Step-by-step instruction

The organization delivered goods to the buyer Domostroy LLC (debtor) in the amount of 144,000 rubles. (including VAT 20%). The buyer did not pay the debt after the payment deadline.

On June 01, the Organization (assignor) entered into an agreement on the assignment of the right to claim this debt with Business Center LLC (assignee) for 120,000 rubles.

On June 10, the assignee transferred payment under the assignment agreement.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Exercise of the right to claim receivables | |||||||

| June 01 | 76.09 | 91.01 | 120 000 | 120 000 | 120 000 | Proceeds from the sale of the right of claim | Sales (act, invoice) - Services (act) |

| Drawing up the Federation Council | |||||||

| June 01 | — | — | 120 000 | — | — | Drawing up a Federation Code for the exercise of the right of claim | Invoice issued for sales |

| — | — | — | — | — | Reflection of VAT in the Sales Book | Sales book report | |

| Write-off of accounts receivable | |||||||

| June 01 | 91.02 | 62.01 | 144 000 | 144 000 | 144 000 | Write-off of accounts receivable | Debt adjustment - Debt write-off |

| Receipt of payment from the assignee | |||||||

| June 10th | 51 | 76.09 | 120 000 | 120 000 | 120 000 | Receipt of payment from the assignee | Receipt to the bank account - Payment from the buyer |

Example

Initial Creditor LLC entered into an agreement for the supply of goods with Debtor LLC in the amount of 240 thousand rubles.

(including VAT 20% - 40 thousand rubles). Let's assume that the cost of a batch of goods is 120 thousand rubles.

Debtor LLC did not pay under this agreement, and Initial Creditor LLC assigned the right to claim this debt to New Creditor LLC for 170 thousand rubles.

In the accounting records of Initial Debtor LLC, these business transactions will be reflected as follows:

Debit 62 “Settlements with buyers and customers” Credit 90-1 “Revenue” - 240 thousand rubles. — goods were shipped to Dolzhnik LLC.

Debit 90-3 “VAT” Credit 68 “Calculations for taxes and fees” subaccount “Calculations for VAT” - 40 thousand rubles. - VAT has been charged.

Debit 90-2 “Cost of sales” Credit 41 “Goods” - 120 thousand rubles. — the cost of goods sold is written off.

Debit 90-9 “Profit/loss from sales” Credit 99 “Profits and losses” - 80 thousand rubles. (240 thousand rubles - 40 thousand rubles - 120 thousand rubles) - reflects the financial result from the sale of goods.

Debit 76 “Settlements with various debtors and creditors” Credit 91-1 “Other income” - 170 thousand rubles. — an agreement on the assignment of the right of claim was concluded with New Creditor LLC.

Debit 91-2 “Other expenses” Credit 62 “Settlements with suppliers and contractors” - 240 thousand rubles. — sold receivables are written off.

Debit 99 “Profits and losses” Credit 91-9 “Balance of other income and expenses” - 70 thousand rubles. (240 thousand rubles - 170 thousand rubles) - reflects the financial result from the assignment of the right of claim.

Debit 51 “Settlement accounts” Credit 76 “Settlements with various debtors and creditors” - 170 thousand rubles. — payment was received from New Creditor LLC under an agreement on the assignment of the right of claim.

Exercise of the right to claim receivables

Regulatory regulation

Assignment of the right of claim (cession) is the transfer of a right owned on the basis of an obligation from one creditor to another (Article 382 of the Civil Code of the Russian Federation).

Read more Change of persons in an obligation. Legal basis

BOO. The creditor (assignor) has the following rights recognized on the date of transfer:

- other income - in the amount for which the right was assigned (clause 7, 16 PBU 9/99);

- other expenses - in the amount of the assigned debt (clause 11, clause 14.1 of PBU 10/99).

WELL. When assigning the right of claim after the expiration of the payment period under the contract, the assignor recognizes on the date of transfer of the right (clause 2.1, clause 1, article 268 of the Tax Code of the Russian Federation):

- proceeds from the sale in the amount for which the right was assigned;

- expenses from sales in the amount of the assigned debt.

The loss upon assignment of the right to claim a debt to a third party before the due date of payment is normalized. It is recognized in an amount not exceeding the interest that the creditor would have paid if he had not sold the debt, but had taken the proceeds from the sale of the debt on credit. The period for which interest is calculated is from the date of assignment to the payment deadline (clause 1 of Article 279 of the Tax Code of the Russian Federation).

Interest is calculated based on:

- the maximum interest rate established for the corresponding type of currency (clause 1.2 of Article 269 of the Tax Code of the Russian Federation);

- interest rate confirmed in accordance with the methods established in section V.1 of the Tax Code of the Russian Federation.

The method for determining the interest rate must be fixed in the accounting policy.

VAT. The assignor pays VAT on the positive difference between the sales price and the amount of debt (clause 1 of Article 155 of the Tax Code of the Russian Federation).

The VAT rate for the exercise of the right of claim is 20%, since property rights are not listed as taxable at preferential rates (Article 164 of the Tax Code of the Russian Federation).

The implementation of the right of claim arising from a loan (credit) agreement is not subject to VAT (clause 26, clause 3, article 149 of the Tax Code of the Russian Federation).

Even in the absence of a VAT base (if sold at a loss), the taxpayer is obliged to reflect in the sales book an invoice for the sale of the right of claim with a tax base and VAT amount equal to zero (Letter of the Ministry of Finance of the Russian Federation dated November 5, 2019 N 03-07-11/84894 ).

Accounting in 1C

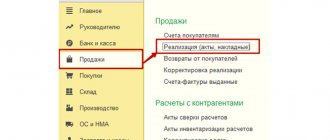

Reflect the implementation of the right of claim with the document Sales (act, invoice) transaction type Services (act) in the Sales - Sales (acts, invoices) section - button Sales - Services (act).

Indicate in the header of the document:

- Counterparty - the name of the counterparty purchasing the debt is selected from the Counterparties directory;

- Agreement - the name of the agreement with the counterparty, selected from the Agreements directory;

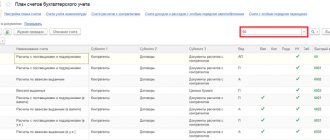

- Settlements : Account for accounting of settlements with the counterparty and Account for accounting of settlements for advances - 76.09 “Other settlements with various debtors and creditors.”

Fill in the table section:

- Nomenclature - a position from the Nomenclature directory, for example, Right to claim debt : Type of nomenclature - Services .

- Income account - 91.01 “Other income”;

Postings according to the document

The document generates the posting:

- Dt 76.09 Kt 91.01 - proceeds from the sale of the right of claim.

To ensure that the sales amount is reflected in the sales book only in column 13b PDF (since there is no taxable base), check the Manual adjustment checkbox (allows editing of document movements) and edit the data on the VAT Sales the Amount without VAT column to zero .

Is the assignment subject to VAT?

Usually, when selling property rights, it is necessary to pay a tax fee. This is stated in paragraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation.

But this tax levy is not always assessed. To determine whether this is necessary or not, the tax treatment of the underlying liability should be examined. According to clause 1, Article 155 of the Tax Code of the Russian Federation, when selling a debt, the tax fee should be calculated in the same manner as the original obligation.

For a better understanding, we will study the taxation features of debt assignment agreements that arise from different transactions.

Drawing up the Federation Council

Create an invoice for sales using the Write invoice at the bottom of the document Sales (act, invoice) .

- Operation type code — «».

Not all invoice indicators are automatically filled out correctly for a given case, so go to the printed invoice form and manually correct the indicators in the following order (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation, clauses c, e, g, h , and clause 2 of the Rules for filling out an invoice, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137): PDF

- column 4 - the price of the transferred right under the contract excluding tax;

- column 5 - the difference between the amount of realization of the right of claim (without VAT) and the amount of the claim itself (with VAT); if the difference is negative or zero - 0;

- column 7 - VAT rate;

- column 8 - the amount of accrued VAT; if column 5 contains 0, then this column also contains 0;

- Column 9 - amount under the assignment agreement, including tax.

The invoice is drawn up in a single copy and is not transferred to the buyer, since the deduction of VAT on transactions of assignment of the right of claim is not provided for in Art. 171 Tax Code of the Russian Federation.

Civil law basics

The procedure for assigning the right of claim is regulated by Chapter 24 “Change of persons in an obligation” of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation).

According to paragraph 1 of Article 382 of the Civil Code of the Russian Federation, a right (claim) belonging to the creditor on the basis of an obligation may be transferred by him to another person under a transaction (assignment of the claim) or may be transferred to another person on the basis of law. The assignment of a claim based on a transaction made in simple written or notarial form must be made in appropriate writing. In this case, an agreement on the assignment of a claim under a transaction requiring state registration must be registered in the manner established for the registration of this transaction, unless otherwise provided by law (Clause 2 of Article 389 of the Civil Code of the Russian Federation).

Paragraph 2 of Article 382 of the Civil Code of the Russian Federation establishes that in order to transfer the rights of a creditor to another person, the consent of the debtor is not required, unless otherwise provided by law or agreement. The parties to the agreement on the assignment of the right of claim are:

- original creditor - the person assigning the right of claim (assignor);

- new creditor - the person acquiring the right of claim (assignee).

Unless otherwise provided by law or agreement, the right of the original creditor passes to the new creditor to the extent and on the conditions that existed at the time of transfer of the right.

In particular, the rights ensuring the fulfillment of the obligation, as well as other rights related to the claim, including the right to interest, are transferred to the new creditor (Article 384 of the Civil Code of the Russian Federation). The right to claim a monetary obligation may be transferred to another person in part, unless otherwise provided by law. The right to receive performance other than payment of a sum of money may be transferred to another person in part, provided that the corresponding obligation is divisible and the partial assignment does not make the debtor’s performance of his obligation significantly more burdensome, unless otherwise provided by law or contract (clause 3 Article 384 of the Civil Code of the Russian Federation).

The mutual rights and obligations of the assignor and assignee are determined by the Civil Code of the Russian Federation and the agreement between them, on the basis of which the assignment is made. This is indicated in paragraph 1 of Article 389.1 of the Civil Code of the Russian Federation.

The claim passes to the assignee at the time of concluding the agreement on the basis of which the assignment is made, unless otherwise provided by law or agreement. Unless otherwise provided by the agreement, the assignor is obliged to transfer to the assignee everything received from the debtor on account of the assigned claim.

The assignor is responsible to the assignee for the invalidity of the claim transferred to him, but is not responsible for the failure of the debtor to fulfill this requirement, with the exception of the case where the assignor has assumed a guarantee for the debtor to the assignee (Article 390 of the Civil Code of the Russian Federation).

Unless otherwise provided by law, the agreement on the basis of which the assignment is made may provide that the assignor is not liable to the assignee for the invalidity of the claim transferred to him under the agreement, the execution of which is related to the implementation of entrepreneurial activities by its parties, provided that such invalidity is caused by circumstances , about which the assignor did not know or could not know or about which he warned the assignee, including circumstances related to additional requirements, including requirements for rights ensuring the fulfillment of an obligation and rights to interest.

When making an assignment, the assignor must meet the following conditions:

- the claim being assigned exists at the time of assignment, unless the claim is a future claim;

- the assignor is entitled to make an assignment;

- the assigned claim was not previously assigned by the assignor to another person;

- the assignor has not committed and will not perform any actions that could serve as a basis for the debtor’s objections to the assigned claim.

The law or agreement may also provide for other requirements for the assignment.

If the assignor violates the above rules, the assignee has the right to demand from the assignor the return of everything transferred under the assignment agreement, as well as compensation for losses caused. In relations between several persons to whom the same claim was transferred from one assignor, the claim is recognized as transferred to the person in whose favor the transfer was made earlier (clause 4 of Article 390 of the Civil Code of the Russian Federation).

In the event of performance by the debtor to another assignee, the risk of the consequences of such performance is borne by the assignor or assignee who knew or should have known about the assignment of the claim that took place earlier.

Write-off of accounts receivable

Write off accounts receivable by documenting the Debt Adjustment type of transaction Debt Write-off (section Sales - Debt Adjustment - Create button).

Indicate in the header of the document:

- Write off - Buyer's debt ;

- Buyer (debtor) - the name of the debtor (debtor) under the agreement, selected from the Counterparties ;

Click the Fill in tabular part of the Buyer's debt (accounts receivable) to fill in the balances on mutual settlements with the buyer:

- Contract - an agreement with the original buyer from the Contracts ;

- A settlement document is a sales document on which a debt has arisen;

- Amount - the amount of debt in the accounting department (in our example - 144,000 rubles);

- Amount of NU - the amount of debt in NU (in our example - 144,000 rubles);

- Settlement amount - the amount of debt that is written off;

- Accounting account - an account in which the debt is recorded (in our example - 62.01 “Settlements with buyers and customers”).

Specify on the Write-off Account :

- Account - 91.02 “Other expenses”;

- Other income and expenses - an article from the directory Other income and expenses : Type of article - Realization of the right of claim after the payment deadline ;

Postings according to the document

The document generates the posting:

- Dt 91.02 Kt 62.01 - accounts receivable written off.

Other ways to implement the procedure

In practice, quite often, a tripartite agreement is concluded between the parties, in which the old debtor, the new one and the creditor immediately participate. Registration of relations in this way will eliminate the need to conclude two separate contracts, which seems more convenient.

The text of the trilateral agreement states:

- details of the creditor, old and new debtor. In relation to organizations, you should indicate their legal addresses, details of representatives, TIN and OGRN, as well as bank details;

- subject of the contract. The fact of assignment of debt from one person to another and the consent of the creditor to this is indicated. Without expressing consent, a transaction is impossible, since any assignment of rights is carried out only if this requirement is met;

- rights and obligations of the parties;

- amount of debt. It is indicated whether the debt is transferred in full or in some part;

- liability of the parties for failure to fulfill obligations;

- signatures of representatives and date of agreement.

Download the tripartite assignment agreement (sample)

Legal assistance in preparing a contract >>

Copies of the initial agreements and other papers may be attached to the agreement if necessary for the transaction.

Receipt of payment from the assignee

Reflect the receipt of payment from the assignee with the document Receipt to the current account transaction type Payment from the buyer (section Bank and cash desk - Bank statements - Receipt button).

Please indicate:

- Counterparty - the name of the counterparty who purchased the debt (assignee), selected from the Counterparties ;

- Contract - the name of the contract with the counterparty, selected from the Contracts ;

- Settlement account and Advance account - 76.09 “Other settlements with various debtors and creditors”;

- Income item is a predefined item from the Cash Flow Items Payment from Customers .

How to formalize the assignment of debt between entrepreneurs

The procedure will consist of two main stages:

- Conclusion of an agreement between the original debtor and the new one. The parties must determine under what conditions the debt is transferred, whether the new debtor will be a creditor, that is, whether he will be able to claim the debt after paying the debt and in what amount, and so on.

- Conclusion of an agreement between the new debtor and the creditor.

If the original and new debtor do not stipulate in the agreement that the new debtor does not have the right to demand repayment in the future, he will receive this opportunity automatically. This is directly stated in paragraph 3 of Article 391 of the Civil Code of the Russian Federation.

The agreement is always drawn up in writing. The law does not contain conditions on the need for notarization; however, if necessary, the parties have the right to contact an appropriate specialist.

A separate notice is not sent to the creditor, since he signs an agreement with a new debtor. There is also no need to indicate in the document the conditions reached by the old and new debtor; this moment will not affect the rights of the creditor in any way.