Credits and loans - what is the difference

When an organization does not have enough money, for example, to purchase equipment or raw materials, it can obtain a loan or loan. Financial instruments are similar and solve one problem - to provide the company with free money. However, there are a few differences.

Difference No. 1 - The person issuing the loan or loan

An organization can receive a loan only from a credit institution, that is, from a bank. To do this, a loan agreement is concluded, according to which the party issuing money is the lender, and the party receiving money is the borrower.

The loan can be issued by any individual or legal entity. Banks do not provide loans. When lending money, a loan agreement is concluded, under the terms of which one party is the lender, and the other is the borrower.

Difference #2 - Percentages

A loan is always issued at a certain percentage for the use of credit funds. It may vary from bank to bank, but it is never 0%. Interest on loans issued is the bank's income.

The loan, in turn, can be either interest-bearing or interest-free. The legislator leaves this condition at the discretion of the parties (clause 1 of Article 809 of the Civil Code of the Russian Federation).

Important! If the loan agreement is supposed to be interest-free, it must indicate that no fee is charged for the use of borrowed money. Otherwise, the lender has the right to collect interest at the rate of the Central Bank of the Russian Federation in effect at the time the loan agreement was valid (clause 1 of Article 809 of the Civil Code of the Russian Federation).

Difference 3 - Item

The loan is issued only in the form of cash. The bank cannot issue a loan in goods, raw materials or other property.

The loan can be issued in any form. The most popular form of loan is cash, but sometimes goods and other property are loaned, for the use of which interest is also charged.

Difference 4 - Legislative regulation

Credit relations are mainly regulated by regulations of the Central Bank of Russia. Some issues are also enshrined in federal laws and the Civil Code.

The loan agreement is not subject to the regulations of the Central Bank of Russia, therefore it is regulated only by federal laws and the Civil Code.

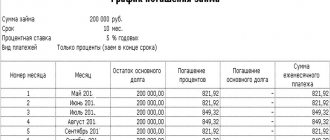

The procedure for calculating interest on a loan

First of all, it should be remembered that the loan agreement always specifies the amount of fees for the use of funds from a particular bank or microfinance organization. But in some situations this information may not be available. In this case, the borrower will pay interest at the current refinancing rate. The agreement may also provide for free use of banking services.

To correctly calculate interest, you must have a set of documents, which includes the official contract itself, agreement, agreed payment schedule, client receipts and other extracts from the financial institution. You can calculate the interest rate yourself if you have the following information:

- the specified amount of overpayment (if any);

- interest rates (taking into account the accrual period);

- the amount of money issued as loans;

- calendar days of provision of funds;

- the total number of days in the year or selected month.

Important! If the agreement document states that interest will be charged for delays, calculations must be made based on the specified rates.

Accounting for loans and borrowings

Accounting for loans and borrowings is regulated by PBU 15/2008. Despite the fact that credit and loan differ from each other in legal nature, in accounting these concepts are almost identical.

For accounting purposes, the repayment period of credit or borrowed obligations is important, so two accounts are used:

- 66 - for accounting for short-term loans and borrowings, the repayment period of which is no more than 12 months (inclusive);

- 67 - for accounting for long-term loans and borrowings with a repayment period of more than 12 months.

Accounts are passive. They carry out three types of operations: receiving borrowed funds, accruing interest and repayment. The credit reflects the receipt and accrual of interest, and the debit reflects the return and repayment of interest. The body of the loan and the amount of interest are taken into account in different sub-accounts opened to accounts 66 and 67.

The balance of the loan or loan at the end of the period falls into line 1410 of the balance sheet if it is long-term, and in line 1510 if it is short-term.

Analytical accounting for these accounts should reflect information in the context of creditors and lenders, loan or credit agreements, and types of funds received.

Costs of loans and borrowings

The amount of credit or loan received is not the company’s income, just as the return of this amount is not an expense. Therefore, the amounts themselves do not participate in the formation of the financial result and the tax base (clause 1 of Article 251 of the Tax Code of the Russian Federation).

However, obtaining a loan or a loan is associated with expenses that are taken into account as part of other expenses for tax purposes:

- interest on the use of borrowed funds;

- additional expenses in the form of payment for information and consulting services, payment for services for examination of the contract, and so on.

An exception is expenses that are included in the cost of an investment asset. That is, interest on loans and borrowings that are directly related to the acquisition, construction or construction of an investment asset. Organizations that use simplified accounting methods can recognize all expenses on loans and borrowings as other expenses.

Costs for loans and credits in accounting are reflected separately from the principal amount of the loan or credit. For this purpose, subaccounts are opened for accounting accounts.

Interest on loans or credits is taken into account evenly during the term of the agreement or in the manner provided for by the terms of the agreement, if this does not violate the principle of equal accounting (clause 8 of PBU 15/2008).

Why calculate interest on a loan?

Preliminary loan calculations allow you to choose the most profitable and safe lending conditions. Clients can choose the most suitable loan options for themselves, which in the future will eliminate overpayments and ensure the safety of their own funds. To calculate a loan, you do not need to have special knowledge or mathematical abilities. The whole procedure consists of several steps that are aimed at studying legislation and banking formulas. At the same time, detailed calculation will provide a number of advantages for users:

- determination of the real interest rate;

- saving your own funds when borrowing;

- rationalization of credit use;

- selection of favorable lending conditions;

- minimizing the likelihood of unforeseen situations.

Every client who contacts a specific financial institution is required to find out the actual amount of interest. However, not all companies provide detailed information. Therefore, users are forced to independently calculate the interest rate. Preliminary calculations help not only optimize the lending procedure, but also increase your own security. Simple formulas and online calculators will allow you to choose the most appropriate loan program. At the same time, clients do not have to visit banks or pay for the services of specialists.

Also, preliminary calculations will help you find out real information about how much you need to pay in case of overdue loan. After all, most financial companies, in order to attract a large number of clients, try in every possible way to hide real data.

Accounting entries when receiving loans and borrowings

For example, on April 1, Fortuna LLC entered into a loan agreement in the amount of 300,000 rubles for a period of 3 months at 1% monthly. The date for payment of interest and part of the loan body is the last day of the month. The loan is revolving, that is, it is borrowed for the purchase of raw materials and materials. The accountant of Fortuna LLC makes the following entries in the accounting.

| date | Debit | Credit | Amount, rub. | Description |

| 01.04.2021 | 51 | 66.1 | 300 000 | Credit funds have been credited to the current account |

| 30.04.2021 | 91.2 | 66.2 | 3 000 | Interest accrued for the use of borrowed funds in April |

| 30.04.2021 | 66.2 | 51 | 3 000 | Interest paid for April |

| 30.04.2021 | 66.1 | 51 | 100 000 | Part of the loan has been repaid |

| 31.05.2021 | 91.2 | 66.2 | 2 000 | Interest was accrued for the use of borrowed funds in May. The amount is calculated based on the fact that part of the loan has already been repaid, therefore, we calculate the interest from 200,000 rubles. |

| 31.05.2021 | 66.2 | 51 | 2 000 | Interest paid for May |

| 31.05.2021 | 66.1 | 51 | 100 000 | Part of the loan has been repaid |

| 30.06.2021 | 91.2 | 66.2 | 1 000 | Interest was accrued for the use of borrowed funds in June. The amount is calculated based on the fact that part of the loan has already been repaid, therefore, we calculate the interest from 200,000 rubles. |

| 30.06.2021 | 66.2 | 51 | 1 000 | Interest paid for June |

| 30.06.2021 | 66.1 | 51 | 100 000 | The last part of the loan has been repaid |

The date for payment of interest and the principal of the loan may not fall on the end of the month, but on any other date. In this case, at the end of the month we create the entry Dt 91.2 Kt 66/67 for accrual of interest expenses, and the entry for their repayment is made on the date when the money was actually transferred to the creditor.

When receiving a loan, we use account 51, since it was received in cash. If the loan is issued in non-cash form, you can use accounts 10, 41 and similar. However, in this case, a transfer of ownership occurs, and therefore the transaction is subject to VAT.

Since January 2021, changes to the law have been introduced in Russia that regulates relations related to consumer loans. The legislator once again made an attempt to rein in credit institutions and curb their appetites.

2021 will be no exception.

❶. Payday loan

This is a relatively new type of loan, which is characterized by the following. The loan amount should not exceed 10,000 rubles. The loan term is no more than 15 days.

If a citizen has entered into a loan agreement with precisely these conditions, then you should know that the amount of accrued interest on such a loan should not exceed 3 thousand rubles (or 30% of the loan amount). The daily payment on such a loan should not exceed 200 rubles. Such a loan cannot be extended or its amount increased. That is, if, for example, you borrowed 10,000 rubles from a microcredit organization for a period of 15 days, then in addition to the principal debt, the creditor has the right to collect only 3,000 rubles. And therefore, the total amount of the debt, regardless of the period of delay, will be only 13,000 rubles. Therefore, nip in the bud all calls from a creditor who reports a debt of hundreds of thousands and demands to repay it. Now you know that you only owe the lender 13,000 rubles.

❷. Debt limit

The new law establishes a single limit on the borrower’s debt under a consumer credit (loan) agreement, which is concluded for a period of up to one year. From January 1, 2021, the amount of debt cannot exceed 1.5 times the amount of such a loan. After reaching this amount, the law prohibits further accrual of interest, as well as the collection of penalties (fines, penalties), other payments and the application of other measures of responsibility to the borrower, regardless of the length of the delay. That is, as soon as the amount of your debt to a microcredit organization reaches 1.5 times the loan amount, the accumulation of debt stops.

Example: a borrower borrowed 10,000 rubles for a period of two months. At no point in time, even if the delay is a year, two, or three, will the lender owe more than (10,000 + 15,000) = 25,000 rubles (the body of the debt plus accrued interest and other payments). Therefore, when you receive “chain letters” from creditors stating that you owe 100,000 rubles for a 5,000 ruble loan, and there are such, as my experience shows, rest assured, this is nothing more than an attempt to intimidate you by misleading you.

Be literate, because unscrupulous lenders take advantage of your illiteracy. They pretend that they do not know about the new laws and apply to the magistrate’s court for a court order, exposing fantastic amounts of debt. The court, without understanding the situation and without calling the debtor, issues a court order to collect unfounded and fantastically inflated debts. As a rule, the borrower learns about the court order a year or more later, when the bailiffs begin collection and write off sums of money from the bank card.

What to do? First of all, know your rights, be able to read the terms of the loan or loan, and be sure to cancel the court order if you have not received one. This is not difficult to do; our “Public Reception” will definitely help you.

But it should be remembered that loans taken by borrowers before January 2010 will not be subject to the new rules. So, for example, if the loan was received from January to July 1, 2019, then the cover will be no more than 2.5 times the amount of the loan taken. If in the period from July 1, 2021 to January 1, 2020, then the overpayment will be no more than twice the amount of the loan taken. And only for those who take out a loan after January 1, 2021, the debt should not exceed 1.5 times the loan amount, regardless of the period of delay.

❸. Interest rate limit

From July 1, 2021, the daily interest rate under the loan agreement was reduced to 1% per day. The same rate remains for 2020. Check your consumer loan agreements: if your agreement was concluded between 01/28/2019 and 06/30/2019 inclusive, then the interest on the loan for the period for which the loan was issued should not exceed 1.5% per day. For contracts concluded from 07/01/2019, the interest should not exceed 1% per day. If your percentage is higher, then ask the lender to amend the agreement and recalculate the amount of debt. However, remember that the lender can charge 1% per day only during the period for which the loan was issued. After this period, he has the right to charge interest based on the refinancing rate - 6.5% per annum, which is 0.017% per day. As they say, feel the difference.

Example:

Loan in the amount of 10,000 rubles.

Loan term – 20 days.

Interest – 1% per day. We remember that the lender has the right to charge this percentage only for 20 days. Thus, the amount of interest will be 100 rubles (1% of 10,000) per day x20 days = 2,000 rubles.

On day 21, the interest amount will be 1.7 rubles. (0.017% of 10,000) per day. And this 1 rub. and 7 kopecks. will be accrued until the amount of the entire loan reaches the limit of 1.5 times the loan amount. Then the lender is obliged to stop all accruals, and the borrower, regardless of the period of delay, will not have to pay more than this amount.

❹. Rules of conduct with a creditor

Remember the main rule: if you have a debt under a loan agreement, you need to pay either the entire amount at once or not pay at all. Each payment, regardless of its size, 100 rubles, or 500 rubles, or 2000 rubles, will not change the situation and will not close the debt, but this payment will allow the lender to consider the loan agreement a new one, and you will again be charged 1% per day. Moreover, by paying the amount you acknowledge the debt and can interrupt the statute of limitations. Therefore, before deciding to pay a debt, consult with a lawyer.

If a creditor calls you and demands to repay the debt, intimidating you by going to court, do not panic. You know your rights, moreover, there are often situations when only in court it is possible to defend your rights, reduce the amount of debt and punish a negligent creditor.

❺. Credit amnesty in 2021

When contacting the “Public Reception”, citizens are increasingly asking the question when a credit amnesty will be introduced in 2021 and all their debts will be written off. I will disappoint many debtors, but such a law will never be adopted, because in this case it will be the state that will have to compensate the banks for the debts forgiven to citizens. But the financial situation in our country leaves much to be desired. Therefore, all the talk on the Internet about the upcoming credit amnesty is nothing more than rumors. And in part, citizens simply confuse mortgage holidays with amnesty. Indeed, on July 31, 2021, a new law came into effect that obliges banks that issued mortgage loans to provide mortgage holidays to borrowers in difficult life situations. But this does not mean that the citizen will be freed from debt. The new law gives the borrower the right to demand that the bank suspend loan payments or reduce their amount for a period of 6 months.

I spoke in detail about mortgage holidays on the pages of the newspaper “Chance”, read the article on the website shansonline.ru.

It can be concluded that legislators sided with the borrowers. Now it's up to the borrowers themselves. After all, problems with microcredit organizations arise due to ignorance of their rights and unwillingness to defend them.

If you have any questions or you cannot calculate the amount of the real debt to the microfinance organization, collectors are harassing you with calls, voicing exorbitant amounts of debt, a court order has been issued to you, according to which you are obliged to pay a debt several dozen times greater than the amount of your loan, we are waiting for you in the “Public reception of the newspaper “Chance”. Come, all consultations are free. We are waiting for you at the address: st. Kati Perekreshchenko, 13 (newspaper “Chance”), tel.: 8 -902-996-88-91, Tatyana Vitalievna Cherednichenko.

Taxable temporary difference

When receiving a loan to purchase an investment asset, a taxable temporary difference arises, since in accounting, interest is charged to the cost of the asset, and in tax accounting, it is included as an expense. A difference arises between tax and accounting accounting, therefore, a deferred tax liability is formed in account 77 in accordance with PBU 18/2002.

The write-off of the deferred tax liability will begin as soon as the investment asset is accepted for accounting and begins to be depreciated.