There are several remuneration systems. The most popular of them: time-based; piecework; commission. Within one organization, several remuneration systems may be used. The choice is dictated by the peculiarities of the labor process and economic feasibility.

An employee's salary is established by an employment contract between the employee and the organization in accordance with the company's current remuneration systems.

In turn, remuneration systems (including the size of tariff rates, salaries, additional payments and allowances of a compensatory and incentive nature) are established by collective agreements, agreements and other local regulations (Article 135 of the Labor Code of the Russian Federation).

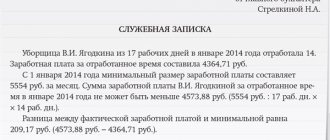

The salary of an employee of an organization who has fully worked the monthly working hours and fulfilled his job duties cannot be lower than the minimum wage (Article 133 of the Labor Code of the Russian Federation). This rule applies to all remuneration systems, provided that the employee has worked a full month, working full-time.

From January 1, 2021, the minimum wage is 6,204 rubles. (Article 1 of the Federal Law of December 14, 2015 No. 376-FZ). In the constituent entities of the Russian Federation, the minimum wage established by regional agreements may exceed the federal minimum wage (Article 133.1 of the Labor Code of the Russian Federation).

There are several remuneration systems. The most popular of them:

- time-based;

- piecework;

- commission.

Within one organization, several remuneration systems may be used. The choice is dictated by the peculiarities of the labor process and economic feasibility.

If there is a trade union in the company, the choice of the remuneration system is made taking into account this representative body (Part 4 of Article 135 of the Labor Code of the Russian Federation).

Automatically calculate payroll, do accounting and send reports online.

Try for free

Time-based wage system

Employees are paid for the actual time worked based on the established monthly salary (hourly or daily rate). In practice, this is how employees who do not participate in the production process (for example, economists, accountants) or participate but constantly perform the same amount of work are paid (for example, assembly line workers).

If an employee who has a monthly salary has worked all working days of the month, then he should be paid the salary in full. Moreover, the number of working days in a month does not matter. Depending on the number of working days in a particular month, only the “cost” of the day changes. So, the most “expensive” days are in January with its record low number of working days.

A situation may arise when an employee whose salary is set has worked for less than a full month. For example, an employee did not get a job at the beginning of the month, got sick or went on vacation during that month. In this case, the salary for a month not fully worked must be calculated by dividing the employee’s monthly salary by the number of working days in this month and multiplying by the number of days he worked. In formula form it looks like this:

Salary = Monthly salary: Number of working days in a given month x number of days worked by the employee

An employee who is assigned an hourly rate must calculate his salary by multiplying the number of hours he worked by the hourly rate set for him.

An employee for whom a daily rate is established has his salary calculated by multiplying the number of days he worked by the daily rate.

A special case of a time-based wage system is a time-based bonus system. With this remuneration system, in addition to the salary, the employee may be paid a bonus (provided that he has fulfilled the conditions for receiving it).

Calculation of basic wages of main production workers

The basic salary of the main production workers involved in the manufacture of the product consists of the tariff part (Ztar.), additional payments (D), allowances (N), bonuses (Ex.):

Basic = Z tare. + Ave. + D + N.

The tariff part of the wages of main workers per unit of product is determined based on the labor intensity of a unit of product (t pcs.) and the tariff rate of workers (TS):

Ztar.= t pcs.i * vehicle i

, where i = from 1 to n (n is the number of operations in the manufacture of the product, pcs.)

The bonus of the main production workers is determined by the formula:

Z container * Kpr.

Etc. =———————,

Kpr. - percentage of the main bonus

100

production workers, %.

Additional payments are made in accordance with current legislation.

At the enterprise in question, the following types of additional payments are provided:

— for overtime work

for the first two hours of work payment is made in

one and a half sizes, for the next hours -

in double size:

D1 = 1.5 * TC hour. * t

, where t is the duration of the first two hours of work

overtime,

D1 = 2 * TC hour. * T

, where t is the duration of subsequent hours of work

overtime, but not more than four hours per day

for two days in a row.

— for working on holidays

Double surcharge will be made

hourly rate:

D2 = 2 * TC hour.* t

, where t is the duration of work on a holiday,

hour.

— for night work

additional payment is made in the amount of 40% of the hourly

tariff rate:

D3 = 0.4 *TS hour. * T,

where t is the duration of work at night.

The duration of work for all types of additional payments can be obtained from the coursework supervisor.

Current legislation provides for bonuses for work in the Northern regions and other equivalent regions. The enterprise in question is located in a region that is not covered by these surcharges, so in this case H = 0.

Calculation of additional wages for main production workers.

Additional wages (3 extra) in accordance with labor legislation include:

· payment of basic and additional holidays,

· preferential hours for teenagers,

· time to perform government duties

· time to feed children for nursing mothers, etc.

The calculation of additional wages at the enterprise in question is based on percentages of the basic wages of production workers:

Basic * To additional salary

Z extra = ————————

, where K additional salary - percentage of additional

100

wages, %.

Piece wage system

In contrast to the time-based wage system, the piece-rate wage system is introduced to motivate workers to increase labor productivity. In most cases, this system is used for workers involved in the production process.

The piecework wage system implies that the organization, by local regulatory documents, establishes prices per unit of manufactured products (work performed) and keeps records of output.

In general, an employee’s wages on a piece-rate wage system are calculated as the product of the quantity of products produced (work performed) and the piece rate per unit of product produced (work performed). In formula form it looks like this:

Salary = Number of products produced (work performed) x Piece rate per unit of product produced (work performed)

To motivate staff, a company can reward piece workers by paying them bonuses. This system of remuneration is called piecework-bonus.

Another special case of the piecework system is the progressive piecework system: products (work) produced in excess of the norm are paid at increased prices.

Payroll Methods

Each organization is obliged to implement in its practical activities one of the following payroll methods:

- Advance based on the results of two weeks of the current month worked and payment of wages after the end of the month;

- Salary for the first and second half of each month.

The use of the second method must be prescribed by the employer in a collective or labor agreement with employees and is a more labor-intensive process, since it requires the accounting department to calculate wages twice a month.

Tariff rates, grouping

Different industries require different tariff rates. Not only the significance of the work is taken into account, but also the complexity. Each division into categories of employees takes into account not only the significance of the work, but also factors such as the complexity and intensity of working conditions. In addition, clear differentiation depends on how remuneration is carried out and the role of the work performed itself.

Typically there are three groups of bets:

- Normal working conditions.

- Hard work. 10-15% is added to the usual amount of remuneration.

- Particularly difficult conditions. Then the increase is 20-30%.

Such differentiation makes it possible to easily eliminate possible injustice and attract any categories of employees to perform work.

The tariff rate usually depends on which specific unit of time is chosen for measurement. In most cases, hourly rates are used.

Allowances and surcharges

Wages are needed not only to ensure minimal financial well-being. It should be a kind of incentive to increase labor productivity.

It is for this purpose that management is developing a system of additional payments and bonuses.

Compensation payments are actually taken into account by production and social labor parameters, which do not directly depend on the employee himself. Such payments do not change over time. Additional compensation takes into account work at night, on weekends and during holidays. This is especially true for those who work in multiple shifts.

The legislation itself establishes the amount of compensation. Therefore, they become mandatory for use.

To determine average earnings, one must rely on a period equal to three months preceding the date of payment of wages. This indicator is taken into account in many enterprises. In some cases, one year is taken per billing period, but this is the exception and not the standard rule.

Part-time salary

The law does not separate part-time workers from other employees. When hired, he must sign an employment agreement. And part-time workers are subject to all rules related to internal regulations, the same applies to job responsibilities and rights.

Partners have standard rights in the case of payroll. There is only one nuance that matters to employers. This is related to actual working hours. In second place they should not exceed half the time in first place. If remuneration is time-based, then remuneration is received for hours actually worked. In this regard, part-time workers may receive less than others. Even if the positions are the same. But with a piece-rate scheme, such workers can receive even more than others.

Maternity leave and salary

The law says that any woman can count on leave equal to 70 days before giving birth, as well as 70 days after. The main thing is the total number of 140 days. But in each case, you can divide this time into other parts. You can expect an increase of several days if the birth is complicated.

During maternity leave, the employee receives an average salary. Or an average stipend if the employee is studying somewhere.

Even the unemployed are eligible to receive a scholarship. But only if they are registered with the employment service. After all, the payment comes from the capital in the Social Fund. insurance. If, before registration, the workplace was absent for two years or more, then the benefit will be minimal. There are also government payments, but they deserve a separate discussion.

When calculating wages in an incomplete month, it is important to find out what exact rate is used: daily, hourly, or monthly.

In the case of an hourly rate, the hourly rate is multiplied by the time worked. If necessary, the bonus is multiplied by the norm per unit of time. The result is then divided by the hours actually worked.

Salary may or may not be monetary. In the latter case, they do not rely on the basis for payment, but on the way in which they pay the employee. The monetary form is currently the most widely used. But the law does not prohibit the execution of employment agreements, which state that payment is made in a different form.

So, there are several types of payroll. It is important to accurately understand this issue in order to avoid errors in calculations.

Noticed a mistake? Select it and press Ctrl+Enter to let us know.

No matter how they pay, they still strive to pay less and not on time. Unfortunately, you can’t go to court in every case. They somehow took and cut off my entire bonus at once. I decided to quit - I was tired. As soon as I quit, everything returned to the card. Did they “play” it somewhere? Everyone will not calm down with the increase in their profits.

In fact, all these calculations are not simple and it is, of course, better to entrust this to accountants. It’s not bad to have a general idea and understand how our salaries, bonuses, etc. are calculated.

A useful article that will help people learn to calculate their salary levels themselves. I personally like everything to be clear, so I check my accruals myself monthly

We pay at an hourly rate. There is a tariff schedule indicating the amount per hour of work. Then bonuses are added to the total amount; the size of the bonus is not constant and depends on the implementation of the plan.