The product is subject to VAT, but the bonus is not

A wholesale trade organization supplies goods to a retail chain; under the supply agreement, a “bonus” is calculated monthly as a percentage of the goods received and, as the buyer requests, without VAT.

How to carry out accounting operations in such a situation and what account correspondence to use? What about VAT? We ship the goods taking into account this tax, but the bonus is without VAT?

There are several ways sellers provide discounts (bonuses) to their customers.

In this case, discounts (premiums) can be divided into two categories:

– discounts in the price of goods;

– premiums (bonuses) without changing the price of the product.

In accordance with paragraph 3 of Art. 424 Civil Code of the Russian Federation

price changes after the conclusion of the contract are permitted in cases and under the conditions provided for by the contract, the law or in the manner prescribed by law.

Thus, discounts (bonuses), the procedure for determining them and the timing of their provision must be stipulated in the supply agreement

.

Based on the content of your question, you provide a premium (bonus) to your buyer without changing the price

previously shipped goods.

Such a bonus can be provided by:

- her return

in cash to the buyer (if the goods have already been paid for by the buyer);

– test

it in payment for future shipment of goods;

– reducing accounts receivable

buyer to supplier;

– transfer of goods

for the amount of the accrued premium (bonus) to the buyer.

In accordance with paragraph 1 of Art. 154 Tax Code of the Russian Federation

the tax base when a taxpayer sells goods (work, services) is defined as the cost of these goods (work, services), calculated on the basis of prices determined in accordance with

Art.

40 of the Tax Code of the Russian Federation , taking into account excise taxes (for excisable goods) and excluding VAT.

Art. 40 Tax Code of the Russian Federation

, in turn, it is determined that for tax purposes the price of goods, works or services specified by the parties to the transaction is accepted. Until proven otherwise, this price is assumed to be in line with market prices.

At the same time, according to clause 3 of Art. 40 Tax Code of the Russian Federation

When determining the market price,

price premiums or discounts

when concluding transactions between non-dependent persons are taken into account .

In particular, discounts caused by:

– seasonal and other fluctuations in consumer demand for goods (works, services);

– loss of quality or other consumer properties of goods;

– expiration (approximation of the expiration date) of the shelf life or sale of goods;

– marketing policy, including when promoting new products that have no analogues to markets, as well as when promoting goods (works, services) to new markets;

– implementation of experimental models and samples of goods in order to familiarize consumers with them.

Thus, the tax base for VAT is determined based on sales prices, taking into account surcharges or discounts to the price.

But if the price of the goods under the terms of the contract does not change as a result of the provision of a discount, then the tax base is determined without taking into account the discounts provided

.

A similar opinion was expressed by the Ministry of Finance of the Russian Federation in letter dated October 25, 2007 No. 03-07-11/524, indicating that if sellers of goods provide discounts

for payment for goods

without changing the price of goods

, then the provision of such discounts is not a basis for the seller of goods to reduce the tax base for value added tax and make changes to the invoices issued upon shipment of goods.

Along with this, in the same letter the Ministry of Finance of the Russian Federation reported that the bonuses

, received by the buyer of goods from the seller and

not related to the provision of services by the buyer, are not subject to VAT

.

Thus, the amount of sales of goods

fully

included in the VAT tax base

, since the premium is provided without changing the price of the product.

In this case, the entire amount of the premium provided to the buyer is not subject to VAT.

Let's consider a situation where a premium (discount) is provided to the buyer in the form of a product.

In accordance with paragraphs 1 clause 1 art. 146 Tax Code of the Russian Federation

transfer of ownership of goods, results of work performed, provision of services

free of charge is recognized as the sale of

goods (work, services) for VAT tax purposes.

Therefore, the transfer of goods on account of the discount provided to the buyer is considered as a gratuitous transfer

.

According to paragraph 2 of Art. 154 Tax Code of the Russian Federation

When selling goods (work, services) free of charge, the tax base is determined as the cost of the specified goods (work, services), calculated on the basis of prices determined in the manner established by

Art.

40 of the Tax Code of the Russian Federation , taking into account excise taxes (for excisable goods) and excluding VAT.

That is, as we have already indicated above, the tax base in this case will be determined as the cost of the transferred goods, determined on the basis of the prices established by the supply agreement, excluding VAT.

The transfer of goods to the buyer is documented by shipping documents.

Since in this case a VAT tax base arises, when shipping “bonus” goods it is necessary to issue an invoice

(clause 16 of the Rules for maintaining logs of received and issued invoices, purchase books and sales books for value added tax calculations, approved by Decree of the Government of the Russian Federation of December 2, 2000 No. 914).

According to the Ministry of Finance of the Russian Federation, for a buyer receiving goods free of charge, there are no legal grounds for VAT deduction

(letter of the Ministry of Finance of the Russian Federation dated March 21, 2006 No. 03-04-11/60).

According to clause 11 of the Rules... invoices received for the gratuitous transfer of goods (performance of work, provision of services), including fixed assets and intangible assets, the buyer

does not register

in the purchase book .

For corporate income tax purposes, expenses in the form of a premium (discount) paid (provided) by the seller to the buyer as a result of fulfilling certain terms of the contract, in particular, the volume of purchases, are taken into account as part of non-operating expenses

(

p.p. 19.1 clause 1 art. 265 Tax Code of the Russian Federation

).

Since the discount is provided in the form of goods of a certain value, it is assumed that the accrued amount of VAT in this value is included in the discount.

In this case, the question arises: is it possible to take into account accrued and paid VAT as a non-operating expense for profit tax purposes?

On the one hand, pp. 19.1 clause 1 art. 265 Tax Code of the Russian Federation

directly provides for the accounting of discounts (premiums) as part of non-operating expenses, without specifying in what form they are provided (cash or in kind).

But, on the other hand, the Tax Code of the Russian Federation does not provide for the inclusion in income tax expenses of VAT amounts billed to customers in the price of goods.

The tax authorities consider the transfer of goods to the buyer as a premium as a gratuitous transfer and can exclude VAT from expenses, based on the letter of the Ministry of Finance of the Russian Federation dated September 22, 2006 No. 03-04-11/178, in which the financial department reported that the amount of value added tax

, calculated by the taxpayer when selling goods (work, services), including gratuitous transfers,

are not included in expenses when calculating corporate income tax

.

Therefore, if you nevertheless decide to take into account the VAT amounts calculated when transferring goods to the buyer in the form of a premium, as part of non-operating expenses, then you will most likely have to defend your case in court.

In the supplier’s accounting, the premium provided to the buyer is included in expenses for ordinary activities (clause 5 of PBU 10/99 “Organizational expenses”

, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n).

In accordance with the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of an organization, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, bonuses (bonuses, discounts) provided to buyers are taken into account as the debit of account 44 “Sales expenses”

.

The execution of the transaction to provide a discount to the buyer depends on the method of its provision.

Accrual of premium to the buyer

is prepared using the following accounting entries:

DEBIT 44 “Sales expenses” CREDIT 62 “Settlements with buyers and customers”

– reflects the amount of expense in the form of a bonus provided to the buyer.

This entry will be sufficient to offset the premium provided to the buyer against accounts payable, or (if there are no accounts payable) against payment for future shipment of goods.

Transfer of “live” funds

The buyer should record the following entries:

DEBIT 62 “Settlements with buyers and customers” CREDIT 51 “Settlement accounts”

– the amount of the bonus provided to the buyer is debited from the current account.

Note!

If, as a result of offset of the premium against payment for future shipment of goods, accounts payable has arisen in the supplier’s accounting in account 62 “Settlements with buyers and customers,” then the offset premium is considered an advance payment and, accordingly, is subject to inclusion in the VAT tax base in accordance with paragraph 1 tbsp. 154 Tax Code of the Russian Federation

.

Therefore, the accounting records should reflect the entries for calculating VAT on the advance:

DEBIT 76 “Settlements with other debtors and creditors”

, subaccount “VAT on advances received”

CREDIT 68 “Settlements with the budget for taxes and fees”

, subaccount “VAT”

– VAT is charged on the advance payment.

Transfer of the accrued premium to the buyer in the form of goods

in accounting it is formalized by postings:

DEBIT 62 “Settlements with buyers and customers” CREDIT 90 “Sales”

, subaccount “Revenue”

– products were sold for the amount of the premium (bonus) provided;

DEBIT 90 “Sales”

, subaccount “VAT”

CREDIT 68 “Settlements with the budget for taxes and fees”

- VAT is charged on the cost of the transferred goods.

Write-off of goods

, transferred on account of the provided premium, is recorded as follows:

DEBIT 44 “Sales expenses” CREDIT 41 “Goods”

– the cost of goods transferred to the buyer on account of the premium provided is written off.

At the end of the month, sales expenses in the form of provided discounts (premiums, bonuses) are written off to financial results:

DEBIT 90 “Sales”

, subaccount “Cost of sales” (or another subaccount opened to account 90 “Sales” to account for business expenses)

CREDIT 44 “Sales expenses”

- expenses in the form of a provided bonus are included in the cost of sales.

Let's consider the procedure for documenting a discount (premium, bonus).

In accordance with paragraph 2 of Art. 9 of the Federal Law of the Russian Federation of November 21, 1996 No. 129-FZ “On Accounting”,

primary accounting documents

are accepted for accounting if they are drawn up in the form contained in the albums of unified forms of primary accounting documentation, and documents whose form is not provided for in these albums

must contain the following mandatory details

:

A)

Title of the document;

b)

date of document preparation;

V)

name of the organization on behalf of which the document was drawn up;

G)

content of a business transaction;

d)

measuring business transactions in physical and monetary terms;

e)

the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution;

and)

personal signatures of these persons.

Unified form

a document reflecting the fact of accrual of a discount (bonus)

has not been established

.

Therefore, your organization should develop its own form

act, protocol or other document confirming the fact of accrual of a premium (bonus) to the buyer.

This document must be drawn up in two copies, one of which is transferred to the buyer, and the other remains with the organization.

In accordance with clause 4 of PBU 1/2008 “Accounting policies of the organization”

, approved by order of the Ministry of Finance of the Russian Federation dated January 6, 2008 No. 106n, the accounting policy approves the forms of primary accounting documents, accounting registers, as well as documents for internal accounting reporting.

Therefore, the form of the document confirming the fact of accrual of the discount (bonus) should be approved in the accounting policy of your organization.

The concept of advertising and signs of advertising costs

The main document giving the definition and concept of advertising and advertising expenses is the Federal Law of March 13, 2006 No. 38-FZ “On Advertising”. In it we will find a definition of the concept of “advertising” - this is “information disseminated in any way, in any form and using any means, addressed to an indefinite circle of people and aimed at attracting attention to the object of advertising, generating or maintaining interest in it and its promotion to market."

Systematize or update your knowledge, gain practical skills and find answers to your questions in advanced training courses at the School of Accountancy. The courses are developed taking into account the professional standard “Accountant”. That is, the distinctive features of advertising:

- advertising is information about a product, manufacturer or seller, distributed in any form and by any means;

- the purpose of advertising distribution is to attract attention to the object of advertising and create (maintain) interest in the object of advertising, which should contribute to its promotion in the market;

- The key feature of advertising is that the information must be intended for an indefinite number of people.

The concept of “An indefinite circle of persons”, for the purposes of defining advertising, is given in the Letter of the Federal Antimonopoly Service of the Russian Federation dated 04/05/2007 No. ATs/4624 - these are “those persons who cannot be determined in advance as a recipient of advertising information and a specific party to the legal relationship arising in connection with implementation of the advertised object."

Employee bonuses: included in income tax expenses or attributed to net profit

The most common type of bonus is that paid to employees. They share:

- on those included in the wage system;

- not included in this system.

Inclusion in the remuneration system (i.e., in wages) implies:

- Reflection of this circumstance in the internal regulatory act.

- Direct connection between bonuses and employee performance.

- Development of a bonus system as a description of all bonuses paid by the employer, the principles of the emergence of the right to accrue them, calculation algorithms, and circumstances serving as the basis for deprivation of a bonus. This system can be quite complex, including both regularly accrued remuneration and bonuses from the fund of the head of the organization or its division, paid periodically.

Remunerations that are not included in the salary may be reflected in the bonus system, but they will be distinguished from bonuses regarded as payment for work by the lack of connection with labor achievements and the irregularity of payment.

Read about existing types of employee incentives in the article “What are the types of bonuses and employee benefits?”

The accrual of bonuses that form the employee’s salary is done in accounting by posting:

Dt 20 (23, 25, 26, 29, 44) Kt 70.

Bonuses, which are a salary, are fully included in the expenses taken into account in the NU when determining the profit base.

Remunerations that are not included in the salary are not reduced to the profit base (letter of the Ministry of Finance of Russia dated April 24, 2013 No. 03-03-06/1/14283), but are included in net profit.

Are insurance premiums paid to employees from net profit? You will find the answer to this question in ConsultantPlus. Trial access to the legal system is free.

Postings for bonuses at the expense of net profit in accounting can have two options:

- with attribution to costs, but as expenses not taken into account for NU:

Dt 20 (23, 25, 26, 29, 44) Kt 70;

- with write-off from existing profits of previous years:

Dt 84 Kt 70;

- with inclusion in other expenses of the current year (in the absence of profits from previous years), not taken into account for NU purposes:

Dt 91 Kt 70.

Accounting for bonuses under UTII regime

When an enterprise conducts exclusively activities that are subject to UTII, it is not expected to pay any other taxes on the bonus amount. This fully applies to incentives in the form of a cash bonus. When combining UTII with the “simplified” tax, the income that is taken into account in calculating the tax is part of the bonus. It is determined by the type of activity that does not apply to UTII. This is reflected in accounting as follows:

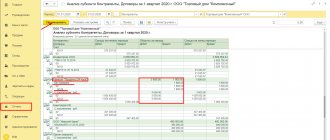

| Accounts | Description | |

| Debit | Credit | |

| 60 | 91 | The amount of incentive received is reflected |

| 60 | 60 | The bonus is counted towards payment for future product deliveries |

| 51 | 60 | Promotion has arrived |

Retrobonuses received from the supplier entail clarification of the amount of income and expenses (in tax accounting). In the Tax Code, such a procedure is not regulated clearly enough. Therefore, in order to avoid additional problems and claims, it is advisable to omit the clause in the contract that provides for adjustment of the price of goods purchased earlier.

Features of bonus accounting

Based on the economic meaning, a bonus involves receiving a certain reward for fulfilling previously specified requirements. The buyer may be promised additional income (premium) from the supplier. The previously agreed delivery of goods is not cancelled. Income can be in cash or in kind.

Bonus indicators:

- excessive purchase volumes;

- full advance payment.

The premium amount is set by agreement between the buyer and supplier. There is a restriction on food group products. In this case, the share of the bonus should not exceed five percent of the price payable for the products. The receipt of goods is recorded by the following records:

| Accounts | Description | |

| Debit | Credit | |

| 60 | 90.1 | premium from the supplier accrued |

| 51 | 60 | the award was credited to the bank account |

The bonus is included in other income. Accounting should be carried out no earlier than the supplier provides a notice of it or another similar document.

Features of taxation when taking into account bonuses

Accounting and calculation of VAT amount

A purchasing enterprise that has received a bonus (in the form of a discount, premium) for fulfilling the volume of purchase of goods specified in the contract must not:

- Restore the amount of VAT that has been accepted for deduction. The provisions of the Tax Code require this to be done only when a separate clause in the contract stipulates a decrease in the commodity value. When food products are purchased, VAT is not reinstated in any case.

- Separate VAT from the bonus amount even when it is a cash bonus. Material incentives to the buyer for conscientious fulfillment of the previously established terms of the agreement are included in the contract price. This amount is not taken into account when determining the cost of goods. Therefore, the bonus does not affect their price, and there are no grounds for restoring the deductible VAT.

Income tax accounting

Bonus raw materials, products, goods are recognized as property received free of charge. Their cost should be taken into account in the income on which income tax is calculated. The bonus amount should be included in non-operating income:

| Conditions | On the date |

| The agreement stipulates the provision of a bonus. This is recorded in a separate paragraph | receiving a bonus from the supplier |

| There was no bonus provided when concluding the contract | drawing up and signing an additional agreement. It states that the bonus will be provided |