Support for children and their parents

New benefits for single-parent families and pregnant women have been introduced in Russia. The federal law was signed by the President of the Russian Federation after his corresponding message. Let us tell you in more detail what kind of benefit has appeared and what features it may have.

Support for family and motherhood is one of the basic principles of law in Russia, based on the Constitution. By default, raising children imposes additional responsibilities and expenses on citizens. For example, it was recently calculated that getting a child into first grade costs from 15 to 50 thousand rubles. Combined with the systematically falling incomes of the general public, the amount spent on children makes up an impressive part of the family budget.

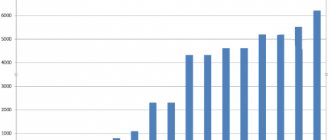

The coronavirus crisis of 2021 did not add optimism in this matter. The state could not stand aside and introduced additional measures to support citizens with children. Thus, several new payments have appeared, for example, benefits from 3 to 7 years, one-time payments of 10,000 rubles. in the summer of that year and others. Practice shows that this is not enough.

New payments

So, the new payment will be given to the following categories of Russians:

- pregnant women who have registered with the housing complex

The novelty here is that before the changes were adopted, the benefit was a one-time benefit, but now it has been made monthly. The deadline for applying to the LCD has also been clarified - up to 12 weeks of pregnancy. Previously, this period was blurred due to the wording “early terms”. Now, in order to receive benefits, there is no need to delay registration.

- children aged eight to seventeen years

Here we are talking, rather, about benefits for families, but the main thing here is the presence of children. Teenagers also need support, lawmakers decided. Previously, the question was repeatedly raised as to why children from 0 to 7 years old are given benefits, but those from 8 years old are not. Now this issue has been resolved at the legislative level, but, again, not for everyone; more on that below.

The rules, including requirements and the procedure for assigning payments, will be determined by the Government a little later. The Pension Fund of the Russian Federation, which replaced the Social Insurance Fund in this position, will “steer” the issue of transfers. The money will come from the federal budget.

Benefit for pregnant women

About deadlines

The new norm establishes the duration of the benefit - from the moment of registration in the Housing Code (but not earlier than 6 weeks after conception) and up to the month of permission. There is one nuance here. Registering with a residential complex and applying for benefits are different actions. If you come with an application for payments later than a month after registration, support will be assigned from the moment of application.

About payment amounts

The amount of payment will be calculated based on the cost of living in the region. Thus, payments are equal to 50% of the monthly wage of the working population . In the Pskov region, for example, the amount will be 6,395 rubles. in 2021, in Moscow - 7,493.50 rubles, in St. Petersburg - 6,536.90 rubles. monthly. As the PM changes, the benefit amount will also change annually.

“What payments are due to self-employed people on maternity leave?”

Benefits that a self-employed woman with a child can count on include:

One-time benefit for the birth of a child - 18,886.32 rubles in 2021

The payment amount is the same throughout Russia, but may differ due to regional coefficients. Also, some regions provide their own payments - you can find out more on the Social Insurance Fund portal or on the website of the social protection authorities at your place of residence.

Who is entitled to the payment : one of the child’s parents.

How to obtain : unemployed self-employed citizens must contact the social security authorities at their place of residence.

What documents will be needed : an application, the original birth certificate of the child, a certificate from the second parent confirming that he did not receive benefits. Such a certificate is issued at work or at social security authorities.

You are given six months from the date of birth of the child to apply for benefits.

Maternity capital for the 1st child under 1.5 years old - 483,881.83 rubles, for the 2nd - 639,431.83 rubles (if maternity capital for the first has not yet been received)

Maternity capital can be obtained subject to Russian citizenship.

Residents of some regions can count on additional maternity capital; it does not replace federal maternity capital.

How to obtain : you will need to issue a certificate at the pension fund, MFC or on the State Services website. Then you need to write an application to the pension fund, and the money will be transferred to one of the purposes for which maternity capital can be spent.

What documents will be needed : to issue a certificate you need an application, an identification document of the applicant or the applicant’s representative, birth (adoption) certificates of all children.

Child care allowance up to 1.5 years old - from 7,082.85 rubles per month

Every month the Social Insurance Fund will transfer money to the parent caring for the child. The minimum payment per child is 7,082.85 rubles per month.

How to get it : unemployed parents can apply for benefits from the social security authorities.

What documents will be needed : check with the MFC or social security authorities at your place of residence.

Allowance for the 1st and 2nd child from 0 to 3 years old - approximately 11,000 rubles per month

Attention : this payment in the amount of 1 subsistence minimum per child is provided for families whose income does not exceed two subsistence minimums in the region.

How to receive : payment for the 1st child can be received from the MFC or social protection authorities, for the 2nd from the pension fund.

What documents will be needed : check with the MFC or social security authorities at your place of residence.

Putin’s payments to families with children under 1.5 years old - 1 living wage per child per month

These payments will not replace or cancel other benefits. Every month the child’s mother receives one regional subsistence minimum on her bank card.

The payment is received by parents whose 1st or 2nd child was born or adopted after January 1, 2021. Another condition is that in 2021 and 2019, the average income for each family member did not exceed 1.5 regional subsistence minimum per month. From 2021, the limit was increased to 2 living wages. Also, the applicant must be a citizen of the Russian Federation, and so must the child.

How to receive : to receive payments for the 1st child, documents can be submitted to the social protection authorities or the MFC; for payments for the 2nd child, documents are accepted by the MFC and the Pension Fund.

What documents will be needed : check with the MFC or social security authorities at your place of residence.

Allowance for children 8-17 years old

The right to this type of support arises from the only parent (legal representative) . The main nuance here is the mandatory presence of a court decision on alimony. Without it, payment will not be assigned. The second significant nuance can be called the average per capita income of such a family. It cannot be higher than the subsistence level in the subject. The benefit is assigned to all children of the specified age in the family.

About the only parent

Until recently, there was no clear definition of “sole parent” in the legislation. Amendments to 81-FZ give the following definition:

the only parent is the one who is indicated in the registry office and there is no information about the other parent. Either the information about the father was included in the act record from the words of the mother, or the second parent died (recognized by the court as missing or deceased)

Duration of payment

Money is paid from the day you reach eight years of age if applied no later than six months from the date of birth. But, in any case, not earlier than the first of July 2021. If you apply later than six months, they will be assigned from the date of application. The benefit is established for a year - each new period you need to apply anew.

Payment amount

The size is the same - PM divided in half, but for a child. So, in the above regions the amounts will be as follows:

- Pskov region - 5,889.50 rubles.

- Moscow region - 6,658.50 rubles.

- St. Petersburg - 5,803.50 rubles. In the rest - accordingly.

These are the main “milestones” of the new payments. The Government will come up with detailed rules: documents, grounds for refusal, procedure for filing, etc., etc.

Link to changes. More on the topic “Benefits for single-parent families with children and pregnant women from July 1, 2021”:

- Child benefit up to 3 years old: innovations in 2020

- Single parent - what is this status and how is it secured?

- Unemployment benefit amount in 2021 plus some changes

- Increased payment for children from 3 to 7 - new rules from the Ministry of Labor

- Payments for children from 3 to 7 years old - some features and nuances

❗ The rules for paying new benefits for pregnant women and children from 8 to 17 years are ready

A draft has been published with rules for assigning and paying benefits to women registered in the early stages of pregnancy, and benefits for children aged 8 to 17 years.

The Ministry of Labor has developed requirements for family composition and a list of types of income taken into account when calculating the average per capita family income, as well as a list of documents (information) necessary for the assignment of these benefits, and application forms for their assignment.

The Pension Fund will assign and pay benefits for pregnant women and single parents.

Most information for receiving benefits will be verified automatically; in most cases, you will not need to provide additional information. The application can be filled out on the government services portal or you can apply for payment to the Pension Fund in person. Benefits for pregnant women will be paid upon registration up to 12 weeks. At the same time, in order to confirm her right to benefits, a woman must visit a medical organization when her pregnancy reaches 11-14 weeks, 19-21 weeks, 30 weeks.

New benefits will be paid to low-income people. However, not only income will matter, but also the availability of property.

For example, benefits will not be given to those who own more than one apartment if the total area of all apartments is more than 24 m2 per family member. True, there are exceptions to this rule - for example, housing for large families provided as part of social support.

In addition, those families who have 2 or more cars, 2 or more country houses, a garage, or a boat will not be able to apply for benefits.

Here is a list of “permitted” property:

- one apartment of any size or several apartments if the area for each family member is less than 24 square meters. m. Moreover, if the premises were declared unsuitable for living, it is not taken into account when assessing need. Also not taken into account are residential premises occupied by an applicant or a member of his family suffering from a severe form of a chronic disease, in which it is impossible for citizens to live together in the same premises, and residential premises provided to a large family as a support measure. Shares constituting 1/3 or less of the total area are not taken into account;

- one house of any size or several houses if the area for each family member is less than 40 square meters. m. Moreover, if the premises were declared unsuitable for living, it is not taken into account when assessing need. Also not taken into account are residential premises occupied by the applicant or a member of his family suffering from a severe form of chronic disease, in which it is impossible for citizens to live together in the same premises. Shares constituting 1/3 or less of the total area are not taken into account;

- one dacha;

- one garage, parking space or 2, if the family has many children, the family has a disabled citizen, or the family has been issued a motor vehicle or motor vehicle as part of social support measures;

- a land plot with a total area of no more than 0.25 hectares in urban settlements or no more than 1 hectare if the plots are located in rural settlements or inter-settlement areas. At the same time, land plots provided as a measure of support for large families, as well as a Far Eastern hectare, are not taken into account when calculating need;

- one non-residential premises. Outbuildings located on land plots intended for individual housing construction, private household plots or on garden land plots, as well as property that is common property in an apartment building (basements) or common property of a horticultural or vegetable gardening non-profit partnership are not taken into account;

- one car (except for cars under 5 years old with an engine more powerful than 250 hp, with the exception of families with 4 or more children, if the car has more than 5 seats), or two, if the family has many children, a family member has a disability, or the car was received in as a measure of social support;

- one motorcycle, or 2, if the family has many children, a family member has a disability, or the motorcycle was received as a measure of support;

- one unit of self-propelled equipment under 5 years old (these are tractors, combines and other pieces of agricultural equipment). Self-propelled vehicles older than 5 years are not taken into account when assessing need, regardless of their number;

- one boat or motorboat under 5 years old. Small vessels older than 5 years are not taken into account when assessing need, regardless of their number;

- savings, the annual interest income on which does not exceed the subsistence level per capita in Russia as a whole (i.e., on average, these are deposits worth about 250 thousand rubles).

In addition, the reason for denial of benefits will be the lack of income of an able-bodied family member. But there are many exceptions to this zero income rule. It’s not scary if you have income, but you have unemployed status, if you are caring for disabled people or children under 3 years old, if you are talking about a large family, if you are a single mother, etc.