If an organization urgently needs money, and the founder has the necessary amount, then thanks to an interest-free loan agreement between the organization and the founder, the situation can be resolved without any problems. In this article, we suggest downloading an interest-free loan agreement from the founder, available for free at the bottom of the article.

The founder's money and the financial resources of the organization itself are one and the same. If the founders lend their financial resources to organizations, then they are essentially making a loan to themselves. This refers to the usual practice when loans are issued interest-free, and the question of how to settle accounts with creditors is resolved at a meeting of directors.

If there is not one founder, but several of them, and only one of the founders decides to invest financial resources, then it is desirable that the money be returned to him with interest (). The law does not prohibit this, but the organization itself must pay personal income tax.

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

What type of loan is considered permanent?

As the name suggests, a perpetual loan is a loan for an indefinite period, that is, there is no agreement between the parties regarding the timing of repayment of the debt.

A perpetual loan can be an internal government loan in which the repayment period of the capital amount is not specified.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Interest-free loan agreement from the founder/member of the company

| (place of conclusion of the contract) | (date of conclusion of the agreement) |

(Full name of the Lender), who is a participant/founder of the Borrower Company, hereinafter referred to as the “Lender”, on the one hand, and

(Full name of the Borrower), represented by (position, full name), acting on the basis of (Charter, Regulations, Power of Attorney), hereinafter referred to as the “Borrower”, on the other hand, and together referred to as the “Parties”, have concluded this agreement on the following:

Subject of the agreement

1.1. Under this Agreement, the Lender transfers the ownership of funds to the Borrower in the amount of (amount and currency of funds), and the Borrower undertakes to return the loan amount to the Lender upon expiration of the period specified in clause 1.2. Agreement.

1.2. The loan is provided for a period of ______________.

1.3. The loan provided under this Agreement is secured (method of securing the obligation).

1.4. No interest is paid on the loan amount.

Rights and obligations of the parties

2.1. The borrower is obliged:

- return to the Lender the received loan amount upon expiration of the period specified in clause 1.2 . actual agreement;

- ensure the fulfillment of your obligation to the Lender;

2.2. The Borrower has the right to repay the loan amount to the Lender ahead of schedule.

2.3. The Lender is obliged to provide the Borrower with borrowed funds within (period) from the moment of signing this Agreement.

Final provisions

3.1. This Agreement is considered concluded from the moment the money is transferred to the Borrower.

3.2. The loan amount is considered repaid at the moment of transfer of funds to the Lender.

3.3. Any changes and additions to this Agreement are valid if they are in writing.

3.4. This Agreement is drawn up in two copies having equal legal force - one for each of the Parties.

3.5. In everything that is not provided for in this Agreement, the Parties are guided by current legislation.

Details and signatures

| Lender | Borrower |

| ______________ Lender ______________ | ______________ Borrower ______________ M.P. |

Download the document “Interest-free loan agreement from the founder of the company”

Is a contract necessary?

It is necessary if one of the parties to the transaction is a legal entity (clause 1 of Article 807 of the Civil Code of the Russian Federation). A loan from the founder of his company without interest in the absence of a direct indication of this in the document will give him a reason, in case of problems, to demand from the company not only the money itself, but also the amount of interest, based on the key rate of the Central Bank of the Russian Federation in force during the period of actual use of these funds (p 1, Article 808 of the Civil Code of the Russian Federation).

But you can get credit not only with money, but also with property: let’s turn to clause 4 of Art. 809 of the Civil Code of the Russian Federation, which states that an agreement will be considered interest-free if it does not contain an interest clause.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Interest-free loan agreement from the founder of the company participant”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Features of the agreement

Each interest-free loan agreement is a unique legal project, therefore, when drawing it up, it is necessary to take into account the emerging features:

| If the loan is provided by the founder | who is also a director of the company, then he needs to sign the agreement twice - on his own behalf (as a lender) and on behalf of the company (as a director of the company) |

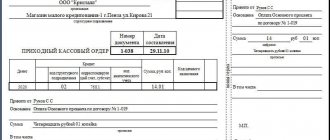

| If the contract does not indicate the date of transfer of funds | then the moment of entry into force will be the fact of transfer of money, confirmed by the presence of payment documents |

Procedure for receiving funds

After agreeing and signing the agreement, the founder needs to deposit funds into the account of the borrowing organization or, vice versa, if the borrower is the founder.

This can be done in one of the available ways:

- To the company's current account.

- Cash to the company's cash desk.

- Goods (in the case of an interest-free loan for goods).

Debt repayment options

Methods of debt repayment - relevant information reflected in one of the clauses of the contract. The law allows for the listing of several methods available to the borrower for convenient transfer of payments to pay the debt to the lender.

The main ones are:

| From a current account through the organization's cash desk | if the founder wants to receive money in cash, you can withdraw funds from the organization’s account, deposit them in the cash register and then issue them to the lender |

| Product | in order not to withdraw cash from your accounts, you can sell the goods to the creditor at the market price, thereby offsetting counterclaims |

| To a bank card | repayment of the loan to the founder is possible by transferring funds to his personal account from the organization’s current account |

| Deduction from salary | if the founder-borrower is on the staff of the organization, an additional agreement can be drawn up on the amount and frequency of deductions from wages or other material payments to the employee |

Comments on the document “Interest-free loan agreement from the founder of the company participant”

Reply 0

| 5 Elena Podgor | 07/17/2014 at 22:08:00 Thank you! Everything is clear and clear. It turns out that the lender and the borrower can coincide: for example, the lender is one of the co-founders, and he is also the borrower, but as a director of an LLC? |

Reply 0

| 5 Rufina | 07/29/2014 at 22:11:59 Thank you |

Reply 0

| Olga | 10/03/2014 at 14:09:49 Wonderful site, easy to use!!! |

Reply 0

| 5 Julia | 12/15/2014 at 12:38:34 Convenient service, I quickly found the required document, in which everything is written in essence and there is no confusion. Thank you. |

Reply 0

| 5 Natalia | 02/25/2015 at 15:09:24 What is a method of securing an obligation? |

Personal message | Reply 0

| Chechetkina Ksenia Vladimirovna Status: Lawyer rating 12185 | 02/26/2015 at 20:52:30 reply to Natalya Good evening, Natalya. The method of securing obligations is what ensures the fulfillment of the obligation (how the lender can return his money if the borrower does not return it). For example, it could be a pledge, a stand, etc. Art. 329 of the Civil Code of the Russian Federation. Article 329. Methods of ensuring the fulfillment of obligations 1. Fulfillment of obligations may be ensured by a penalty, a pledge, retention of the debtor’s property, a surety, a bank guarantee, a deposit and other methods provided for by law or contract. 2. The invalidity of an agreement to ensure the fulfillment of an obligation does not entail the invalidity of this obligation (the main obligation). 3. The invalidity of the main obligation entails the invalidity of the obligation securing it, unless otherwise established by law.

|

Reply 0

| [email protected] | 07/28/2015 at 13:40:17 Thank you very much! helped a lot. |

Reply 0

| Olga | 09/04/2015 at 09:19:39 The contract is clear, everything is clearly spelled out and there is nothing superfluous. Thank you! |

Reply 0

| 5 Irina | 10/05/2015 at 11:54:54 The contract example is useful for work, thank you. |

Reply 0

| Natasha | 10/14/2015 at 15:40:12 Thank you. very affordable. |

Reply 0

| nata | 11/10/2015 at 14:09:28 It’s kind of short - it should be made more colorful - in our country they love it - by the time you start reading, by the end you’ll forget what was discussed in the contract. |

Reply 0

| Olga | 11/19/2015 at 15:11:24 Thank you. I found what I was looking for on your site. |

Reply 0

| Zhanette | 12/10/2015 at 09:24:55 Thank you very much, everything is simple and clear. |

Reply 0

| Valentine | 02/04/2016 at 11:43:21 Thank you. Very accurate and good document. |

Reply 0

| Victoria | 09/15/2016 at 12:04:29 Good afternoon, tell me, is it possible to extend such an agreement with an additional agreement? |

Reply 0

| 5 Inna | 04/03/2017 at 12:52:46 Thank you. The agreement is quite clearly stated. |

Personal message | Reply 0

| 5 Natalia Status: Client | 06/09/2018 at 17:03:59 Thank you very much. The agreement is laconic, clearly formulated, without frills or “fluff”. |

Reply 0

| 5 Svetlana | 07/03/2018 at 19:37:07 Thank you. Exactly what is needed. |

Reply 0

| Tatiana | 12/01/2020 at 09:57:03 Nice site. Helpful information. |

Founder and founder-director of an LLC as a lender: is there a difference?

The decision on the need for additional investments in the organization in the form of a loan is made at a meeting of the founders of the LLC.

The loan agreement between the founder and the LLC, a sample of which is given in this article, is drawn up in a standard way: one party to the transaction is the founder (he can be an individual or legal entity), and the other is the organization. The details are indicated appropriately.

Is it possible for a loan to be provided by the founder, who is the director of the LLC?

In 2004, the court considered the dispute, which was resolved based on the content of paragraph 2 of Art. 182 of the Civil Code of the Russian Federation: “A representative cannot make transactions on behalf of the represented person in relation to himself personally. He also cannot make transactions in relation to another person, whose representative he is at the same time” (Resolution of the FAS ZSO dated January 15, 2004 No. F04/191-2632/A27-2003). The lender, the director of the LLC, was unable to return his money.

In 2006, the Presidium of the Supreme Arbitration Court of the Russian Federation, in its resolution dated April 11, 2006 No. 10327/05 in case No. A13-13712/04-22, explained that, according to Art. 53 of the Civil Code of the Russian Federation, an organization establishes, changes or terminates its rights and obligations through its bodies acting in accordance with the constituent documents.

All actions of bodies are considered actions of a legal entity.

Thus, the actions of the director of the organization as an executive body are considered the actions of the organization, and not its representative. Clause 2 art. 182 of the Civil Code of the Russian Federation does not apply in such disputes.

In such cases, the founder acts as a lender as an individual, and as a borrower on behalf of the organization.

Found documents on the topic “interest-free loan agreement from the founder sample”

- Interest-free loan agreement from the founder of a company participant Money loan agreement → Interest-free loan agreement from the founder of a company participant

-free loan agreement from a founder /member of the company (place of conclusion of the agreement ) ... - Agreement interest-free loan from founder company member (2)

Money loan agreement → Interest-free loan agreement from the founder of the company participant (2)-free loan agreement from the founder /member of the company (place of conclusion of the agreement ) ...

- Sample. Agreement loan (interest-free) with payment of the amount loan in parts

Money loan agreement → Sample. Loan agreement (interest-free) with payment of the loan amount in installmentsloan agreement ( interest-free ) "" 20 citizen, hereinafter referred to as (last name, first name, patronymic) " lender ",...

- Sample. Agreement loan (interest-free)

Money loan agreement → Sample. Loan agreement (interest-free)loan agreement ( interest-free ) "" 20, hereinafter referred to as (name of organization) " lender ", represented by, ...

- Sample. Agreement interest-free loan between a shareholder of a closed joint stock company and the company

Money loan agreement → Sample. Interest-free loan agreement between a shareholder of a closed joint-stock company and the company...and the board of directors (name of company) minutes no. dated "" 20, Chairman of the Board of Directors \\ loan agreement no. ( interest-free ) "" 20 closed joint-stock company, called (name of the company) in ...

- Agreement loan (interest-free)

Money loan agreement → Loan agreement (interest-free)loan agreement ( interest-free ) (date of conclusion of the agreement ), called ...

- Sample. Agreement interest-free loan between an employee of a closed joint stock company and the company

Money loan agreement → Sample. Interest-free loan agreement between an employee of a closed joint-stock company and the company...and the board of directors (name of company) minutes no. dated "" 20, Chairman of the Board of Directors \\ loan agreement no. ( interest-free ) "" 20 closed joint-stock company, called (name of the company) in ...

- Sample. Agreement interest-free loansecured by a guarantee between the shareholder of a closed joint stock company and the company

Money loan agreement → Sample. Agreement on an interest-free loan secured by a guarantee between a shareholder of a closed joint-stock company and the company...and the board of directors (name of company) minutes no. dated "" 20, Chairman of the Board of Directors \\ loan agreement no. ( interest-free ) "" 20 closed joint-stock company called (name of the company) in yes ...

- Agreement loan (interest-free) with an employee

Debt, loan agreement → Loan agreement (interest-free) with an employeeagreement No. of a loan ( interest-free ) with an employee of the city, hereinafter referred to as the “ lender ”, in ...

- Sample. Agreement interest-free loan between a shareholder of a closed joint-stock company and a company with collateral (property pledge)

Money loan agreement → Sample. Interest-free loan agreement between a shareholder of a closed joint-stock company and a company with collateral (property pledge)...and the board of directors (name of company) minutes no. dated "" 20, Chairman of the Board of Directors \\ loan agreement no. ( interest-free ) "" 20 closed joint-stock company, called (name of the company) in ...

- Sample. Agreement interest-free loan between an employee of a closed joint stock company and a company with collateral (property pledge)

Money loan agreement → Sample. Interest-free loan agreement between an employee of a closed joint-stock company and a company with collateral (property pledge)...and the board of directors (name of company) minutes no. dated "" 20, Chairman of the Board of Directors \\ loan agreement no. ( interest-free ) "" 20 closed joint-stock company called (name of the company) in yes ...

- Sample. Agreement pledge of an apartment owned by the pledgors to ensure the return of the amount loan By agreement loan

Pledge and pledge agreement → Sample. Pledge agreement for an apartment owned by the mortgagors to ensure repayment of the loan amount under the loan agreementcontract no. pledge of property (apartment) "" 20 closed joint-stock company, (name of company) named after...

- Sample. Agreement pledge of an apartment owned by the borrower to ensure repayment of the amount loan By agreement loan with collateral

Pledge and pledge agreement → Sample. An agreement to pledge an apartment owned by the borrower to ensure repayment of the loan amount under a secured loan agreementcontract no. pledge of property (apartment) "" 20 closed joint-stock company, (name of company) named after...

- Agreement loan (interest on the amount loan paid simultaneously with the principal amount loan upon expiration of the period for which the loan is provided)

Money loan agreement → Loan agreement (interest on the loan amount is paid simultaneously with the principal amount of the loan upon expiration of the period for which the loan is provided)loan agreement (date of conclusion of the agreement ), hereinafter referred to as...

- Sample. Agreement between founder and the newspaper editors

Founding agreements, charters → Sample. Agreement between the founder and the editorial board of the newspaperapproved by decree of the government of the Russian Federation of February 28, 1994 no. 157 agreement the government of the Russian Federation (hereinafter referred to as the founder ) represented by the Minister of the Russian Federation - head of the a...

Debt forgiveness by the founder under a loan agreement

The company is not always able to return what was received to the participant, and the accounts payable would like to be reduced. In this case, you can consider several options:

- transfer of debt obligation to authorized capital;

- transfer of debt into a contribution to the company’s property;

- debt forgiveness as free financial assistance.

The first option is troublesome because you will need to register changes to the charter. The second is simpler and cheaper: when making such a deposit in money from 01/01/2019, the transaction is not subject to income tax (clause 11.1, clause 1, article 251 of the Tax Code of the Russian Federation). The third is financially unprofitable, since the entire amount of the debt obligation will be subject to income tax, unless the founder owns more than 50% of the authorized capital.

To indicate which method is chosen, the parties need to formalize a debt forgiveness agreement. Or the lender may send a notice to the company specifying how the debt will be repaid.

Related documents

- Interest-free loan agreement from the founder of the company (2)

- Loan agreement (interest-free)

- Loan agreement (loan repayment is carried out in installments)

- Loan agreement (interest on the loan amount is paid simultaneously with the principal amount of the loan upon expiration of the period for which the loan is provided)

- Targeted loan agreement

- An agreement to borrow money with payment of interest.

- Loan agreement between individuals

- Money loan agreement

- Additional agreement on extending the term of a loan agreement concluded to pay for repairs and restoration of a car owned by the borrower

- Loan agreement

- Loan agreement (option 2)

- Sample. Interest-free loan agreement between a shareholder of a closed joint-stock company and the company

- Sample. Interest-free loan agreement between a shareholder of a closed joint-stock company and a company with collateral (property pledge)

- Sample. Interest-free loan agreement between an employee of a closed joint-stock company and the company

- Sample. Interest-free loan agreement between an employee of a closed joint-stock company and a company with collateral (property pledge)

- Sample. Agreement on an interest-free loan secured by a guarantee between a shareholder of a closed joint-stock company and the company

- Sample. Loan agreement (interest-free)

- Sample. Loan agreement (interest-free) with payment of the loan amount in installments

- Sample. Loan agreement with collateral

- Sample. A loan agreement concluded to pay for the repair and restoration of a car owned by the borrower

- Sample. Regulations on the conditions and procedure for providing loans to employees and shareholders of a closed joint stock company

- Sample. The borrower's receipt of the amount of money under the loan agreement

- Sample. Receipt from the lender for receipt of the entire amount of money under the loan agreement

- Sample. Receipt from the lender for receiving part of the amount of money under the loan agreement

- Sample. A fixed-term obligation of an individual borrower under a loan agreement concluded between an employee (shareholder) of a closed joint-stock company and the company

- Sample. Agreement on borrowing money with a penalty

- Sample. Agreement on the termination of an obligation by agreement of the parties to replace one obligation with another, as well as its fulfillment

Accounting for an interest-free loan in foreign currency

If the Russian participant provides assistance in foreign currency, it will be necessary to use PBU 15/2008 and PBU 3/2006 in accounting, which require the conversion of currency into rubles at the Central Bank exchange rate on the dates of capitalization, repayment and reporting dates.

Consider an interest-free foreign currency loan from the founder; the wiring will be as follows:

- Dt 51 Kt 66 - the amount of debt converted into rubles at the Central Bank exchange rate on the date of receipt of money;

- Dt 91.2 Kt 66 - negative exchange rate difference;

- or Dt 66 Kt 91.1 - positive exchange rate difference calculated on the last day of each month until the obligation is repaid;

- Dt 66 Kt 68 - personal income tax is charged if the exchange rate difference was positive and the participant is an individual;

- Dt 66 Kt 51 - the amounts taken were returned excluding personal income tax;

- Dt 68 Kt 51 - Personal income tax is transferred to the budget.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Interest-free loan agreement from the founder of the company” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

Important points

An interest-free loan is a successful replacement for bank loans. If an organization urgently needs working capital to purchase raw materials, equipment, purchase fuel or other needs, the founder has the opportunity to sponsor his business brainchild interest-free. In this case, no legislative or tax violations will arise.

The same scheme works in reverse. If the founder has an urgent need for funds, he does not have to go to the bank for a loan, but it is also impossible to simply withdraw funds from the proceeds from the company’s cash desk. Therefore, concluding and signing an interest-free loan agreement is an excellent solution to the problem.

Each loan agreement is an individual project, in which the parties to the transaction prescribe mutually beneficial conditions.

The important features of such a document are:

| Preparation in writing | despite the fact that the founder and the LLC are interdependent persons, no oral agreements are officially legitimized, therefore drawing up an agreement is a legally and financially justifiable necessity |

| Mandatory indication of interest-free loan | in the absence of such information, the agreement is legally regarded as a loan with interest for the use of borrowed funds and at the end of its validity period you will be billed based on the current refinancing rate |

| Currency selection | It is best to make a transaction in Russian rubles, this will protect both parties from tax risks arising in the event of a “jump” in prices and changes in exchange rates (the tax inspector can interpret the difference as non-operating income, which is taxed) |

| The agreement comes into force only from the moment of transfer of funds | or other material assets into the hands of the borrower - it is necessary to accurately indicate the date on which the subject of the transaction will be transferred |

Legal field

If the organization and the founder decide to draw up and conclude an interest-free loan agreement, then they must first of all be guided by the information contained in the following legislative acts:

| Civil Code of the Russian Federation | This set of laws defines not only the basic concept of a loan, but also helps answer the following questions:

|

| Tax Code of the Russian Federation | If the contract is drawn up correctly in accordance with tax legislation, neither party to the transaction will be required to pay taxes |

It is better to entrust the drafting of an interest-free loan agreement between the founder and the LLC to an experienced lawyer, who is probably on the staff of the organization.

Is a transaction possible without paperwork?

An interest-free loan agreement must be drawn up in writing, as a separate document, preferably on the letterhead of the organization participating in the transaction.

If the participants in an interest-free loan do not want to draw up an agreement and prefer to be limited to an oral agreement and a document about the issuance or receipt of money (receipt, cash receipt, etc.), then such a transaction is not considered legal.

In case of negative developments (delays in payments, refusal to fulfill financial obligations, etc.), the injured party will not have the opportunity to prove its case through legal proceedings.

In the event of a dispute between the founder and the organization due to the latter’s refusal to repay the borrowed funds, a bilaterally signed interest-free loan agreement will serve as evidence of the fact that the money was lent.

Drawing up an agreement is a guarantee of the legal flow of the transaction process and the absence of any consequences (tax, legal, etc.).

Video: the founder issued a loan to his company

Results

A loan without interest can be taken by an LLC from its owner and vice versa. In the second case, the borrower, since the loan agreement between the founder and the organization is interest-free, must pay personal income tax at a rate of 35% on material benefits.

Find out more about the procedure for taxing material benefits in the material “How are material benefits taxed with personal income tax (rate)?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

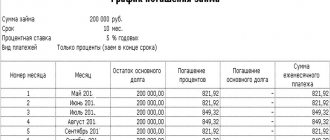

How is debt repayment done?

As already mentioned, the borrower must pay the lender the entire amount of the debt within 30 calendar days after receiving the request for payment.

If a loan is issued with interest, then most often the borrower pays the lender only interest until he receives a demand for repayment.

However, the parties may agree to return the entire amount plus interest within 30 calendar days after receipt of the request.

The contract must have a liability clause - that is, penalties for late loan payments. Most often, this is the share of the CRF refinancing rate for each day of delay.

Standard penalties are 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of the principal amount.

However, the parties can agree differently. For example, about a specific amount for each full or partial month of delay. The law does not prohibit such a decision.

As a rule, a permanent contract is also interest-free, so the borrower returns the entire amount immediately after receiving the request, especially if the relationship between the parties to the contract is friendly.

However, the tax authorities do not recommend that legal entities and individual entrepreneurs enter into interest-free loan agreements. The fact is that officials may see this as concealment of tax income.

To avoid conflict situations, it is better to indicate in the contract the minimum interest rate on the loan.

Tax authorities also do not welcome the conclusion of an open-ended agreement between those economic entities that maintain accounting and tax records - that is, between legal entities and individual entrepreneurs.

The fact is that the loan amount will “hang” in the accounts receivable of the lender, and in the accounts payable of the borrower. Consequently, these figures will be reflected in the annual balance sheet. Tax authorities are very wary if some indicators in the balance sheet do not change for a long time.

The law does not prohibit repaying a permanent loan at any time when the borrower has the required amount. After the loan is repaid, the agreement loses its legal force.

However, the borrower also needs to insure himself - take a receipt from the lender and pay him the full amount of the debt with interest (if provided for in the agreement). The receipt must indicate the amount that the borrower will repay and the date of its repayment.