The procedure for calculating VAT during construction and installation works

To calculate VAT when performing construction and installation work for the taxpayer’s own consumption, the following steps are performed sequentially:

- The tax base for completed construction and installation works is calculated.

- The tax period in which VAT must be calculated and the tax amount must be calculated is determined.

- An invoice is drawn up for the cost of construction and installation work performed.

- The amount of VAT on purchased materials, works, services necessary to carry out construction and installation work, and the amount of VAT accrued on the volume of construction and installation work performed are subject to deduction.

- A completed VAT return is submitted to the tax authority.

- Tax is paid to the budget if the declaration reflects the amount of VAT payable.

BASIC

In tax accounting, fixed assets built (manufactured) by contract are reflected at their original cost.

An example of reflection in accounting and taxation of the construction of fixed assets by contract. The organization is both an investor and a customer

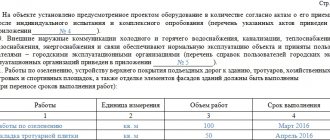

In January, Proizvodstvennaya LLC (investor, customer) entered into a construction contract with Alpha LLC (contractor) for the construction of a utility room. According to the contract, the work must be completed by April 30. Phased delivery of work is not provided.

The cost of construction work in accordance with the estimate attached to the contract is 118,000 rubles. (including VAT – 18,000 rubles). In addition, according to the terms of the contract, “Master” purchases part of the materials necessary for construction independently and transfers them to the contractor. The contractor, in turn, submits a monthly report to the customer on the materials consumed.

In March, “Master” purchased materials for construction in the amount of 59,000 rubles. (including VAT - 9,000 rubles) and immediately handed them over to Alpha. According to the monthly reports submitted by the contractor, in March he spent materials worth RUB 30,000, and in April – in the amount of RUB 20,000.

The following entries were made in the “Master’s” accounting.

In March:

Debit 10-8 Credit 60 – 50,000 rub. – construction materials intended for transfer to the contractor have been capitalized;

Debit 19 Credit 60 – 9000 rub. – VAT is reflected on purchased materials;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 9000 rub. – accepted for deduction of VAT on purchased materials;

Debit 10-7 Credit 10-8 – 50,000 rub. – reflects the cost of materials transferred to the contractor for the construction of the utility room;

Debit 08-3 Credit 10-7 – 30,000 rub. – the cost of the materials used is taken into account in the initial cost of the utility room under construction.

In April:

Debit 08-3 Credit 10-7 – 20,000 rub. – the cost of the materials used is taken into account in the initial cost of the utility room under construction.

Upon completion of the work, “Master” and “Alpha” signed an act in form No. KS-2 and a certificate in form No. KS-3. The cost of work based on construction results in comparison with the estimated cost provided for in the contract has not changed. Therefore, the “Master” accountant made the following entries:

Debit 08-3 Credit 60 – 100,000 rub. – reflects the cost of contract work, which forms the initial cost of the constructed utility room;

Debit 19 Credit 60 – 18,000 rub. – VAT on contract work is reflected;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 18,000 rub. – accepted for deduction of VAT on contract work;

Debit 01 subaccount “Fixed assets in operation” Credit 08-3 – 150,000 rubles. – the constructed utility room was accepted for accounting and put into operation.

The initial cost of the built utility room, according to accounting data, was 150,000 rubles. (30,000 rub. + 20,000 rub. + 100,000 rub.).

In tax accounting, the Master's accountant included the utility room as part of the depreciable property at the original cost of 150,000 rubles.

An example of how to reflect contract manufacturing of fixed assets in accounting and taxation. The organization is an investor

In January, Proizvodstvennaya LLC (investor) entered into an investment agreement with Alpha LLC (customer) for the construction of a utility room. According to the contract, the work must be completed by April 30. The cost of construction work in accordance with the estimate attached to the contract is 118,000 rubles. (including VAT – 18,000 rubles). The cost of customer services is 70,800 rubles. (including VAT – 10,800 rubles). According to the agreement, the “Master” transfers the amount provided for in the estimate in January.

On April 30, upon completion of construction, “Alpha” transferred the utility room to “Master” at a cost of 118,000 rubles. (including VAT – 18,000 rubles). Alpha provided the investor with a consolidated invoice for this amount. “Master” transferred the reward to the customer on April 30. The following entries were made in the “Master’s” accounting.

In January:

Debit 76 Credit 51 – 118,000 rub. – funds for construction are transferred to the customer.

April 30:

Debit 08-3 Credit 76 – 100,000 rub. – the built utility room was accepted from the customer;

Debit 19 Credit 76 – 18,000 rub. – VAT presented by the contractor is reflected (based on the consolidated invoice received from the customer);

Debit 08-3 Credit 60 – 60,000 rub. – reflects the amount of remuneration due to Alpha;

Debit 19 Credit 60 – 10,800 rub. – VAT is reflected on the amount of remuneration;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 28,800 rub. (RUB 18,000 + RUB 10,800) – accepted for deduction of VAT on the amount of contract work and remuneration;

Debit 01 subaccount “Fixed assets in operation” Credit 08-3 – 160,000 rubles. – the constructed utility room was accepted for registration and put into operation;

Debit 60 Credit 51 – 70,800 rub. – remuneration is transferred to the customer.

The initial cost of the built utility room, according to accounting data, was 160,000 rubles. (60,000 rub. + 100,000 rub.).

In tax accounting, the Master's accountant included the utility room as part of the depreciable property at the original cost of 160,000 rubles.

Determination of the tax base for VAT during construction and installation works

The tax base for VAT when performing construction and installation work is determined as the cost of this work. The indicated cost includes all expenses of the taxpayer actually incurred by him during the construction of fixed assets.

If third-party organizations are partially involved in carrying out construction and installation work, then the cost of construction work performed by contractors should not be included in the tax base (see decision of the Supreme Arbitration Court of the Russian Federation dated March 6, 2007 No. 15182/06 and resolution of the Federal Antimonopoly Service of the Ural District dated January 14, 2008 No. Ф09-11071/07-С2). Tax officials also adhere to this position (letter of the Federal Tax Service of Russia dated July 4, 2007 No. ШТ-6-03/527).

Investment agreement

Objects can be built not only under a construction contract, but also within the framework of an investment agreement.

In an investment agreement, the relationship scheme is somewhat different, since the investor does not independently enter into relations with contractors or suppliers of goods (works, services), as a result of which the tax amount is presented not to him, but to the customer who is implementing the project. Due to the fact that the direct procedure for applying tax deductions under the terms of investment agreements is not spelled out in Chapter 21 of the Tax Code of the Russian Federation, today there are two possible points of view on this issue. Some experts believe that an investor does not have the right to take advantage of the VAT tax deduction, since investment activities are not taxed. Therefore, the amount of the “input” tax must be taken into account by him in the cost of the constructed facility. In particular, this conclusion is contained in the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated March 10, 2006 in case No. A29-502/2005.

Others, including the author, believe that only the transfer of property, which is of an investment nature, is not subject to tax, and construction operations within the framework of an investment project, carried out at the expense of the investor’s funds, are taxed in the general manner. Consequently, if the necessary conditions are met, the investor has the right to take advantage of a deduction for the amount of “input” tax transferred to him by the customer. At the same time, in order to understand the procedure for tax reimbursement by an investor, it is necessary to consider the scheme for executing the investment agreement.

Let us recall that the main regulatory document in the Russian Federation, establishing the legal and economic foundations of investment activities carried out in the form of capital investments, is the Federal Law of February 25, 1999 No. 39-FZ “On investment activities in the Russian Federation, carried out in the form of capital investments "(hereinafter referred to as Law No. 39-FZ).

As defined in Art. 4 of Law No. 39-FZ, the subjects of investment activities carried out in the form of capital investments are investors, customers, contractors, users of capital investment objects and other persons.

An investor is understood as a person financing the construction of an object, and the subject composition of investors is not limited by law. These may include individuals and legal entities (including foreign ones) created on the basis of an agreement on joint activities and not having the status of a legal entity of an association of firms, as well as government bodies at various levels.

The customer is an individual or legal entity authorized by the investor who is implementing the investment project. Moreover, as a general rule, customers do not interfere in the activities of other investment entities.

Let us note that the customer, who is not an investor, is granted the rights to own, use and dispose of capital investments for the period and within the powers established by the investment agreement.

It should be said that in shared-equity housing construction the concept of a customer-developer is quite often used, and nowhere is it said what is hidden behind this term.

Note! Relations between the parties when investing in housing construction are based on Federal Law No. 214-FZ dated December 30, 2004 “On participation in shared-equity construction of apartment buildings and other real estate and on amendments to certain legislative acts of the Russian Federation.”

Let us note that an analysis of the provisions of the Town Planning Code of the Russian Federation allows us to conclude that in investment activities, the customer-developer is understood as the entity implementing the investment project, which has the right to the land plot intended for the construction of the facility.

The construction of the construction project is carried out by a contractor, which can be individuals and legal entities who have a certificate of admission to work that affects the safety of capital construction projects, issued by a self-regulatory organization.

Law No. 39-FZ does not prohibit investment entities from combining the functions of two or more entities.

Relations between subjects of investment activity are built on the basis of an investment agreement, which, by the way, is not designated in Russian law as an independent agreement, therefore, general rules on the agreement that do not contradict current legislation apply to it.

Analyzing the legislation, we note that an investment agreement for the construction of an object, in essence, resembles an intermediary agreement in which the customer, at the expense of the investor’s funds, organizes the construction of an object intended for the investor. The main feature of such an agreement is that the ownership of the constructed object belongs to the investor, therefore the customer-developer, upon completion of capital construction, transfers the completed capital construction object to the investor for balance.

VAT accrual on construction work

VAT when performing construction work for own consumption must be calculated at the end of each tax period (clause 10 of article 167 of the Tax Code of the Russian Federation). Thus, the taxpayer calculates the amount of VAT on a quarterly basis based on the volume of work that was performed during the quarter.

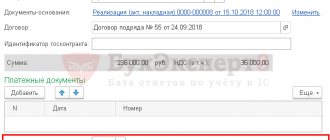

On the last day of the quarter, an invoice is issued in accordance with Art. 163 of the Tax Code of the Russian Federation and clause 21 of the rules for maintaining a sales book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. The document can be drawn up in one copy, since the buyer to whom the second copy should be transferred does not exist as such (clause 6 of the rules for filling out an invoice - invoices approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137). Based on this, in the lines “Seller”, “Consignee and his address”, “Consignor and his address”, “Buyer” it is necessary to enter the details of the taxpayer who carried out the construction work on his own.

An invoice issued in this way is simultaneously registered in the purchase book and the sales book (clauses 3 and 21 of the rules for maintaining a sales book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 and paragraph 2 of clause 20 of the rules for maintaining a purchase book, approved by a Government Decree RF dated December 26, 2011 No. 1137).

VAT deduction in construction

When carrying out construction and installation work in an economic way, the taxpayer can claim the following amounts of VAT for deduction:

- VAT paid to suppliers when purchasing materials, works, services used during construction work.

- VAT paid to the seller of an unfinished capital construction project, subsequently completed using economic methods.

- VAT, which was accrued when performing construction and installation work for own consumption.

In this case, the VAT amounts specified in clauses 1 and 2 can be deducted as materials, works, services are received and invoices are received from suppliers (letter of the Ministry of Finance of Russia dated September 21, 2007 No. 03-07-10/20, Federal Tax Service Russia in Moscow dated July 22, 2008 No. 19-11/069325). The data on the amount of input VAT on goods (work, services) purchased for construction and installation work, and the amount of tax presented by contractors, are necessary to calculate the indicator on line 120 of section. 3 VAT declaration forms (paragraph 6, clause 38.13 of the procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ).

It is necessary to deduct VAT, which was accrued on the amount of expenses incurred during the construction of a fixed asset using one’s own resources, on the last day of the tax period at the time the tax base is determined. This procedure for accepting deductions is established in paragraph. 3 paragraph 6 art. 171 and para. 2 clause 5 art. 172 of the Tax Code of the Russian Federation. Thus, VAT on completed construction work can be deducted in the same quarter in which it was accrued for payment to the budget (letter of the Federal Tax Service of Russia dated March 23, 2009 No. ШС-22-3/ [email protected] ). The specified amount of tax must be reflected in the VAT return in lines 060 “Performing construction and installation work for own consumption” section. 3 and 140 “The amount of tax calculated when performing construction and installation work for own consumption, subject to deduction” section. 3 (clauses 38.3 and 38.10 of the Procedure for filling out a tax return for value added tax, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ).

See also “The court recognized the work as completed, but there are no invoices for it. Is it possible to deduct VAT?

General information

VAT is a tax that is first included in the price of services and products sold in Russia. The value added tax has an impact on the material formation of small and medium-sized businessmen. In Russia, the VAT rate is 18%.

In the procedure for making monthly calculations of tax obligations, legal. and physical persons assign VAT to the state budget as the difference between purchase and sale.

What it is?

Many medium and small businessmen often encounter the process of compensation for value added tax from the state budget. This situation occurs when the amount of acquired inventory exceeds the amount of the reporting period.

Purchased products can be used in the production procedure, or can be sold, with an appropriate markup. It should be noted that only those amounts of paid VAT that are certified by documents are subject to compensation.

When exporting related to the sale of products, services and works to foreign partners, businessmen acquire the right to full VAT compensation. After all, exported products are subject to 0% tax upon sale.

Russian commercial organizations, when purchasing these goods from their suppliers, must pay VAT. Therefore, the Russian Government is meeting the needs of exporting businessmen and compensating them for their expenses when paying VAT.

When carrying out the process of VAT compensation legal. and physical persons must be guided by the Tax Code, namely Art. 172, 173 and 176.

Who is eligible?

According to the legislation operating in the Russian Federation, representatives of medium and small businesses have the right to return VAT:

- Those who have paid all tax obligations for three years in an amount that exceeds 10 billion rubles.

- Who brought to the inspection organizations a valid bank guarantee document, according to which the bank will make all payments for the excess VAT purchased.

Results

VAT on the construction of fixed assets is calculated and deducted at the end of each tax period.

The basis for calculating the tax is the costs incurred during the construction campaign. VAT refundable is taken into account in the purchase book as materials and work are received, as well as the necessary documentation is received. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

UTII

Organizations that pay UTII are required to keep accounting records in full (Article 2, 5 of the Law of December 6, 2011 No. 402-FZ). Therefore, when reflecting fixed assets built by contract in accounting, apply the same rules as under the general taxation system.

Operations related to the receipt, movement and disposal of fixed assets do not affect the calculation of UTII (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

If a fixed asset created by contract is a piece of real estate, then the organization must register the ownership of it (Part 1, Article 4 of Law No. 122-FZ of July 21, 1997).