Journal of business transactions

- Accounting for labor and its payment (3rd lesson).

Basic points you need to know about labor accounting.

The organization independently establishes the forms, systems and amounts of remuneration, as well as other income of employees.

The main forms of remuneration are:

- time-based - payment is made for a certain amount of time worked;

- piecework - payment is made for the number of units of manufactured products based on piecework prices.

The primary documents that are used to maintain labor records are personnel documents approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1: unified forms NN T-1, T-2, T-3, T-6, T-7, T- 8, T-9, T-10 and 10a, T-12, etc.

Deductions from wages are made in accordance with the law (personal income tax).

When a taxpayer is provided with a tax deduction, this means that when calculating personal income tax, no tax will be charged on the amount of the deduction. Standard tax deductions are as follows:

- 400 rub. - for an individual; is provided until the employee’s income, calculated as a cumulative total from the beginning of the year, does not exceed 40,000 rubles;

- 1000 rub. for one child under 18 years of age or up to 24 years of age for a student studying full-time at a university; is provided only until the employee’s income, calculated as a cumulative total from the beginning of the year, does not exceed 280,000 rubles;

- other deductions.

The Unified Social Tax is a tax (Chapter 24 of the Tax Code of the Russian Federation) that is paid by all employers; The object of taxation is all payments accrued to employees, as well as all payments accrued under civil contracts.

The UST rate is 26%. When an employer pays contributions to compulsory pension insurance (hereinafter referred to as OPS) for an employee, he finances two parts of the future pension: insurance and funded. In total, contributions to the OPS are 14%, while if an employee was born in 1966. and older, then all 14% is the insurance part of the pension; if the employee was born in 1967 and later, the contributions will be, respectively, 8% to the insurance part of the pension and 6% to the funded one.

Journal of business transactions

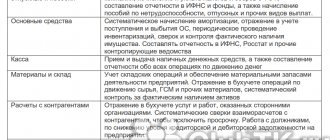

Basic points you need to know about inventory accounting.

Inventories (hereinafter referred to as inventories) are part of the property:

- used in the production of products, performance of work, provision of services intended for sale (raw materials, fuel, containers, etc.);

- intended for sale (raw materials, finished products);

- used for administrative needs (auxiliary materials, spare parts).

Accounting for the receipt of materials and materials is carried out on account 10 “Materials”.

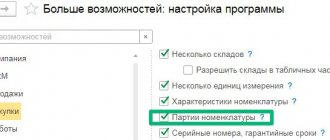

The choice of accounting scheme for the capitalization of material assets is determined in the accounting policy of the enterprise and can be carried out in two ways:

- at actual cost and accounted for on account 10;

- according to invoice value using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviations in the cost of material assets”.

When releasing materials into production, the following inventory valuation methods can be used:

- at average cost;

- at the cost of the first purchases (FIFO method).

Cross-cutting task (Table 3). Materials were purchased from the supplier and written off using the FIFO method. 1st arrival: 1000 m x 4.56 rub. 897 m written off for production. 2nd receipt: 800 m x 3.20 rub. 900 m are written off for production. 3rd receipt: 1000 m x 6.10 rub. 1001 m were written off for production. Amounts are indicated without VAT.

Journal of business transactions

The accounting policy of the enterprise establishes that the costs of auxiliary production are distributed among individual productions in proportion to the direct costs of their maintenance.

The costs of auxiliary production will be distributed in the following order:

- expenses related to the activities of the main production - 58,049 rubles. (170,000 / 205,000 x 70,000);

- expenses related to the activities of service production - 11,951 rubles. (35,000 / 205,000 x 70,000).

Journal of business transactions

Basic points you need to know about accounting for intangible assets.

Intangible assets are abbreviated as intangible assets.

The main regulatory document for accounting for intangible assets (hereinafter referred to as intangible assets) is the Accounting Regulations “Accounting for Intangible Assets” PBU 14/2000, approved by Order of the Ministry of Finance of Russia dated October 16, 2000 N 91n.

In order for an asset to be recognized as intangible, it must have the following properties:

- have no material form;

- used for production needs or enterprise management;

- be used for a long time, i.e. more than 12 months;

- bring income to the organization;

- purchased not for resale.

Intangible assets include patents, licenses, etc.

Accounting for intangible assets is carried out at historical cost, which includes the acquisition price and costs accompanying the acquisition and readiness process.

The methods of depreciation of intangible assets coincide with the methods established for fixed assets, with the exception of the method of writing off the cost by the sum of the numbers of years of the useful life.

To register intangible assets at an enterprise, primary documents must be drawn up, which have a unified form and are approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a: NN NMA-1, OS-1, as well as other documents that the organization can independently develop and approve.

Journal of business transactions

The main points you need to know about the organization’s income.

According to PBU 9/99, an organization’s income is recognized as an increase in economic benefits during the reporting period or a decrease in accounts payable, which lead to an increase in capital other than the contribution of the owners.

Revenue is recognized in the income statement when the resulting increase in future economic benefits associated with the related property or decrease in accounts payable can be known with reasonable reliability.