One of the parents, guardian or adoptive parent has the right to receive a one-time state benefit at the birth of a child (Article of the Law on State Benefits dated May 19, 1995 N 81-FZ). The benefit amount is fixed and is indexed annually from February 1 at the legislative level. From 02/01/2018, the benefit amount was 16,759.09 rubles, before this time (from 02/01/2017 to 01/31/2018) – 16,350.33 rubles. The allowance is calculated on the date of birth; you can apply for it before the child is six months old.

The benefit is assigned for each child born. The specified amount is paid for one baby; if twins are born, the payment is made in double amount, for triplets - in triple amount, etc. When calculating benefits, the regional coefficient established for a specific region is taken into account. Employed parents (adoptive parents) apply to the employer for benefits. Also, the employer can additionally pay financial assistance for a newborn from its own funds. Let's consider the features of registration of these operations in the company's accounting.

Accounting support for the payment of a lump sum benefit upon the birth of a child

- Upon application by the applicant and after checking all necessary documentation.

Dt69.01 Kt70 – calculation of benefits.Note! Benefits are accrued to a specific employee of the company, and records are kept separately on the account. with a breakdown for each employee (information about accruals is entered on the credit side of the account, and settlements with the employee are displayed on the debit side).

- Issuance of benefits to the employee.

Dt70 Kt50 – when paying cash from the organization’s cash desk.Dt70 Kt51 – non-cash transfer of funds to an employee’s bank account.

Something to keep in mind! This accrual does not relate to the employee’s income - this is state social assistance to citizens, therefore the payment is not subject to personal income tax.

- Reimbursement of expenses to the organization's bank account.

Dt Kt69.01 (despite the transfer of control over the payment of insurance premiums to the Federal Tax Service of Russia, reimbursement of the company's costs for social benefits is carried out using funds from the social insurance fund).

Exception to the general rule

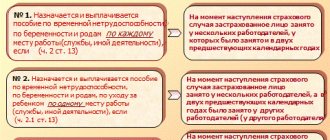

An exception to the general rules for paying a lump sum benefit at the birth of a child are insurance companies registered in the constituent entities of the Russian Federation taking part in activities within the framework of the pilot project (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294). Currently, 33 constituent entities of Russia are participating in it, in which employees receive payments by contacting the Social Insurance Fund directly.

In addition, an exception is made for employees of organizations in the Far North and similar areas: the size of the one-time benefit is adjusted by the regional coefficient.

Category “Questions and Answers”

Question No. 1. I am an accountant at an enterprise, I am preparing maternity payments for an employee, what payments are due and how to make entries

First, you need to decide whether your region is participating in the Pilot Project; if so, then no wiring will be required, and if not, then:

- When a woman goes on maternity leave, you are provided with a sick leave certificate, on the basis of which you calculate a lump sum maternity benefit in accordance with her salary for the last two years

- then you need to apply for benefits if she is registered in the early stages of pregnancy

- when she gives birth, she provides the next sick leave for which you accrue benefits for child care up to one and a half years and a lump sum at birth

The postings will be similar for all operations,

- Dt 69 Kt 70

- KT 70 Dt 50(51)

If a woman in labor has a complicated birth, she is entitled to an additional payment to the one-time maternity benefit

List of required documentation

The Federal Social Insurance Fund of the Russian Federation has regulated the list of the necessary package of documents required for calculating a one-time benefit at the birth of a child:

- employee statement;

- a certificate from the spouse’s place of work stating that they did not receive benefits;

Note! If the second parent is not employed, a certificate from the social security fund must be provided. - birth certificate in form 024, issued by the civil registry office or a document that is proof of the birth of a child outside the territory of the Russian Federation.

To make a decision on the allocation of funds, the branches of the Social Insurance Fund carry out a desk audit of the provided package of documentation, which requires the provision of copies of documents certified by the employer confirming the correctness of the costs incurred and their validity.

What documents should I submit?

The main document for receiving benefits is a child’s birth certificate from the civil registry office. If the baby was born outside of Russia, you need a copy of a certificate or other document that will confirm the fact of the baby’s birth abroad. An employee can receive such documents at a Russian consular office abroad or at another relevant department. Please note that the document must be translated line by line and certified with an apostille and legalized.

The second document is an application for granting benefits.

This document has its own peculiarities. Although there is no standard form for the form, there is a list of required details in it. Here they are: the name of the employer, full name without abbreviations and employee status (mother, father, adoptive parent, guardian, foster parent). You also need information about the identity document - type, series, number, by whom and when it was issued. You cannot do without information about the place of residence, place of stay - postal code, name of the region, district, city, other locality, street, number of the house, building, apartment according to the passport or other document. Data on the place of actual residence is also required - postal code, name of the region, district, city, other locality, street, house number, building, apartment. In addition, indicate the type of benefit and method of payment (postal order, to a bank card, etc.). If an employee asks to transfer money to an account, he will have to indicate the name of the bank, INN, KPP, BIC, and the recipient’s account number.

The employee must confirm all information in the application with a personal signature and indicate the date when he wrote the application. This is stated in paragraph 6 of Order No. 1012n.

An employee representative can also submit an application. Then the document must additionally indicate the full name, postal address of the place of residence or place of stay, the actual residence of the representative, details of a passport or other identification document. Well, information about the power of attorney or other paper that confirms the authority of the representative (clause 7 of Procedure No. 1012n).

The third document is a free-form certificate from the place of work or service of the other parent stating that he was not assigned benefits.

Having accepted the application and documents, within five days, issue the employee a receipt-notification in any form.

Then issue an order for the assignment of benefits.

These are the requirements of paragraph 8 of Order No. 1012n.

If the benefit is claimed by a guardian, adoptive parent or foster parent, then in addition to the documents on the birth of the child, you will need an extract from the decision on adoption or establishment of guardianship over the child. And also a copy of the court decision on adoption that has entered into legal force, a copy of the agreement on the transfer of the child (children) to a foster family.

Reimbursement of one-time benefit

After paying money to an employee, the company has the right to apply to the territorial social insurance fund for reimbursement of costs by providing the following documents:

- application for reimbursement;

- reference-calculation;

- application from an employee to receive payments;

- an employment contract with an employee or a copy of the work record book;

- order to assign payment to the employee;

- birth certificate in form 24;

- a certificate stating that the second parent did not receive benefits;

- calculation of insurance premiums with information about accrued benefits and with a mark of acceptance by the INFS of Russia.

How to correctly apply for a one-time benefit in 1C ZUP?

Send this article to my email

The material in the article will focus on the issue of registering a one-time benefit in 1C ZUP. What are lump sum benefits? These are social benefits that are paid one-time in certain life situations provided for by the legislation of the Russian Federation. These payments are divided into federal - allocated from the federal budget, the amount of which is set the same for all subjects of the Russian Federation and regional, the amount of which can be determined depending on the region, city, etc.

I will set up your 1C. Experience since 2004. Read more →

Next, let's move on to processing a one-time benefit in 1C ZUP. The amount of benefits in the program can be viewed in the information register “Amounts of state benefits”. To do this, if you have the appropriate administrative rights, you need to open the main menu and then select “All functions”. If this item is not available, then you need to select the “Service” item, then “Options” and in the settings form that opens, check the box “Display the “All functions” command.”

Next, in the window that opens with objects, find the information registers and open the above register.

A register form will open, where the amount of benefits will be presented.

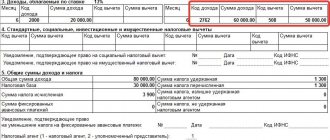

In the ZUP configuration, there is a separate, specialized document for automatic calculation of the benefits in question. To do this, go to the “Salary” section of the program and select the “All accruals” item. We create the document “One-time benefit at the expense of the Social Insurance Fund”. When creating the form, the document will look like this

It should be noted right away if the organization participates in the FSS pilot project, i.e. benefits are paid directly to the Social Insurance Fund, then the document will provide a choice of only two benefits. Let's look at an example with such an organization. The organization Kron-Ts LLC is registered in a region with direct payment of benefits through the Social Insurance Fund.

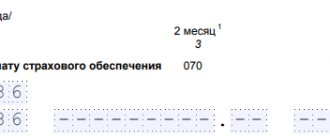

Let's return to the document and select this organization. We will also select a specific allowance, after which the program will automatically fill in its amount. We will indicate the employee to whom the payment will be made and when the payment will be made. In our example, “With salary”. Then click “Pass”. If you select payment during the inter-settlement period, payment can be made directly from the document using the “Pay in the header” button.

Next, consider another example in which the organization is not participating in the pilot project. Let’s create a document and select the benefit “At the birth of a child”. The rest of the steps will be the same.

In the event that a project has been set up for an organization, and it is necessary, for example, to pay benefits for the birth of a child, it is necessary to fill out an application for payment and create a register for the Social Insurance Fund. To do this, go to the “Reporting, Certificates” section and select the “Benefits at the expense of the Social Insurance Fund” item. Next, click “Create an application” in the middle window and fill out the document. In the header we indicate the employee and the type of benefit. After which the data on the “Recipient” tab is filled in from the physical data. faces.

We check and fill in the data on other bookmarks and click “Submit”. Then we create the document “Register of application for payment of benefits”, fill it out and send it to the Social Insurance Fund.

EVERYONE MUST DO THEIR JOB! TRUST THE 1C SETUP TO A PROFESSIONAL. MORE →

Discuss the article on the 1C forum?