Basics

By law, the lender may charge the borrower a certain fee for the use of borrowed funds - interest accrued according to the agreement. If the interest rate is not specified in the agreement, it is calculated according to the key rate designated by the Central Bank on the day that is considered the main day for paying off obligations. If the contract stipulates that no interest will be paid, then it is considered interest-free.

It is advisable for the parties (especially the borrower) to understand the interest calculation method. To avoid controversial situations, the lender must carry out calculations using transparent methods stipulated by law, and the borrower has the right to demand full clarification. Based on the following information specified in the agreement, you can independently calculate the final loan interest:

- the full amount of borrowed funds included in the agreement;

- interest rate for a certain period (this could be a month, quarter or year);

- the period of validity of the agreement;

- number of days in each month during the entire term of the agreement.

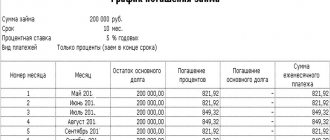

Such information is provided in the main body of the contract text or in an additional agreement. As for the payment method, the possibility of a one-time payment or periodic payment may be agreed upon. Accordingly, payments are divided into periods or limited to one amount. For multiple payments, in addition to the agreement, a schedule is attached that specifies mandatory payments with dates and amounts.

The execution of a loan agreement is regulated by articles of the Civil Code. The rate when providing borrowed funds can be strictly fixed or floating, depending on external factors.

The right of the lender to apply sanctions against the borrower must be specified. If the latter does not pay the required amounts or does not comply with the payment schedule, fines, penalties or other measures will be applied to him.

Tax consequences

Before executing an interest-free loan agreement between legal entities, it is necessary to carefully weigh all the benefits and benefits of the transaction or its negative consequences.

It would be useful to analyze the tax consequences of its conclusion.

Incorrect execution of contractual relations may result in the accrual of penalties by regulatory authorities. It is no big secret that tax authorities are especially attentive and picky about interest-free agreements.

According to regulatory authorities, interest-free use of money or property is a source of income for the organization. In other words, the tax authorities recognize the right to use the actual receipt of profit.

Alas, judicial practice on this matter is ambiguous and, sometimes, is not on the side of the entrepreneur.

You may be interested in an article about federal loan bonds.

Read an article about the features of a loan agreement between individuals here.

Interest calculation formulas

To independently calculate the amount of interest payable by agreement, you can go in two ways:

- use the formulas specified in the contract;

- use the services of a service on the Internet, where specialized calculators are provided.

It is important to remember that payment using an online service is not always suitable for a variety of lenders. These services should be used in exceptional cases. Self-calculation is not a difficult undertaking. When the interest on the loan is not specified in the agreement, it is necessary to calculate it at the key rate of the Central Bank.

Interest accrual begins from the moment the borrowed funds are transferred in cash equivalent directly to the borrower. Additionally, receipt of funds by the borrower can be confirmed by a corresponding receipt.

The method of interest calculation depends directly on the agreement concluded. If the entire loan amount is intended to be repaid, then interest is charged directly on it. Accordingly, the borrower must pay the amount and interest on it. If the refund is made in parts, then the payment schedule is drawn up as follows:

- The total interest on the loan is added to the amount of funds borrowed and divided by the number of payments. Payments will be identical, for the same amount.

- A more complex calculation option implies that interest is calculated on the total amount of the agreement and divided by the number of payments. After the next payment, what has already been returned is subtracted from the remaining amount and the resulting result is subject to interest. The resulting amount is again divided by the number of payments. This technique is common in mortgage lending from banking structures.

There are many other options for calculating interest. Let's consider them further.

Receiving funds

To receive a loan, any person must fill out an application indicating the amount and expected repayment period. Based on this document, the lender makes a decision.

The loan agreement is drawn up on the basis of the passport of a person who is one of the parties to the transaction or the passport of a representative of the organization.

For a legal entity, the full name of the organization and its details (location address, bank account details, etc.) are additionally indicated.

Companies primarily receive loans to their current account. The loan amount must be reflected in the company’s accounting department.

Individuals, including individual entrepreneurs, can independently choose the method of transferring borrowed money.

The most popular of them include:

- crediting money to the borrower's account or to his bank card;

- it is possible to obtain a loan in cash at the lender’s cash desk;

- microfinance companies practice loan transfer methods such as transfer to an electronic wallet or through the Contact system.

If the loan amount is large enough, it can be transferred in parts. To do this, a loan schedule is drawn up, which is an appendix to the main document.

Other methods for calculating interest

Sometimes the lender does not indicate the interest accrued on the amount of the loan received, but specific values of the funds. A certain amount is added to the loan and the resulting result is determined as the main lump sum payment, or is divided into several payments over certain periods.

Private investment involves charging interest for the use of borrowed funds as follows:

- the loan amount is multiplied by the accepted rate;

- the term for which the loan is issued is multiplied by the number of days in a year;

- the first product is divided by the second.

Sometimes a more complex formula is used to calculate the final amount required to be paid. She looks like this:

K * 1 + C / 100 * P , where:

K – the total amount of the loan issued; C – interest rate under the agreement; P – periods involving the transfer of funds.

An interest-free loan is often used in the event of an agreement between legal entities. This is done so that the companies’ budget does not include income received from the transaction, which must be reported to the tax service. When one of the parties acting as lenders decides to receive a material benefit, then interest is calculated using simple calculation formulas.

Let's point out other features:

- When the loan is valid for no more than a month, it is easier to indicate the rate for the month rather than apply its annual value. When using it, you should calculate the full amount required to be paid at the end of the term, and then divide by twelve (according to the number of months in the year).

- Annual interest is most often used in banking structures when concluding agreements on the provision of borrowed funds. If we mean a standard year, the value of 365 days is applied; in a leap year it is increased by one.

- In the event that the debt is not repaid at once, but in parts, it is imperative to inquire about the possibility of early repayment of the loan. An important point: if the final amount of debt is calculated using a simple formula, then one-time payments and periodic payments have a fixed value, therefore there is no difference to the creditor in terms of repayment. The main thing is no delays. When a complex formula is applied with recalculation of interest after each payment, the final amount may change. Therefore, the bank may suppress the possibility of early repayment for its own benefit.

- When taking the refinancing rate as the basis for calculations, its value for a specific payment day is applied. The Central Bank may change the key rate.

Interest-free loan repayment

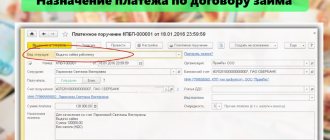

Possible methods of loan repayment are determined by the agreement or company rules (applicable to banks and microfinance organizations). A loan issued by a legal entity is primarily repaid by transferring funds to a current account.

To carry out the operation you can use:

- banks;

- ATMs;

- payment terminals.

In some cases, it is possible to deposit funds to pay for the loan to the company's cash desk.

Loans from individuals can be repaid:

- in cash, using a personal meeting or existing money transfer systems;

- by crediting funds to a person’s card or bank account;

- transfer to an electronic wallet.

If the loan agreement does not provide for a method of debt repayment, the borrower can independently choose the most suitable method for himself.

Any loan agreement provides for penalties for late repayment of the debt. An interest-free loan is no exception.

If the borrower does not pay the debt on time, the loan automatically becomes interest-bearing, but it is accrued only after the repayment period has expired.

Some features of calculating interest under a loan agreement

The accrual of interest should be agreed upon first when concluding an agreement on the provision of borrowed funds. Often, lenders may be silent about the techniques used. Therefore, it is worthwhile to immediately raise the issue for discussion in order to be able to independently calculate the final payments. Information on the concluded transaction must be documented.

This is done as follows:

- An agreement is drawn up, which specifies the subject of the agreement, the parties, details, rights and obligations.

- If the initial conditions change, an additional agreement must be drawn up and signed by both parties.

- If necessary, a payment schedule is added to the agreement. This applies if the payment is not a lump sum. While not a document in its own right, the schedule is a necessary attribute of the concluded agreement for divided payments and for the convenience of the parties.

- Documents confirming the payment must be kept. This could be a check or receipt. If the borrower wants to repay the debt ahead of schedule, it is necessary to provide the lender with all the facts of payments at the current time so that the interest component can be recalculated.

If suddenly conflict situations arise during the current agreement, both parties must have the appropriate package of accompanying documentation.

Self-calculation and its advantages

The positive aspects of independently calculating interest on undertaken obligations are as follows:

- if the lender charges “additional” interest not provided for in the agreement, the borrower sees the changed final amount;

- you can challenge the creditor’s decisions before his representatives, or by seeking legal proceedings;

- Having previously calculated the final amount, the borrower can choose a more favorable loan offer.

It is always worth focusing on the calculation method. It is easier to calculate the required amount when interest is calculated under a loan agreement using a simple formula.

Large financial structures prefer the dependence of the repaid loan on floating factors. Calculation and recalculation of interest is always more profitable for the lender than fixed amounts. Some banks apply penalties for early loan repayment. In this case, the borrower will have to repay the loan, pay interest for its use, and even pay off the bank with fines.

By carefully reading the text of the concluded agreement, you can protect yourself from additional waste. If disputes arise, you can always turn to the courts. Again, do not be afraid to demand clarification of actions under various circumstances:

- early repayment;

- recalculation of interest;

- delay in payment;

- late payment of principal or interest;

- sanctions;

- possibilities and requirements.

All this must be explained by representatives of the lender’s side when requested by the borrower.

Taking into account all of the above, it can be noted that the lender can charge interest under a loan agreement at the end of the contract term only if a complex formula is used to calculate the final payment.

Decor

Only a simple written form of a loan agreement has legal force.

The loan agreement and the terms of the agreement must be confirmed by documents confirming the actual transfer of money or material assets to the borrower, their quantity and size.

In terms of the transfer of property under a loan agreement, it is necessary to comprehensively describe the following parameters:

- name of property;

- quantity;

- cost of a unit of property;

- the total amount of the transaction.

These parameters are one of the essential conditions of any loan agreement. If one of the specified conditions is missing from the contract, the transaction may be declared invalid.

(You can download a sample interest-free loan agreement between legal entities here).