General concepts

If an employee has not used the days provided for by law allotted to him for vacation, then he has the right to receive monetary compensation for this period of time.

But before demanding a certain amount of money from the employer, we strongly recommend that you familiarize yourself with the legislative framework. Chapter 19 of the Labor Code of the Russian Federation describes in detail all the nuances, rules and regulations regarding annual leave (Articles 114 -128).

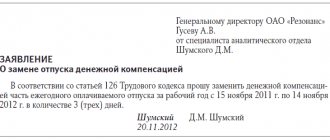

We advise you to pay special attention to articles 126 and 127 of the current code, which state how to correctly, without deviating from legislative norms, replace the right to rest with material resources.

Also referring to additional articles, for example, number 255, which is contained in the second part of the Tax Code, an individual may demand that compensation for unused vacation days be calculated for him.

Read our article on how to receive compensation for missed vacation.

It should be noted that those employees whom the employer transferred to work on the territory of another enterprise may also qualify for payments intended for unused days.

Individuals working in an organization under the terms of a contract concluded not on a permanent basis, but only

for a certain period, also have the right to receive compensation.

Calculation of the number of days for compensation for unused vacation

In order to accurately calculate the amount of compensation for vacation that an employee did not take, you first need to calculate the number of unspent days intended for the employee to rest. This calculation is carried out according to the formula:

A = B/(C*D)*E

Coefficient A is the number of days that were not used for vacation purposes.

Coefficient B is the duration of leave, calculated in days, which is provided to an individual every year in accordance with the employment contract.

Coefficient C is the number of calendar days calculated over the period of time during which all kinds of settlement operations are carried out.

Coefficient D is the total number of days intended for holidays and days free from work.

Coefficient E is the number of calendar days for that period of time when the employee was actually present at work and fulfilling his direct duties (parameter E does not include officially non-working days).

The month was not fully worked

Clause 35 of the Rules explains how to determine the period of work for calculating compensation if the month is not fully worked.

When calculating the terms of work that give the right to compensation for leave upon dismissal, surpluses amounting to less than half a month are excluded from the calculation, and surpluses amounting to at least half a month are rounded up to a full month.

Example 3

The employee was hired on January 26, 2021, and dismissed on August 31, 2021. At the time of dismissal, 7 months and 6 days had been worked.

Since in a month that is not fully worked, the days worked are less than half of the month, this month is not included in the calculation. Therefore, compensation is due for 7 months: 7 months. x 2.33 = 16.31 calendars. days

If he had quit, for example, on September 10, then the time worked would have been 7 months and 16 days. The number of days worked in an incompletely worked month is more than half of the month, therefore, this month is included in the calculation. In this case, the employee is entitled to compensation for 8 months: 8 months. x 2.33 = 18.64 calendars. days

Final formula

Having previously calculated the number of days for monetary compensation intended for unspent vacation days, it is necessary to correctly calculate the average salary of an individual for one working day.

However, it should be remembered that to determine the amount of the average daily salary, the following number of features must be taken into account:

- If an employee works for the benefit of the organization for quite a long time, which exceeds one year, then the last 365 working days are taken into account for the calculation.

- Payments provided to an employee due to temporary loss of ability to work, as well as material incentives in the form of bonuses, must be taken into account when calculating the amount of the average salary per day.

- When making this calculation, you should not take into account the period during which the individual did not fulfill his duties for valid reasons.

- It is worth considering possible changes in the amount of wages.

For other individuals, the period during which they worked in the organization is simply taken into account in full.

Thus, if the employer decides to increase it, then it is necessary to multiply the amount of salaries for all months preceding the increase by the corresponding parameter.

To find out this parameter, called the increase factor , simply divide the amount of the increased salary by the amount of the previous salary.

Using the above recommendations, you can directly proceed to calculating the average salary of an employee for one working day.

To do this, it is enough to correctly calculate all the income of an individual for each month, then add these numbers and divide by the number of calendar days.

And only after these steps will it be advisable to use the final formula, which will help determine the exact amount of compensation. It consists of performing a mathematical calculation made in the following way: K=L*M .

Thus, to find out the exact figure of monetary compensation, you need to multiply the number of unused vacation days (coefficient L) by the number obtained as a result of calculating the average daily salary (parameter M) .

Example of self-calculation

In order for individuals to be able to quite easily independently calculate the amount of compensation, we propose to consider a clear example of such a calculation, which consists of three main stages:

- Counting the number of days that were allotted to the employee for vacation, but were not used.

- Determination of average wages per working day.

Let’s assume that a certain employee, Ivan Ivanovich Ivanov, has worked at the company for 5 years and has not used his right to vacation during the last year. In this case, he was entitled by law to 28 days to rest.

During the 30 calendar days falling within the billing period, he was absent from work during Easter, International Women's Day and Whitsunday (that is, during the 3 days designated for holidays), and also took 7 days off for a valid reason.

Thus, 3+7 =10 is the total number of days used for rest due to official holidays and weekends.

Also, over the past year, Ivanov was absent from work for two days without a valid reason. This means that the number of actual working days is – 366 (total number of calendar days) – 10 (7 days off plus three holidays) – 2 (period of unjustified absence) = 354.

Now, dividing 28 by the number 30, previously multiplied by 10, we get a coefficient of 0.09. Multiplying this number by 354 gives the number 33. This is the final result, reflecting the number of rest days that the employee did not use.

Ivanov Ivan Ivanovich worked at the enterprise from January to May and received a salary of 20,000 rubles .

Then the employer decided to increase the salary and made it equal to 25,000 rubles. Dividing the increased salary (25,000) by the previous salary (20,000), we obtain a parameter equal to the figure 1.25 (increase factor) .

Now let’s take into account all the payments that Ivanov received from January to May, taking into account this coefficient. For January, February and March, the employee received 20,000 rubles, multiplying this figure by 1.25, we get 25,000 rubles for each month.

For April and May, Ivanov received a normalized salary and an additional bonus of 5,000 rubles. Thus, we perform the following operation - (20,000 + 5,000) * 1.25 = 31,250 rubles. For the period from June to December (inclusive), Ivanov received a salary in a fixed amount - 25,000 rubles.

Now we summarize the income received for all 12 months. The amount of income received by an employee for the year is 312,500 rubles . Then we divide this figure by the number of calendar days (366), excluding holidays and those taken for a good reason (10).

And thus, we see that 312,500/356 = 877 rubles. This is the average daily wage of Ivan Ivanovich Ivanov.

And finally, as the final stage, we calculate the amount of monetary compensation for unspent vacation.

We simply multiply the number of days obtained in the first paragraph by the average daily earnings (33*877) and come to the conclusion that the employer must compensate the employee for material resources in the amount of 28,941 rubles.

Cheat sheet on compensation for unused vacation

We bring to your attention a reminder that will help you quickly calculate compensation for unused vacation. Moreover, both when an employee is fired, and in the case when the employee remains working in the company, but wants to get money instead of rest. We have focused on when these payments are calculated the same and when there are differences.

DIFFERENCES: In what cases is it necessary to pay compensation Compensation associated with dismissal

The accountant will have to calculate and accrue this payment if the employee is dismissed on one of the grounds provided for by the Labor Code of the Russian Federation. For what reason, it doesn’t matter. Compensation is due in any case. Including upon dismissal through transfer to another company.

But here are the situations when it is not necessary to issue compensation: - an external part-time worker was transferred to the main place of work in the company (this is precisely the case of transfer; if the part-time worker first wrote a letter of resignation, and then an application for employment, then it is necessary to pay compensation) ; - the employee worked for the company for less than half a month (the accountant needs to calculate how many calendar days fall on the time worked; and if this is less than half of the total number of calendar days in a given month, then compensation does not need to be paid).

There are no grounds for paying compensation in cases where an employee is transferred from one unit to another.

And of course, no compensation for vacation is due to those who worked under civil contracts. After all, leave is provided only to employees with whom employment agreements have been concluded. The exception is cases when a civil contract contains provisions on vacations and their compensation. But this rarely happens in practice.

Compensation not related to dismissal

Paying compensation for vacation not related to dismissal is the right, not the obligation of the employer. That is, in principle, management can refuse compensation to an employee and send him on vacation. This follows from Article 126 of the Labor Code of the Russian Federation.

SIMILARITY. How to determine the time for which an employee is entitled to vacation

To calculate compensation, you first need to determine the time for which the employee was not given leave and for which rest is due. The fact is that there are periods that do not give the right to vacation. This:

— the time when the employee was absent from work without good reason (including if he was suspended from work in cases provided for in Article 76 of the Labor Code of the Russian Federation);

— time of maternity leave;

- time of unpaid leave that was granted to the employee at his request and if their total duration exceeds 14 calendar days during the working year. Such a list is given in Article 121 of the Labor Code of the Russian Federation. Please note that the period when a woman was on maternity leave gives the right to leave. This follows from articles 261 and 121 of the Labor Code of the Russian Federation. And therefore, if an employee is fired during this time, she is also entitled to compensation (of course, provided that she did not have time to take the day off).

DIFFERENCES. How to determine the number of calendar days for which compensation is due

The organization is obliged to provide employees with vacations every year. Accordingly, you need to look at for what years the employee did not use vacation. In this case, one must focus not on calendar years, but on the working years of the person being dismissed. So, if the first day of work is May 20, 2008, then the first working year for which the employee is entitled to vacation will end on May 19, 2009.

Compensation related to dismissal

If the employee has not used vacation for the full working year.

In this case, compensation must be paid for 28 calendar days (provided that there were no periods in the year that do not provide vacation rights). The same amount of compensation is also due if you work from 11 to 12 months inclusive during the year. Also, don't forget about extra vacations. Upon dismissal, you must pay compensation for all unused vacations due to the employee in this organization - both main and additional.

We also note that if an employee has not taken vacation for several years, then the organization is obliged to pay him compensation for all days not taken off that have accumulated since the employee joined the company (Article 127 of the Labor Code of the Russian Federation).

If the employee has time that entitles him to vacation, but this time is less than 11 months.

In this case, the number of unused vacation days for which compensation is due is determined by the following formula: number of unused calendar days of vacation = duration of full annual leave: 12 months. *number of complete months worked.

In this case, the full months worked are calculated as follows. Surpluses amounting to less than half a month are excluded from the calculation, and surpluses amounting to half a month or more are rounded up to the full month. This procedure is prescribed in paragraph 35 of the Rules on regular and additional holidays, approved by the People's Commissar of the USSR on April 30, 1930 No. 169.

EXAMPLE

Ivanov N.P. has been working at Priboy LLC since March 14, 2006. On May 20, 2008, he resigned from the organization of his own free will. During the entire period of his work, Ivanov was not on vacation (the employee was not entitled to additional vacations).Ivanov worked for the organization for two full working years: from March 14, 2006 to March 13, 2007 and from March 14, 2007 to March 13, 2008. It turns out that during this time Ivanov is entitled to compensation for 56 calendar days of unused vacation (28 +28).

From March 14, 2008 to May 20, 2008, Ivanov worked for two full months (from March 14 to April 13 and from April 14 to May 13). The excess days from May 14 to May 20 amount to less than half of the month and are therefore excluded from the calculation.

Let's calculate the total number of calendar days of vacation for which Ivanov is entitled to compensation:

56 days + 28 days : 12 months * 2 = 60.66 k.d.

Compensation not related to dismissal

You can replace with money only that part of the vacation that exceeds 28 calendar days per year. That is, if an employee has accumulated unused vacation for two years, then compensation can only be paid for those days that are due in excess of 56 calendar days (28 days * 2 years). Such restrictions are established by Article 126 of the Labor Code of the Russian Federation. In fact, this means that employees can receive money instead of rest only for additional vacations.

If the employee has not used additional leave for the full working year. In this case, compensation must be paid for all days of additional vacation (provided that there were no periods in the year that do not provide vacation rights). You are also entitled to compensation for the full number of days of additional leave if you work from 11 to 12 months inclusive in a year.

If the employee has not taken additional vacations for several years, compensation is due for all the days that the employee did not rest.

If the employee has time that entitles him to leave, but this time is less than 11 months. Then the number of unused calendar days of additional leave for which compensation is due is determined by the formula:

number of unused calendar days of additional leave = duration of additional leave: 12 months * number of full months worked.

In this case, the full months worked are calculated in the same way as is done for compensation upon dismissal. That is, surpluses amounting to less than half a month are excluded from the calculation. And the number of days equal to half a month or more is rounded up to a full month, for which the employee will be entitled to compensation.

SIMILARITY. How to round the total number of vacation days for which compensation is due

The legislation does not say anything about the fact that the calculated indicator must be rounded to whole calendar days. Therefore, traditionally the calculated value is taken with two decimal places.

However, if the company’s management decides to round the indicator to whole units, then this will have to be done not according to the rules of arithmetic, but upward.

After all, organizations do not have the right to worsen the situation of workers. This is established by Article 8 of the Labor Code of the Russian Federation. That is, it is impossible to pay compensation for, say, not 20.4 days, but 20 days. If we round up, then up to 21 days. This point of view was also expressed in the letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 No. 4334-17.

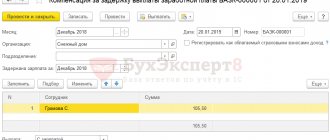

SIMILARITY. How to determine the amount of compensation

Rest days for which the employee is entitled to compensation are paid based on average earnings. The method for calculating it is completely similar to that used when determining the amount of vacation pay. That is, the main document here is the Regulation on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

That is, in the end, having determined the average daily earnings, the accountant will simply multiply it by the number of days for which the dismissed employee is entitled to compensation. The result obtained will be compensation for unused vacation by the employee.

DIFFERENCES. When should compensation be given to the employee?

Compensation related to dismissal

The employee must be given money on his last working day, that is, on the day of dismissal.

It happens that employees take vacation before leaving the organization. Then compensation will have to be issued on the last working day before the vacation. This conclusion follows from Article 80 of the Labor Code of the Russian Federation. After all, it is on the last day of work that the organization must make a final settlement with the employee, issue him a work book and other documents related to the work (upon written application).

In this case, the last day of work will be indicated in the work book as the last day of vacation (Article 127 of the Labor Code of the Russian Federation).

Compensation not related to dismissal

Labor legislation does not establish clear deadlines for payment of money. This is due to the fact that the employer is not obliged to pay compensation for unused vacations. Therefore, the terms are agreed upon individually between the employee and the management of the organization. Typically, compensation is issued along with the next salary.

If the employee has not gone on vacation for several years

According to Article 122 of the Labor Code of the Russian Federation, the organization is obliged to provide employees with vacations annually. That is, in principle, a situation where an employee has not rested for more than a year is a violation of labor legislation. And if labor inspectors discover this during an inspection, they will most likely issue an order to the company to eliminate this violation. And later they may be fined.

However, if this situation does arise in the organization and such an employee decides to quit, then he must be paid compensation for all the days that he did not take time off. This conclusion follows from Article 127 of the Labor Code of the Russian Federation. It says that upon dismissal, the employee is paid compensation for all unused vacations.

Rounding off days of compensation for unused vacation

In accordance with existing legislative acts currently in force in the Russian Federation, there are several provisions that contain basic guidelines regarding rounding:

- Rule #1.

- Rule #2.

- Rule #3.

To calculate the periods of time an individual works, on the basis of which he will be provided with compensation for unused vacation days. Periods less than 15 days are not taken into account.

Days worked in excess of this period are subject to rounding to the equivalent of a full working month.

If an employee worked for an employer for 11 months and went to work strictly on those days provided for by law, then he has the right to receive compensation calculated for a period rounded to a year .

The company has the right to round up a non-integer number of days.

However, if the organization has expressed such a desire, nevertheless rounding up the number of days in favor of the employee, then the tax authorities may impose some requirements on the payment rules. The tax office has the right to oblige the employer to pay compensation for a rounded day from the total profit of the enterprise.

CAS court decision dated January 18, 2021: vacation compensation upon dismissal (rounding days)

Share

The motivation of an employee is very interesting - to go through three levels of authority on an issue on which the practice is almost identical.

The dismissed employee did not agree with the calculation of days of compensation for unused vacation, namely that 13.33 days of vacation (44/12 * 8-16) had to be rounded to a whole number, otherwise discrimination in labor rights would result, since vacation is provided in kind, and compensation for some reason with commas. The plaintiff most likely asked to round in favor of the employee, i.e. 14 days (approx. 2kk.info).

Of course, the employee lost. All courts noted that rounding of the number of calendar days of unused vacation is not provided for by law. This is an almost verbatim position of the Russian Ministry of Health, expressed in letter No. 4334-17 dated December 7, 2005, to which judges usually refer.

He also wrote that if an organization decides to round up compensation for unused vacation (for example, to whole days), then this should be done not according to the rules of arithmetic, but in favor of the employee (not 20.4 days, but 21 days ).

Determination of the Investigative Committee for civil cases of the Third Cassation Court of General Jurisdiction dated January 18, 2021 in case No. 8G-18195/2020[88-94/2021-(88-17288/2020)]

The Judicial Collegium for Civil Cases of the Third Cassation Court of General Jurisdiction, consisting of:

presiding Bakulin A.A., judges Petrova T.G., Snegirev E.A.

considered in open court a civil case, case No. 2-2653/2020, based on a claim by Full Name against JSC for the recovery of underpaid compensation for unused vacation upon dismissal, compensation for late payment of compensation for unused vacation in full, on a cassation appeal by Full Name against the decision of the Syktyvkar City Court Republic of Komi dated March 4, 2021, appeal ruling of the judicial panel for civil cases of the Supreme Court of the Komi Republic dated June 25, 2021.

Having heard the report of the judge of the Third Cassation Court of General Jurisdiction, T.G. Petrova, the Judicial Collegium for Civil Cases of the Third Cassation Court of General Jurisdiction

installed:

The full name filed a lawsuit against the JSC to recover the amount of lost compensation for unused vacation upon dismissal, compensation for late payment of compensation for unused vacation in full, starting from 01/11/2020 to the day of actual payment.

In support of the requirements, the full name referred to the fact that from 05/08/2018 to 01/10/2020 he was in an employment relationship with the JSC. Upon dismissal, the defendant paid him compensation for unused vacation for the working period from 05/08/2019 to 01/10/2020 in the amount of 23,217.84 rubles. for 13, 33 calendar days of unused vacation. The plaintiff does not agree with the amount of compensation paid.

By the decision of the Syktyvkar City Court of the Komi Republic dated March 4, 2021, left unchanged by the appeal ruling of the judicial panel for civil cases of the Supreme Court of the Komi Republic dated June 25, 2021, the claim was denied.

The cassation appeal of the full name raises the question of canceling these court decisions as illegal and sending the case for a new trial.

The parties, duly notified of the time and place of the trial, did not appear at the court hearing of the cassation court. Information about the consideration of the case was promptly posted on the website of the Third Cassation Court of General Jurisdiction. The Judicial Collegium for Civil Cases of the Third Cassation Court of General Jurisdiction, guided by Part 5 of Article 379.5 of the Civil Procedure Code of the Russian Federation, considers it possible to consider the case in the absence of persons participating in the case who have not appeared.

Having checked the case materials and discussed the arguments of the cassation appeal, the judicial panel for civil cases of the Third Cassation Court of General Jurisdiction finds the complaint not subject to satisfaction.

In accordance with Article 379.7. According to the Civil Procedure Code of the Russian Federation, the grounds for canceling or changing court decisions by a cassation court of general jurisdiction are the discrepancy between the court's conclusions contained in the appealed court decision and the actual circumstances of the case established by the courts of first and appellate instances, violation or incorrect application of substantive law or procedural law.

In the present case, no such violations have been established, taking into account the arguments of the cassation appeal.

The courts have established that the full name was in an employment relationship with the defendant since 05/08/2018, by order No. 01-k of 01/09/2020, the employment contract with him was terminated at the initiative of the employee, the plaintiff was fired on 01/10/2020.

Upon dismissal, the plaintiff was paid compensation for unused vacation (for the period from 05/08/2019 to 01/10/2020) in the amount of 13.33 calendar days, which is confirmed by the note-calculation upon termination (termination) of the employment contract with the employee (dismissal).

Based on the average daily earnings of the plaintiff - 2100.59 rubles, the number of unused vacation days - 13.33, the plaintiff was paid an amount of compensation for unused vacation in the amount of 28,000.86 rubles.

The court of first instance, taking into account the circumstances established in the case and the legal relations of the parties, as well as the rules of law to be applied, guided by the provisions of Articles 84.1, 127, 139, 140, 236 of the Labor Code of the Russian Federation, the Regulations on the peculiarities of calculating the average wage, approved by the Decree of the Government of the Russian Federation dated December 24, 2007 N 922, Rules on regular and additional vacations, approved by the People's Commissariat of the USSR on April 30, 1930, rightfully refused to satisfy the claims, since he came to the conclusion that the calculation of compensation for unused vacation by the defendant was made in strict accordance with the law, and The plaintiff's arguments about the need to round the number of unused vacation days when calculating compensation are untenable and based on an incorrect interpretation of the law.

The appellate court, agreeing with the correctness of the conclusions of the first instance court, additionally noted that from the case materials it follows that, according to the terms of the employment contract, the plaintiff was entitled to 44 calendar days of basic annual leave for the working year, of which 16 calendar days were used by the plaintiff. Considering that Full Name worked for the defendant for less than 11 months (from 05/08/2019 to 01/10/2020, i.e. 8 months), the vacation days for which compensation must be paid are calculated in proportion to the months worked (clause 35 of these Rules), their number in the calculation was 13.33 days, taking into account the vacation previously used by the plaintiff. The case materials confirm and are not disputed by the plaintiff that the final payment was received by him on the day of his dismissal; accordingly, the court had no grounds for collecting monetary compensation in favor of the plaintiff under Article 236 of the Labor Code of the Russian Federation.

The panel of judges finds that the conclusions made by the courts correspond to the established circumstances and the rules of law cited in judicial acts; there are no grounds for re-evaluating these conclusions based on the arguments of the cassation appeal.

The arguments of the cassation appeal of the full name, challenging the conclusions of the courts, cannot be taken into account, since they are based on an erroneous interpretation of the norms of substantive and procedural legislation, and also essentially come down to an expression of disagreement with the court’s assessment of the circumstances of the case and the evidence presented in the case, therefore, force of Art. 390 of the Civil Procedure Code of the Russian Federation cannot serve as a basis for canceling or changing the appealed court decisions adopted in this case.

By virtue of Articles 67, 327.1 of the said Code, establishing the circumstances of the case and evaluating the evidence falls within the competence of the court of first and appellate instances. The cassation court is not vested with the right to re-evaluate the evidence presented by the parties, as well as to accept new evidence and establish new circumstances, which is essentially what the arguments of the cassation appeal are aimed at.

Cancellation or modification of a court decision in cassation is permissible only if, without eliminating the judicial error that occurred during the previous proceedings and influenced the outcome of the case, it is impossible to restore and protect significantly violated rights, freedoms and legitimate interests, as well as public interests protected by law . The cassation appeal does not contain any indication of a judicial error.

Guided by Articles 390 and 390.1 of the Civil Procedure Code of the Russian Federation, the judicial panel for civil cases of the Third Cassation Court of General Jurisdiction,

determined:

the decision of the Syktyvkar City Court of the Komi Republic dated March 4, 2021, the appeal ruling of the judicial panel for civil cases of the Supreme Court of the Komi Republic dated June 25, 2020 is left unchanged, the cassation appeal is not satisfied.

Presiding

Judges

Share

Related Posts

- Court decision of 02.28.2020: refusal to hire The applicant was interviewed at a government agency, wrote a job application, passed a medical examination...

- Court decision of May 28, 2019: dismissal for absenteeism (lunch does not interrupt a 4-hour absence from work) In this case, the employee is a car driver. The driver brought the passenger to the place without waiting...

- Court decision of 04/24/2020: dismissal for absenteeism (lunch interrupts a 4-hour working day) Despite the fact that many courts note that a lunch break does NOT interrupt the working day, but only...

Compensation for vacation followed by dismissal

According to the law, no matter how long an individual has worked for the benefit of the enterprise, in the event of termination of the employment relationship between the employee and the employer, the latter is obligated to pay him money for unused vacation.

After the employment agreement was terminated as a result of the reasons described in Article 77 of the Labor Code , the employee must be awarded a certain monetary compensation.

This procedure is carried out in accordance with the following formula: Y=X*Z.

Y is the amount of monetary compensation upon dismissal, which is accrued to the employee if there are unused vacation days.

X is the employee’s average salary per day, calculated for the estimated period.

Z is the number of days intended for annual vacation that the individual did not take advantage of.

To make it more clear how to correctly calculate the X coefficient and accurately use the given formula, let’s look at an illustrative example.

Let's assume that an employee, Ivan Ivanovich Ivanov, worked within the organization for a period of 1.5 months .

In this case, the average salary must be calculated for the time during which he actually performed his duties and was present at the workplace (even days of officially registered sick leave and days off for a good reason must be excluded from the calculation).

Thus, if he has two days off a week and was sick for two more days, then the calculation period for 45 days will be 20 calendar days.

During this period of time, the employer paid Ivanov 17,000 rubles, dividing this figure by the billing period (by 20), it turns out that 850 rubles is the average daily salary.

How the Z coefficient is calculated was discussed in detail above. For a given billing period of 20 calendar days, it is equal to two. Thus, multiplying the number 2 by 850 rubles, we obtain that compensation upon dismissal is equal to 1,700 rubles .

Formula for calculating compensation for unused vacation

The employee's payment includes the following payments:

- basic income;

- premium;

- severance pay;

- reimbursement of unspent vacation.

Calculation of vacation pay upon dismissal is carried out using the following formula:

Average daily earnings for the year × Number of days of unspent vacation

The rules for calculating and paying compensation are regulated by the following legislative acts:

- Art. 139 of the Labor Code of the Russian Federation - determines the algorithm for calculating average earnings;

- Art. 140 of the Labor Code of the Russian Federation - regulates the timing of wages, bonuses and other payments in the event of termination of the employment relationship;

- Art. 127 of the Labor Code of the Russian Federation - explains the features of dismissal after used vacation;

- Decree of the Government of the Russian Federation No. 922 - explains special cases of calculating average income;

- Letter of the Ministry of Health and Social Development No. 4334-17 - defines the algorithm for calculating unspent vacation upon termination of an employment contract.

The average income parameter is calculated using the following formula:

Total earnings for the previous year / Number of days in the worked period.

When calculating income, the amounts of vacation payments, disability benefits and financial assistance are not taken into account. The duration of fully worked months is 29.3 days (fixed value).

The number of days in months in which there are excluded periods is calculated using the formula:

Number of excluded days × 29.3 / Length of month.

28 calendar days of vacation – the duration of an employee’s rest per working year. For each month worked, a citizen accumulates 2.33 days. To calculate the period for which compensation payment is required, you need to use the following calculation formula:

(OM × 2.33) — IO , where:

- OM – months fully worked from the date of employment;

- 2.33 – number of accumulated vacation days over 30 days;

- IO – number of vacation days used.

If a citizen worked less than 15 days and quit, the current month is not taken into account for calculations.

IMPORTANT! The total value is always rounded in favor of the employee.

An example of calculating the number of vacation days, average income and amount of compensation under the following conditions:

- date of employment – January 1, 2021;

- date of dismissal – August 31, 2021;

- monthly income – 60 thousand rubles;

- additional annual leave – 3 days;

- number of days used – 31.

The amount of compensation is:

- Full months of work for the period from 01/01/18 to 08/31/19 – 20.

- The duration of additional days for the estimated period is 6.

- Determination of the number of unused days: 20 × 2.33 + 6 - 31 = 21.6. The value is rounded in favor of the employee - 22.

- Average employee earnings per day: 60,000 × 12 / (12 × 29.3) = 2,047 rubles.

- Vacation pay: 2,047 × 22 = 45,034 rubles.

Upon dismissal, the employer must accrue the employee 45,034 rubles.