Payment order

The form of the payment order was approved by the Central Bank of the Russian Federation by issuing Regulations dated June 19, 2012 N 383-P. This form is used everywhere in Russia. Regardless of the recipient of the funds or their payer, the same document form is used. The only difference is the need to fill out additional sections of the form.

When issuing a payment order for an individual, you must consider the following:

- The citizen's last name, first name and patronymic should be indicated in the nominative case. This requirement is set out in clause 1 of Appendix No. 1 to the Regulations dated 06/19/2012 N 383-P;

- It is necessary to reflect information that allows you to identify the recipient of the transfers.

According to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n, if a citizen makes a payment to the budget, then the identifier of information about the individual in the payment order is reflected in column 108 of the form.

In this case, a detailed list of information that allows you to identify a citizen in a payment order is given in Letter of the Ministry of Finance of the Russian Federation dated April 14, 2016 N 02-08-12/21481. According to the position of the Ministry of Finance of the Russian Federation, the person filling out the order for the transfer of money has the right to indicate any of the named documents.

How many copies should there be?

For one financial transaction, 4 copies of the payment order are made. The first copy is kept in a banking institution, and on its basis money is debited from accounts.

The second and third copies are intended for the recipient and his bank. That is, one copy remains in the recipient’s bank, on its basis the money is credited to the current account. And the second is attached to the bank statement, which is transferred to the recipient.

The last copy, with the bank’s mark of completion, is returned to the paying institution. That is, the payment is attached to the bank statement as confirmation of the execution of the PP.

Please note that the number of copies may be different, depending on the circumstances and conditions of sending the wire transfer.

Payment to an individual

When creating a payment invoice for a citizen, the question may arise as to what to indicate in the purpose of payment to an individual.

According to the general rule developed by the Central Bank of the Russian Federation in Regulations dated June 19, 2012 N 383-P, section 24 of the payment order indicates the following information:

- purpose of payment;

- paid goods or services;

- details of agreements, contracts, and other similar documents;

- other information, including regarding VAT.

It is important to note that the rule-making acts of the Russian Federation do not contain any exceptions to the general rule in the case of generating a payment document for an individual. Therefore, section 24 of the payment slip should be drawn up in accordance with the instructions of the Bank of Russia.

If a payment order is issued to an individual’s card, then the purpose of the transfer can additionally include the following information:

- about enrollment on a plastic card;

- Owner's full name.

However, this recommendation is not mandatory.

It is important to remember that if a private person pays money to the budget system of the Russian Federation, he must fill out additional sections in the payment order, for example, field 101 about the status of the payer - an individual.

The Ministry of Finance of the Russian Federation, by its Order No. 107n dated November 12, 2013, approved a list of code designations for the status of payers in the budget system.

For an individual, it is acceptable to indicate one of the following statuses:

- code “13” is reflected if the citizen is a taxpayer and at the same time a bank client;

- the number “16” takes into account entities participating in foreign economic activity;

- an individual making payments to the budget is reflected using the code “24”;

- the status of a citizen carrying out customs transfers is defined as “18”.

Compliance with the above requirements will allow you to issue a payment order to an individual without errors, a sample of which is available for download via the link.

payment order to an individual

ik-spektr.ru

For this reason, a provision was created with the rules for the application of transactions, contained in paragraph 2 of Article No. 420 of the Civil Code of the Russian Federation.

Contract and obligations are two distinct concepts that overlap relatively. An agreement is the fact of the emergence of rights and obligations, recorded from the legal side. An obligation is a civil legal relationship that arises on the basis of a legal contract and other types of transactions (unilateral, unlawful, and so on).

A contract is an important part of society, since with its help relations between participants are regulated on the basis of civil legal relations. But the main area of application is property relations. But nothing prohibits regulating non-property relations using an agreement.

An agreement is a legal act, but it differs from other legal facts.

In this case, in order to protect its interests, the customer organization, before transferring the contractor’s remuneration to a third party, should receive either the corresponding condition of the civil law contract itself, or an additional agreement to it, or an application requesting payment to be made to a third party’s card.

And also when transferring remuneration under the GPA to the account of a third party, it is better to indicate the statement of the contractor in the payment order.

Gorbunova T.E. LLC "IK U-Soft" Regional center of the ConsultantPlus Network

We pay under a contract on a card, what is the purpose of payment?

Reflection of settlements under civil contracts with individuals. The question relates to postings under a contract. We make all calculations in the payroll program. Calculation of amounts for wages:.

VIDEO ON THE TOPIC: Unregistered workers.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website.

GPC agreement with the employee

Since the relationship between the customer (employer) and the contractor (individual) in this case is regulated only by the civil law contract itself, it must contain comprehensive information about what work should be performed, in what volume, within what time frame, what payment for it will be paid to the performer.

A civil contract is an agreement concluded with an employee in cases where it is necessary to perform a certain amount of work or provide a service. Often a GPC agreement is concluded for the performance of seasonal work or other limited scope of services or work.

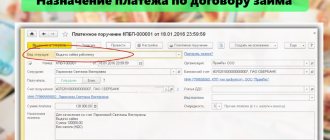

We pay under a contract on a card, what is the purpose of payment in the payment order?

Such information may include:

- Accountable funds.

- Name and payment of work, service, product.

- Date and number of the agreement, contract, agreement, etc.

- More information about value added tax.

- Renting real estate, transport, etc.

VAT is always written in the purpose of payment. In any payment orders and under any tax regime. With VAT Without VAT If the amount of VAT is allocated in the payment amount, for example, Payment in the amount of 10,000.00 rubles, including VAT 1,800.00 rubles.

Sample payment order for personal income tax under a GPC agreement

Contents Quite often you hear indignation from individual entrepreneurs when you tell them that an individual entrepreneur is a tax agent in relation to his employees. In response you receive an angry exclamation: “I’m not an agent!”

These two numbers in the “1019" and indicate that the originator of the payment document is a tax agent.

Work (services) under the GPD, as a rule, are paid only after their completion (execution) and delivery to the customer (signing of the act).

Before drawing up a civil contract, you need to find out whether the contractor is registered as an individual entrepreneur.

However, often the inspection authorities try to find clues in the content of the contract that would allow it to be reclassified as a labor agreement and, accordingly, additional taxes to be charged to the budget.

This article explains how to correctly draw up a civil contract to avoid such troubles, as well as how to correctly conduct accounting and taxation of such payments.

Contract agreement with an individual with staged payment from customer materials sample

The costs of the examination are borne by the Contractor, except in cases where the examination establishes the absence of violations by the Contractor of this agreement or a causal connection between the Contractor’s actions and the detected deficiencies. In these cases, the costs of the examination are borne by the Party that requested the appointment of the examination, and if it is appointed by agreement between the Parties, by both Parties equally.

The Customer pays the Contractor a penalty in the amount of 0.1% for each day of delay of the amount of unpaid work. 7. Force majeure. 7.1. The parties are released from liability for partial or complete failure to fulfill obligations under this agreement if this failure was a consequence of circumstances caused by force majeure that arose after the conclusion of the agreement as a result of extraordinary events that the relevant party to the agreement could neither foresee nor prevent by reasonable measures. 8. Special conditions. 8.1. This agreement has been drawn up in two copies having equal legal force, one of which is kept by the Contractor and the other by the Customer. 8.2. A civil law contract is also called a GPC (civil law) agreement. The differences between GPC and an employment contract are described in detail in the article “Requalification of an employment contract.” In the event that the work is performed by the Contractor with deviations from this contract that worsen the result of the work, or with other shortcomings that make it unsuitable for normal use, the Customer has the right, at his choice, to demand from the Contractor:

How to pay under a GPC agreement payment purpose

Here you can download a completed sample payment order for the transfer of payment under a work contract or an empty form of a payment order for the transfer of payment under a work contract.

Otherwise, you will either have to clarify the payment or re-transmit the tax amount to the budget (,).

Who pays personal income tax KBC Ordinary individual (not individual entrepreneur) 182 1 01 02030 01 1000 110 Individual entrepreneur (when paying personal income tax for himself) 182 1 0100 110 Tax agent 182 1 0100 110 Sample payment order for personal income tax in 2019.

can be found in . When transferring penalties in the 14th category, “1” changes to “2”, in the 15th - “0” to “1”.

Sample payment order for personal income tax under a GPC agreement

Quite often you hear indignation from individual entrepreneurs when you tell them that an individual entrepreneur is a tax agent in relation to his employees. In response you receive an angry exclamation: “I’m not an agent!”

These two numbers in the “1019" and indicate that the originator of the payment document is a tax agent.

Download forms on the topic: about the investment tax credit for local taxes about the investment tax credit for income tax about the temporary suspension of payment of the amount of debt on federal taxes and fees about the provision of an investment tax credit Statement of error in the payment order the wrong BCC is indicated. Sign up and keep reading!

Sign up and continue reading. Registration will only take one and a half minutes. I have a password.

Please check your email Enter. Enter login. Login or. Your personal selection. Articles on the topic in the electronic journal.

Stay up to date! There is too much accounting news and too little time to search for it. I give my consent to the processing of my personal data. Themes menu.

The tax agent must calculate personal income tax on the date of actual receipt of income by an individual (clause 3 of Article 226 of the Tax Code of the Russian Federation). The date of actual receipt of income under the GPA is the day of payment of income (transfer to a bank account or withdrawal from the cash register) (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). This date is reflected in line 100 “Date of actual receipt of income” of form 6-NDFL.

6-NDFL: civil contract

Having completed the work, the contractor is obliged to hand over the result to the customer, and the customer is obliged to accept it. The delivery and acceptance of the work result is documented in a delivery and acceptance certificate, which must be signed by the contractor and the customer (or their authorized representatives). Based on this act, the customer makes settlements with the contractor.

But if you put “TP9quot;, this payment will also go through, don’t worry.

Download in or

Whether the request contains a UIN code or not, it depends on what we write in the “229quot; payment order. If the tax office has not indicated anything, set the zero “09quot;. To fill out the remaining details, you can take the information from the table below.

Download in or

Sample payment of fines upon request with UIN

Download in or

Work agreement

For construction contracts, cost is not a mandatory condition. Instead of putting down numbers, you can indicate how the remuneration is set: usually it is labor costs plus payment for the work. The price may not be indicated: in this case, the calculation takes place at similar prices for similar work.

A work contract implies a specific subject - the result for which the contract was concluded. The achieved result must be material, separable from both sides. In addition, it must be possible to guarantee the quality of the result; it must depend on objective factors.

Sample payment order for payment of personal income tax fine for individual entrepreneurs

We provide examples of filling out only for the case when the fine is paid upon request.

However, in this situation, there are two options for processing a payment order.

Fine upon request from the tax office

The examples differ only in the content of the “229quot; props.

If the tax agent does not fulfill his mandatory conditions for paying the tax to the state treasury, he will be held responsible for this.

If the tax is levied on a legal entity or entrepreneur, then the payer is not a tax agent.

That is, the tax is paid by the contractor himself based on the taxation system used.

If an entrepreneur uses a standard taxation system, then personal income tax is paid by him independently, as specified in Article No. 227 of the Tax Code of the Russian Federation.

Attention: In this case, a certificate of completion of work or another document confirming the completion of work is required only for two types of contracts: a work contract (clause 1 of Article 702 of the Civil Code of the Russian Federation) and an agreement on the provision of paid services (Article 783 of the Civil Code of the Russian Federation).

If in most cases this amount must be confirmed using documents, then there are rules that set a limit to the accrued amount of remuneration when creating:

- photographs, audio and video works, architecture - 25%

- industrial designs, inventions - 30% of revenue for the first 2 years

- developments in the field of science and literature—20%

- music, graphics for design and decoration, sculptures - 40%

The amount of tax paid is determined as follows:

- 13% for residents of Russia (Article No. 221 of the Tax Code of the Russian Federation)

- 30% for non-residents of Russia (Article No. 230 of the Tax Code of the Russian Federation)

Registration under a GPC agreement is a procedure that is the process of concluding a document between the employer-customer and the performing employee, signing it during hiring for any (mostly short-term) work.

Find And even better - find out the relevant data at the stage of concluding an agreement and issuing a card at a bank branch.

Contract agreement with an individual with staged payment from customer materials sample

No further actions are required to initiate the contract.

- Mutual responsibility. Both parties are legally equal. The basis of contracts of this type is initial mutual trust and good conscience.

- Remuneration. Both parties, having fulfilled the agreement, receive a certain profit.

- Divisibility of an object. If the result obtained can be divided into several equal independent parts, the subject of the contract is considered divisible.

Manual for concluding a work contract The form of a work contract is not fixed by law, but civil practice has developed the most universal type of contracts of this type. The most important thing is to reach an agreement on all points, especially the essential ones: it is then that the contract will be considered concluded (clause 1 of Article 432 of the Civil Code of the Russian Federation). The first thing that needs to be done when concluding a contract is to carefully study the content, correctly formulating the main provisions. We will go through all the stages of drawing up such an agreement.

We recommend reading: Until what age do they pay a survivor’s pension to their wife?

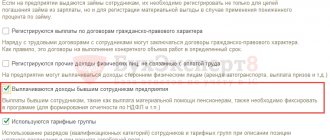

GPC agreement: taxes and contributions in 2021

But there are specifics regarding social contributions and contributions for injuries. Let's look at each aspect in detail.

As in the case of payment of wages, regarding the GPA, see the list of insured persons in special regulations. This is Federal Law No. 167-FZ dated December 15, 2001

“On compulsory pension insurance in the Russian Federation”

. And Federal Law of November 29, 2010 No. 326-FZ

“On compulsory health insurance in the Russian Federation”

In particular, contributions to pensions and compulsory health insurance are accrued if the contractor (performer):

- citizen of the Russian Federation;

- a foreigner temporarily or permanently residing in the Russian Federation.

Insurance premiums for pension and health insurance under GPC contracts in 2021 are calculated at the usual rates that the company applies to payments to its full-time employees.

As a general rule, 22% of remuneration goes to pension accruals, 5.1% to medical accruals.

At the same time, the 22% tariff in 2021 is applied for payments not exceeding (for each physicist on an accrual basis from the beginning of the year) RUB 1,021,000.

Further, a reduced rate of 10% is used. But medical contributions at a rate of 5.1% must be charged on the entire amount of remuneration, regardless of the total level of income.

That is, no bar or limit value has been established for calculating medical contributions. And, let us remind you that accrued amounts from 2020 are transferred not to the funds - the Pension Fund and the Federal Compulsory Medical Insurance Fund, but to the Federal Tax Service.

For 2021, this procedure remains in full force. If an individual has entered into a GPC agreement with you in 2021 as a businessman, then there is no need to accrue contributions.

The merchant pays his own fees according to the established procedure. You are relieved of such responsibility. This is the main exception that every accountant should be aware of.

Insurance premiums in case of temporary disability and in connection with maternity, paid from 2021 also not to the fund, but to the Federal Tax Service, do not arise under the GPA. This is the most distinctive feature of such agreements from employment contracts. And as a result, contractors cannot take paid sick leave, as well as maternity and children’s leave.

Thus, all things being equal, it is more profitable for a citizen to work under an employment contract than under the GPA. But employers save money. In particular, on the transfer of 2.9% of the amounts paid to the contractor (up to the maximum base in 2021 of 815,000 rubles). Therefore, if civil legal relations are fictitious, they carry risk.

Controllers pay close attention to the execution of agreements.

The goal of the inspectors is to identify and eliminate cases where labor relations are hidden under the guise of civil regulations.

As a punishment - a fine under the Tax Code of the Russian Federation - 20% of the amount of “hidden” contributions (Article (Clause 4, Article 5.27 of the Code of Administrative Offenses of the Russian Federation). To avoid claims and unnecessary questions from auditors, remember:

GPH agreement with prescription of payment of insurance premiums sample

But at the same time, the insurance period is taken into account, and work under GPC contracts gives the right to apply for a labor pension. The customer transfers contributions to the Pension Fund, as under an employment contract. Relations between the parties are regulated by the Civil Code.

Federal Law. Legislative acts on the topic It is recommended to study the following laws: Law Title of paragraph 1 of Art. 7 of the Federal Law of July 24, 2021 No. 212-FZ On the recognition of remuneration under a civil law agreement as an object for taxation of insurance premiums, paragraphs. 2 p. 3 art. 9 of Federal Law No. 212-FZ of July 24, 2021, stating that contributions to the Social Insurance Fund for civil partnership agreements are not accrued, para. 4 paragraphs 1 art. 5, paragraph 1, art. 20.1 of Federal Law No. 125-FZ dated July 24, 2021 Contributions for injuries are accrued to the GPC agreement only in cases where this is provided for by the terms of the agreement, Art. 702 of the Civil Code of the Russian Federation On the subject of the GPC agreement, Art. 426 of the Tax Code of the Russian Federation Amounts of insurance premiums Typical errors in calculations Error No. 1. The GPC agreement was concluded with an individual entrepreneur. The employer paid insurance premiums.

Reflection of income under GPC agreements in 2 personal income taxes

Certificate 2 of personal income tax reflects income and taxes paid on it. It is prepared by the tax agent for each person separately and is the main document confirming his earnings. Since a certificate is necessary when applying for a loan and receiving other services, employees often apply for it to the accounting department at their place of work. However, not all employees are registered under an employment contract; some are entered into a civil contract.

Can such persons obtain a personal income tax certificate 2 and are there any features in its execution? An organization or individual entrepreneur is recognized as a tax agent for the payment of remuneration to the following categories of citizens:

- To your employees, as well as to your former employees;

- employees according to the GPA;

- other individuals (for example, payment of rent).

The organization does not pay insurance premiums to the Social Insurance Fund for employees with whom it has a GPC agreement.

Purpose of payment in a payment order for contributions to funds under a civil law agreement

Accrue accident insurance premiums for payments under civil contracts only if such an obligation of the organization is directly provided for in the contract (paragraph 4, paragraph 1, article 5, paragraph 1, article 20.1 of the Law of July 24, 2021 No. 125 -FZ).

Insurance premiums from remuneration under civil contracts are calculated in the same way as from payments under employment contracts

. The only exception: for remuneration under civil contracts there is no need to accrue contributions to the Federal Social Insurance Fund of Russia for compulsory social insurance in case of temporary disability and in connection with maternity (Clause 2, Part 3, Article 9 of the Law of July 24, 2021 No. 212- Federal Law).