Transport tax must be paid by December 1, 2021. If this is not done on time, a penalty will be charged. Legal regulation in this matter is carried out by part 1 of Art. 75 NK. A penalty for non-payment of transport tax is a certain amount of money that must be paid in case of late payment of funds to the budget. It is calculated for each day of overdue debt.

All owners of vehicles, regardless of whether they are legal entities or individuals, are required to pay transport tax. But not only do you need to know for yourself how and in what amount the fee is paid, you also need to meet the deadlines for paying the transport tax

. In our article you will learn about what payment deadlines are, for whom they are provided and what liability the taxpayer faces if he fails to meet the deadline and does not pay his obligations.

Has the transport tax really been abolished?

The transport tax has become so familiar to citizens of the Russian Federation that it was difficult for many to imagine its abolition. Nevertheless, this happened - such information quite recently literally shook up the Internet. The president of the country allegedly signed the corresponding law. As a result, the new rules were approved by society and received only positive feedback. In essence, fuel prices were increased. As a result, gasoline became more expensive.

In practice, this would mean that those drivers who actively use vehicles would pay much more than those who drive very little or, for certain reasons, do not use their car at all. Or, in other words, if you are the happy owner of ten cars, then you won’t pay too much for any of them. After all, the payment for road transport will be calculated from the increased excise tax on gasoline. The rule is simple: those who drive more pay more.

Unfortunately, this turned out to be untrue. This transformed news came from several sources. First of all, Dmitry Medvedev’s comment that the transport tax has been abolished for electric vehicles, and the regions still do not take advantage of this at all. As well as the new law of 2018-2019 on amnesty for taxes unpaid before 2015.

NEWS REGARDING TRANSPORT TAX 2018

Despite the fact that in 2021 the transport tax will not be completely frozen or abolished completely, some changes have occurred in this law.

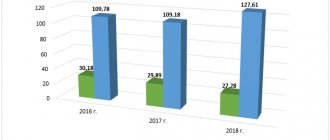

The main feature is that it has changed the coefficient of increase in transport tax on expensive cars. In popular parlance, such tariffs are called “luxury taxes.” These provisions in the law apply only to those cars that exceed the price of 3 million rubles.

Also, a new feature appeared in tax legislation at the end of August, following which a citizen of the Russian Federation can pay all taxes in a single payment, regardless of what they were assessed for movable or immovable property.

Source

Deadline for payment of transport tax in 2018-2019

The deadline for submitting the declaration in 2018-2019 depends on who exactly pays such tax - an individual, an individual entrepreneur or a legal entity. For example, individuals and individual entrepreneurs must pay tax no later than December 1st. To pay, the corresponding bills must arrive at the post office in the summer. If the letter suddenly gets lost, then you can use another simple method - through the personal account of the Federal Tax Service. This option is quite convenient. In your personal account, you can check the information on payments for 2021, then print them out and pay at any nearest bank branch.

But the easiest payment option is directly in your Personal Account using a bank card. Important: to take advantage of this unique opportunity, it is necessary for your bank to enter into an appropriate agreement with the Federal Tax Service. To date, all the largest banks in the Russian Federation have already done this.

By what date should taxes be paid in 2018?

The deadlines for paying land tax are established by local regulations.

Deadlines for payment of insurance premiums to the Federal Tax Service and the Social Insurance Fund in 2021 One of the most important changes in 2021 is that the administration of insurance premiums (except for contributions for injuries) will be handled by the Federal Tax Service. Accordingly, contributions will need to be transferred to the Federal Tax Service. But the deadline for paying insurance premiums will remain the same. Thus, employers will have to transfer contributions from payments to employees no later than the 15th day of the month following the month in which contributions were calculated (clause 3 of Article 431 of the Tax Code of the Russian Federation). In our Online calendar you will find deadlines for payment of other obligatory payments to the budget (for example, “import” VAT or water tax).

If the payment deadline is violated, penalties are charged for each day of delay (Article 75 of the Tax Code of the Russian Federation).

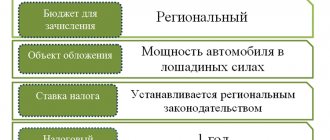

Transport tax is calculated based on the technical parameters of the vehicle. The tax service receives information about the car from traffic police officers. The transport tax replaced several existing taxes: for the use of roads, for air vehicles, and a tax on car owners.

The essence of the transport tax is that car owners pay for the use of federal roads and environmental pollution.

Briefly about the tax The tax for using your vehicle in the Russian Federation constitutes a significant part of the state budget.

Attention

It is larger than property and land. This is a mandatory fee for all car owners.

The tax inspectorate is provided with information about the vehicle, and inspectors calculate the amount of tax for individuals independently.

By what date must the transport tax be paid?

In order to meet all deadlines and pay the state tax on time, you need to know when to pay the transport tax in 2021.

Based on this information, the payer will have a complete understanding of what to expect by the end of the tax period, which lasts one calendar year.

Features of transport tax Transport tax is calculated on the basis of information received by regional tax offices from the traffic police service.

Tax payment deadlines in 2021

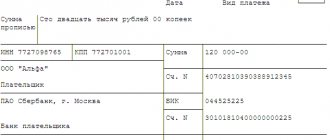

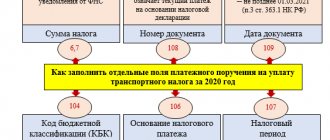

Transport tax is calculated based on the number of months of ownership. Notification of the need to pay tax The basis for paying tax is a notification from the Federal Tax Service, which is sent to the owner by inspectors. A tax notice is sent 30 days before the payment is due.

The document contains all the necessary information for payment: amount, object of taxation, tax base, payment deadline.

Important

The notification is given to the individual personally against signature (or his legal representative), sent by registered mail, transmitted electronically or through the Personal Account (https://www.nalog.ru/rn77/fl/).

If sent by mail, it is considered received upon expiration of six days from the date of sending the letter. If the taxpayer has not received a tax notice, he must appear in person at the Federal Tax Service. Here (https://order.nalog.ru/) you can make an appointment with the inspection online.

Deadlines for payment of transport tax

When do you need to pay transport tax for 2021? What are the deadlines for paying transport tax in 2021? When do I have to pay transport tax for 2021? Transport tax is required to be paid by all citizens and organizations that own any vehicles. must be paid once a year, but no later than the due date.

In 2018, payments must be made for 2021, and the deadlines are different for population groups. Legal entities must pay transport tax no later than February 1, 2018, and individuals - before December 1, 2018. If we mean transport for 2018, then you will have to pay it in 2021.

Moreover, legal entities must do this before February 1, 2019, and individuals - no later than December 1, 2021.

If we are talking about transport for 2021, then we note that payment must be made by November 30, 2021 inclusive.

Online magazine for accountants

Deadlines for payment of transport tax

- technical characteristics of the equipment (power measured in horsepower);

- environmental group;

- load capacity (for trucks);

- fixed rate;

- preferential categories.

Payment deadlines If the payer refuses to pay or does not manage to do it on time, he will face penalties and consequences, which are usually mentioned in the tax notice.

Deadlines for paying taxes and contributions for organizations and individual entrepreneurs in 2021 Current as of: September 14, 2021 You will find the deadlines for paying contributions, as well as the deadlines for paying taxes in 2021, in our calendar.

Deadlines for payment of property taxes in 2021 Deadlines for payment of property tax for organizations, as well as transport tax, are established by the law of the constituent entity of the Russian Federation.

By what date do taxes need to be paid in 2021?

Administrative liability occurs for non-payment or late payment.

The fine is 20% of the tax amount. If it has been proven that payment evasion is intentional, 40% will be charged.

But a penalty will be charged in advance. Accrual occurs every calendar day of delay. Size - 1/300 of the current refinancing rate of the Central Bank of the Russian Federation. If a person evades payment for a long time, he faces legal proceedings.

The presence or absence of debts is checked in your Personal Account or at the tax office itself.

If there is a debt, it can be paid off easily and quickly. If the notification was not sent by the authorities in the appropriate manner, no penalties will be charged. There is a statute of limitations for vehicle taxes. This is the period of time for which the tax office has the right to demand payment of debts for that reporting period.

By what date do you need to pay transport tax in 2018?

That is, a vehicle belonging to one of the existing categories is considered an object of taxation:

- ground transport;

- water technology;

- air Transport.

The priority of local authorities is to assign current rates for each type of vehicle, taking into account power indicators (horsepower) and other technical characteristics (load capacity, environmental category, etc.).

Therefore, the transport tax differs significantly from region to region, being the amount that is calculated individually for each region. There are some features regarding the calculation of the fee amount.

They consist of information used that may be relevant for one region and unimportant for another.

Ipc-zvezda.ru

When must a taxpayer fill out a personal income tax return? Citizens are required to file a personal income tax return in the following cases: when receiving income from the sale of real estate that has been owned for less than 3 years, and from the sale of property rights (assignment of the right of claim); By what date should taxes be paid in 2021? The average number of employees in a company should not exceed 100 people; The most important thing for individual entrepreneurs on UTII is that 2021 will not be the last year for this special regime.

From February 1, 2021, inspectors will register new cash registers with an online module.

From July 1, 2021, all sellers who were required to use a regular cash register system (dated July 3, 2018) will have to use the new online cash register.

Source: https://yurist123.ru/do-kakogo-chisla-nuzhno-oplatit-nalogi-v-2018-godu/

When will the transport tax be abolished in Russia?

Starting from 2018-2019, individuals and individual entrepreneurs do not have to pay transport fees to the state for periods before January 1, 2015. The corresponding law was signed by the president of the country in December 2021. At the same time, all tax debts of entrepreneurs and citizens will be written off automatically. This type of write-off includes debts that arose before January 1, 2015. If you were charged a penalty for non-payment, this will also be written off automatically.

Please pay special attention: you do not need to submit any documents to the tax office. The tax authorities themselves will write off everything and cover all debts. There is also no need to attend the inspection in person. Even if you have some debts, for example, for 2014 and penalties for non-payment, then in 2018-2019 this debt will be written off automatically - both tax and penalties.

Law on the abolition of transport tax

Some time has passed since the fake news appeared. But as soon as the bulk of motorists calmed down, just a few days ago, many publications again became alarmed with information about new changes and information that the vehicle tax was completely abolished in 2021. We are talking about the emergence of a new bill, which completely excludes transport tax from the code as an item for replenishing the budget. This news is true, but only partly. A corresponding bill exists, but not everything is so clear. It was created on June 5th, but two months later, on August 5th, it was moved to the archives. The reason is quite simple - on July 2, the bill was rejected during preliminary consideration.

IS IT TRUE OR FALSE THAT THE TRANSPORT TAX WILL BE ABOLISHED

At the beginning of 2021, many media and Internet resources began to report information that the transport tax would be frozen to some extent, suspended, or, in some cases, canceled altogether.

But many users will not believe any information due to the fact that there were no specific links to government authorities and official websites that would confirm this news. We can already say with absolute certainty that the President of the Russian Federation, Vladimir Putin, did not sign any relevant laws and agreements, because there is no information on the official website about such signatures of the president.

That is why the law that was in force before will remain in force in 2021. Let us remind you that this law states that every car owner must pay a transport tax once a year, which is calculated depending on the region of registration, as well as the residence of the driver, and the amount of the tax is also affected by the power of the car.

Last news

The Ministry of Finance opposed the abolition of the transport tax due to the fact that such actions would significantly affect the increase in prices for diesel fuel and gasoline. After all, such a burden will be included in excise taxes on fuel. In turn, this decision will lead to an increase in the cost of goods, since their transportation will cost much more. In addition, another good reason was named - funds from the tax in 2018-2019 go directly to the budgets where it is collected. And if such a tax is abolished, the quality of roads in the regions may well deteriorate.