What payments are not subject to insurance premiums?

Where is the employer obliged to pay them, and what liability can he incur for non-payment? Answers to these questions in the article Firmmaker. The history of insurance premiums is quite young. The emergence of social insurance was facilitated by the development of the economy and the emergence of labor relations, as a result of which employees began to need social protection. The first mentions of social insurance go back to the 19th century, at which time the Bismar Code of Imperial Laws appeared in Germany.

The amount of additional pension contribution rates is determined depending on the fact of a special assessment of jobs. These contributions are paid in addition to the basic tariffs; they allow certain categories of workers to retire earlier and receive pension benefits.

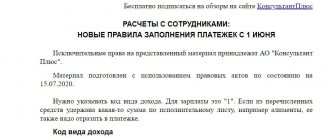

The codes also allow you to directly differentiate between deductions, penalties and fines for late payment.

Transfer of contributions to the budget is carried out according to the rules of Art. 432 of the Tax Code of the Russian Federation - no later than the 15th day of the month following the reporting period.

Deadline for payment of social insurance contributions in 2021

Employee social insurance contributions (VNIM) are paid to the budget monthly - until the 15th. If the deadline for payment falls on a non-working day, it is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

So, in 2021, the deadline for paying social contributions will be postponed in February, March, August and November. More details about the specific deadlines for paying social contributions can be found in this article.

Insurance premiums for employees in 2021

The rate of insurance contributions to the Pension Fund is 22%. This rate is applied until the income limit of 1,292,000 rubles is reached.

In addition to the listed documents, Decree of the Government of the Russian Federation No. 713 is important, which sets out the conditions for classifying types of economic activities into certain occupational risk groups. The establishment of insurance rates for OSS will depend on these risk groups, and the main types of economic and production activities are subject to annual confirmation.

The OSS system is global, and areas of responsibility within it are distributed among various bodies that help citizens in the event of various types of insurance situations.

Let us remind you that insurance contributions for compulsory pension insurance are limited ... - no more than eight times the fixed amount of insurance contributions for compulsory pension insurance, then ... 8). Thus, the maximum amount of insurance premiums for an individual entrepreneur will be equal to...

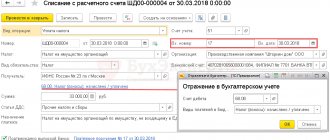

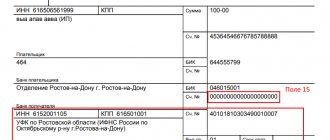

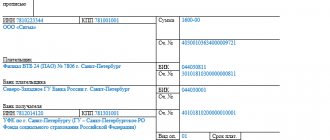

How to fill out fields 104-109 in a payment order for VNiM contributions

Fields 104-109 in the payment order are the most important, so we have placed the order of filling them out in a separate table:

| Line title | Number | Note |

| 104 | Budget classification code | For contributions paid to VNiM, indicate code 182 1 0210 160 |

| 105 | OKTMO code | OKTMO inspection, to which contributions are transferred. Companies indicate the code at their location (legal address), individual entrepreneurs - at the place of registration, separate divisions - at their location |

| 106 | Payment basis code | If contributions are transferred on time, we enter the code “TP” (current payments). When paying off a debt voluntarily, you need to enter the code “ZD”, and when paying at the request of the Federal Tax Service - “TR” |

| 107 | Taxable period | The tax period for employee social security contributions is a calendar month. Therefore, the payment slip indicates the abbreviation “MS”, month number and year. For example, for contributions for January 2021 you need to indicate “MS.01.2020” |

| 108 | Document Number | We put “0” if the fees are paid on time, and the code “TP” is in field 106. If payments are transferred at the request of the Federal Tax Service (code “TR” in field 106), in these fields you must indicate the number and date of the request for payment |

| 109 | Document date |

Sample payment order for VNiM contributions

Voluntary OSS insurance in case of VNIM

The policyholder pays insurance premiums from the organization’s funds, without deducting this amount from the employee’s salary.

Insurance against accidents and illnesses resulting from the performance of work duties.

Fact! The assignment of insurance compensation is not the main form of classification of OSS. Typically, classification is based on the authorities responsible for insurance payments.

Center for Accounting Services Comprehensive accounting support for organizations and individual entrepreneurs, registration and liquidation of legal entities, legal advice, etc. 353925 Russia Krasnodar region Novorossiysk st.

What are insurance premiums and when did they arise?

Categories of insurance premium payers who have the right ... to apply reduced tariffs Insurance premium rate, % In ... which - not. Payments (remunerations) are subject to insurance contributions. Payments (remunerations) are not subject to insurance contributions. For...

As for insurance payments in case of accidents and accidents, an individual entrepreneur has the right not to make them “for himself”.

OSS is a component of the overall state social protection system. The task of the OSS is to protect citizens from serious changes in their financial/social situation in the event of problematic (insurance) situations.

Deductions for compulsory medical insurance, regardless of the amount of income, are:

- 5840 rub. - for 2021;

- 6884 rub. - for 2021;

- 8426 rub. — for 2021

One of the fundamental systems for ensuring the financial security of Russians is compulsory social insurance. This system is complex, consisting of several component elements, which will be discussed further.

Option 1 – the base for calculating insurance premiums did not exceed the established limit, the salary was 20,000 rubles.

If you look at the KBK for 2021, the changes did not affect insurance premiums. So this year there will be fewer mistakes. However, they may occur in the process of filling out other fields in the payment order.

You can pay earlier, but not later. However, if you are late in payment, you still need to pay as soon as possible, since penalties will then be charged for each day of delay.

Insurance contributions to extra-budgetary funds must be paid by all organizations and entrepreneurs, although there are differences in individual insurance contributions for companies with and without employees. There is one detail on which the correct transfer of insurance premiums in 2021 depends - KBC. We will find out what it is, why it is needed and how it changes.

In this case, the average earnings from which the benefits are calculated are assumed to be equal to the minimum wage established on the day the insured event occurred.

Tariffs for insurance premiums

To calculate contributions for pension, health insurance and in case of VNIM, the following are established:

- Basic tariffs

- Reduced rates

- Additional tariffs for OPS

VNiM contributions are insurance contributions to the Social Insurance Fund for temporary disability and maternity.

Basic tariffs of insurance premiums for compulsory health insurance, compulsory medical insurance and for cases of VNiM

If the employer does not have the right to apply reduced tariffs, then insurance premiums must be calculated from the salaries of employees according to the basic

tariffs.

| Rates | Insurance premiums for OPS | Insurance premiums for VNIM (in case of temporary disability) | Insurance premiums for compulsory medical insurance |

| From payments within the established limit of the base for calculating contributions | 22% | 2.9%, 1.8% - from payments to foreigners and stateless persons temporarily staying in the Russian Federation (except for highly qualified specialists) | 5,1% |

| From payments in excess of the established limit of the base for calculating contributions | 10% | X |

Reduced rates of insurance premiums for compulsory medical insurance, compulsory medical insurance and for cases of VNIM

Reduced rates are provided for policyholders making payments and other remuneration to individuals

insurance premiums. In this case, contributions are calculated within the established limit of the base.

This means that if an employee’s salary exceeds the base limit, then insurance premiums for payments in excess of the established limit are not charged.

| Policyholders | Rates |

| Individual entrepreneurs and organizations included in the SME register for payments in excess of the minimum wage | From 04/01/2020: for compulsory medical insurance - 10.0%, for VNiM - 0%, for compulsory medical insurance - 5% This tariff also applies to payments in excess of the established maximum base amount |

| Charitable organizations on the simplified tax system | During 2021 - 2024: for compulsory medical insurance - 20.0%, for VNiM - 0%, for compulsory medical insurance - 0% |

| Non-profit organizations (except for state (municipal) institutions) on the simplified tax system, carrying out activities in the field of social services for citizens, scientific research and development, education, healthcare, culture and art, mass sports (with the exception of professional) | |

| Organizations engaged in the production and sale of animated audiovisual products produced by them | During 2021 - 2023: for compulsory medical insurance - 8.0%, for VNiM - 2.0%, for compulsory medical insurance - 4.0%. In case of temporary disability from payments to foreign citizens (stateless persons) temporarily staying in the Russian Federation (except for highly qualified specialists) - 1.8% |

| Insurers making payments to crew members of ships registered in the Russian International Register of Ships | During 2021 – 2027: for compulsory health insurance – 0%, for VniM – 0%, for compulsory medical insurance – 0% |

| Participants in the special administrative region in the territories of the Kaliningrad Region and Primorsky Territory, making payments to crew members of ships registered in the Russian Open Register of Ships | |

| Participants of the Skolkovo project | For compulsory medical insurance - 14.0%, for VNiM - 0%, for compulsory medical insurance - 0% |

| Organizations operating in the field of information technology | For compulsory medical insurance - 6.0%, for VNiM - 1.5%, for compulsory medical insurance - 0.1% |

| Participants of the free economic zone in the territories of the Republic of Crimea and the city of Sevastopol | |

| Residents of the territory of rapid socio-economic development | |

| Residents of the free port of Vladivostok | |

| Residents of the special economic zone in the Kaliningrad region | |

| Organizations developing electronic components and electronic products |

From 01.04.2020

Until

June 30,

2020, there is a zero tariff for small and medium-sized businesses operating in the sectors of the economy most affected by the coronavirus.

Additional tariffs for insurance premiums for compulsory health insurance

For payments in favor of insured persons who are employed in certain types of work, policyholders must also pay contributions to compulsory health insurance at the following additional rates.

| Conditions | Class of working conditions | Subclass of working conditions | Additional tariff in relation to payments in favor of individuals who are employed in the work specified in Part 1 of Art. 30 of the Law on Insurance Pensions | |

| clause 1 | p.p. 2 – 18 | |||

| There is no special assessment of working conditions (up-to-date certification of workplaces) | — | — | 9% | 6% |

| There is a special assessment of working conditions (up-to-date certification of workplaces) | Optimal | 1 | — | |

| Acceptable | 2 | — | ||

| Harmful | 3,1 | 2% | ||

| 3,2 | 4% | |||

| 3,3 | 6% | |||

| 3,4 | 7% | |||

| Dangerous | 4 | 8% | ||

What is the base limit?

If wages exceed the established limit, the applicable tariff for calculating insurance premiums changes.

| Insurance premiums | Base limit | |||

| 2021 | 2020 | 2019 | ||

| For compulsory pension insurance | RUB 1,465,000 | RUB 1,292,000 | RUB 1,150,000 | |

| For compulsory social insurance in case of temporary disability and in connection with maternity (VNiM) | RUB 966,000 | 912,000 rub. | 865,000 rub. | |

There is no maximum base for calculating insurance premiums for compulsory health insurance

.

How to win a tender - checklist

Contributions for compulsory insurance are subject to most payments under GPC and labor contracts.

If yes, what responsibility does the employer have for the absence of this data (about occupational risks) in the employment contract during a scheduled inspection of the State Labor Inspectorate?

To give the correct answer to the question you need to watch the video. After viewing, you will not need to seek help from specialists. Detailed instructions will help you solve your problems. Enjoy watching.

Quite often there are situations when one person falls under several categories of insurance premium payers. In this case, insurance contributions must be made on each basis. For example, an individual entrepreneur who has employees. In this case, he must pay for himself and for his employees.

For individual entrepreneurs making insurance contributions for themselves, fixed amounts are provided. On OPS, if the amount of income does not exceed 300,000 rubles:

- RUR 26,545 - for 2021;

- RUB 29,354 - for 2021;

- RUB 32,448 — for 2021

Such offset/reimbursement relates to excess expenses for benefits based on the results of the reporting (calculation) period. And within the reporting period, the following rule applies: the amount of contributions to VNIM is reduced by the amount of expenses incurred for the payment of benefits for this type of insurance.

It should be borne in mind that compensation for health damage through social insurance does not include moral damage, which is compensated only in court.

Then the inspection transmits to your FSS department appendices 2-4 to section 1 of the calculation with data on accrued contributions to VNiM and paid benefits. The inspection has 5 working days for this from the date of receipt of the calculation in electronic form and 10 working days on paper.

Preferential rates in 2020

Based on the norm of Part 1 of Article 7 of Law No. 212-FZ (as amended by Federal Law No. 339-FZ of December 8, 2010), the object of taxation is insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (hereinafter referred to as OSS VNiM) are payments and other remuneration accrued by payers of insurance premiums in favor of individuals within the framework of labor relations.

In other words, all these amounts are actually paid by the policyholder, but then they are presented for credit to the Social Insurance Fund, that is, they are counted against contributions to the Social Insurance Fund.

Commentary on the Letter of the Ministry of Finance of the Russian Federation... is the amount of forgiven debt subject to insurance premiums? The question is ambiguous. In the commented Letter... the amount of unrepaid debt is subject to insurance premiums as a payment made in favor of... the question of the validity of the tax benefit received by the payer of insurance premiums.

Moreover, the Ministry of Finance of Russia considers it possible to count the amounts of expenses under OSS in case of temporary disability and in connection with maternity for periods before January 1, 2021 against upcoming payments of insurance premiums for OSS in case of temporary disability and in connection with maternity after January 1, 2017.

Where are insurance premiums paid?

When the costs of paying benefits exceed the amount of contributions to VNiM after the end of the reporting period, the payer will also be able to offset the specified difference against upcoming payments of insurance premiums, since the Fund’s confirmation of expenses after the tax authorities send calculations for insurance premiums will occur in a short time. The automatic offset of benefits against the payment of contributions to VNiM also follows from the new form for calculating insurance premiums and from the Procedure for filling it out.

This year there are even fewer firms and entrepreneurs who can pay contributions at reduced rates.

For each employee, the employer must track the amount of all accruals from January 1 on an increasing basis. As soon as it exceeds the limit, the contribution rate for compulsory pension insurance is reduced from 22% to 10%. And if the company operates at preferential rates, no fees are paid.

Payment order for VNiM contributions: sample 2020

You can fill out a payment form for the payment of insurance premiums for VNiM on paper or using special programs. When filling out a document manually, you must follow the rules approved by:

- By Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n;

- Regulation of the Bank of the Russian Federation dated June 19, 2012 No. 383-P.

Payment order form 2020

The procedure for filling out each field of the payment order is presented in the table:

“Overexpenditure” on benefits will reduce contributions to VNiM

GPC as an object of taxation with insurance premiums. The object of taxation of insurance premiums for organizations making payments ... tariffs.

Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.” Thus, payments made to individuals with whom the organization does not have an employment relationship (including in cases where treatment and medical care are provided to family members of a person who is an employee of the organization) should not be subject to insurance premiums for OSS VNiM.

Added income tax (ATI)

The AIT is still undergoing adjustments to some points and clarifications in order to reduce the risk of a fall in oil products, in particular, its value on the world market.

Added income is the difference between the income from the sale of a company's petroleum products and the resources spent on its production.

The added income tax is a tax levy on the production and sale of petroleum products, without taking into account the equipment spent on it, processing materials, and other costs.

In particular, the costs of operating oil by transport, etc. are not taken into account. Tax collection will be carried out on the total amount of sales of products, and not on the extracted volume, as before.

The tax levy for 2021 on petroleum products is currently expected to be 50%. What exactly will happen:

— tax deduction amounts;

- the procedure for its payment;

— instead of the mineral extraction tax, the tax on added income of petroleum products will be replaced by the tax on added income.

The bill on added income tax should be introduced no earlier than 2021. This is approved at the next government meeting.

Initially, it was planned to activate it in 2021, but due to circumstances, the project will only affect new points of the oil field, respectively, young oil companies and wells.

Following the words of the Deputy Prime Minister of the Russian Federation, the project received several significant technical comments from the Office of the President of the Russian Federation.

After correcting the shortcomings, the project will again be put up for discussion in the Duma for approval. The project is currently in pilot mode.

The first stage of the adoption of the law on the NDD took place during the first reading of the Duma. The NDD was initially proposed and developed jointly with the Ministry of Energy and the Ministry of Finance of the Russian Federation.

Experts predict that thanks to innovations in the taxation system in the oil industry, the state budget could be replenished by about 600 billion rubles.

The previous mineral extraction tax (MET) should be reduced, but the tax itself, as such, will remain and will not be removed anywhere.

The essence of introducing the new tax is to replace a number of benefits for oil products for export and the size of rates in the direction of production of these products for young areas of the oil field.

The state offers oil companies an exchange where they cancel the benefits, but introduce a new tax deduction system with a number of multiple concessions.

For the state, such a counter step towards the oil business is important. By abolishing the duty on exports of products and replacing it with an added income tax, the Ministry of Finance finds another additional source of income for the country’s budget.

Since innovations are inevitable in any case, oil companies are all trying to defend their right to choose the type of tax deduction in their activities.

Since the new AIT bill has not yet been finally approved by the Russian government, companies retain the right to choose the taxation procedure.

Companies can choose whether to remain on the old MET deduction system or switch to the new MET.

Please note that the old program is not going anywhere, its cost is simply decreasing, so companies will have to withhold two types of taxes on production and product income.

The Ministry of Finance first tried to extend the new project to fresh, new oil fields, but at the same time, bypassing those to which export benefits for the mineral extraction tax began to apply in 2021.

If the government abolishes the old system of taxation on mineral income, then all oil companies will have to switch to a new system.

Thus, the old system will lose its meaning if someone else tries to use it. According to experts, oil companies will not gain much with the application of the new AIT.

Another question concerns the technical part of the industry. For example, they set a threshold value for the production of brownfields (young oil fields).

We are talking about fields that have been depleted from 20% to 80%, and for Siberia only 5%. Experts almost unanimously say that the efforts of companies will not bring the desired result.