We continue to talk about support for acquiring operations in 1C: Accounting 8 edition 3.0*. In this article, read about the features of accounting for acquiring transactions with “simplified” companies, including when combining special tax regimes, as well as when trading their own and commission goods.

*What settings need to be made in the program to account for payments by bank cards, how such payments are reflected in wholesale and retail trade when applying the general taxation system, including for VAT accounting purposes, read the article Accounting for acquiring transactions in “1C: Accounting 8” "

What is acquiring

Acquiring in general is a system that allows businessmen to accept payments to a bank account from bank cards of buyers or customers.

Acquiring consists of two interconnected parts:

- Equipment and (or) software:

A. A cash register with an acquiring function or a separate terminal installed in a retail outlet, cafe, etc.

B. For courier delivery of goods, mobile acquiring is used. The terminal for accepting payments is connected to the courier’s smartphone or tablet. With the help of mobile acquiring, card payments can be accepted anywhere there is access to the Internet.

B. When trading online, Internet acquiring is used. In this case, a terminal or other equipment is not needed. The buyer makes payment by entering his card details into a special form on the seller’s website.

- Agreements between several participants:

- seller of goods or provider of services;

- buyer or client - card owner;

— the acquiring bank in which the seller’s account is opened;

— the issuing bank that issued the card to the buyer.

It is important for the seller to enter into an agreement with the acquiring bank on favorable terms. As a rule, it cannot influence all other interactions here. Buyers pay with the card they want, and the contractual relationship between banks is also in no way connected with the seller.

Comparison of commissions of TOP-15 banks

To choose an inexpensive tariff, we recommend using the table. It shows the interest rates on transactions and the cost of equipment.

| Organization | Percent | Cost of equipment | |

| Sberbank | 1,8-2,5% | 1,700-2,200 rub./month. | |

| Dot | 1,3-2,3% | From 5,000 to 20,000 rubles. + 500 rub. months – for online enrollments | |

| Tinkoff | 1,59-3,6% Separate tariffs are provided for the transport sector and housing and communal services | 1,990-3,990 rub./month. | |

| Alpha | From 2% and above | Free rental. The tariff is selected individually | |

| VTB | 1,8-3,5% | Negotiated individually + 3 months of free PC service | |

| Opening | 1,9-2,5% | The tariff is selected individually (no Internet acquiring) | |

| Raiffeisen | From 1.99% and above | From 23,000 to 33,000 rubles. | |

| RFI | 1.8% and above | From 20,000 to 23,000 rubles. | |

| UBRD | From 1 to 2.5% | RUB 25,900 – single price | |

| Module | From 1.5 to 2% | Terminal rental is free. You can buy from 16 to 27 thousand rubles. | |

| Russian standard | 1,8-2,2% | From 13,300 to 42,000 rubles. | |

| Uralsib | 1.65-2.6% (RUB 2,600 per month minimum) | The terminal is rented free of charge | |

| MTS | 1.69% + 499 rub. for service | Free rental | |

| ICD | 1.6-1.95%, or 2500 rub. | Rent free | |

| Vanguard | 1,7-2,3% | Rent from 200 to 750 rubles. months First 4 years, then free | |

To choose a suitable acquiring service, you need to take into account all the nuances and features of your business. If Sberbank’s conditions become suitable for one organization, then another will choose Avangard.

The lowest percentage may not always bring benefits to the entrepreneur. Choose a bank taking into account the cost of equipment and current account maintenance.

Who needs acquiring

As of today (May 2021), all businessmen with annual revenues of up to 30 million rubles. are obliged to provide customers with the opportunity to pay using bank cards. From July 1, 2021, this limit will be reduced to RUB 20 million. per year (law dated July 31, 2020 No. 290-FZ).

But for businessmen with lower turnover, in most cases it is better not to give up acquiring.

Buyers have long appreciated the convenience of cashless payments. Therefore, a retail outlet where you cannot pay by card may quickly experience an outflow of customers who will go to competitors.

And if we are talking about online trading, then acquiring is generally the only option that will allow the seller to receive money.

How much does acquiring cost and how to choose the best option?

The acquiring cost consists of two components:

- Equipment acquisition costs.

Most banks that provide acquiring services sell or rent terminals. These devices can also be purchased or rented from specialized companies. The cost of a terminal starts at approximately 15,000 rubles, and rental rates range from 1,500 to 2,000 rubles per month.

The rental option is beneficial, for example, for seasonal work. Also, renting an acquiring service is convenient if a businessman is not yet sure of the benefits of cooperation with a specific bank and wants to conduct a “testing”.

- Payment of commission to the bank.

The acquiring commission comes in two versions: a percentage of turnover or a fixed amount.

The rate for the percentage option depends on the type of acquiring, client category, industry, turnover and other factors. Typically banks set the percentage individually for each client. As a rule, the acquiring rate is lower, the greater the inflows on the account.

The cheapest acquiring is merchant, with the installation of a stationary terminal. The percentage on average ranges from 1% to 2.5%.

Internet acquiring will cost the seller the most. Rates on it can reach 3-4% or even more. This is due to the fact that when transferring funds via the Internet, the procedure usually involves an additional service - a payment gateway, which also receives its share of the commission.

Mobile acquiring, in terms of commission level, on average occupies an intermediate position between online sales and stationary trading.

Also, banks sometimes offer a fixed payment for acquiring, regardless of account turnover. Here the businessman must compare the fixed and percentage options, taking into account the planned revenue.

What does the acquiring commission depend on?

IP owners are looking for cheap and high-quality acquiring for small businesses to accept payments. And here it is useful to know what the size of the commission depends on.

As with the bet, the commission depends on the amount of revenue. This is the first indicator by which the percentage is determined.

Budget rates are available for organizations with large monthly turnover. Because banks operate on the principle that the lower the turnover, the higher the commission.

Let's say your monthly income is 50,000 rubles, then a rate of 2.5% is provided for you. It will be 1250 rubles.

For an organization whose revenue is 100,000 rubles, the percentage will be different - 2.2%. Then you need to give 2200 rubles to the bank.

As you can see, a low interest rate does not guarantee that you will pay less. In both cases, the amount is almost the same, despite the fact that the second organization is twice as fast as the first in terms of profit.

How to reflect acquiring transactions in accounting

Acquiring is a method of crediting revenue to a current account. Therefore, standard transactions that are associated with calculations are used here:

DT 62 - CT 90 - revenue accrued.

Further account transactions depend on the timing of the money transfer. If the bank credits the proceeds to the seller’s current account “day to day,” then direct posting is used:

DT 51 - CT 62 - money has been credited to the account;

DT 91 - CT 51 - the bank’s acquiring commission is written off as other expenses.

But often the bank does not transfer funds to the seller immediately, but after 2-3 days and immediately withholds its commission from this amount. Then you need to use additional account 57 “Transfers in transit”:

DT 57 - CT 62 - funds are debited from the buyer’s card;

DT 91 - CT 57 - the bank withheld the commission;

DT 51 - CT 57 - the bank transferred the proceeds to the seller’s account minus the commission.

Retail sales of goods (ATT) under UTII

When selling goods through ATT, the sale is documented in the document Retail Sales Report, transaction type Retail Store in the Sales – Sales – Retail Sales Reports section.

Payment Card Transaction document using this example.

The title of the document states:

- Warehouse – a warehouse from which goods are sold. Selected from the Warehouses ; when selling at retail, it must be of the Retail Store ;

- Price type – type of retail prices, selected from the directory Price types of items . Prices of the selected type will be automatically entered when selecting items into the tabular part of the Retail Sales Report .

On the Products , select items, enter price and quantity.

On the Non-cash payments , you must fill in the Payment Type and the amount that the buyer pays by card. The payment type is selected from the Payment Types directory .

Postings according to the document

How acquiring affects tax calculations

Under the general tax system (OSNO), revenue for income tax is generally accounted for on an accrual basis. Those. the tax base is formed upon transfer of goods to the buyer or signing of an act on the provision of services, regardless of the payment procedure.

The exception here applies to companies with a turnover of up to 1 million rubles. per quarter, which theoretically can count income and expenses for income tax on a cash basis, i.e. upon payment (Article 273 of the Tax Code of the Russian Federation). But in practice, such situations occur rarely.

Therefore, for companies on OSNO, the use of acquiring in most cases does not in any way affect the tax accounting of revenue.

But under the simplified tax system or unified agricultural tax, revenue, on the contrary, should be counted only “on payment”. The same applies to entrepreneurs on OSNO who pay personal income tax.

The question arises: how to determine the date of receipt of proceeds if the bank transfers funds to the seller several days after debiting from the buyer’s card?

According to the Ministry of Finance, the date of receipt of proceeds for the simplified tax system is the day the funds are credited to the seller’s current account (letter dated July 28, 2014 No. 03-11-06/2/36926).

The Ministry of Finance did not issue such letters for the unified agricultural tax or personal income tax, but by analogy the above clarification can be extended to these tax regimes.

Sales of goods according to the simplified tax system

Sales of goods are reflected in the document Sales (act, invoice) transaction type Goods in the section Sales – Sales – Sales (acts, invoices) – Sales – Goods (invoice).

Postings according to the document

Receipt of payment from the buyer using a payment card is documented in the document Transaction on a payment card, transaction type Payment from the buyer in the Bank and cash desk – Cash desk – Payment card transactions section.

Postings according to the document.

Example 2

The buyer paid by card on June 30, and the bank transferred the money to the seller’s account on July 2. In this case, it is considered that the income was received in July, and the amount received will be included in the tax base for the 3rd quarter.

There is also uncertainty regarding the determination of the amount of income if the bank immediately withholds a commission and the seller’s account receives less money than the buyer paid. The Ministry of Finance indicated that in this case, the seller’s income is the entire amount that the buyer transferred, without deducting the bank’s commission (letter dated September 19, 2016 No. 03-11-11/54526).

Example 3

The merchant, under an agreement with the bank, has an acquiring commission of 1.5% of the amount received into the account. The buyer paid 10,000 rubles using the card. The bank transferred 9,850 rubles to the seller’s account. But the taxable income for the simplified tax system must include 10,000 rubles.

The situation with expenses is somewhat simpler. The bank's commission reduces the taxable base under all tax regimes where accounting for expenses is, in principle, provided for: OSNO, simplified tax system “Income minus expenses” and unified agricultural tax.

When accounting using the accrual method, the commission must be included in expenses in the month to which it relates under the terms of the agreement with the bank. When accounting “on payment”, the expense must be recognized on the date of actual write-off or deduction of the commission by the bank.

But in this case it is impossible to reduce the tax base for VAT. Bank commissions associated with servicing accounts and card payments are not subject to VAT (clause 3, clause 3, article 149 of the Tax Code of the Russian Federation). Therefore, the businessman cannot recover this tax through the acquiring commission.

Of all the costs associated with acquiring, VAT can only be reimbursed on the purchase or rental of a terminal. Of course, provided that the seller or lessor pays this tax himself.

Accounting for acquiring transactions when combining simplified taxation system and PSN

Let's look at the following example to consider the procedure for reflecting bank card payments from "simplified" companies when combined with the patent taxation system.

Example 1

| IP Shilov S.A. is engaged in the retail trade of footwear, applies the simplified tax system with the object “income reduced by the amount of expenses.” In addition, IP Shilov S.A. provides shoe repair services and is the payer of the patent in relation to this type of activity. IP Shilov S.A. uses cash registers when receiving cash and making payments with payment cards. The acquiring bank's remuneration is 2% of the amount of revenue received. IP Shilov S.A. On March 13, 2016, he provided services in the amount of RUB 50,000.00. and sold goods worth RUB 150,000.00. Goods and services were paid for by buyers in cash in the amount of RUB 170,000.00. and payment cards in the amount of RUB 30,000.00. (including: for goods 20,000.00 rubles, for services 10,000.00 rubles). On March 15, 2016, the acquiring bank credited funds in the amount of RUB 29,400.00 to the settlement account of IP Shilova S.A. In accordance with the accounting policy of IP Shilova S.A. goods are accounted for at purchase prices. Both goods and services are sold through an automated point of sale. |

Before starting work, the user must enable the necessary functionality of the 1C: Accounting 8 version 3.0 program, as well as configure the accounting policy and tax accounting parameters. The specified settings are accessed from the Main -> Settings section using the corresponding hyperlinks.

Let's go to the Functionality hyperlink and make the settings for Example 1.

On bookmarks:

- Bank and cash desk set the Payment cards flag;

- Trade -> flag Retail trade.

Let's follow the hyperlink Accounting Policy to the register of the same name and set the attribute Method for valuing goods in retail to the position: At acquisition cost.

Starting from version 3.0.44.94, selecting a tax system, setting up tax accounting parameters and the list of provided reports is carried out in a separate form Setting up taxes and reports, which can be accessed using the Taxes and reports hyperlink.

In the Taxation system section, using the switch, you must indicate the one used by the individual entrepreneur S.A. Shilov. the main tax system is Simplified (income minus expenses), and also set the Patent flag (Fig. 1). The Patents directory is intended to store information in the accounting system about the types of activities in respect of which a patent is paid. The directory can also be accessed from the Setting up taxes and reports form in the Patents section. In addition, information about patents can be indicated directly from the accounting system documents reflecting the sale of goods (works, services).

Rice. 1. Tax system

The following information is indicated in the Patents directory element form:

- working title of the patent;

- number and date of issue;

- validity period of the patent (in case of loss of the right to use the patent taxation system or termination of business activity, the actual validity period of the patent is indicated);

- tax base (monetary value of potential annual income) and tax amount;

- KBK payment.

In collapsible groups:

- Payment - the amounts and terms of payment for the cost of the patent are indicated;

- Tax Inspectorate - information is stored about the tax authority with which the organization is registered as a PSN taxpayer.

To reflect retail sales through an automated point of sale, the program uses the accounting system document Retail Sales Report (Sales section) with the transaction type Retail Store.

This document allows you to maintain separate accounting of income in accounting and tax accounting, received within the framework of the main taxation system (USN) and for activities with a special taxation procedure (transferred to the payment of a patent).

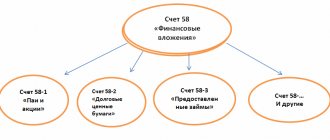

To generate financial results for the main type of activity and for activities with a special taxation procedure in “1C: Accounting 8”, separate sub-accounts have been opened for account 90.

Income from the retail sale of shoes should be accounted for under the credit of account 90.01.1 “Revenue from activities with the main taxation system.”

Income from activities transferred to pay for a patent (shoe repair) should be accounted for in the credit of account 90.01.2 “Revenue from certain types of activities with a special taxation procedure.”

Accounting for expenses should be kept in the debit of accounts 90.02 “Cost of sales”, 90.07 “Sales expenses”, 90.08 “Administrative expenses” for third-order accounts (Fig. 2):

- “1” - to account for expenses for the main activity (STS);

- “2” - to account for expenses for activities with a special taxation procedure.

Rice. 2. Accounts of income and expenses for activities with a special taxation procedure

To store a list of accounts that record transactions for activities with a special taxation procedure (for example, for activities subject to UTII or PSN), the information register of the Income and Expense Account for activities with a special taxation procedure is intended. The register is accessed from the Chart of Accounts register using the hyperlink More -> Income and expense accounts for activities with a special taxation procedure.

In order for income and expense accounts from sales for different types of activities to be entered automatically into documents, it will be useful to set up the Item Accounting register, which is available via the hyperlink of the same name from the Nomenclature directory, located in the Directories section.

Let's create a new document Retail Sales Report. In the header of the document we will indicate the cash register account, in correspondence with which retail revenue received in cash will be reflected. The Warehouse field is filled with the default value. If your organization has several warehouses, then only warehouses with the Retail store and Wholesale warehouse types are available for selection.

If an organization conducts activities with a special taxation procedure (UTII, patent system or activities subject to payment of trade tax), the Income in NU field appears in the document, where you need to indicate the procedure for accounting for income from sales. Based on the conditions of Example 1, the user selects the following value in the Income in NU field:

- simplified tax system, if this document reflects the sale of shoes;

- name of the patent (for example, Shoe repair), if services within the scope of the activity are reflected in the patent. If necessary, here you can add and select a new patent (Create patent...).

On the Products tab, goods and services sold to a retail buyer per day are indicated: their product range, quantity, price and amount.

By default, all payments are considered cash. If during the day payments were made with payment cards, bank loans or gift certificates, then you must fill out the Non-cash payments tab (Fig. 3).

Rice. 3. Indication of the non-cash payment method in the “Retail Sales Report” document

After posting the document Retail Sales Report, where the Income at NU variable takes on the value Shoe Repair, the following accounting entries will be generated:

Debit 62.Р Credit 90.01.2 - for the amount of revenue from the sale of services under the patent (RUB 50,000.00); Debit 57.03 Credit 62.R - for the amount of payment by payment cards (RUB 10,000.00); Debit USN.03 - for the amount of revenue from sales of activities on a patent, paid by card (RUB 10,000.00); Debit 50.01 Credit 62.R - for the amount of cash payment received (RUB 40,000.00);

Please note that if there are several payment options from customers, retail revenue is reflected in the intermediate account 62.Р “Settlements with retail customers”, after which it is distributed according to payment methods.

Off-balance sheet account USN.03 “Settlements with customers for patent activities” is intended to store information about what part of the receivables, when repaid, should be attributed to income from patent activities.

In addition to the accounting register, entries are entered into special accumulation registers for tax accounting under the simplified tax system and for accounting for income under a patent. Thus, cash received for shoe repairs amounted to RUB 40,000.00. will be reflected as part of patent income in the Income Book (patent) register. We remind you that accounting for income when applying PSN is needed for only one purpose - to control the conditions for applying PSN (income from all types of business activities on a patent should not exceed 60 million rubles - subclause 1, clause 6, Article 346.45 of the Tax Code of the Russian Federation).

In the register Book of Income and Expenses (Section I) the amount is 40,000.00 rubles. will be reflected for reference in the columns UTII Income and Total Income. The UTII Income field is intended to reflect income from activities with a special taxation procedure for the purpose of maintaining separate accounting.

After posting the document Retail Sales Report, where the detail Income in NU takes on the value of the simplified tax system, the following accounting entries will be generated:

Debit 90.02 Credit 41.02 - for cost of goods sold (RUB 112,500); Debit 62.R Credit 90.01.1 - for the amount of proceeds from the sale of goods (RUB 150,000.00); Debit 57.03 Credit 62.R - for the amount of payment by payment cards (RUB 20,000.00); Debit 50.01 Credit 62.R - for the amount of cash payment received (RUB 130,000.00);

In addition to the accounting register, entries are made in special accumulation registers, including the following amounts:

- RUB 130,000.00 - in the register Book of Income and Expenses (section I) as part of the income of the simplified tax system;

- RUB 112,500.00 - in the register Book of Income and Expenses (Section I) as part of the simplified tax system expenses.

We will generate a document Receipt to the current account with the transaction type Receipts from sales on payment cards and bank loans in the amount of RUB 29,400.00. If the document is entered manually, then in the Amount of services field you need to enter the amount of the bank commission (RUB 600.00).

After posting the document, the following entries are entered into the accounting register:

Debit 51 Credit 57.03 - for the amount of funds received from the acquiring bank (RUB 29,400.00); Debit 91.02 Credit 57.03 - for the amount of remuneration withheld by the acquiring bank (RUB 600.00); Credit USN.03 - to the amount of payment credited to the current account for activities on a patent (RUB 10,000.00).

In addition to the accounting register, entries are made in special accumulation registers, including the following amounts:

- RUB 10,000.00 — in the register Book of Income Accounting (patent) as part of patent income;

- RUB 20,000.00 - in the register Book of Income and Expenses (section I) as part of the income of the simplified tax system;

- RUB 400.00 — in the register Book of Income and Expenses (Section I) as part of the simplified tax system expenses.

As you can see, the 1C: Accounting 8 program, edition 3.0, automatically distributed among different types of activities not only the funds received under the acquiring agreement, but also the amount of the bank’s commission reflected as expenses under the simplified tax system.

Let's create a balance sheet for account 57.03. The absence of a balance indicates the complete completion of settlements with the acquiring bank.

Conclusion

Acquiring is a system for accepting non-cash payments in retail trade and the provision of services to individuals.

To organize acquiring payments, the seller must purchase equipment and (or) software and enter into an agreement with the bank.

The commission for acquiring services depends on the category of the client and the parameters of his business. It can average from 1% to 4% of turnover or be expressed as a fixed amount.

When accounting for acquiring, you need to take into account the order in which funds are credited to the account - immediately or after a few days.

When tax accounting “on payment”, you must include in the taxable base the entire amount that the buyer transferred, without deducting the commission. Revenue should be recognized on the date the money is actually credited to the seller's account.

Acquiring fees can be included as expenses for tax purposes. VAT cannot be refunded on them.

Creating a new document “Retail Sales Report”

In its header you need to put a cash register account, with which retail revenue in the form of cash will be reflected in correspondence. The "Warehouse" field will be filled with the default value. In the case when a company has several warehouses at once, only warehouses of the “Retail store” and “Wholesale warehouse” types will be available for selection.

When conducting business activities with a special taxation procedure - this could be a patent system, UTII or a business subject to a trade tax), the income field in the document in NU becomes active. It needs to include regulations for accounting for sales income. In our example, the user selects a value in it:

- simplified tax system - in the case when this document reflects the sale of clothing;

- the name of the patent (in this case “Clothing Repair”), if services within the scope of work on the patent are displayed. If necessary, new patents are immediately added and selected (you need to click “Create a patent”).

The “Products” tab contains services and goods sold to customers at retail per day, including their product range, number, cost and amount. By default, any payment is considered to be received in cash. If payments were made with bank cards, credit cards or gift certificates during the day, you need to fill out the non-cash payments tab.