No. 3: New export rules have been introduced

Accompanying documents

From October 1, 2021, for goods exported outside the EAEU, there will be no need to submit copies of transport, shipping and/or other documents with customs marks of the place of departure confirming the export of goods outside of Russia. The Federal Tax Service can receive data on the export of goods directly from customs – in electronic form.

However, if customs does not provide these data or they contradict the information declared by the taxpayer himself, then the Federal Tax Service may request copies of transport, shipping and other documents confirming the export of goods. The taxpayer is given 30 calendar days from the date of receipt of the inspection request to submit such documents. Reason: Federal Law of August 3, 2018 No. 302-FZ

If the company ships goods to the EAEU countries, such documents also do not need to be submitted together with the VAT return. But provided that the company has submitted an electronic list of applications for the import of goods and payment of indirect taxes (tax authorities have the right to request them, but selectively).

Export contract

For goods sold for export from October 1, 2021, an export contract to confirm the zero VAT rate can be submitted to the Federal Tax Service only once.

If in the future it is also needed to confirm the export rate, the VAT payer will be able to send a notification drawn up in any form to the inspectorate instead. This notification will need to be sent to the inspectorate along with a VAT return, which reflects the export transactions related to the previously submitted contract.

Confirmation of the zero rate for Russian companies

Until October 1, 2021, when selling goods abroad, Russian companies could not confirm the zero VAT rate if the foreign buyer was a Russian organization. Tax authorities, in this case, demanded payment of VAT in the usual manner - as for domestic sales. Moreover, the fact that the goods crossed the Russian border in this case did not matter to the inspectors, since in order to confirm the export rate, a contract with a foreign one is now needed.

For goods that will be sold for export starting from October 1, 2018, it will be possible to confirm the zero VAT rate even if there is a contract with a Russian organization. According to its terms, the goods must be supplied to a separate division of the company (branch, representative office of a Russian company).

Calculations for “advance” VAT

The buyer has the right to deduct the amount of VAT charged to him by the seller when transferring an advance payment on account of upcoming deliveries of goods (performance of work, provision of services, transfer of property rights) (Clause 12 of Article 171 of the Tax Code of the Russian Federation).

The grounds for deducting VAT from the buyer are (clause 9 of Article 172 of the Tax Code of the Russian Federation):

- an invoice that the seller must issue no later than five calendar days from the date of receipt of the advance payment (clause 1, clause 3 of Article 168 of the Tax Code of the Russian Federation);

- payment documents confirming that money has been transferred for upcoming deliveries of goods (performance of work, indication of services), transfer of property rights;

- an agreement that must contain a condition for prepayment.

If the purchasing company does not fulfill at least one of these conditions, it will be denied a deduction.

The law establishes that if the seller has shipped goods whose cost is less than the advance payment received earlier, the buyer is obliged to recover VAT only in the amount indicated in the invoice for shipment.

If all of the above conditions are met, then the VAT transferred to the supplier as part of the prepayment can be deducted.

Please note that for the buyer, deducting VAT from the advance payment is a right, not an obligation. That is, by transferring an advance payment to the seller, the buyer may not count the “advance” VAT, but take advantage of the deduction only upon shipment. But if a deduction from the advance payment is claimed, upon receipt of the goods the tax should be restored (subclause 3, clause 3, article 170 of the Tax Code of the Russian Federation).

The commentary letter states that if the seller issued an advance invoice in one quarter, and the buyer received it in the next, then VAT can be deducted only in the period when the invoice was received by the buyer. The period of its exposure does not matter.

Example.

Deduction of VAT on a “late” invoiceA contract was concluded between the buyer and seller for the purchase of goods in the amount of 600,000 rubles. (including VAT - 100,000 rubles). The agreement provides for 100% advance payment. The prepayment was transferred on February 28, 2021. The seller issued an invoice for the prepayment received and sent a copy of the document to the buyer by mail, but it was received by the accounting department only on April 1, 2021. The supplier shipped the goods on April 20, 2021. On the day of shipment, the supplier presented the buyer with an invoice for the shipped goods. When posting goods, the accountant of the purchasing company must accept the “input” VAT for deduction and at the same time restore the VAT accepted for deduction from the advance payment. The accountant of the purchasing company will make the following entries: 02/28/2019 Debit 60, subaccount “Calculations for advances issued” Credit 51,600,000

rubles.

– prepayment was transferred to the supplier. In the first quarter, the transfer of the advance payment by the buyer did not entail any tax consequences. 04/01/2019 Debit 68, subaccount “Calculations for VAT” Credit 76, subaccount “Calculations for advances issued”

100,000 rubles.

– based on the invoice, VAT was accepted for deduction on the transferred advance. 04/20/2019 Debit 41 Credit 60, subaccount “Settlements for advances issued”

500,000 rubles.

– the goods are capitalized; Debit 19 Credit 60, subaccount “Settlements with suppliers”

100,000 rub.

– reflected “input” VAT on goods received; Debit 68, subaccount “Calculations for VAT” Credit 19,100,000

rub.

– accepted for deduction of VAT on goods received; Debit 60, subaccount “Settlements with suppliers” Credit 60, subaccount “Settlements for advances issued”

600,000 rubles.

– prepayment for the goods has been credited; Debit 76, subaccount “Calculations for advances issued” Credit 68, subaccount “Calculations for VAT

100,000 rubles. – the VAT accepted for deduction on the advance was restored.

1C Accounting 8 edition 3.0 - Entering balances for advances received

When starting accounting in the program, many organizations enter opening balances. But if there are usually no complications when entering initial balances for materials and goods, then errors may occur when entering balances for received advances and accrued VAT. Let's take a closer look at how to correctly perform this operation in 1C Accounting 8 edition 3.0.

Let's look at an example

: The organization begins to keep records in the program from 01/01/2016 and enters opening balances. On November 10, 2015, the organization received an advance payment for upcoming services in the amount of 59,000 rubles. (VAT 18/118 9,000 rub.). On the same day, an advance invoice with number 77 was issued to the buyer.

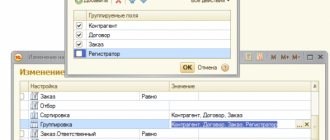

To enter initial balances, go to the “Main” section and call the assistant for entering initial balances. Let's set the date for entering balances to 12/31/15. Advances received are reflected in account 62.02 “Settlements for advances received.” Let’s create a document “Entering balances”. In the tabular part, we will indicate account 62.02, select the counterparty, the agreement (type of agreement “with the buyer”), the settlement document (in our case, the settlement document replaces the receipt to the current account) and the amount on the account credit. See fig. 1

Picture 1.

In accordance with paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, upon receipt of payment amounts, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, invoices are issued, and VAT is charged in accounting. Accrued VAT is reflected in the debit of account 76.AB “VAT on advances and prepayments”. Therefore, we will create a document “Entering balances” for account 76.AB. In the tabular part of the document, we will select our buyer, the contract and the settlement document we created (through this document the connection between the accrued VAT and the specific advance payment is made), and we will indicate the details of the invoice issued for the advance payment, the rate and the amount of VAT. Let's see the filling and movement through the document in Fig. 2.

Figure 2.

01/21/2016 The organization provided services for the amount of the advance payment. To reflect the provision of services in the program, the document “Sales (act, invoices)” with the type of operation “Services” is used. The document contains an invoice for the sale. When posted, the document will create entries in accounting and tax accounting for the accrual of revenue; in accounting, VAT will be charged on the amount of revenue and the advance offset will be reflected. The document will also create an entry in the accumulation register “VAT Sales” (Sales Book). The result of the document is shown in Fig. 3.

Figure 3.

In accordance with clause 8 of Article 171 of the Tax Code of the Russian Federation, tax amounts calculated by the taxpayer from amounts of payment, partial payment received on account of future deliveries of goods (work, services) are subject to deductions.

According to clause 6 of Article 172 of the Tax Code of the Russian Federation, deductions of the tax amounts specified in clause 8 of Article 171 of the Tax Code of the Russian Federation are made from the date of shipment of the relevant goods (performance of work, provision of services), transfer of property rights in the amount of tax calculated from the cost of shipped goods (performed works, services provided), transferred property rights, in payment for which the amount of previously received payment, partial payment in accordance with the terms of the contract (if such conditions exist) are subject to offset.

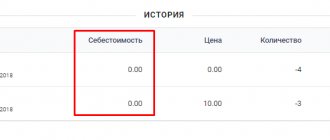

Let’s create the document “Creating purchase ledger entries.” We will set the document date to 03/31/2016. and fill out the document. Deductions of VAT amounts from advances are reflected on the “advances received” tab. When posting the document in accounting, it will make an entry DT 68.02 - CT 76.AB to accept for deduction the amount of VAT from the advance payment and will create an entry in the Purchases VAT accumulation register (Purchases Book). In Fig. 4 shows the document “Creating a purchase ledger entry” and the result of its implementation.

Figure 4.

To check the correctness of our actions, we will create a purchase book for the first quarter of 2021. See Fig.5

Figure 5.

Dear readers! You can get answers to questions about working with 1C software products on our 1C Consultation Line. We are waiting for your call!