DESCRIPTION OF THE PROBLEM

Various regulatory legal acts on accounting provide for a wide range of approaches and methods for forming the cost of manufactured products, ranging from limiting this cost only to direct cost items and ending with the formation of the so-called full cost, which implies the inclusion in it, in addition to direct costs, of all general production and general business expenses. In practice, both of these extreme options are used, as well as various intermediate options. Such varied practices result in incomparable reporting among different organizations and thereby reduce the value of this information.

In addition, when talking about the cost of production, as a rule, it is not specified what “cost” is meant. In some cases, we may be talking about cost as a way of estimating inventories, when the question relates to the indicator of balances of finished goods (and work in progress) presented in the balance sheet. In other cases, we may be talking about the cost of products sold (goods, works, services), when the question relates to the “cost of sales” indicator presented in the balance sheet. The essence of these indicators is fundamentally different, which is why the approaches used in their formation cannot be identical.

The solution to emerging issues comes down to the formulation of acceptable approaches to accounting for general production and general business expenses, as well as the unification of these approaches by determining a uniform procedure for their accounting.

Accounting for general business expenses

To summarize information about expenses for management needs not directly related to the production process, the “General business expenses” account is intended. In contrast to the distribution of general production expenses, general business expenses on account 26 in most cases are not divided, from the point of view of analytical accounting, among the various structures of the organization. After all, as a rule, a company has only one administrative and management division, which is responsible for overseeing its work as a whole. However, if accounting tasks require it, the organization can maintain additional parameters for data reflection.

At the same time, the reflection of the costs themselves in various areas (wages, materials, rent, depreciation, etc.) will be similar to the registration of entries in account 25 “General production expenses”. That is, the postings in this case will be formed exactly according to the same principle: from the credit of accounts for inventory accounting, settlements with employees for wages, settlements with other organizations (individuals) to the debit of account 26. At the end of the month, as well as general production, general business expenses are written off by posting to the debit of accounts 20, 23 or 29.

If we are talking about companies that do not carry out production activities, but, say, are engaged in the provision of services, then such organizations can use account 26 to summarize information about expenses for all their activities. In this case, the expenses reflected on it will be written off at the end of the month not through account 20, but immediately to the debit of account 90 “Sales”.

SOLUTION

1. All general business expenses, as well as the part of general production costs not included in the cost of inventories in accordance with paragraph 3 of this Recommendation, are recognized as expenses and are included in the financial results of the period in which they were incurred.

2. General production costs are included in the cost of inventories, unless otherwise established by paragraph 3 of this recommendation.

3. If production capacity utilization in the reporting period has decreased significantly compared to the normal (usual) level (except for cases of predicted seasonal fluctuations in production volumes), the organization includes the cost of inventory and production overhead in the following order. Variable production overhead costs are included in the cost of inventories in full. Conditionally fixed overhead costs are included in the cost of inventories only in a part proportional to the ratio of the volume of products produced in the reporting period to the volume of production at normal (usual) capacity utilization. The remaining part of the conditionally fixed overhead costs is recognized as an expense of the reporting period in accordance with paragraph 1 of this Recommendation.

BASIS FOR CONCLUSIONS

Underutilization of production capacity is most often due to an insufficient order portfolio. Costs associated with heating, lighting, maintenance of underutilized capacity, depreciation, wages of management and maintenance personnel of workshops, rent for premises and equipment of workshops, services of auxiliary production, etc., taken into account as part of general production expenses that do not depend on volume of output of finished products are distributed to the cost of actual production of finished products.

Thus, the cost of a unit of finished products includes that part of the fixed overhead costs that, if the Company’s production capacity was fully utilized, would be distributed among the cost of other products. As a result, the Company faces the problem of overestimating unit costs when the order book is insufficient.

Currently, the procedure for the formation of work in progress and the cost of a unit of product is not determined by regulatory acts on accounting in the Russian Federation. Companies develop cost accounting methods on their own.

In accordance with paragraph 7 of PBU 1/2008 “Accounting Policies of an Organization,” if the regulations do not establish accounting methods for a specific issue, then the organization independently develops an appropriate method based on accounting provisions, as well as International Financial Reporting Standards.

According to IAS 2 “Inventories”, the cost of inventories includes the costs of processing inventories, such as direct labor costs that are directly related to the production of products. Also included in the cost of inventories are allocated fixed and variable manufacturing overhead costs that arise when processing raw materials into finished products. At the same time, the cost of finished products does not include part of the fixed production overhead costs associated with underutilization of the Company’s production capacity.

According to paragraph 13 of IAS 2 Inventories, the allocation of fixed manufacturing overheads to processing costs is based on the normal production capacity of the production facility. The amount of fixed overhead allocated to each unit of output is not increased as a result of low production levels or idle time. Unallocated overhead costs are recognized as an expense in the period incurred. Variable manufacturing overhead is charged to each unit of production based on actual capacity utilization.

Thus, the Company is developing a suitable method for forming the cost per unit of production when production capacity is not fully utilized, taking into account the specifics of the activity and the provisions of IAS 2 “Inventories”, which regulates this procedure.

As part of setting up the methodology for forming the cost of finished products when the Company’s production capacity is not fully utilized, it is necessary to solve the following tasks:

Develop a procedure for allocating fixed overhead costs to the unit cost of finished products and period expenses, taking into account capacity utilization in the reporting period;

Determine the procedure for classifying costs that are not included in the cost of finished products due to incomplete capacity utilization, for the purpose of being reflected in the accounting (financial) statements.

1. The procedure for assigning fixed overhead costs to the unit cost of finished products and period expenses, taking into account capacity utilization in the reporting period.

The application of the approach to attributing fixed production overhead costs to the cost of a unit of finished products based on the normal productivity of production facilities in practice is associated with the solution of a number of issues for the Company.

In particular, it is necessary to define and develop a methodology for calculating the normal productivity of production facilities. In addition, it is necessary to determine a list of fixed and variable overhead costs.

Normal productivity of production facilities means the volume of output of finished products (or hours of work), which is achieved taking into account the usual load of the existing equipment park and production space for the organization, as well as taking into account normal conditions associated with the market needs for products manufactured by the Company, the required quantity repairs and preventive maintenance for this type of production facilities.

According to IAS 2 Inventories, actual production can be used if it approximates normal production.

The calculation of the normal productivity of production facilities is carried out by economic services based on the shifts established in the Company and the length of the working week, which are considered normal for the Company in the current market conditions.

Every month during the year, fixed overhead costs should be included in the cost of finished products in proportion to a coefficient calculated as the ratio of the actual utilization of production capacity to the indicator of normal utilization of production capacity. The specified coefficient is calculated using the formula:

Kfz=FZ/NZ, where

Kfz – coefficient of actual production capacity utilization,

Federal Law is an indicator of the actual utilization of production capacity,

NZ is an indicator of normal utilization of production capacity.

The indicator of normal productivity of production facilities can be expressed in units of measurement of finished products (pieces, kg, linear meters, etc.), or in units of measurement of labor intensity (standard hours, machine hours, etc.). This is determined by the nature of production.

The procedure for determining the normal productivity of production facilities and the actual utilization rate of production facilities, in proportion to which fixed overhead costs are written off to the cost of a unit of finished products, is fixed in the Company’s local regulations.

The list of fixed and variable production overhead costs also depends on the specifics of the Company’s activities and is independently approved in its local regulations.

2. The procedure for classifying costs that are not included in the cost of finished products due to incomplete capacity utilization, for the purpose of being reflected in the accounting (financial) statements.

Fixed production overhead costs (fixed production overhead costs) incurred during periods of underutilization of production capacity are included in the “Sales Profit (Loss)” indicator of the Income Statement.

Thus, if these expenses are significant, they are reflected in the Income Statement as a separate line, for example, “Other overhead expenses.” If the amount of such expenses is insignificant, it can be included in the “Cost of sales” indicator, or in "Management expenses".

The explanations to the accounting (financial) statements provide relevant information characterizing the costs associated with incomplete utilization of production capacity (for example, the types of costs included in this indicator, the calculation procedure and the percentage of capacity utilization, etc.).

Accounting for overhead costs

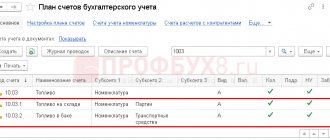

To reflect costs that are directly related to the production of any product, the Chart of Accounts uses account 25 “General production expenses”. Postings on it are reflected taking into account information about the costs of servicing the main and auxiliary production facilities of the organization. The debit of this account accumulates data on the composition of costs, which are also reflected in the credit of accounts payable to personnel, accounting for inventory, rental deductions, etc. Simply put, analytical accounting for account 25 can be carried out in the context of various expense items. If the company has many divisions, workshops or similar separate structures, then it is also advisable to carry out analytics on account 25 “General production expenses” taking this factor into account, using additional division. General production expenses are written off by posting from the credit of account 25 to the debit of accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”. This entry is made at the end of the month, thus the accumulated cost data on account 25 is reset to zero.

An example of reflecting general business expenses and postings:

| D25-K10 | Materials written off for general production purposes |

| D25-K02 | Accrued depreciation of general production equipment |

| D25-K70 | Wages paid to employees involved in production |

| D25-K69 | Insurance premiums are calculated on the wages of workers involved in production. |

| D25-K60 | Works/services of third party suppliers purchased for general production purposes are accepted |

| D20-K25 | General production expenses were written off as expenses of the main production |