- Definition and meaning of basic accounting principles

- What are the requirements for accounting?

- Documentation of economic events

- Comparison of financial indicators with planned ones

- Maintaining the completeness of accounting information

- Timely submission of reports

- Requirements for the reporting form

- Data Accuracy

- Significance

- Validity of information

- Economic indicators

- Basic Accounting Rules

Definition

The accounting principle is the basic rule that must be followed in measuring, evaluating and recording business transactions, as well as their display in financial statements.

Unlike the basic tenets of the natural sciences, accounting principles are implemented by humans and may not interact in cases where significant fluctuations occur in the economy. The general use of principles depends directly on the extent to which they meet three important criteria: relevance, objectivity, and feasibility. There are several types of principles:

- enterprise property;

- operation of the enterprise on an ongoing basis;

- unit of monetary measurement;

- calculation methods

How to do accounting?

Companies keep accounting records of property, liabilities and business transactions (facts of economic life) by double entry on interconnected accounting accounts.

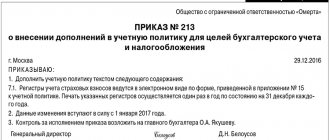

Accounting registers are used to systematize and accumulate information contained in primary accounting documents accepted for accounting, for reflection in accounting accounts and in accounting (financial) statements.

The procedure for reflecting individual facts of economic life in accounting is established by federal and industry accounting standards, as well as by company methodological documents.

All transactions carried out in the company are documented by supporting documents drawn up in accordance with the requirements of the legislation of the Russian Federation on accounting. These documents serve as primary accounting documents on the basis of which accounting is maintained and the company's accounting (financial) statements are compiled.

Data contained in primary accounting documents (accounting objects) are subject to timely registration and accumulation in accounting registers.

Omissions or withdrawals are not allowed when registering accounting objects in accounting registers, as well as registration of imaginary and feigned accounting objects in accounting registers. An imaginary accounting object is understood as a non-existent object reflected in accounting only for appearance (including unrealized expenses, non-existent obligations, facts of economic life that did not take place). A sham accounting object is understood as an object reflected in accounting instead of another object in order to cover it up (including sham transactions recognized as such in accordance with clause 2 of Article 170 of the Civil Code of the Russian Federation).

Reserves, estimated liabilities, funds provided for by the legislation of the Russian Federation, and the costs of their creation are not imaginary objects of accounting.

Such requirements for accounting are established in Part 3 of Art. 6, parts 2 and 3 art. 10, part 2 art. 12 of Law No. 402-FZ.

Important! Micro-enterprises and non-profit organizations have the right to conduct accounting using a simple system (that is, without using double entry), having prescribed such a procedure in the accounting policy (clause 6.1 of PBU 1/2008, part 4 of article 6 of Law No. 402-FZ).

Starting from 2013, the forms of primary accounting documents used (with the exception of government organizations) are determined by the head of the economic entity (clause 4 of article 9 of Law No. 402-FZ). These can be unified forms or your own, developed in compliance with the mandatory details of the primary documents. Before this date, when using unified forms, it was impossible to delete the existing details of such documents; it was only possible to supplement the form with new lines or columns.

At the same time, as practice shows, few economic entities have abandoned the use of the usual unified forms for which most accounting software products are designed.

And only for registration of business transactions for which unified forms of primary accounting documents are not provided, companies independently develop the necessary forms of documents, which are approved by separate administrative documents for the company (usually an appendix to the company’s accounting policy).

For example, to account for production costs, a route sheet is used, which is generated in the software product “1C: Enterprise 8.3” and contains the following information:

- Order number;

- division carrying out order fulfillment;

- basis of order (specification number).

Primary accounting documents can be compiled electronically using an electronic signature in the prescribed manner. A primary accounting document drawn up in electronic form can be accepted for accounting only if it is signed with the electronic signature of the responsible persons in compliance with the requirements and conditions of Art. 6 of the Federal Law “On Electronic Signature” dated April 6, 2011 No. 63-FZ.

A primary accounting document signed with a non-qualified electronic signature can be accepted for accounting if the use of such a signature is provided for by agreement of the parties (Letter of the Federal Tax Service of the Russian Federation dated November 24, 2011 No. ED-4-3 / [email protected] ).

Which documents list accounting requirements?

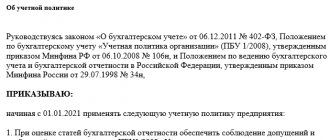

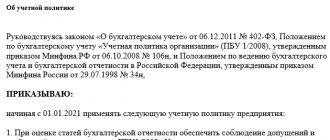

Accounting requirements are established by the law dated December 6, 2011 No. 402-FZ “On Accounting”, as well as by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n “On approval of the Regulations on Accounting...”. At the same time, the provisions of these regulations, although they overlap in meaning in terms of establishing accounting requirements, still have some nuances.

Thus, Law 402-FZ, Chapter 2, entitled “General Accounting Requirements ” establishes:

- list of accounting objects;

- a list of persons who are required to maintain accounting, are exempt from it, or have the opportunity to maintain accounting in a simplified version;

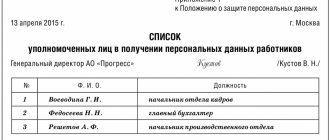

- principles of organizing accounting (who can be entrusted with accounting responsibilities, what qualifications should the person responsible for accounting have);

- general requirements for accounting policies;

- rules for drawing up primary documentation;

- the procedure for compiling and maintaining accounting registers;

- general requirements for inventory;

- rules for monetary measurement of accounting objects;

- general requirements for accounting;

- clarification of the concepts “reporting date”, “reporting period”;

- features of preparing accounting reports during the reorganization and liquidation of legal entities;

- rules for submitting legal deposit statements;

- obligation to maintain internal control by a business entity.

Read about what accounting studies in the publication “What is the subject of accounting?”

In turn, order No. 34n includes among the accounting requirements:

- the need to use double entry using accounting accounts;

- rules for approving the working chart of accounts;

- the procedure for monetary valuation of accounting objects;

- requirements for the language used to document facts of economic activity in the Russian Federation;

- brief requirements for accounting policies;

- the need for separate accounting of current and capital costs.

Order No. 34n also provides rules (which it does not directly call accounting requirements, unlike Law No. 402-FZ):

- documenting business operations;

- compiling and maintaining accounting registers;

- valuation and inventory of assets and liabilities;

- preparation and submission of accounting reports.

Thus, in general, the considered regulations constitute a complete picture of modern accounting requirements . Let's take a closer look at them.

Who is completely exempt from accounting?

Completely exempt from accounting:

- an individual entrepreneur (if he keeps records of income or income and expenses and (or) other objects of taxation or physical indicators in the manner established by Russian tax legislation);

- A branch, representative office or other structural unit of a company located on the territory of Russia, created in accordance with the legislation of a foreign state (if they keep records of income, expenses and (or) other objects of taxation in the manner established by tax legislation).

Such rules are established by clauses 1 and 2 of Article 6 of Law No. 402-FZ.

1.1. Main tasks of accounting in credit institutions

Currently, the main issues of accounting in banks (credit institutions) are regulated by Bank of Russia Regulation No. 579-P dated February 27, 2021 “On the Chart of Accounts for Credit Institutions and the Procedure for its Application,” registered by the Ministry of Justice of Russia on March 20, 2021 No. 46021.

This Regulation establishes uniform legal and methodological principles for constructing accounting, mandatory for all credit institutions in Russia. This Regulation was developed in accordance with the Civil Code of the Russian Federation, Federal Laws “On the Central Bank (Bank of Russia)” and “On Banks and Banking Activities”.

In accordance with this Regulation, the main objectives of accounting, in relation to credit institutions, are:

- generation of reliable, detailed and meaningful information about all types of economic activities of the credit organization, its property status. This information is necessary, first of all, for internal users, which include bank managers, as well as its owners (founders), as well as external users of financial statements - large clients of the bank, holders of its bills and bonds, other creditors, potential clients, as well as state regulatory authorities, including tax authorities;

- identifying the internal financial reserves of a credit institution to ensure full stability, minimize all types of emerging risks, as well as accurate and complete compliance with mandatory economic standards established by the Bank of Russia;

- maintaining reliable accounting records of all financial and banking transactions, the movement of all claims and obligations of the credit institution, monetary and other valuables held by it, the procedure for the credit institution’s use of all types of material and financial resources, in order to prevent shortages, theft, and misuse of any types of valuables ;

- ensure complete internal control over the movement of all types of material and financial assets, the legality of all transactions performed by the credit institution;

- ensure that effective management decisions are made by the management of the credit institution based on accounting data.

Who can do accounting in a simplified way?

“Kids” (small businesses) can do accounting in a simplified way.

However, the situation changes if the “kids” are subject to mandatory audit. In this case, the company is faced with the need to ensure the maintenance of accounting records in full, including the formation of differences between accounting and tax accounting in the accounting accounts (i.e., apply PBU 18/02, approved by Order of the Ministry of Finance of the Russian Federation dated November 19, 2002. No. 114n), create a reserve for vacation pay (i.e. apply PBU 8/2010, approved by Order of the Ministry of Finance of the Russian Federation dated December 13, 2010 No. 167), etc.

The simplified method can be used by organizations that have received the status of participants in the Skolkovo project and non-profit organizations (clause 4 and clause 5 of Article 6 of Law No. 402-FZ).

Results

The requirements that modern accounting must meet are aimed primarily at increasing the reliability of the information contained in the financial statements. They must be adhered to by all persons responsible for accounting.

For information about who may be interested in accounting data, read the article “Users of accounting information - who are they?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Entrust your accounting to professionals - specialists!

Errors and inattentive attitude of company management to accounting issues can lead to penalties. It is extremely important to either provide the staff with a sufficient number of specialists with the necessary experience, or, which is more reliable, simpler and more profitable for the manager, to transfer the solution of these tasks to a third party.

Important! offers accounting services and solutions to other issues related to the work of accounting, with a guarantee of quality. Choose a modern offer for your business!