How to account for fully depreciated fixed assets

In practice, there are often cases when the initial book value of a fixed asset is completely repaid by depreciation, but the fixed asset itself continues to be used and participates in generating the enterprise’s income.

Find out how to calculate the book value of an enterprise from the article “The book value of fixed assets is...”.

According to the rules of PBU 6/01, it is possible to write off an asset from accounting only if it is disposed of or loses its ability to generate income. If the OS continues to be used, it should continue to be taken into account for accounting purposes and, if necessary, disclose information about it in the financial statements.

From 2022, PBU 6/01 will no longer be in force. Instead, FSBU 6/2020 will apply. The organization has the right to begin applying the standard earlier.

ConsultantPlus experts explained in detail how to properly keep records according to the new standard. Get free demo access to K+ and go to the Review Material to find out all the details of this procedure.

Why a certificate of the book value of an organization’s assets is issued, see this material.

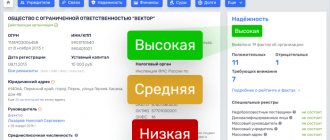

Tax authorities adhere to a similar point of view on this issue: if 100% of depreciation has been absorbed for a fixed asset, but it is still in use, it must continue to be taken into account (letter of the Federal Tax Service of Russia dated December 8, 2010 No. 3-3-05/128).

In this case, the residual value of the fixed assets, reflected in the balance sheet and defined as the difference between the initial cost (Dt 01) and depreciation (Kt 02), will be equal to 0.

For more details, see the article “Reflecting fixed assets in the balance sheet” .

Accounting

Costs associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, products are classified as other expenses (clause 11 of PBU 10/99).

The procedure for recognizing income and expenses associated with the write-off of fixed assets in accounting is similar to the procedure used for taxation of profits. In accordance with paragraph 31 of PBU 6/01, income and expenses from this operation are reflected in the reporting period to which they relate.

The cost of materials received during disassembly and dismantling of liquidated fixed assets is reflected in other income (clause 7 of PBU 9/99). The amount of other income for accounting purposes is determined in the same way as for tax purposes - based on the current market value of capital assets (clause 9 of PBU 5/01).

Nuances of calculating property tax on fixed assets with 100% depreciation

To calculate property tax, the residual value of property is included in the tax base (Article 375 of the Tax Code of the Russian Federation).

In this case, it is equal to 0, i.e. there will be no tax to pay. But before depreciation of fixed assets is written off, the organization must include information about them in the declaration or tax calculation of advance payments for property tax (letter of the Federal Tax Service of Russia dated December 8, 2010 No. 3-3-05/128).

IMPORTANT! From 2021, movable property is not subject to tax.

Read about all the news related to filling out and submitting a property tax return in the section “Tax return for corporate property tax .

How can we calculate depreciation?

As you can see from the formula, you will need to determine the original cost and useful life to calculate the monthly depreciation amount. If there are no problems with the amount of the initial cost, then determining the period of use is sometimes a difficult task.

Accounting with Elba is easy!

Submit reports without accounting knowledge

Elba will prepare accounting reports for the LLC. The service is simple: you don't need to know the wiring. Tax reports and reports for employees will also be generated automatically.

Repair and modernization of depreciated operating systems

Fully depreciated OS objects may require repair or modernization.

If you are modernizing or reconstructing such facilities, then both in accounting and tax accounting, the costs for it will increase the current value of the object.

In this case, the amount of depreciation accrued in NU for one month should be determined as the product of the initial cost increased as a result of modernization and the depreciation rate determined based on the useful life of this object. That is, it will depend on whether the SPI has increased as a result of modernization or not. If the period remains the same, the norm established when the OS was put into operation is applied. If it has increased, the norm should be revised (see letters of the Ministry of Finance dated September 11, 2018 No. 03-03-06/1/64978, dated October 23, 2018 No. 03-03-06/1/76004, dated October 25, 2016 No. 03-03- 06/1/62131)

Find out about the position of the tax authorities regarding the start of depreciation of the modernized fixed asset from the publication “The Federal Tax Service supported a profitable option for depreciation of the modernized fixed asset.”

For accounting purposes, the organization has the opportunity to choose: extend the useful life of the operating system or leave it the same. The decision is made based on how much time will be used or how much product still needs to be released on this upgraded OS.

For transactions on the modernization of fully depreciated property, see ConsultantPlus. If you don't have access to the system, get a free trial online.

If you are repairing fully depreciated operating systems, then the costs are taken into account immediately in the period in which the repairs were carried out. For tax purposes, these expenses must be taken into account as part of other expenses, and in accounting, repair expenses are classified as expenses for ordinary activities.

Documenting

The commission's decision to liquidate a fixed asset is formalized by an act on the write-off of a fixed asset item in form No. OS-4 (clause 78 of the Methodological Instructions). This form of the act can be used (from January 1, 2013 it is not mandatory) when deregistering all types of fixed assets, with the exception of vehicles. If you wish, you can independently develop and approve the form of the act for writing off the fixed assets. When liquidating vehicles, an act in form No. OS-4a is used.

The object being written off must be clearly identified, therefore the act indicates data characterizing the asset: the date the fixed asset was accepted for accounting, the year of manufacture or construction, time of commissioning, useful life, initial cost and the amount of accrued depreciation, revaluations, repairs. The act must indicate the inexpediency of further operation of the facility and the irrationality of its modernization. In addition, the act describes the condition of the main parts, parts, assemblies, structural elements and indicates the possibility of their further use, for example, for the repair of other objects.

The act is drawn up in two copies, signed by the members of the commission and approved by the head of the organization. One copy of the executed act for write-off of the asset remains with the financially responsible person. The second copy is transferred to the accounting department for registration of accounts. Based on this document, a mark indicating its disposal is placed in the inventory card of the item being written off. Inventory cards for retired fixed assets are stored separately for at least five years. The actual shelf life of such cards is determined by the head of the company (clause 80 of the Guidelines).

Note that the procedure for documenting the write-off of a fixed asset does not depend on the amount of accrued depreciation and applies even if the object is fully depreciated. Only when a vehicle is written off does the paperwork increase slightly. After all, a document confirming the deregistration of the car with the State Traffic Inspectorate is sent to the accounting department along with the report.

Sale and liquidation of fixed assets with a residual value of 0

The sale price of fully depreciated property is the contract price (Article 105.3 of the Civil Code of the Russian Federation). Sold or liquidated fixed assets are deregistered (clause 76 of the Guidelines for accounting for fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

When selling an asset with a residual value of 0, you need to charge VAT on the full sales amount.

Read more about the calculation of VAT on the sale of fixed assets in the article “Calculation and procedure for paying VAT on the sale (sale) of fixed assets.”

For tax purposes, proceeds from the sale of fixed assets are considered as income from sales (clause 1 of Article 249 of the Tax Code of the Russian Federation). Since the residual value of a depreciated fixed asset is 0, income from sales can only be reduced by those costs that are associated with securing a transaction for this fixed asset (clause 1 of Article 268 of the Tax Code of the Russian Federation).

Liquidation expenses for calculating income tax are included in non-operating expenses (clause 1 of Article 265 of the Tax Code of the Russian Federation) at a time in full in the period when they were actually incurred (clause 7 of Article 272 of the Tax Code of the Russian Federation).

There is no need to restore VAT (which was previously accepted for deduction) on a liquidated object with 100% depreciation (Article 170 of the Tax Code of the Russian Federation).

Check whether you have correctly reflected the sale of fully depreciated property with the help of advice from ConsultantPlus. Learn for free with a free trial of the legal system.

Accounting

Proceeds from the sale of fixed assets are recognized as other income of the organization (clause 7 of PBU 9/99). In this case, the residual value of the disposed object is written off from accounting as other expenses of the organization (clause 11 of PBU 10/99). Other expenses also include costs associated with the sale of fixed assets. It is clear that when selling a depreciated object, there are no expenses in the form of residual value.

Please note: accounting does not provide for the use of bonus depreciation. Accordingly, if in tax accounting upon the sale of a fixed asset the depreciation bonus is restored, the provisions of PBU 18/02 must be applied in accounting and the permanent difference must be reflected, which leads to the emergence of a permanent tax liability (clauses 4 and 7 of PBU 18/02).

Donation of a fully depreciated OS object

Donation of property worth over 3,000 rubles. between two commercial organizations is prohibited by law (Article 575 of the Civil Code of the Russian Federation).

For details of gratuitous agreements between legal entities, see here.

Since there is no separate procedure for determining the price of an asset with a zero book value transferred as a gift, the calculation should be made by analogy with other legal norms, in particular Art. 105.3 and 154 of the Tax Code of the Russian Federation (based on the market value of the object).

NOTE! The zero residual accounting value of an asset does not mean at all that the market value of this asset is 0. An expert assessment of the object will be required for a gratuitous transfer.

Free transfer to non-profit organizations and institutions, as well as individuals, is allowed. Wherein:

- With regard to income tax in accordance with the content of Art. 39 and 41 of the Tax Code of the Russian Federation, the transferring enterprise does not have an object of taxation (income) for income tax upon gift. At the same time, according to the norms of Art. 270 of the Tax Code of the Russian Federation, an enterprise does not have the right to take into account donation expenses for tax accounting. Thus, the transfer of fixed assets as a gift should not in any way affect income tax calculations.

- With regard to VAT, the donation of any fixed asset will be recognized as a sale for tax purposes (clause 1, article 39 and clause 1, article 146 of the Tax Code of the Russian Federation). The tax will need to be calculated and paid on the market value of the transferred asset (Clause 2 of Article 154 of the Tax Code of the Russian Federation). The amount of VAT paid on a gift should not reduce the income tax base (Clause 16, Article 270 of the Tax Code of the Russian Federation).

IMPORTANT! In some cases listed in paragraph 2 of Art. 146 of the Tax Code of the Russian Federation, donation of fixed assets is not subject to VAT. For example, if OS are transferred to state or local authorities. In this case, the donor should restore the input VAT on the transferred objects. The amount of tax to be restored is determined in proportion to the residual value of the fixed assets (clause 3 of Article 170 of the Tax Code). That is, for fully depreciated fixed assets (whose residual value is 0), VAT for restoration will also be equal to 0.

In accounting, all expenses associated with the donation are taken into account as part of other expenses in the period in which the fixed asset is written off from accounting.

Example 2

Alpha LLC has decommissioned equipment on its balance sheet. A commission appointed by order of the general director of Alpha LLC determined that it could be sold. The specified fixed asset belongs to the first depreciation group, its initial cost is 200,000 rubles. The asset was accepted for accounting on February 1, 2009 and fully depreciated in April 2010. For profit tax purposes, the organization, when accepting the object for accounting, applied a depreciation bonus in the amount of 10%, which amounted to 20,000 rubles. Let's say a fixed asset was sold in May 2010 for RUB 82,600. (including VAT RUB 12,600).

Since at the time of sale the property had been used by the organization for less than five years, the depreciation bonus must be restored. That is, in tax accounting in May 2010, 90,000 rubles must be taken into account as income. (RUB 82,600 - RUB 12,600 + RUB 20,000).

For the amount of the restored depreciation bonus, the organization will accrue a permanent tax liability in the amount of 4,000 rubles. (RUB 20,000 × 20%).

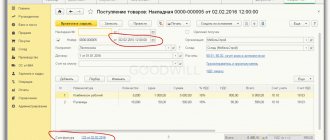

When selling an object, the following entries will be made in accounting:

- Debit 01 subaccount “disposal of fixed assets” credit 01 subaccount “fixed assets in operation” RUB 200,000. — the original cost of the fixed asset being sold is written off

- Debit 02 credit 01 subaccount “disposal of fixed assets” 200,000 rub. — depreciation accrued on the property being sold is written off

- Debit 62 credit 91-1 82,600 rub. — income from the sale of fixed assets is reflected

- Debit 91-2 credit 68 subaccount “VAT calculations” 12,600 rubles. — VAT accrued

- Debit 99 credit 68 subaccount “income tax calculations” 4,000 rubles. — a permanent tax liability is reflected

More taxable items

Another reason for the increase in property tax is the emergence of a new type of taxable objects.

According to paragraph 10 of FSBU 6/2020, the company’s significant costs for repairs, technical inspection, and maintenance of fixed assets with a frequency of more than 12 months or more than the normal operating cycle exceeding this period are independent inventory items. They will also have to be recognized in accounting and subject to property tax at the average annual value.

Methods for calculating depreciation

Accounting has four options for calculating depreciation. You can learn more about the methods for calculating depreciation in PBU 6/01.

Depreciation should be calculated from the month following the month in which the asset was registered. Let’s say the computer was capitalized in October 2018, the accountant will begin calculating depreciation from November 1, 2018.

Depreciation calculation methods:

- Linear.

- Reducing balance method.

- A method of writing off cost based on the sum of the numbers of years of useful life.

- The method of writing off the cost is proportional to the volume of products (works).

Please note that the listed methods relate to depreciation of fixed assets in accounting. In tax accounting, there are only two ways to calculate depreciation charges - linear and non-linear.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Linear method

Most often, practicing accountants use this method. It is very simple and clear.

To find out the amount of monthly depreciation, you should find the product of the original cost of the asset and the depreciation rate.

Depreciation rate = 1/SPI (months) x 100%.

Example. Funtik LLC registered a Samsung computer. The initial cost is 49,320 rubles. SPI - 5 years (60 months).

The depreciation rate for a Samsung computer = 1/60 * 100% = 1.67.

Monthly depreciation = 49,320 x 1.67% = 823.64 rubles.

Due to rounding, the amount of depreciation in the first months will differ from the amount of depreciation in the last month (the total amount of depreciation for the entire period should not be more than the original cost).

In practice, it is customary to calculate depreciation in a simpler and more accurate way.

Monthly depreciation = 49,320: 60 = 822 rubles.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Reducing balance method

To find out the required amount, you will need the residual value of the fixed assets at the beginning of the year, SPI. Companies also have the right to use an acceleration factor from 1 to 3.

Example. Funtik LLC uses OS in production, the residual value of which as of 01/01/2018 is 49,320 rubles (the same amount is the initial cost). SPI - 60 months. The coefficient is set at 1.3.

2018

49,320: 60 x 1.3 = 1068.60 rubles per month

The amount of depreciation for 2021 will be 12,823.20 rubles (1068.60 x 12).

2019

Residual value as of 01/01/2019 = 49,320 - 12,823.20 = 36,496.80 rubles.

36,496.80: 60 x 1.3 = 790.76 rubles per month.

Depreciation in subsequent years is also calculated in this way. The residual value of the operating system is always taken as a basis. Thus, every year depreciation charges decrease.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Method of writing off cost based on the sum of the numbers of years of useful life

The calculation is based on the initial cost and the sum of the number of years remaining until the end of the investment project.

Example. Funtik LLC uses OS in production, the initial cost of which is 49,320 rubles. SPI - 48 months (4 years). Depreciation is accrued from 01/01/2017.

First, let's determine depreciation rates.

2017 = 4 / (1 + 2 + 3 + 4) x 100% = 40%.

2018 = 3 / (1 + 2 + 3 + 4) x 100% = 30%.

2019 = 2 / (1 + 2 + 3 + 4) x 100% = 20%.

2020 = 1 / (1 + 2 + 3 + 4) x 100% = 10%.

This method allows you to write off most of the cost of the OS in the early years.

The amount of depreciation is determined by multiplying the original amount by the calculated rate.

Depreciation amount for 2021 = 49,320 x 40% = 19,728 rubles.

Monthly depreciation in 2021 = 19,728: 12 = 1,644 rubles.

The method of writing off the cost in proportion to the volume of products (works)

With this method, quantitative indicators of production (pieces, kilograms, etc.), the initial cost and the planned productivity of the operating system are taken as a basis.

Example . Pound LLC produces spare parts on the A458 machine. The machine was purchased in April 2021 and immediately put into operation. The initial cost of the A458 machine is 589,000 rubles. Over the entire period of use, it is planned to produce 350,000 units of products on this machine. In May, the machine produced 4,200 parts, in June - 3,100 units.

Depreciation in May = 589,000: 350,000 x 4,200 = 7,068 rubles.

Depreciation in June = 589,000: 350,000 x 3,100 = 5,216.86 rubles.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!