The simplified taxation system (STS) is a special type of tax regime that is valid throughout Russia and is aimed at reducing the burden on medium and small businesses, and also simplifies the maintenance of documentation in the field of accounting.

Using such a system is quite beneficial due to the exemption of small and medium-sized businesses from a number of tax payments that are mandatory when using the special tax system, including:

- For enterprises: income tax, value added tax and property tax.

- Individual entrepreneur: tax on personal income, on property (except for the list from list 7 of Article 378.2 of the Tax Code of the Russian Federation), on value added (except for goods imported from abroad).

This tax system is very profitable and convenient for entrepreneurs due to the reduced tax rate. You can find out more about it in chap. 26 of the Tax Code of the Russian Federation.

Who cannot use such a tax system?

Tax payers under this system can be both individuals (IP) and legal entities (LLC), but only if they are not included in the list of restrictions. The following types of enterprises cannot operate under the simplified tax system (as specified in the Tax Code of the Russian Federation):

- financial institutions: banks, insurance companies, microfinance organizations, investment funds;

- enterprises with branches;

- state structures;

- foreign companies;

- organizations operating in the field of gambling;

- enterprises with a stake in other organizations of more than 25%.

Also, persons who:

- sell excisable goods (gasoline, cars, fuel, alcohol, tobacco);

- extract and subsequently sell natural resources (the list does not include sand, peat, building stone, clay and crushed stone);

- switched to an agricultural tax;

- did not notify about the transition to the simplified tax system in the proper manner and within the required time frame.

The system does not apply to lawyer and notary offices, as well as to other forms of lawyer organizations.

In order not to find yourself in a situation where it will no longer be possible to get into this system, it is recommended to carefully study the information and choose the right code in the All-Russian Classifier of Types of Economic Activities (OKVED) for both an LLC and an individual entrepreneur. If a certain code does not fit the list specified above, the territorial tax office will not accept the report.

Payment deadline for tax agents

The Tax Code states that the tax period is a calendar year (Article 346.19):

- the beginning of the tax period is January 1;

- The end of the tax period is December 31.

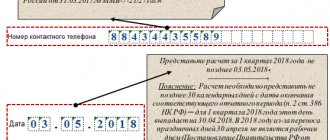

It should be noted that in accordance with Article 346.21 and Article 346.23 of the Tax Code of the Russian Federation, the deadline for filing a tax return coincides with the deadline for paying the simplified tax system for the tax period:

- organizations - no later than March 31;

- IP – no later than April 30.

If the deadline for submitting a declaration and paying tax coincides with a weekend, then this deadline is postponed to the first working day (Article 6.1 of the Tax Code of the Russian Federation).

Organizations using the simplified tax system are not exempt from the duties of tax agents (clause 5 of article 346.11 of the Tax Code of the Russian Federation). These organizations can act as tax agents in the following cases (Article 161 of the Tax Code of the Russian Federation):

- during the period of renting property from the administration;

- when purchasing goods/services from foreigners for further work with them on the territory of the Russian Federation;

- when purchasing vacant municipal property.

Thus, organizations exempt from VAT become tax agents for the payment of VAT for the period of renting municipal property or transactions with foreigners.

VAT payment deadline for tax agents:

- 1st quarter – April 25;

- 2nd quarter – July 25;

- 3rd quarter – October 25.

Organizations with the right of the simplified tax system can include the payment of VAT as expenses.

Who can use the simplified tax system?

ONS can be used by all legal entities that meet the following criteria:

- conduct an acceptable type of activity under this system;

- income not exceeding 150 million rubles. for any of the reporting periods or for the year;

- OS not exceeding 150 million rubles;

- the number of employees is not more than 100 people for any period or year;

- the share of participation of other companies among the founders is less than 25%;

- a company wishing to operate on a simplified basis should not have branches;

- tax rate is up to 6% depending on the region in the “Income” section and up to 15% in the “Income minus expenses” section.

An organization can make the transition to “simplified” if, based on the results of 9 months. the year in which she reports her intention to use the simplified tax system, her income amounted to no more than 112,500,000 rubles. This applies exclusively to LLCs; this rule does not apply to individual entrepreneurs.

Current BCC for tax in 2017

With the advent of 2021, there have been some changes in the budget classification codes (BCC), which all entrepreneurs paying taxes need to be informed about.

| Purpose of payment | Budget classification code |

| simplified tax system "income" | |

| Advance payments, tax | 18210501011011000110 |

| Penalty | 18210501011012100110 |

| Fines | 18210501011013000110 |

| Simplified tax system “income minus expenses” | |

| Advance payments, tax, minimum tax | 18210501021011000110 |

| Penalty | 18210501021012100110 |

| Fines | 18210501021013000110 |

The fact is that until 2021, there were different budget classification codes for paying tax and the minimum payment for organizations that had the right to apply the simplified tax system “income minus expenses,” which caused confusion. Starting from 2021, the legislator decided to combine all payments into one BCC, which greatly simplifies filling out a payment order.

System innovation in 2021

Previously, if even a single point was violated, companies working on the “simplified” system immediately flew automatically from this system and returned to the OSN at the beginning of the quarter in which the discrepancy with the necessary conditions was revealed.

In the new year, “simplers” will see an innovation: in case of violation of the established basic limits on the number of employees and income, the organization will not be removed from the simplified tax system and will not have to switch to the general taxation system. Based on this, the simplification concerns points 2 and 4 from the previous list, all other rules remain unchanged.

How to work with innovations under the simplified tax system?

Despite innovations in the form of simplifications, you still shouldn’t “relax” in the work process. Letting the arrival and departure of employees take their course and not monitoring revenue are not the best ideas for running a successful business.

With a slight increase in the limit on the number of employees and income, the right to use the simplified tax system will be retained, and both LLCs and individual entrepreneurs will be able to continue to use it if:

- the number of employees on average did not exceed 130 people;

- the income threshold has not reached 200 million rubles.

Exceeding the established limits is not recommended.

Exceeding indicators

In case of violation of one of the points of the conditions for using the simplified tax system, the legal entity will be forced to pay tax at a higher rate and at the moment a “transition period” begins when an individual entrepreneur or LLC is on the simplified tax system, but is forced to use increased tax rates.

The “transition period” comes into effect in the quarter in which the permissible limits for the number of employees and income were exceeded. The rate may be (depending on the object of taxation):

- for the object “Income” – 8%;

- for the object “Income minus expenses” – 20%.

The use of this system at increased tax rates will remain in effect until the taxpayer eliminates problems with the number of employees and equalizes income. If the limits are exceeded again, the transition to OSN will be inevitable.

When are reports submitted under the simplified taxation system?

ONS is a kind of “preferential” system, according to which the declaration is submitted to the tax office only once a year. Payment is also made once a year no later than April 30 for individual entrepreneurs and March 31 for LLCs. But this is not a single payment that businesses must make to the state budget. Each period of activity of individual entrepreneurs and LLCs when receiving income must end with the payment of advance payments.

Why are advance payments needed?

Payments under the advance payment system make transfers of funds to the state budget uniform, i.e. partial, based on the results of the outgoing reporting period. Payments are called advance payments, because the tax from an organization or individual entrepreneur is received in the form of an advance, as if in advance, without waiting for the end of the year. In this case, advance payments are reflected in the declaration at the end of the year, thereby reducing the final amount at the end of the reporting period.

The reporting periods for advance payments are the first quarter, half a year and nine months of the year. If the “simplified” people received income during the reporting period, then within twenty-five days after it they need to make calculations and pay up to 6% or up to 15%. Payment is not required if there was no income during the reporting period. You can pay contributions and taxes through a bank account. In addition, banking institutions now provide favorable conditions for opening and maintaining a current account.

Periods for reporting advance payments according to the National Tax Service in 2021

The deadlines for paying advance payments in the new year are established by the Tax Code of the Russian Federation. Payment is made within the following terms:

- for the first quarter – until April 26;

- 6 months before 26.07;

- 9 months before 25.10.

There is no fourth reporting period. It is replaced by filing a final tax return for the entire year.

Late payment of the advance payment under the simplified tax system in the new year

If there was a delay in payment of the advance payment, then the individual entrepreneur or organization is charged a penalty for each late day of payment. For each of them it is calculated differently:

- for individual entrepreneurs: amount of non-payment of debt * number of days of delay * 1/300 of the refinancing rate;

- for enterprises: (1/300 of the refinancing rate * 30 calendar days * amount of non-payment) + (1/150 of the refinancing rate * number of days of delay after 31 days * amount of non-payment).

The last formula is applicable for enterprises if payment delays exceeded thirty days. If the payment delay is less than thirty days, then the formula for calculating the debt is similar to the formula for individual entrepreneurs.

Confirmation of the correctness of the calculations of advance payments is not required, and there is no need to submit them to the Russian tax authorities. These amounts should be displayed in the income-expense book. It is also necessary to keep documents that confirm payment of invoices.

Deadlines for filing a declaration and paying tax according to the simplified tax system for 2021

In accordance with Art. 346.19 of the Tax Code of the Russian Federation the following are recognized as reporting periods:

- first quarter;

- half year;

- nine month.

| Reporting period | Tax payment date |

| First quarter | 25th of April |

| Half year | July 25 |

| Nine month | the 25th of October |

Organizations that are on the simplified tax system for “income” at the end of the reporting period are required to calculate the amount of the advance payment in accordance with the tax rate and income determined by it, reducing them by the amount of paid insurance premiums, but not more than 50% (Article 346.21 of the Tax Code of the Russian Federation).

The amount of the advance payment is calculated on an accrual basis, starting from the beginning of the tax period (January 1) until the end of the first quarter, half a year, nine months.

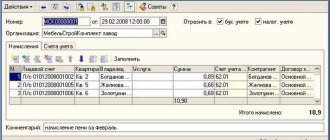

| Advance payment | = | ( | Income | * | Tax rate (%) | – | Insurance payments | ) | – | Advance payments for previous periods |

LLC "ABV" on the simplified tax system "income" 6%.

| Reporting period | Income | Insurance payments | Advance payments | Tax amount | payment date |

| First quarter | 1100000 | 15000 | 51000 | 25th of April | |

| Half year | 2500000 | 33000 | 51000 | 66000 | July 25 |

| Nine month | 3500000 | 45000 | 66000 | 99000 | the 25th of October |

Organizations that are on the simplified tax system “income minus expenses” at the end of the reporting period are required to calculate the amount of the advance payment in accordance with the tax rate and income determined by it, reducing them by the amount of expenses (Article 346.21 of the Tax Code of the Russian Federation)

| Advance payment | = | (Revenue | – | Expenses) | * | Tax rate (%) | – | Advance payments for previous periods |

LLC "ABV" on the simplified tax system "income minus expenses" 15%.

| Reporting period | Income | Expenses | Advance payments | Tax amount | payment date |

| First quarter | 1100000 | 800000 | 45000 | 25th of April | |

| Half year | 2500000 | 1300000 | 45000 | 135000 | July 25 |

| Nine month | 3500000 | 2100000 | 135000 | 75000 | the 25th of October |

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

Based on the above rules, the specific deadlines for submitting the report and paying the simplified tax system in 2021 are determined as follows.

For advance payments that do not depend on who pays them, the deadlines for paying the simplified tax system 2021 will be the same for legal entities and individual entrepreneurs:

- 04/27/2020 is the deadline for paying the simplified tax system for the 1st quarter of 2021;

- 07/27/2020 is the deadline for paying the simplified tax system for the first half of 2021;

- 10/26/2020 is the deadline for paying the simplified tax system for 9 months of 2021.

But the deadlines for paying the final simplified tax system for 2021, tied to the deadline for filing the declaration, will be different for legal entities and individual entrepreneurs:

- 03/31/2020 is the deadline for submitting the declaration and paying the simplified tax for 2021 for legal entities;

- 04/30/2020 is the last day for submitting the report and paying the simplified tax system for individual entrepreneurs 2021.

Thus, you will need to submit reports and pay taxes on time.

We calculate advance payments according to the simplified tax system

Advance payments are calculated according to the accruing tax. The calculation of the advance payment for the first quarter is carried out in this way: the tax base is multiplied by the tax rate. The amount received must be paid by April 26.

When calculating an advance payment for 6 months, you need to multiply the tax base in the period from the first month of the year to the sixth month by the tax rate. From the amount received, subtract the previously paid advance for the first quarter. The balance must be paid to the state budget no later than July 26.

Advance payment for 9 months. is calculated in a similar way: the tax base calculated for the last nine months is multiplied by the tax rate. From this amount you need to subtract the previously paid advances for three and six months. The balance must be paid by October 25.

The results of the year are calculated in this way: the tax base for the year is multiplied by the tax rate. From this amount we subtract all three advance payments paid earlier, and pay the balance: for individual entrepreneurs - until April 30, and LLC - until 31.03 of the year following the reporting period.

How to transfer tax correctly?

In order to transfer tax you must:

- fill out and submit a tax return to the Federal Tax Service, where it is very important to correctly and correctly make all calculations;

- generate a payment order;

- pay the tax in accordance with the payment order.

We invite you to familiarize yourself with the Punishment for surplus during inventory

It is necessary to clearly understand that the taxpayer’s obligation can be considered either fulfilled or unfulfilled, as stated in Art. 45 of the Tax Code of the Russian Federation.

Non-payment of tax can occur in the following cases:

- the taxpayer has withdrawn his payment order;

- return to the taxpayer of funds intended for tax payment by the paying agent (administration, post office);

- incorrect indication in the payment order of the Federal Treasury account number or the name of the recipient's bank;

- There are not enough funds in the taxpayer’s account.

Let's sum it up

The simplified tax system is an excellent basis for a new business that is only in its infancy. It allows individual entrepreneurs and LLCs not only to pay less, but also to keep accounting records easier. In addition, you can reduce tax payments through a properly selected tax base, combining regimes, receiving deductions and using holidays. But despite the simplified taxation system, payers have a set of rules that they must adhere to in order to successfully work with the possible minimum payment of taxes. Among them are payment of advance payments throughout the tax period and compliance with the rules for paying penalties in case of late payments.

The base for an individual entrepreneur and an enterprise implementing their work according to the simplified tax system is calculated on an accrual basis. The tax rate depends on the object (Income or Income minus Expenses). The tax amount for each reporting period is reduced by the amount of previously paid advance payments, which allows significant savings on taxes.

Explanations to the tax office according to the simplified tax system

Without waiting for any payments, the tax office may ask you to explain. In this case, you will receive an information letter asking you to tell why there is no money.

If you have a reasonable and well-reasoned explanation for this, please respond. But if you don't answer, nothing will happen to you. This is not a request for explanations, for failure to provide which there is a fine, but just a letter. Let us remind you that the tax office has the right to request information or documents in limited cases, and this does not apply to them.