Cost calculation in 1C: Trade Management 11, 1C: Integrated Automation 2 and 1C: ERP 2

11/07/2016 Andrey Shurygin

One of the main reports for a manager is the gross profit report, which allows you to assess the profitability of sales. In order to correctly display the necessary information, you need to correctly calculate the cost of goods sold.

In this article, using the example of the Trade Management 11.2 configuration, we will look at what basic capabilities 1C offers us for calculating the cost of an item. The same principles apply to configurations such as Integrated Automation 2 and ERP 2.

Methods for estimating the value of goods

First, we need to decide how we will calculate the cost of goods. The valuation method is specified in the organization's accounting policy. To get there, you need to go to the “Accounting Policy” tab in the organization’s card and click the button for selecting the current accounting policy:

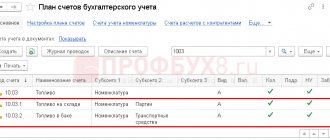

On the “Inventory” tab of the accounting policy that opens, the available methods for estimating the cost of goods will be located:

As you can see, 1C offers 3 methods for calculating costs: average, FIFO weighted and FIFO moving estimate. Let's briefly examine each of them.

Monthly average - determined by calculating the average cost of goods in stock, plus monthly receipts are taken into account.

For example, at the beginning of the month there were 10 items in the warehouse. at a price of 1000 rubles.

Then, within a month, 5 more units were purchased. for 600 rub. and 5 pcs. for 700 rub.

Thus, the average cost of one piece will be: (1000+600+700)/(10+5+5) = 115 rubles. That is, the ratio of the total amount to the total quantity.

Within a month, 15 pieces were sold for 3,000 rubles.

The cost of goods sold will be 15*115=1725 rubles.

FIFO moving - the cost of each sold batch is taken, determined using the FIFO method (from the English FIFO - “First In First Out” - “First in, first out”, i.e. disposal occurs from the earliest received batch).

For example, at the beginning of the month there were 10 items in the warehouse. at a price of 1000 rubles.

Then, within a month, 5 more units were purchased. for 600 rub. and 5 pcs. for 700 rub.

During the month, 15 pieces were sold, using the FIFO method, first the goods will be written off from the first batch at 1000/10 = 100 rubles. per piece, then from the second batch for 600/5 = 120 rubles. As a result, we get the total cost of goods sold 1000 + 600 = 1600 rubles.

FIFO weighted - the average cost of lots sold, determined using the FIFO method, is taken and divided by the quantity of disposed goods.

For example, at the beginning of the month there were 10 items in the warehouse. at a price of 1000 rubles.

Then, within a month, 5 more units were purchased. for 600 rub. and 5 pcs. for 700 rub.

During the month, 15 units were sold, using the FIFO method, the cost price of all goods sold will be: 1000+600=1600 rubles, but the unit cost is calculated according to the average, based on the lots sold: 1600/15=106.67 rubles.

In most cases, unless there is some special need, it is better to choose the average estimation method, since it requires the least resources. FIFO moving provides the most “understandable” way of estimating costs, i.e. classic batch accounting. On the other hand, average FIFO averages the cost of one unit of goods, which may be required for, for example, evaluating the work of managers, so that the gross profit does not depend on the cost of the lot sold.

It should also be added that to use the FIFO moving valuation method, you need to enable the “Partition Accounting” functional option. The option is located in the Master Data and Administration -> Financial Result and Controlling -> Goods Accounting section.

Cost calculation

The cost price is calculated using the document “Cost Cost Calculation”. This document can be found in the section Financial results and controlling -> Regulatory documents. It is formed when performing month-end closing operations, and specifically when calculating cost. To force the creation of a document, in the same Financial Result and Controlling section, go to the month-end closing operations workplace and there, opposite the cost calculation, execute the “Calculate” command:

Let's open the cost calculation document:

We see that he has two options: actual and preliminary, and the preliminary is always calculated according to the average. The actual calculation option is intended for the final determination of cost using the method specified in the organization’s accounting policy. It is recommended to perform it at the end of the month.

The preliminary version is used for rapid assessment of gross profit; the cost calculation document is generated (updated) according to a schedule within a month. To enable the ability to use preliminary cost calculations, you need to check the appropriate option in the Master Data and Administration -> Financial Result and Controlling -> Goods Accounting section:

You will also need to set up a schedule that determines how often the preliminary cost is calculated.

Cost Analysis

The cost of goods may also include additional costs (or TZR - transportation and procurement costs).

Let's look at a simple example of reflecting fuel and equipment on costs. We will purchase 10 pieces of the “Product 1” nomenclature for 10,000 rubles and 5 pieces of “Product 2” for 2,500 rubles. In the receipt document, in the tabular section, you need to add an item with the “Service” type, for example, “Delivery”. In order for the delivery cost to be distributed among the cost of receipt of goods, you need to indicate the desired pre-created expense item in the “Write off as expenses” column, and indicate the current document in the “Cost Analytics” column.

Let's take a closer look at the expense item:

In the “Distribution option” field, you must indicate “At the cost of goods”; in the distribution rule, the distribution base is indicated, i.e. in proportion to which the share of expenses will be calculated. In this case, the option of distribution by quantity is selected. In the form of analytics, the receipt document is indicated, i.e. in the context of which object the additional distribution will occur. expenses.

To add. expenses have been allocated to cost, operations to close the month are required.

The cost of goods in the warehouse can be viewed using the “Cost of goods” report, which is located in the section Financial results and controlling -> Reports on financial results:

The report shows that delivery costs were distributed among the cost of goods indicated in the receipt. To view information about the share of additional expenses, you need to enable visibility for the corresponding column in the report settings.

Let's sell all purchased goods for 2000 rubles and 600 rubles per piece, respectively, and see the gross profit. For this purpose, use the corresponding report “Enterprise Gross Profit”, located in the Sales -> Sales Reports section:

It can be seen that, despite the sale at a price higher than the purchase cost, due to the additional expenses there is a negative profitability for the “Product 2” nomenclature. Therefore, it is important to monitor costs in order to also control pricing.

So, in this article we got acquainted with the main capabilities of calculating cost in 1C. We looked at various assessment methods. We also checked how additional payments are distributed. cost of production costs and what reports can be used to control them.

Tag cloud About the author - Andrey Shurygin

certified software engineer

>Solutions to tasks using the FIFO method

Solution from assino

The assino company, as one of the leaders in international business automation, has established practices in providing manufacturing and trading companies with functionality for maintaining warehouse records by batch according to the client’s needs.

“The main advantage of modern integrated ERP systems in the field of batch accounting is that they fully implement both operational accounting functionality in terms of production and tracking of goods and batches, as well as financial accounting, including accounting for the purposes of calculating costs and meeting legal requirements , such as labeling and accounting according to the customs declaration. For our part, we have extensive knowledge and practice on how to fully automate our customer’s business processes using standard functionality.”

Konstantin Semchinov,

director of the international project office assino.

Thus, during the project for the implementation of a unified business process automation system for the biotechnology company BIOCAD, specialists from Assino Group provided:

- correct maintenance of batch records for the purpose of traceability of each received batch of materials;

- helped company employees correctly use standard 1C functionality to generate and record a cargo customs declaration (CCD).

Thanks to the capabilities of the software solution “1C:ERP Enterprise Management 2”, the customer sees the cost structure of any manufactured medicinal product down to the series of batches of raw materials included in the product.

BIOCAD project

assino has a ready-made solution for your business.

Leave a request for an expert consultation!

Submit your application

What are cost calculation formulas?

Let's illustrate with an example what the problem is. Imagine that a company purchases 1,000 chocolate bars at CU 30. every. The accounting entry will be like this:

- Debit. Inventories: CU 30,000 (1,000*30).

- Credit. Accounts payable: CU 30,000

This company then sells 200 chocolates at CU40. each. Wiring:

- Debit. Accounts receivable: CU 8,000 (200*40).

- Credit. Revenue from the sale of goods: CU 8,000

In addition, the company must reflect in its accounting the fact that some of the bars have left the warehouse. Accounting entry:

- Debit. Cost of sales: CU 6,000 (200*30).

- Credit. Inventories: CU6,000

In this very basic example, the company knew exactly what amount should have been recognized in cost of sales because the acquisition cost (purchase price in this case) was CU30. for 1 chocolate bar.

But what happens when a company buys candy bars at different prices?

For example, imagine that a company bought 100 bars at CU31, 150 bars at CU32.50, 200 at CU29. etc.

What is the cost of sales in this case?

This depends on the 'cost formula' or inventory valuation method the company uses. So there may be more than one correct answer.

Impact of the choice of assessment method on reporting indicators

So, we can generally characterize the impact of the choice of inventory valuation methods on reporting indicators as follows:

- the method of calculating the cost of each unit of inventory makes it possible to identify the financial result from the sale of each unit of inventory and present their assessment in reporting in strict accordance with the purchase price of each specific element (unit) of the organization’s inventory;

- the average price method hides (shades out, blurs, veils) the impact of changes in purchase prices for inventories on their valuation indicators as an element of a balance sheet asset, period expenses and financial results (profit and loss);

- The FIFO method, in conditions of rising prices for the acquisition of inventories, forms the maximum estimate of inventories at the end of the period, the minimum estimate of expenses for the period and the maximum estimate of the financial result. In conditions of declining prices, FIFO, on the contrary, gives us a minimum estimate of inventories at the end of the period in the balance sheet, a maximum estimate of expenses for the period and a minimum value of the financial result;

- The LIFO method, in conditions of rising prices for purchased inventories, forms the minimum estimate of inventories in the balance sheet at the end of the period, the maximum amount of expenses for the period in the income statement and the minimum estimate of the financial result (profit or loss). In an environment of declining prices, LIFO gives us a maximum estimate of inventory on the balance sheet, a minimum estimate of period expenses, and a maximum estimate of financial result.

Setting up the parties

In the settings, the possibility of batch accounting is enabled through: Purchasing

–

Even more possibilities

–

Nomenclature batches

.

It is also necessary to enable the ability to use a batch for each individual item: Go to the item card using the link Batch

and check the

Use batches

Where to find Accounting Settings

Let's answer this classic question first. The settings are hidden in a separate interface to protect them from accidental intervention.

You need to go to the Account Manager interface. In this interface we find the menu Accounting setup - Accounting settings setup:

Interface Accounting manager - Setting up 1C accounting parameters

The settings window opens, where we will be primarily interested in pitfall No. 1:

What's new in the Treasury

In "1C: Trade Management 11.4.8" ( "1C:UT" ) the developers have developed the functionality for reconciliation of mutual settlements. The configuration supports the following features:

- expanded selections by reconciliation objects (type of settlements, contracts, partners and their fields);

- group creation of reconciliation reports broken down by partners, contracts, and types of settlements is available;

- you can generate reconciliation reports based on the organization’s data or the counterparty’s data;

- reconciliation of mutual settlements can be carried out in the context of loan and deposit agreements;

- implemented display of opening and closing balances, total turnover for the reconciled period;

- Printing a reconciliation report is allowed with an empty column according to the counterparty's data.

New reconciliation assistant

Analytical value of reserve valuation methods

What should we show in the financial statements when applying inventory valuation methods?

So, we have determined the nature of the influence of the choice of one or another method of inventory valuation on the content of financial statements. We now need to talk about how this impact relates to the overall objective of reporting - to present a true picture of a company's financial position that is as close to reality as possible. In this case, reality should be understood as the impact on the company’s state of affairs of changes in the acquisition prices of its inventories.

Let's see what this impact is. So, we have at least four elements (indicators) of financial statements, the assessment of which should reflect, among other things, changes in “incoming” inventory prices - these are:

1) the balance of inventories at the end of the period, reflected as part of current assets in the balance sheet,

2) expenses of the period in the income statement,

3) the financial result of the period in the income statement and, as a consequence,

4) the amount of retained earnings (uncovered loss) in the liabilities side of the balance sheet, if any.

Current assets are resources that should bring us income in the future, including those considered as security for the organization’s existing obligations.

First of all, if we talk about analytical ratios calculated on the balance sheet, the assessment of current assets determines the value of the total liquidity ratio (or total solvency), determined by the ratio of the values of current assets and short-term liabilities. The reality of the assessment of current assets in this case is ensured by its maximum compliance with the current price level. Hence, the most realistic assessment of current assets on the balance sheet should be as close as possible to the “last” purchase prices.

Profit is a measure of the growth of a company's capital, an increase in capital that is not associated with an increase in its liabilities. Demonstration in the reporting of the growth of a company’s capital indicates either the possibility of expanding the scope of its activities in comparison with the “starting point”, or the possibility of withdrawing from the organization’s circulation part of the funds “earned” by it without prejudice to its financial position, which it had at the beginning of the period, for which profit was calculated in accounting. A change in purchase prices for inventories means that in the next reporting period, subject to the continuation of the activities of our company, we will need funds to purchase these inventories in an amount close to the “last” prices for their purchase in the past period.

Consequently, the most realistic values of expenses and financial results will also be given to us by using in the calculations the “last” prices in the chronology of inventory purchases.

Now let's pay attention to what the use of each of the considered valuation methods allows us to show (here we will deliberately consider the LIFO method in connection with the possibility of its use in management accounting).

The method for calculating the cost of each unit of inventory, in our opinion, does not require special comments. In this case, we separately keep records of the acquisition and sale of each item of inventory, and receive the corresponding reporting data. Let's move on to the average price method.

Average price method

The use of the average price method actually allows us to smooth out the impact of changes in inventory purchase prices on reporting indicators. We calculate the average purchase price of inventory for the period (taking into account the estimate of the opening balance) to estimate the ending inventory as an asset on the balance sheet; costs of the period are assessed at average prices as the cost of inventories written off the balance sheet and reflected in the income statement; “average” results in profit accordingly.

Hence, by applying the average price method and thereby blurring the influence of their dynamics on reporting indicators, we actually demonstrate to users the absence of a significant influence of price dynamics on the financial position of the company. To what extent and in what cases is this fair? Obviously, we must show the absence of the influence of price changes in cases where there really is no such effect (significantly). In other words, the use of the average price method is suitable for situations where the accountant’s professional judgment allows him to assess the impact of changes in the purchase prices of current assets on reporting indicators as insignificant or insignificant.

For example, prices during the period could change frequently, but by insignificant amounts, and the selling prices of inventories also changed accordingly. Hence, the influence of such dynamics can be considered insignificant, which allows us to demonstrate the average price method.

FIFO method

The FIFO method, as you remember, in conditions of rising prices shows the maximum estimate of inventories and profits, and in conditions of declining prices for the acquisition of inventories - the minimum estimate of these indicators. The correspondence of the valuation of inventories in the balance sheet at the end of the reporting period with their “last” prices using the FIFO method brings their valuation as close as possible to the immediate state of affairs. And the larger the share of the “latest” prices in the calculation of the estimate of the remaining inventory, the more realistic it will be in this sense.

Thus, from the point of view of assessing current assets and calculating the solvency indicators of an organization, the FIFO method is the best assessment option. However, the choice of the FIFO method does not have such a positive impact on the assessment of the financial result. Inventories are written off using the FIFO method in the order of acquisition, that is, at “first” prices. This actually overstates the financial result compared to the inventory acquisition price level at the reporting date. The amount of profit, therefore, demonstrates the exaggerated capabilities of the owners to withdraw funds from the company’s turnover and/or expand business volumes. The company looks exaggeratedly profitable.

LIFO method

Using the LIFO method leads us to the opposite situation. The assessment of the balance of inventory at the end of the period in the balance sheet is based in this case on the “first” prices. At the same time, the specificity of the LIFO method is that if there is a balance, the “first” prices can serve as the basis for valuation for as long as desired, and after some time the valuation of inventories on the balance sheet completely loses touch with reality. Hence, when applying the LIFO method, the assessment of current assets distorts reality, and first of all this concerns the indicator of current solvency (liquidity), which, in conditions of rising prices, becomes underestimated, the more significant the share of the remaining inventory in the total volume of current assets of the company.

At the same time, the financial result, as a consequence of an adequate assessment of current expenses, on the contrary, receives an assessment that is most adequate to the real state of affairs. The amount of reported profit takes into account the rise in prices for renewable resources, which determines the volume of free cash outflow required in the future. Hence, profit as a “signal” for the distribution of funds more realistically shows the possibilities of owners for such withdrawal of funds from the company and/or their reinvestment.

FIFO method. Calculation example

This is the most popular cost calculation method. It uses the queuing principle. It is assumed that the items that were delivered first are written off first. Hence the name FIFO method (English: “first in, first out” - “first in, first out”). However, unless the shelf life is important, it is not necessary to ship goods from an earlier delivery first - this is used as an assumption in the calculations. That is, the cost of goods that are sold first is calculated at the price of the balances from the “oldest” delivery. When the balances are quantitatively exhausted, inventory items are written off at the price of the next delivery, then the next one, and so on.

Example of calculation using the FIFO method

As can be seen from the example of calculation using the FIFO method, the profit indicator in this case is lower than in the example with average cost. Accordingly, income tax will be less.

Receipt of batches to the warehouse

In documents for the receipt of goods and materials, the filling of the document does not change and remains standard, as for all other receipts:

Only the analytics in the postings are changed, a new Batch sub-account is filled in:

Important! If another organization is entered in the 1C 8.3 database that does not keep batch records, that is, the accounting policy sets write-off at the average cost, then in the documents the receipt will also be reflected in the batch postings, but the write-off occurs at the average cost.

End of support for obsolete modes

With version “1C:UT 11.5” it is planned to complete support for the following modes:

- batch accounting 2.1;

- accounting policy – FIFO (weighted valuation);

- offline settlements.

“The documents and the very functionality of these modes are retained in versions 11.4 and 11.5 in full. And the transition to version 11.6 from version 11.5 will be possible only if the use of new modes is enabled. The functionality of deprecated modes in 11.6 will be limited. The “Month Closing” assistant checks the modes listed above and gives a recommendation for switching to new accounting modes,” says the description of the new release.

Advanced analytics mode

In the preset accounting settings, it is not at all obvious to an outside observer that there are options within Advanced Analytics itself. Let's do this:

1. Select the cost accounting mode Batch accounting. In the window that opens, uncheck the Use advanced cost analytics checkbox:

Setting up accounting parameters in UPP and KA 1.1. Changing the Cost Accounting Mode

The warning does not scare us; the database is still empty.

2. Click on Change settings and again we see a warning about the need to resend all documents:

3. We agree and look with surprise at the following window:

Setting up accounting parameters in UPP and KA 1.1. Change the Advanced Cost Analytics option

Here they are - options for setting up Advanced Analytics. And these options contain very significant differences.

Read the explanations under each option carefully. Here's an important point. Only the last option allows us to enter management accounting data regardless of the regulated one. Technically, this is expressed in the fact that we have two separate Cost Accounting registers: regulated and managerial.

Plus a highlight - the ability to keep track of costs for projects and management departments is also expected only for the last option:

Cost granularity with advanced cost analytics

4. In my case, I will choose the last option - separate maintenance of regulated and management cost accounting. And again a warning:

We agree, indicate the start period of work in the database:

5. We finally achieve the result: changing the detailing option of Advanced Cost Analytics:

Setting up accounting parameters for UPP and KA 1.1. Advanced Cost Analytics

I think you can quite imagine what it costs to change the Advanced Analytics settings later. It is important to think about what settings will be needed before starting work and select the one you need right away. In a database with a large number of documents this will be much more difficult.

Advantages and disadvantages of the FIFO (weighted valuation) method

Compared to the batch accounting method in UT 10.3, the FIFO (weighted valuation) method is more complicated. Because of this, a number of its advantages can be identified:

- the cost of written-off goods in all documents for the month is averaged. This allows you not to worry about the machinations of managers;

- cost calculation in UT 11 and period closure are carried out faster;

- The system no longer cares about the order in which receipt and sales documents are entered.

Flaws:

- there is no party evaluation after the implementation document has been carried out;

- there is no way to instantly estimate gross profit. This is often required when posting a sales document.

However, at the same time, organizations are switching to the latest versions of software, focusing on the increasingly improving quality standards of the 1C company. New calculation methods provide ample opportunities for maintaining modern management accounting in companies of any size.

Types of batch accounting

Batch accounting is divided into these types:

- FIFO and LIFO. These are automatic methods. That is, they function without user participation.

- Manual. Assumes manual accounting.

- Combined. For the most part, automated accounting is performed. However, the user can make manual adjustments.

The FIFO method is the most common. Its main feature is the write-off of batches in accordance with the capitalization procedure. Under FIFO, you can enter information retroactively. LIFO assumes priority write-off of lots that were capitalized later. This is a favorable method within the framework of inflation. This is due to the fact that if the purchase price increases, it is possible to reduce the markup, profit and VAT. However, it is not possible to enter information retroactively in this case.

Which form of accounting to choose?

If you choose the manual method, you need to consider the following disadvantages:

- Mistakes made due to negligence.

- Intentional mistakes made for the purpose of theft or deception.

- Inconsistency in the work of specialists.

- A lot of time is spent moving documents between the warehouse and the accounting department.

- The need for frequent control of warehouses.

Due to all the disadvantages of the manual system, the automated system is the most common.

FIFO method in warehouse program

Despite the fact that the FIFO method is quite simple in terms of understanding the principle of its operation, manually calculating the cost each time is very labor-intensive. Especially if you have a small business, and you yourself are the director, the cashier, the accountant, and the chief buyer. It is much easier if you simply enter data on deliveries and sales and immediately get the result. This is exactly how you can work with the MyWarehouse service. The program fully automates trading processes and itself calculates the cost of written-off goods or services using the FIFO method.

MyWarehouse calculates profitability for each product or product group, stores and displays current and historical balances, as well as many other data that may be useful. This way, you save time and can be confident in the accuracy of the indicators on which you make decisions. Read more about how MyWarehouse calculates cost in our instructions.

Company accounting policy

According to the law, the organization itself chooses how to calculate the cost of goods. It is important that the method you consider is necessarily reflected in the company's accounting policies. This is stated in Article 313 of the Tax Code of the Russian Federation, as well as in paragraph 73 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 28, 2001 No. 119n.

Changes to accounting policies can be made once a year. That is, you can deposit them earlier, but they will take effect according to the law next year - at the beginning of the new tax period. The accounting policy is drawn up by an accountant and approved by the head of the organization.

For management accounting purposes, you are free to use any costing method. Our advice is to use the same one that is written down in your accounting policy - this way there will be less confusion.

Tasks of batch accounting

Let's consider all the tasks of the above method:

- Displaying the date of purchase, supplier, actual volume of products placed in the warehouse. The information provided is a tool that may be useful in future purchases and sales. Based on the information, you can understand what and in what quantities should be purchased.

- Conducting analysis of turnover and profit from sales of products from various suppliers. As part of accounting, the batch is linked to a specific supplier, which allows the manager to receive all the necessary information.

- Determination of the cost of write-off of products. However, to obtain up-to-date information, one condition must be met: timely entry of data on receipts and write-offs.

This is an incomplete list of tasks facing batch accounting.

The danger of incorrectly calculating the selling price

To improve the efficiency of trade organizations, complex management accounting systems have been developed. They allow, among other things, to monitor the level of productivity and change the vector of the company’s development depending on the data received. When calculating costs using 1C:Enterprise Trade Management 11, the slightest error that creeps into the formula leads to unreliable results. This, in turn, leads to serious losses, especially if we are talking about a large organization with a large turnover. This is why developers who debug computational functions have a huge responsibility. Such specialists must know not only where the cost calculation is in UT 11, but also understand the nuances of the client’s industry. All these qualities can be confirmed by a document indicating that the contracting organization is an accredited partner of the 1C company. For high-quality setup and support of the software and the generation of documents for calculating the cost of goods in UT 11, it is better to turn to professionals. Ultimately, this will help save time and money.

Options for accounting for goods in 1C

The following options are available:

- LIFO (last in, first out). Nowadays it is used very rarely. Effectively used in case of severe inflation. Costs go first to the last batch purchased.

- FIFO (first in, first out). Basically the most logical and most used option for calculating cost.

- Calculation based on average. The simplest method of calculation; previously, when choosing this method, batch accounting was not even carried out.

- Advanced analytical cost accounting (RAUZ). Introduced into the program quite recently. When choosing this type of accounting, the cost is not calculated immediately. Cost amounts appear after the “Cost Cost Calculation” document is completed and processed. This is done to improve productivity and to free users from re-sequencing documents.

Which logistics method to choose?

There cannot be an unambiguous solution to this issue, since everything is determined by specific circumstances. The main criterion is the characteristics of the goods moving along the logistics chain. The FIFO logistics principle is appropriate for obsolete products that have a limited period of time for sale.

An approach is often proposed in which FIFO is used in raw material warehouses, while the second method is used in warehouses with goods already ready for sale. The main thing in each case is the availability of sufficient warehouse space and equipment for efficient logistics, as well as careful analysis in terms of financial efficiency and reporting.

What is batch accounting?

Batch accounting is product accounting in which each batch is taken into account. A product label is attached to each batch. Subsequently, the corresponding numbers are entered into the consumable papers. Product labels must contain document numbers, as well as the number of products sold.

A separate analytical account is created for each batch. It is needed to make movement records. Every month, based on the established analytical accounting, a turnover sheet is formed. It contains the batch number for each product group, as well as the amount and number of containers for each of them.

Results

Comparing the LIFO and FIFO methods thus shows us a very important contradiction. By obtaining (using the FIFO method) the opportunity to most adequately assess inventory balances, we distort the amount of profit reflected in the reporting. By estimating profit most realistically (using the LIFO method), we distort the estimate of the firm's inventory as reported as an asset on the balance sheet. This situation is a special case of the general paradox of accounting methodology based on the balance sheet equality of assets and liabilities, defined by Professor Ya.V. Sokolov (1938-2010) as the principle of complementarity*. According to this principle, the more accurate (adequate, close to reality) assessment one indicator of financial statements receives, the less accurate assessment is received by another indicator associated with it. In our case, such a related “pair” of indicators is inventories and profit.

Note:

* I'M IN. Sokolov. Fundamentals of accounting theory - M.: Finance and Statistics, 2000, pp. 38-39.

It is therefore obvious that the FIFO method is more focused on the tasks of preparing a balance sheet, and the LIFO method is more focused on the income statement. The dominant role of the balance sheet or statement of financial position has now led to the abolition of the LIFO method as recommended by Russian accounting standards and IFRS. However, the LIFO method remains relevant for estimating expenses and profits in management accounting. And it is in management accounting, provided that the assessment of the relevant indicators is important for making management decisions, that we can use the FIFO method in the formation of the management balance sheet and the LIFO method for drawing up the management income statement.

In financial accounting, when choosing between the FIFO method and the average price method, we should not forget about the analytical significance of the profit level as a signal for the payment of dividends. The perception of such a signal by the company's owners, which is inadequate to the real state of affairs, can, in conditions of a significant increase in prices for inventories, lead to the irrational withdrawal of funds from the company's turnover. Based on this, the average price method, when you have to choose between it and FIFO, in our opinion, is more consistent with the principle of prudence (conservatism), allowing you not to instill excessive optimism in the hearts of users of financial statements.

As for tax accounting and the organization’s accounting policy for tax purposes, here the correctness of choosing the LIFO method in conditions of rising prices, in our opinion, is completely indisputable.