Unfortunately, many managers do not always fully realize that it is necessary to maintain accounting and tax records in accordance with the norms of current legislation, because the consequences of incorrect accounting and tax records sometimes cost us too much.

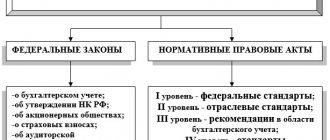

Accounting legislation is regulated by the Law “On Accounting” No. 402 FZ, as well as the Accounting Regulations (PBU) and other regulatory documents. Tax legislation requirements are determined by the Tax Code, as well as orders of the Ministry of Finance, Federal Tax Service, etc.

Who has the right not to keep accounting records?

The Law of the Republic of Kazakhstan “On Accounting and Financial Reporting” allows individual entrepreneurs not to maintain accounting records (AC) and not to prepare financial statements.

In order for an individual entrepreneur to be exempt from accounting and preparation of financial statements, he must simultaneously meet the following conditions:

- from the point of view of tax accounting, apply one of the special tax regimes: patent or simplified declaration;

- not be registered for value added tax (VAT);

- not to appear .

If an individual entrepreneur does not meet at least one of the conditions, then such a person cannot be exempted from maintaining accounting records and preparing financial statements.

However, even if all of the above conditions are met, an individual entrepreneur has the right to decide to maintain accounting records and prepare financial statements, despite the absence of an obligation.

Important!

Individual entrepreneurs who do not maintain accounting records are not exempt from registration of business transactions.

Simplification is not for everyone

A simplified taxation system has become widespread. And it will become more accessible to small businesses. This is evidenced by the decision of the Supreme Arbitration Court of the Russian Federation, which confirmed the legality of multiplying annual deflator coefficients to determine the income limit. This means that today the simplified tax system has the right to be used by organizations and individual entrepreneurs whose annual income does not exceed 57.9 million rubles. The legislative initiative supported by the Chairman of the Government of the Russian Federation was not far from this figure - 60 million rubles.

But there are still many problems with using the simplified system. And one of the problems is related to the emerging difficulties in accounting and reporting.

Having introduced a simplified taxation system, the legislator made it mandatory to maintain tax records. Taxpayers using the simplified tax system keep records of their activity indicators for the purpose of calculating the tax base for a single tax in the book of income and expenses (Article 346.24 of the Tax Code of the Russian Federation). This norm corresponds to clause 3 of Art. 4 of Federal Law No. 129-FZ of November 21, 1996 “On Accounting,” which also establishes the obligation to maintain tax records. At the same time, organizations that switched to the simplified tax system received the right not to maintain accounting records, with the exception of accounting for fixed assets and intangible assets.

And many took advantage of this right. At the same time, it actually turned out that not all organizations have the right not to keep accounting records. The Ministry of Finance of Russia has repeatedly drawn attention to this in its letters (dated 03/11/04 N 04-02-05/3/19, 12/15/05 N 03-11-04/2/154, 09/02/08 N 03-11-04/ 02/131, 09.19.08 N 03-11-04/2/142, 04.20.09 N 03-11-06/2/67).

Norm clause 3 art. 4 of the Federal Law “On Accounting” cannot be applied to limited liability companies in principle.

Namely, this organizational and legal form is most common among small business organizations. And this rule also does not apply to joint stock companies. In particular, for limited liability companies and joint-stock companies, accounting is necessary, at a minimum, to calculate net assets, determine net profit and pay dividends, when allocating a participant’s share, when making large transactions. Moreover, all of these calculations are mandatory due to the direct indication of this in the Civil Code of the Russian Federation, in Federal Laws dated 02/08/98 N 14-FZ “On Limited Liability Companies” and dated 12/26/95 N 208-FZ “On Joint-Stock Companies”.

Since the accounting legislation is general in relation to the legislation on limited liability companies and joint stock companies, the latter has priority over it.

The need for accounting by joint-stock companies was indicated by the Constitutional Court of the Russian Federation in its ruling dated June 13, 2006 N 319-O: accounting reporting ensures information openness and the opportunity for shareholders to exercise their rights, including the right to receive information about the activities of the joint-stock company.

Of course, maintaining full accounting records for small businesses is extremely difficult and burdensome. Therefore, a way out of this situation may be a significant simplification of the rules of accounting and reporting for this category of taxpayers.

But even when maintaining accounting records and preparing financial statements, an organization, as a rule, will not be able to submit it to the tax authority - the statements will simply not be accepted, since the organization uses a simplified taxation system, and it does not appear in the list of statements submitted by such a taxpayer. Moreover, such taxpayers do not have the obligation to submit it to the tax authorities - clause 5 of Art. 23 Tax Code of the Russian Federation.

But organizations using the simplified tax system are required to submit tax reports. Since January 1, 2009, there have been significant changes to tax reporting requirements. Namely, starting from this year, tax returns for a single tax are not submitted to the tax authorities based on the results of reporting periods - quarter, half-year, 9 months (clause 1 of Article 346.23 of the Tax Code of the Russian Federation). That is, the tax return is submitted only once - at the end of the tax period. The volume of tax reporting submitted for transport and land taxes has been reduced. From paragraph 3 of Art. 363.1 and paragraph 2 of Art. 398 of the Tax Code of the Russian Federation has excluded the requirement to submit tax calculations for advance payments for transport and land taxes. But this applies to organizations that apply a simplified taxation system or pay a single agricultural tax.

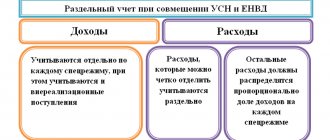

Often, organizations using the simplified tax system pay a single tax on imputed income for certain types of their business activities.

And when using, for example, vehicles in activities transferred to the payment of UTII, the organization still retains the obligation to submit tax calculations for advance payments (letter of the Ministry of Finance of Russia dated April 29, 2009 N 03-05-05-04/03). A similar conclusion is fully applicable to tax calculations for advance payments of land tax.

www.palata-nk.ru

How do individual entrepreneurs who do not maintain accounting records keep tax records?

Individual entrepreneurs who do not keep accounting records, when maintaining tax accounting (TA), apply the provisions, as well as specialized rules approved by the authorized body. The rules for maintaining tax records for these taxpayers have been approved.

Chapter 24 of the Tax Code of the Republic of Kazakhstan and the rules for maintaining tax accounting for these persons establish the basic provisions, based on which taxpayers must maintain and reflect data on their tax accounting activities.

According to the National Tax Code, such taxpayers are required to maintain primary documentation, compile tax registers and conduct inventories. Also, the individual entrepreneur must have an approved tax accounting policy, which reflects the basic principles and provisions for accounting.

As primary documents

, taxpayers use primary accounting documents approved by authorized bodies. The forms of primary accounting documents are approved by Order of the Ministry of Finance of the Republic of Kazakhstan dated December 20, 2012 No. 562. If there is no approved form to reflect a financial and economic transaction, then taxpayers can use forms developed independently.

The requirements applied when drawing up primary documents are contained in paragraphs 22-36, approved by Order No. 241 of March 31, 2015.

Thus, the rules prohibit making corrections to cash and bank documents. In other primary documents, corrections are allowed, but with the consent of the participants in the transactions, which must be confirmed by their signatures.

When drawing up primary documents, an individual entrepreneur has the right not to indicate accounting accounts in them.

Based on the data from primary documents, entries are made in the appropriate tax registers.

For individual entrepreneurs who do not maintain accounting records, specialized

tax registers

, which are approved by Order No. 271 of April 15, 2015:

- Tax register for income accounting;

- Tax register for accounting of purchased goods, works and services;

- Tax register for recording the income of individuals taxed at the source of payment, tax obligations on such income, obligations to record mandatory pension contributions and social contributions, including all taxes and deductions;

- Tax register for recording tax obligations for payments for emissions into the environment and payments for the use of surface water resources.

Cash accounting

Accounting for transactions and money in the cash register can be carried out either personally by the individual entrepreneur or by his authorized person.

Transactions that were carried out in foreign currency are subject to conversion at the exchange rate determined on the date of the transaction. Individual entrepreneurs do not take into account exchange rate differences arising on such transactions.

Inventory accounting

Reserves

– assets intended for sale, as well as use in the production process, for administrative purposes or when performing work or providing services.

In NU, inventories are recognized at cost at the time they are received by the individual entrepreneur or his authorized representative of the individual entrepreneur. Inventories can also be recognized when they are produced, received as a result of dismantling fixed assets, etc.

The cost of inventories includes the cost of costs associated with their acquisition (duties, taxes, except those that are reimbursed), costs associated with processing, other costs incurred to bring inventories to the required condition, and delivery costs.

Thus, the cost of inventories is determined based on actual costs.

In this case, the cost of a unit of inventory can be determined using the weighted average cost method (as the average cost at the beginning, taking into account receipts for the period).

If an individual entrepreneur uses the weighted average cost method, then data on the method used is indicated in the accounting policy.

Inventory receipts and disposals are reflected in a specialized tax register for inventory accounting, the form of which is determined by the individual entrepreneur independently.

If inventories are moved between materially responsible persons (MRP) of an individual entrepreneur, then such a movement is recognized as internal, and it is not income of the individual entrepreneur.

When transferring inventories to another person or organization as customer-supplied raw materials or for storage, such a transfer is not recognized as a disposal of inventories.

When receiving inventories for storage, the cost of the received inventories is also not recognized as income of the individual entrepreneur.

Carrying out an inventory

The inventory is carried out in order to establish the reliability of tax accounting data on the assets and liabilities of the individual entrepreneur.

All property is subject to inventory, regardless of its location. When conducting an inventory, a count is made of property that does not actually belong to the individual entrepreneur: accepted for safekeeping, processing, received under commission agreements and on other grounds.

The frequency of inventory is determined by the individual entrepreneur. Inventories carried out taking into account the established frequency are planned.

In addition to scheduled inventories, unscheduled inspections may also be carried out.

Unscheduled inventories are required in the following cases:

- theft, damage to property;

- natural disasters, fire, accident and other emergencies;

- transition to accounting and financial reporting.

Based on the data of the conducted inventories, inventory lists are compiled, which confirm the existence of the inventory property. Separate inventories are compiled for property that is recognized as having fallen into disrepair, as well as for property that does not belong to, but is owned by, the individual entrepreneur.

Surpluses identified during inventory are recognized as income of an individual entrepreneur.

The procedure for determining income from business activities

Income

– an increase in economic benefits during an accounting period in the form of an inflow or increase in assets or a decrease in liabilities that results in an increase in capital other than an increase attributable to contributions from a participating party.

The income of an individual entrepreneur who does not keep accounting records is measured at the cost of the compensation received, or receivable, taking into account the discounts provided.

Individual entrepreneurs who do not keep accounting records may have the following types of income: income from sales, income from performing work, providing services, income from writing off obligations, income identified as a result of an inventory, income in the form of fines, penalties, penalties, income from assignments rights of claim, etc.

Income from sales is recognized as an individual entrepreneur if the following conditions are simultaneously met:

- Transferring significant risks to the product to the buyer;

- Transfer of the right to manage and control the goods, which entails the transfer of ownership;

- The amount of income can be reliably measured;

- Transaction costs can be reliably measured;

- The likelihood that economic benefits will flow from the transaction.

Provisions on types of income and rules for their determination are established in Article 682 of the Tax Code of the Republic of Kazakhstan.

Transitional provisions

If an entrepreneur does not maintain accounting records and does not prepare financial statements, but has ceased to meet the conditions imposed for this category of persons, then he is obliged to begin maintaining accounting records from the next month after the identified discrepancy.

Example

In July, the individual entrepreneur’s taxable turnover reached the value at which mandatory registration for VAT is required. From August, individual entrepreneurs are required to switch to accounting and preparation of financial statements.

If the individual entrepreneur meets the requirements, but at the same time makes a decision to maintain accounting records, then an individual entrepreneur can begin maintaining accounting records from the next month, after making such a decision.