What is the INV-19 form

Based on the INV-19 form, a comparison sheet is drawn up, in which company employees responsible for inventory record discrepancies between the results of actual calculations of inventory items and accounting data.

This form was approved by the State Statistics Committee in Resolution No. 88 dated August 18, 1998 and is applied only to discrepancies in inventory items. For fixed assets (FP) and intangible assets (IMA) there is a different form. For more information about the form recording discrepancies identified in OS and intangible assets, read the article “Unified Form No. INV-18 - Form and Sample”.

Both forms (INV-18 and INV-19) can be used not only during a planned inventory, but also during an unscheduled count of certain resources owned by the company to identify the expected discrepancy between their actual and accounting quantities.

Find out how to properly take inventory of goods in a warehouse at ConsultantPlus. Get trial access to the system and move on to a typical situation.

INV-19 (matching statement of inventory inventory results): form and sample

One of the forms of matching statements compiled based on the results of the audit is a matching statement of the inventory results of inventory items, a sample of which will allow you to correctly enter all the data into the document form. It is necessary to display surpluses and shortages of inventory items.

The following objects are classified as inventory items:

- Consumables;

- finished products;

- goods;

- other objects related to the values of the enterprise.

During the inspection, all information is recorded in a special inventory INV-3, only at the end of the inventory a comparison sheet of inventory inventory results is used. It is necessary to display identified shortages and surpluses for this category.

Composition of INV-19

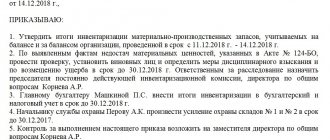

This document consists of 3 pages. The first contains information about the company and the person in charge. The following information is required to be included here:

- Company name;

- the name of the unit in question (for example, warehouse No. 4, if there is none, put a dash in this column of INV-19);

- number of the order to carry out inventory activities;

- when the check was carried out (entered in the format xx.yy.zzzz);

- timing;

- the number of the document itself;

- date of entering information (all in the same format);

- information about officials (names of their positions and full names are written down).

Only if all the listed details are available, the comparison sheet of inventory inventory results, or rather its main page, is considered completely completed. After this, you can begin filling out the other two pages containing information about shortages and surpluses. All information obtained during the inspection is recorded in a special table, which makes it possible to clearly identify all inconsistencies.

Document form INV-19: features of filling out

While filling out the document, the responsible person may have various questions. Before starting the inventory, it is necessary to fill out the INV-19 matching sheet and study the features of filling it out.

If the organization has inventory items accepted by the organization for storage, then information on them is displayed in the INV-5 form, and then an additional matching statement is drawn up.

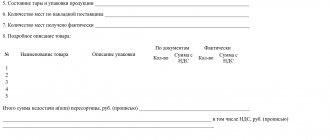

On the second and third pages of INV-19 there is a table where data is entered on all inventory items for which the actual and accounting indicators do not correspond. An example of filling out INV-19 will help you figure out how to correctly display information in a document.

The following information can be entered for each inventory item:

- the unit of measurement used in accounting (including the code of values in accordance with OKEI);

- inventory number;

- passport number (indicated only for those values that contain precious metals; in the INV-19 form it corresponds to column 7);

- surpluses and shortages (indicating quantities and amounts).

The accounting employee is responsible for reconciling the data in the statement. Clarifying information about surpluses and shortages is entered in columns 12 to 17. If some surpluses are used to cover the resulting shortages (re-grading), then data on them is displayed in columns 18–20, and about shortages - from 21 to 23. Sample filling INV-19 will allow you to enter all the information in the required columns.

The total data on surpluses is entered in the following columns:

- 24 shows the amount of surplus;

- 25 displays the total amount of surplus;

- 26 contains the account number for capitalization.

Columns 27 to 32 are used to display data on shortages. Information about quantities and amounts is entered there.

When all the information on surpluses and shortages of valuables is entered into the table, a final count of quantities and amounts is made. The inventory matching sheet form already contains the appropriate cells; you just need to enter information in them.

At the very end, information is entered about the person who filled out the statement and those who acted as the financially responsible person (MRP) for the specified values. By putting their signature on the document, the MOL confirms the data received.

The law does not oblige enterprises to use the unified INV-19 form, which can be completed in a few seconds. Organizations can compose their own document text and apply it.

Form INV 19

form of comparison sheet of inventory inventory results.

Sample of filling out INV form 19

sample comparison sheet of inventory inventory results.

What are the specifics of filling out the form?

The INV-19 form indicates:

- names of inventory items, their main characteristics;

- inventory and passport (that is, registration) numbers of goods and materials;

- inventory results (in the form of surpluses or shortages);

- information on the settlement of surpluses or shortages by clarifying data in accounting;

Attention! In the comparison sheet using the INV-19 form, enter only those inventory items for which deviations recorded in the INV-3 inventory list were identified. Indicate the amounts of surplus and shortage of inventory items in the matching statements in accordance with their estimated value in accounting.

- data on regrading (using surpluses to offset shortages);

- information on the posting of surpluses recognized as final;

- information about shortages recognized as final.

ConsultantPlus experts explained exactly which items of goods should be included in the comparison sheet. If you don't already have access to the legal system, get an online trial and go to the Tax Guide for free.

The document is signed by the accountant, as well as by employees responsible for the safety of inventory items.

For information on which document reflects the results of the inventory of settlements with debtors and creditors, read the material “Unified Form No. INV-17 - Form and Sample”.

General information

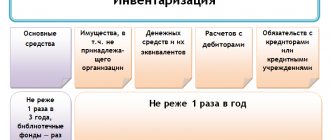

There are several standard forms of such statements:

- INV-18 (the difference between OS and intangible assets is displayed);

- INV-19 (deviations from actual data on inventory and materials are recorded in it).

Already at the end of the year, inventory comparison sheets of the INV-26 form are used to display the results of inspections for the entire reporting period.

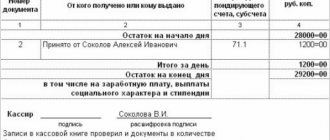

Even before filling out the statements, the responsible person must make sure that all data and calculations were correct. Only after a thorough check are comparison sheets drawn up and inventory results are summed up.

These forms of documents are needed to compare the actual indicators obtained with the data recorded in the accounting documentation. Filling out the inventory comparison sheet is carried out taking into account a number of specific features.

Even small discrepancies in inventory items or operating assets must be reflected in inventory reports. Additionally, accounting certificates are prepared, which indicate the reasons for the shortages. The directions of write-offs depend on this, they can be:

- theft;

- shortages;

- emergency situations (for example, natural disasters);

- damage to valuables due to the negligence of responsible persons.

Officials do not always know how to fill out the matching sheet correctly, in accordance with existing requirements. The following factors must be taken into account:

- differences in amounts caused by misgrading;

- re-grading of goods and materials.

Misgrading refers to the incorrect accounting of goods of any type due to incorrect assignment to one of the varieties. You can read more about what regrading of goods is in the article.

Drawing up inventory comparison sheets presupposes the need for further write-off of losses incurred within acceptable limits (limits of natural loss).

The surpluses or shortages generated during the inspection are indicated in the matching statements as they were assessed and reflected in the accounting records.

The procedure for compiling matching statements deserves special attention. An organization, or rather a responsible person, can use unified registers, where all indicators for inventory lists and reconciliation sheets are combined. They are also compiled if inventory items are not owned by the enterprise, but are listed in accounting. It can be:

- valuables transferred for storage;

- rented valuables;

- goods, materials transferred to the organization for their further processing and use.

During the inspection, a certificate of the results of the inventory check is drawn up. It is transferred to the owners of the valuables along with a copy of the inventory.

All matching statements can be filled out electronically or by hand. Let's consider the features of both matching statements in more detail.

Results

Surpluses and shortages when calculating the actual availability of inventory items and reconciling the corresponding indicators with accounting data are not uncommon phenomena.

To ensure that they do not negatively affect the efficiency of business management, it is necessary to identify them in a timely manner. If possible, optimize through regrading. To reflect and document such results, the INV-19 form is one of the most optimal tools. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What form is used to fill out the matching sheet?

The forms of matching statements are given in the Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88, they can be downloaded on our website:

The matching statement form for budgetary institutions in form 0504092 was approved by Order of the Ministry of Finance dated March 30, 2015 No. 52.

Features of the structure and drafting of the document

The matching statement, prepared according to the INV-18 form, is drawn up in 2 copies. The 1st is transferred to the accounting department, the 2nd is at the disposal of employees who are financially responsible for the inventory resources. Both copies must be signed by the accountant and the financially responsible person (MOL).

The statement compiled according to the INV-18 form records:

- name and main characteristics of the resource being inventoried;

- information about the lessor and the rental period;

- year of release or construction or acquisition of the corresponding resource;

- inventory, factory, passport (or registration) numbers of the asset being inventoried;

- surpluses or shortages recorded in relation to a particular resource.

All statements in the INV-18 form must be stored for 5 years.

For information about what storage periods can be set for documents used by a taxpayer in his work, read the material “What are the storage periods for documents according to the nomenclature of cases?”

Related documents

- Sample. Agreement on repayment of mutual debt

- Sample. Agreement on repayment of mutual debt

- Sample. Cover letter for the accounting report

- Sample. Accompanying register of documents. Form No. 16

- Sample. Certificate No. 1. Components of the actual cost of received material assets

- Sample. Certificate for the act of inventory of settlements with buyers, suppliers and other debtors and creditors (Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Certificate of movement of the actually created reserve for possible loan losses

- Sample. Certificate of verification of compliance with the procedure for conducting cash transactions and working conditions with cash and compliance with clause 9 of Decree of the President of Russia of May 23, 1994 No. 1006

- Sample. Certificate of average monthly earnings for pension calculation

- Sample. Certificate of the amount of earnings taken into account when calculating the pension

- Sample. Certificate of balances of required reserves (Order of the Central Bank of the Russian Federation dated March 30, 1996 No. 02-77)

- Sample. Management balance sheet of the enterprise

- Sample. A conditional example of calculating the amount of funds subject to additional transfer by a credit institution to required reserves when using the right to intramonthly reduce required reserve ratios (Order of the Central Bank of the Russian Federation dated March 30, 1996 No. 02-77)

- Sample. A conditional example of calculating the amount of a fine for underpayment to required reserves (Order of the Central Bank of the Russian Federation dated March 30, 1996 No. 02-77)

- Sample. Accounting for telegraph expenses that will be deducted from the payment amount

- Cash flow statement of a medical insurance organization for compulsory medical insurance. Form No. 4a-insurer (Rosstrakhnadzor order dated April 16, 1996 No. 02-02-12)

- Cash flow statement of an insurance organization. Form No. 4-insurer (Order of Rosstrakhnadzor dated April 16, 1996 No. 02-02-12)

- Report on the movement of products and containers in the kitchen

- Report on the costs of production and sales of products (works, services) of an enterprise (organization) form No. 5-z

- Report on the costs of production and sales of products (works, services) of an enterprise (organization). Form No. 5-з (short)