Anyone may find themselves in a situation where they need urgent financial assistance. Sometimes the company in which he works helps an employee solve a difficult problem. This not only motivates a person to do quality work with full dedication, but also saves money. Loans provided by employers to their employees are most often interest-free or have a symbolic interest rate. The procedure for reflecting the operation of issuing an employee loan in the 1s 8.3 ZUP program takes place in several stages.

Features of issuing a loan to an employee

The loan debt is repaid by deduction from your salary, which is also very convenient. For such loans, there is no need to collect a huge package of documents, since all the necessary data is available in the personnel service.

The employer, by issuing a loan, shows his loyal attitude towards the employee. Accounting is faced with the task of correctly displaying a business transaction in accounting.

Actions for issuing a loan go through a certain algorithm. The 1-c program allows an accountant to correctly keep records of loans, spending a minimum of time on it. WITH

When issuing a loan, an employee needs to remember the following rules:

- Legislative norms that give a company the right to issue loans to its employees are set out in the Civil Code. If disputes and conflicts arise under a concluded contract, you should use the norms of civil rather than labor legislation.

- The loan is issued based on a written application from the employee. The reason for issuing money must be significant (buying a home, illness, children’s education, etc.). The employer has the right to request a credit history from the employee in order to assess the financial condition and ability to repay the debt.

- The agreement must be drawn up in writing, regardless of its amount, since one party to the transaction is a legal entity.

- The issuance of an interest-free loan must be reflected in the text of the agreement. If this is not done, the accounting service is obliged to charge additional interest at a rate based on the key rate of the Central Bank of the Russian Federation in effect at the time of signing the financial document.

- From an interest-free loan or a loan with a symbolic interest rate, the employee receives tax consequences in the form of material benefits. The employer, as a tax agent, is obliged to charge and withhold personal income tax on material benefits.

- The dismissal of an employee does not terminate the contractual relationship between the parties.

To correctly reflect the fact of issuing a loan in the accounting database, all key points must be clearly stated in the agreement:

- the amount of the deal;

- validity;

- procedure for issuing and repaying funds;

- the interest rate (or lack thereof);

- penalties that will be applied to the borrower in case of delay in repayment of the debt;

- the possibility of prolongation or changing the terms in the text of the contract.

Answer Profbukh8

Irina Shavrova Profbuh8.ru

Good evening, Olga!

That is, it turns out that you did not pay additional personal income tax to the budget?

In this case, in my opinion, correction in previous tax periods, transfer of fines and adjustment of submitted reports.

Elena described in detail how to make an accrual from material benefits:

- Manual entry

- Personal income tax accounting operation

—————————————

On our website we provide advice on working in the 1C Accounting, ZUP and UT programs.

We do not resolve accounting issues.

Contact your tax authorities or auditors in writing.

They are obliged to give you an answer also in writing, which you can safely follow.

Please rate this question: (

1 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

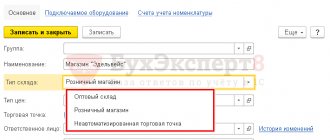

Setting up the program

Before you start recording issued loans in the accounting database, you need to update the settings of the 1C program.

Before starting the procedure, you should select the company that issued the loan, and then update the settings. To do this, open the “Settings” tab, select the “Payroll calculations” item and click the “Loans to employees” tab.

After this, the computer receives the necessary information and when calculating and paying wages to the employee who received the loan, debt servicing operations will be performed automatically.

Entering the agreement into the accounting database

Information about loan agreements issued to employees is collected in the “Salaries” section, subsection “Loans to employees”.

First, the accountant registers the loan issued, using the data from the signed agreement as a basis. Data is entered in blocks:

- Loan terms. It states the amount, term (in months), interest rate. The procedure for issuing money is specified separately, since it can be issued at a time (the employee receives the entire amount at once) or in installments (the loan is issued monthly, quarterly).

- Repayment procedure. The Debt Repayment Practice offers four payment options. A corresponding note is made in the accounting database. If the loan is issued with interest, the selected method of paying interest is indicated in the same block.

- Material benefit from the loan, subject to personal income tax. As soon as the program receives information about the loan issued to an employee, it automatically activates the “Material benefit subject to personal income tax” tab. If the loan is of a targeted nature and the purpose of receiving it is an article that gives the right to receive tax benefits (for example, housing construction), the accountant must uncheck this box.

- Postponement. If the agreement provides for a deferred payment of loan debt, the accounting employee enters the relevant information into the program.

There are 4 payment options:

- Differentiated - the loan is paid in equal installments, and interest is transferred for the current month;

- Annuity – fixed monthly payments;

- Interest only - they are withheld every month, and at the end of the term the loan body and interest for the last month of the contract are paid.

- Loan only - a fixed part of the debt is paid monthly, and interest is paid in the last month of the contract.

After filling out all the data, you can print the contract and check the data entered into the accounting database. To do this, select the “Print” button and the “Loan Agreement” item.

Important! The 1C 8.3 ZUP program also allows you to print a payment repayment schedule for transmission to the borrower.

Loans to employees in 1C: Enterprise Accounting 8

Published 07/03/2018 13:11 Author: Administrator Loans to employees are, on the one hand, a financial investment of the organization (in the case of an interest-bearing loan), and on the other, a form of material support for employees. This article will discuss how to organize accounting for issued interest-bearing loans in the 1C: Enterprise Accounting 8 edition 3.0 program, as well as the nuances of interest-free loans and the calculation of personal income tax on material benefits.

The issuance of interest-bearing loans is reflected in the debit of account 58.03 (“Loans provided”).

In accounting, income from the provision of loans is other income (Account credit 91.01 (sub-account “Accrued interest on a loan”). In tax accounting, income from the provision of loans is non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation). We conclude in writing form of an agreement with an employee, in which we fix the main terms of the agreement: loan amount, loan term, interest rate (per annum). A payment calendar is drawn up for the agreement, in which monthly payments (withholdings) are deciphered, as well as the balance of the principal debt. If an agreement is concluded with an employee interest-free loan, then this condition must be fixed; otherwise, the agreement is considered concluded at the bank interest rate existing in the region or the Central Bank refinancing rate. Advice: do not allow ambiguous interpretations of the provisions of the agreement. Payment calendar option when providing employees with an interest-bearing loan: (loan with 04/01/2018, 8% per annum, loan term 2 months)

| No. | Month | Principal balance | Loan repayment | Number of loan days | Loan interest amount | Hold date |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | April 18 | 50000,00 | 25000,00 | 30 | 328,77 | 30.04.2018 |

| 2 | May 18 | 25000,00 | 25000,00 | 31 | 169,86 | 31.05.2018 |

| 0,00 | 0,00 | 0,00 |

The calculation of interest due on the loan is determined using the simple interest formula (column 6=gr.3*8%/365*gr.5)

Analytical accounting of loans issued is maintained in account 73.01 “Settlements on loans provided” for each employee.

To separately account for the principal loan payment and the interest due to the organization, we will add analytics to the salary deduction settings:

Section “Salary and Personnel” – “Directories and Settings” – “Salary Settings” – “Salary Calculation” – directory “Deductions”. Add the lines: “Loan repayment” and “Loan interest”.

In 1C: Enterprise Accounting 8 edition 3, the deduction of the principal amount and interest on the loan will look like this: - deduction of the loan amount;

— deduction of interest on the loan;

The total amount of deduction can be deciphered.

Important: the “Payroll” document does not generate accounting entries for loan deductions!

To reflect deductions under a loan agreement in accounting, you must create a transaction manually. “Operations” – “Accounting” – “Operations entered manually” – “Operation”. We withhold the loan amount, the amount of interest on the loan and reflect on loan 91.01 other income in accounting and non-operating income in NU.

Let's check the reflection of deductions in the employee's pay slip:

When an employee is issued an interest-free loan or an interest-bearing loan with a rate of less than 2/3 of the refinancing rate of the Central Bank of the Russian Federation, he receives a material benefit in the form of savings on interest (clause 1.clause 2 of Article 212 of the Tax Code of the Russian Federation). The personal income tax rate on the amount of material benefits from savings on interest is 35%. For reference: the uniform refinancing rate of the Central Bank of the Russian Federation since March 26, 2018 is 7.25%. Payment calendar option when providing an employee with an interest-free loan: (loan from 04/01/2018, interest-free, loan term 2 months)

| No. | Month | Principal balance | Number of loan days | Material benefit | Hold date |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | April 2021 | 50000,00 | 30 | 198,63 | 04/30/2018 |

| 2 | May 2021 | 25000,00 | 31 | 102,63 | 05/31/2018 |

The calculation of material benefits is determined by the formula (gr.5 = gr.3/365*30*2/3*7.25%)

To reflect personal income tax on material benefits in the payslip, add the line “personal income tax on material benefits” to the “Deductions” directory. Now the payslip reflects the deduction of loan repayment and personal income tax on material benefits:

In accounting, entries for withholding the loan amount and personal income tax are generated manually:

Next, select registers:

The “Mutual settlements with employees” tab is filled out as follows (“Receipt” – “Amount of mutual settlements”: personal income tax amount with a minus sign): The “Salaries to be paid” tab is filled in similarly (“Receipt” - “Amount to be paid”: personal income tax amount with a minus sign) ). In tax accounting, we reflect the withholding of personal income tax as follows: “Salaries and Personnel” – “All documents on personal income tax” – “Personal income tax accounting operation”. We withhold personal income tax from the amount of material benefit. Tab "Income":

Revenue code 2610:

Tab “Withheld on all bets”:

We recommend checking the correctness of entering transactions using OSV, a universal report (accounting registers “Mutual settlements with employees”, “Salaries payable”); registers for tax accounting of personal income tax. Important: If an employee uses an interest-free loan for the purchase of housing, a land plot provided for individual housing construction, and has the right to a tax deduction (all cases are indicated in the exceptions of paragraph 1, paragraph 1 of Article 212 of the Tax Code of the Russian Federation), material benefits in the form of savings interest is not subject to personal income tax. To do this, the employee is required to provide a certificate from the tax authority confirming that he has such a right. If there is no certificate, we withhold the personal income tax; the employee, based on the 3-NDFL declaration, has the right to a refund of the personal income tax paid from the budget. But that’s another story... Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

Issuing a loan

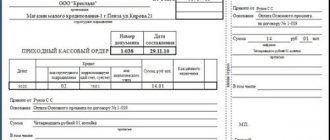

The loan agreement begins after the employee receives funds. To carry out this operation, the following actions are performed in the accounting database:

- On the contract page, a specific employee needs to click on the “Create based on” tab. In the window that opens, select the “Issue” item and fill out the form, indicating the amount issued and the form of issuance (cash or to the employee’s bank account).

- In order for the document to be saved in the database after filling out the form, you need to click on the button labeled “Save and close”.

- If the loan is issued in several tranches, then on the page for recording the agreement for a specific employee, check the box next to the inscription “In several tranches.” Two tables will appear on the screen. The first is with a loan issuance scheme, the second is with a repayment scheme.

- The employee chooses a convenient method for receiving funds: cash or non-cash.

- If money is received at the cash desk, the accountant needs to generate a cash settlement document. With the non-cash method of receiving borrowed funds, a payment order is generated to the bank.

- First, the accountant selects the type of transaction; the correctness of the program’s selection of accounts for accounting entries depends on this.

- Next, fill in the fields of the payment document. The recipient of the funds will be an employee, his bank account is pulled into the payment slip from the general directory. Then the amount and purpose of payment are written down. After checking the generated document, its status changes to “Paid” and the specialist debits the amount from the company’s current account.

Amortization

The program offers two ways to carry out transactions to repay a loan issued to an employee:

- Entering the document “Repayment of a loan to an employee” before calculating wages for the month. The document is entered in the “Salary” section of the “Loans to Employees” tab. To create it, the accountant needs to enter the information: “Name and date of the document. The computer will select all available loans from the database for the specified employee, and the specialist will need to select one document from the existing ones. If there is only one contract, the program will select it automatically. Then you need to manually indicate the amount to be repaid in the appropriate column. The program will compare it with the debt repayment schedule, calculate interest and personal income tax on material benefits.

- Calculation of deductions when calculating wages. With this method, there is no need to create a separate document; all calculations are performed in the “Salary” section in the “Salary and contributions calculation” tab. After opening the “Loans” tab, calculations of the monthly payment, interest on the loan, material benefits and income tax will appear on the monitor screen.

Amendments to the contract

At the borrower's initiative, changes may be made to the agreement, which should be indicated in the accounting database. To do this, you need to open the agreement card and create a document “Changing the terms of the employee loan agreement.” The new document corrects the clauses of the agreement that were changed at the request of the parties.

Important! After the document is posted and saved, all settlements under the agreement in the accounting database will take place according to the new conditions.

Reports

The developers of the 1C 8.3 ZUP program provide the ability to generate and print reports under a contract with a specific employee.

Reports are generated both from the “Employee Loan Agreements” document and from the “Salaries” section.

Reports from the document “Employee Loan Agreement”:

- Loan agreement;

- Repayment schedule (without taking into account changes made to the agreement);

- Amortization;

- Contract registration card.

Reports from the “Salaries” section:

- All repayments;

- Interest accrued and paid;

- Monthly loan balance.

Organization - lender, employee - borrower

An employee can obtain a loan from an employer for various purposes, including the purchase or construction of housing, and other needs. The procedure for providing loans to employees and the terms of repayment are established by the local regulations of the organization.

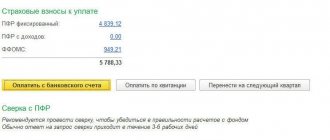

If an employee is provided with an interest-free loan or the interest rate under the contract is less than 2/3 of the key rate of the Central Bank of the Russian Federation, then he receives material benefits from the use of borrowed funds, subject to personal income tax (see paragraph 1, paragraph 1, paragraph 1, paragraph 2, art. 212 of the Tax Code of the Russian Federation).

In accordance with the Tax Code of the Russian Federation, the organization that issued a loan to an employee becomes a tax agent for personal income tax in relation to income in the form of financial benefits. Income in the form of material benefits from loans and personal income tax should be calculated monthly as of the last day of each month and withheld from the next cash payments.

Material benefit is calculated using the formula:

SumZ x (2/3 KlSt - PgSt) x Dm / Dg,

- where Dm is the number of calendar days in the month of calculation. If a loan is issued or repaid in the billing month, then the days are taken into account only after receipt/before repayment, respectively;

- Dg - number of days in a year (365 or 366);

- SumZ - the loan amount as of the time of calculation;

- KlSt is the key rate of the Central Bank of the Russian Federation, valid on the last day of the month. The key rate of the Central Bank of the Russian Federation is the minimum interest rate at which the Central Bank of the Russian Federation provides loans to commercial banks for a period of 1 week. As of 04/30/2019, the KS is 7.75%, and 2/3 of this key rate is approximately 5.17%;

- PgSt - annual interest rate. If the percentage of the annual rate at which the loan is issued is less than this value, then a material benefit arises.

The amount of calculated material benefit is subject to personal income tax. The personal income tax rate that applies to the material benefit from interest savings depends on the tax status of the recipient of such income:

- for a tax resident of the Russian Federation - 35%;

- for a tax non-resident of the Russian Federation - 30%.

For tax non-residents with special statuses (for example, citizens of the EAEU or highly qualified foreign specialists, primarily non-residents), the personal income tax rate on material benefits is 30%.

Personal income tax must be withheld for the next cash payment. The withheld tax should be transferred to the budget no later than the first working day after the personal income tax was withheld.

Please note that if the loan was issued for the purchase of housing (apartment, house, room, shares in them), this is expressly stated in the loan agreement and the employee received a notification from the Federal Tax Service Inspectorate confirming the right to a property deduction in connection with the purchase of housing, then the benefit for this The loan is not subject to personal income tax.

| 1C:ITS For a detailed example of reflecting in “1C: Salaries and Personnel Management 8” edition 3 and in other 1C programs the deduction of principal and interest under a loan agreement with an employee, see the reference book “Personnel accounting and settlements with personnel in 1C programs” section “Instructions” on accounting in 1C programs." |

Income in the form of material benefits and personal income tax on it in “1C: Salaries and Personnel Management 8” edition 3 are calculated in accordance with the legislation of the Russian Federation. In addition, in accordance with the settings of the Loan Agreement document (Fig. 1), the program automatically calculates the monthly repayment amount of the main loan and is kept in the document Calculation of salaries and contributions on the Loan repayment tab. Thus, the loan amount (SumZ) is automatically reduced monthly. The date of occurrence of the material benefit in the program is considered to be the date of payment of interest, that is, the date of calculation of wages.

Rice. 1. Document “Employee Loan Agreement”

To enable the program's capabilities for reflecting deduction transactions for loan repayment, registering material benefits, and calculating and accounting for personal income tax, you must set the flag Loans issued to employees in the payroll settings (menu Settings - Payroll). Then the Employee Loans document block becomes available in the Payroll menu:

- A loan agreement between an employee and an organization registers all the terms of the loan: the amount and procedure for issuance, annual interest and the need to withhold personal income tax, the procedure for repaying debt and interest. You can obtain a printed form of the loan agreement and its annexes - Loan repayment schedule;

- Issuing a loan to an employee - can be formed on the basis of the Loan Agreement document and registers the fact of issuing funds to an employee;

- if changes are necessary to the loan agreement, the document Changes in the terms of the loan agreement to an employee is applied;

- an amount is withheld from the employee's salary to repay the loan in accordance with the payment schedule in the document Calculation of salaries and contributions;

- Early loan repayments are recorded in the document Repayment of Loan to an Employee.