate in the conditions: in this case, during verification, the amount of interest will be additionally accrued from the current Central Bank discount rate (Article 809 of the Civil Code of the Russian Federation). It must be clearly stated that the loan is interest-free.

Postings under such an agreement are drawn up in the general manner, excluding interest charges. An interest-free loan does not affect the calculation of income tax, since it is not included in the income of the recipient of the funds, as well as in his expenses. According to the explanations of the Ministry of Finance, it is also not required to accrue the amount of material benefits from such amounts (Letter No. 03-03-06/1/5149 dated 02/09/15).

Loan repayment: what to consider first?

Before deciding whether to return the interest-free loan to the founder on the card, you need to check:

- the founder-lender has no debt to contribute a share to the authorized capital - if the founder has not contributed his “authorized” share in a timely manner or has not transferred it to the company in full, the borrowed funds received will be used to pay off such debt, and there will be nothing to return to his card;

- the presence in the loan agreement of a condition allowing the use of a method of returning borrowed money to the founder’s card;

- compare the types of borrowed funds received by the company from the founder and the funds returned by it under the loan agreement.

If you received a batch of building materials under a loan agreement, then there can be no question of any return to the loan card in cash. Borrowing relationships presuppose a single rule: “what you borrow, return it” (Clause 1, Article 807 of the Civil Code of the Russian Federation).

Thus, having ensured against mistakes at the stage of agreeing on the terms of the loan agreement and having made sure that the loan can be repaid in money to the card of the founder-lender, you can proceed directly to the procedure for returning the borrowed funds (see below).

Features of a loan from a private lender

The legislative framework does not prohibit transactions between private individuals - the lender and the borrower, if the conditions of the process and the procedure for its implementation are completely satisfactory to them. The subject of the conclusion may be funds and property assets, the owner of which is the giving party. This could be an apartment, a vehicle, jewelry, valuable assets, or household appliances.

The procedure can be either written or oral, provided that the total amount of the transaction does not exceed the permissible threshold. According to Article 807 of the Civil Code of the Russian Federation, this is ten times the minimum wage for a specific period of time.

The document may provide for the lender to receive additional profit. This is a loan agreement between individuals with interest. Their listing is regular. If the funds are transferred without accrual, the agreement is classified as interest-free.

According to the type of loan, the loan can be targeted - where the money will be spent is indicated in the agreement, or non-targeted. In the latter case, the borrower does not report to the lender where exactly the borrowed money was spent.

If the parties to the transaction are far from each other and cannot be present at the registration, it is permissible to exchange documents via telephone, postal or electronic communication. An indispensable condition is the ability to prove that the form was sent by one of the participants in the future transaction.

Returning an interest-free loan to the founder: which method to choose?

A company can only have 2 legal “cash pockets”, from which it can transfer to the founder the funds borrowed from him:

- from a current account;

- from the cash register.

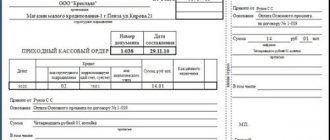

To transfer to the founder's card from a current account you will need:

- a description in the loan agreement (or in an additional agreement to it) of a similar method of debt repayment;

- indicating in it detailed bank details for transferring money to the card.

Note! When repaying a loan to the founder - an individual, there is no need to run a cash register check with the “expense” sign.

If a company does not have money in its current account, but it does have it in the cash register, it is important to consider the following:

- you cannot issue money from the cash register to repay a loan from proceeds (clause 4 of the Bank of Russia Instruction on the procedure for conducting cash transactions No. 3210-U dated March 11, 2014, Decision of the Moscow City Court dated December 14, 2012 in case No. 7-2207/2012);

- funds from the cash desk are deposited into the current account, and then a transfer is made to the founder on the card with a note in the purpose of payment “Return of funds under the loan agreement dated __ No. __”).

Do not neglect cash restrictions, otherwise you may suffer financially - according to Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, the fine for this type of cash violations is up to 50,000 rubles.

Which “cash” requirements are dangerous to ignore is stated in the material “Procedure for conducting cash transactions in 2021.”

dogovor_zayma.jpg

Related publications

The structure and procedure for filling out payment orders are unified by the Bank of Russia. A sample document and the rules for its execution are given in the Regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P. In order for a payment document to be used as evidence of the fact of transfers, it is necessary to specify in detail the purpose of the funds and the reasons for their transfer.

Loan repayment procedure: what other conditions should be taken into account and on which accounts should be reflected?

When repaying a debt to the founder under a loan agreement and transferring money to his card, do not forget about the need:

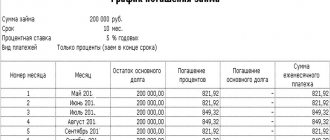

- compliance with the loan repayment schedule stipulated in the loan agreement;

- full repayment of the borrowed debt no later than one month from the date specified in the agreement (if a payment schedule is not provided).

When you cannot do without schedules in your current business activities, learn from the materials posted on our website:

- “How to correctly draw up a schedule for the implementation of professional standards?”;

- “What does this mean - a rotational work schedule?”;

- .

In accounting, reflect the repayment of the loan to the founder’s card by writing:

Dt 66 (67) Kt 51 - repayment of the loan to the founder’s card under the loan agreement.

Apply:

- account 66 “Settlements for short-term loans and borrowings” - if you borrowed funds from the founder for a period of less than 12 months;

- account 67 “Settlements for long-term loans and borrowings” - if the loan agreement provides for a longer borrowing period (over a year).

The bank statement will confirm:

- the fact of repayment of debt to the founder;

- volume and details of transfers.

If you are repaying the loan in parts, apply all of the above recommendations for each part of the debt being repaid.

This video is unavailable

On July 1, 2021, amendments to the Tax Code of the Russian Federation came into force stating that the tax office and banks will check money transfers to cards of individuals. Many took this to mean that the tax office in 2021 will check all transfers and perceive each as income of an individual and demand payment of taxes on income. In this case, personal income tax is paid, 13% of the amount of income of an individual. This also caused panic because for entrepreneurs and many self-employed citizens, transferring from card to card of an individual is a way to evade taxes. At the end of June this year, the Moscow Tax Inspectorate released an official statement on its website, which specified that the tax authorities will not check the accounts of all Russians. An individual’s account can be checked in the event of a tax audit (desk tax audit or on-site tax audit). The reasons for this, for example, may be: - a message from the bank to the tax office about suspicious transfers; — verification of the legal entity and identification of real beneficiaries; — deduction for the purchase of housing in the absence of official income of an individual;

We recommend reading: How to restrict Tajiks from entering

Are all transfers to individual cards now checked by the tax authorities? What is personal income tax? How to properly process a money transfer from card to card so that the tax office and the bank do not pay attention? ➡️ SAVE UP TO 70% ON ACCOUNTING - https://kbdp.ru/