Methodological guidelines

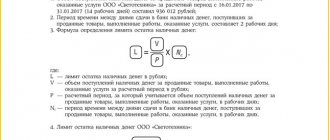

Accounting for cash transactions is regulated by the directive of the Central Bank of the Russian Federation dated March 11, 2014 N 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses.”

We recommend that chief accountants, cashiers and other employees of the financial service of the enterprise who work with cash documents familiarize themselves with it. It is also worth reading the instruction of the Central Bank of the Russian Federation dated October 7, 2013 N 3073-U “On cash payments.” Recipients of budget funds additionally take into account regulations relating to the regulation of cash transactions in budget financing.

Individual entrepreneurs may not keep records of cash transactions in 1C and should not set a cash limit. At the same time, documents such as KUDR must be maintained, because does not apply to cash registers.

Small enterprises (numbers up to 100 people and ready revenue up to 800 million rubles, including microenterprises - organizations with up to 15 people and revenue up to 150 million rubles) are not required to set a cash limit. Other enterprises set a cash limit, above which the cash must be deposited with the bank. An exception is made for funds whose purpose is to pay wages and similar payments. On salary payment days for up to 5 working days (the exact payment deadline is set by the head of the enterprise and indicated on the payroll), it is allowed to exceed the limit of money in the cash register by amounts intended to pay payroll for wages, benefits and similar payments.

Receipt of funds to the cash desk is formalized by the Incoming Cash Order (abbreviated PKO ), payments - by the Expenditure Cash Order (abbreviated RKO ). For payment of wages, etc. You should pre-generate a payroll or payroll statement, even if payments are made to one person. Document flow can be carried out in paper or electronic form. In the latter case, documents must be signed with an electronic digital signature. At the end of the day, a cash book is formed based on PKO and RKO. If there was no movement of funds through the cash register during the day, there is no need to create a cash book for that day.

The maximum limit for cash payments between counterparties under one agreement is 100,000 rubles. Settlements with individuals are carried out without restrictions on the amount.

Funds received by the enterprise's cash desk through the sale of goods, provision of services, or as insurance premiums can only be spent for the following purposes:

- Payment of wages and benefits;

- Payments of insurance compensation to individuals who paid insurance premiums in cash ;

- Payment for goods, works, services;

- Cash issuance on account;

- Refund of funds for goods, works, services previously paid for in cash.

For other purposes, cash should be withdrawn from a bank account.

Violation of the procedure for conducting cash transactions can lead to a fine (Article 15.1 of the Code of Administrative Offenses of the Russian Federation):

- For an official – from 4,000 to 5,000 rubles;

- For a legal entity – from 40,000 to 50,000 rubles.

The tax authorities of the Russian Federation are responsible for checking the correctness of cash transactions (Article 23.5 of the Code of Administrative Offenses of the Russian Federation).

Penalties for lack of PCO

The absence or improper execution of primary cash documents, which, in particular, include a cash receipt order, may result in penalties for the taxpayer in accordance with Art. 120 of the Tax Code of the Russian Federation.

So, according to this article, a gross violation of the rules for accounting for income and (or) expenses and (or) objects of taxation, if these acts were committed during one tax period, in the absence of signs of a tax offense, entails a fine of ten thousand rubles.

At the same time, a gross violation of the rules for accounting for income and expenses and taxable items means the absence of primary documents, including primary cash documents.

Also, the absence of primary cash documents from the purchasing organization may become the basis for the refusal of the tax authority to recognize the specified expenses of the organization for the purposes of taxation of profits or a single tax in accordance with the simplified taxation system (the object of taxation is income reduced by the amount of expenses incurred).

Cash documents in 1C

The above methodology for accounting for cash transactions is not exhaustive and contains the basic rules for working with cash.

Next, we will consider the procedure for working with a cash register using the example of a 1C software product for automating accounting - 1C: Accounting.

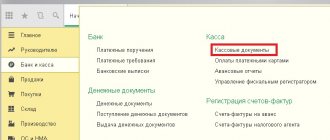

Select menu items Bank and cash desk => Cash desk => Cash documents

Figure 1. Selecting cash documents

Depending on the version of the program, the menu settings may differ slightly, but in any case, in the Bank and cash department you will be able to access the main cash documents - PKO and RKO.

Figure 2. Buttons for entering PKO and RKO

Creation of an enterprise cash register

At least one cash register of the enterprise must be registered in the program. If you work with different currencies or there are several different organizations in the program, then a separate cash register is created for each organization/currency combination.

In the list that opens, click Create. In the cash register card, enter the name, organization and currency:

It is also necessary to include the possibility of issuing DS funds without specifying an application for payment and the possibility of receiving and transferring DS to other cash desks without an order.

Accounting for cash orders is possible in the main cash book of the enterprise, or in a separate cash book (then it must first be created):

This is what the cash book card looks like:

In my case, the main cash book will be used.

Receipt cash order

1C offers ten types of PKO depending on the operation being entered. They are as follows:

- Payment from the buyer;

- Retail revenue;

- Return from an accountable person;

- Return from supplier;

- Receiving cash from the bank;

- Receiving a loan from a counterparty;

- Obtaining a loan from a bank;

- Repayment of the loan by the counterparty;

- Repayment of a loan by an employee;

- Other arrival.

Figure 3. Options for the PQR document

The names of the documents reflect their essence and have appropriate settings, for example, Return from an accountable person will have correspondence with account 71 by default.

Option PKO Other arrival seems universal, because. allows you to select any account from the chart of accounts and carry out any operation. But methodologists from 1C advise using it only as a last resort, for non-standard operations, trying, if possible, to carry out documents with types of operations No. 1-9.

Below are three options for the PKO entry form. General rules – mandatory fields are highlighted with a red line.

Figure 4. PKO - Return from an accountable person

Printable Form Details section can be expanded or collapsed when clicked.

Figure 5. PKO - cash from the bank. Printable form details shown

If the document involves choosing a counterparty who is not an individual, the Contract field must be filled in.

Figure 6. PKO - Payment from the buyer

If you need to specify more than one agreement, use the Split payment function, which allows you to fill out data for several agreements. In this case, after selecting the counterparty, you should open the Payment Breakdown tabular section, select contracts and indicate the amounts for each. The overall result will be reflected in the PQR.

Figure 7. PKO settings - payment by agreement

Field value DDS article is filled in from the directory. This reference book allows you to add the Name of the DDS article, but the Type of movement value is not available for editing. If there are too many items and you want to group them into folders, you should use the “Create group” button. The completed field values will be taken into account in the future when generating reporting form No. 4 “Cash Flow Statement”.

Figure 8. Directory - cash flow items

Let's fill out the PQR for cash receipt from the bank.

Figure 9. Example of a completed PQR

After posting the document, you can view the postings.

Figure 10. Postings through PKO

It should be noted that in this case the movement of money is reflected not only through the cash register, but also through the current account. To avoid double debiting of money from a bank account, transactions of the type Dt 50.01 - Kt 51 are generated by cash and not bank documents.

Account cash warrant

An expense cash order, or RKO, is largely formed according to the same rules as the PKO. In 1C there are the following types of cash registers:

- Payment to the supplier

- Return to buyer

- Issuance to an accountable person

- Payment of wages according to statements

- Payment of wages to an employee

- Payment to an employee under a contract

- Cash deposit to the bank

- Repayment of the loan to the counterparty

- Repayment of loan to the bank

- Issuing a loan to a counterparty

- Collection

- Payment of deposited wages

- Issuing a loan to an employee

- Other expenses

For payments No. 4-5, pay slips should be prepared in advance, even if the payment is made to one employee.

Figure 11. RKO document options

We will issue a settlement settlement for the issuance of funds to an accountable person.

Figure 12. Completed cash register document

After posting the document, you can view the postings.

Figure 13. Postings by cash register

Let's consider the procedure for making wage payments in 1C. We will create a payroll. If all employees received a salary according to it, you can use the “Pay Statement” button (at the bottom of the form), and a settlement settlement will be automatically generated.

Figure 14. Options for cash documents based on payroll

Let’s simulate a situation where one employee’s salary is deposited and the rest are paid. In the paper version of the statement, the corresponding mark is placed on the deposited amounts. In 1C, when accounting for cash transactions, you should open the statement and use the Create based button, then Salary Deposit. For the deposition document, we leave the names we need.

Figure 15. Document Salary Deposit

After completing the document, we look at the postings.

Figure 16. Postings when depositing salaries

We return to the statement and click on the Create button on the basis of which the Cash Issue document . The amount will be recalculated automatically and will be reduced by the deposited amounts.

Figure 17. Document Cash issuance based on payroll

Postings for issuing salaries were generated for two employees, and that’s how it should be.

Figure 18. Postings for the document Cash withdrawal

Deposited amounts can only be kept in the cash desk if they do not exceed the cash storage limit. Otherwise, they should be handed over to the bank. We form a cash settlement cash deposit to the bank.

Figure 19. Filling out the document Cash deposit to the bank

The result of the document.

Figure 20. Postings according to the document Cash deposit to the bank

If you still have questions about working with orders, please contact our support, maintenance and modification service for 1C programs by leaving a request on the website or by phone.

Actions of the cashier after receiving funds

After this, the cashier accepts the money and, after receiving it, puts his signature, surname and initials on the receipt order and receipt.

On the receipt, the cashier also indicates the date the money was received and certifies his signature with a seal. The receipt is stamped so that the edge overlaps the receipt order itself

After the money arrives at the cash register, the cashier tears off the receipt for the PKO along the cut line and hands it to the person who handed over the money, and leaves the cash order at the cash register.

In this case, an entry is made about the received money in the cash book (Form N KO‑4).

Cash book in 1C 8.3

Based on PKO and RKO carried out during the day, we will create a cash book (Figure 21), which is a report on cash transactions performed.

A small note: sometimes when automating, programmers ask users in what form to implement this or that form - as a document or as a report. This question often confuses people. Let me explain the difference using the example of cash documents. PKO or RKO are separate documents for which there is an input form. The amounts in them, as a rule, are entered by the user himself; he can change them if desired. The cash book is a report; there is no input form for it; it is filled out automatically based on the data entered in the PKO and RKO documents. If changes are made to these documents, the report will automatically give the already changed amounts when generated.

Figure 21. Button for generating a cash book

Using this report, you can set the necessary settings.

Figure 22. Cash book settings

Ready report.

Figure 23. Cash Book report

Cash balance limit

To set a cash register limit, go to the section of the same name in the “Organizations” directory card. We have it in the “More” subsection.

This guide indicates the limit amount and validity period. This functionality has made life much easier for accountants to comply with the law.

Advance report

Another document included in the Cash in the 1C program - Advance report

Figure 24. Menu path to documents Advance report

Let's look at an example of filling out an advance report.

Figure 25. Creating an expense report

The table part contains several tabs. We fill out the Advances tab based on the issued cash settlement.

Figure 26. Filling out the Advances tab

Fill in the Products tab with information about purchased goods or materials. If VAT is highlighted in the documents, we indicate this data in the advance report.

Figure 27. Filling out the Products tab

Figure 28. Products tab, account details.

On the Payment tab we show payment for previously purchased goods.

Figure 29. Filling out the Payment tab

Learn more about using the Products and Payment tabs.

If you purchase a single product in a retail store, record this purchase in the Products section. But let’s say you have a situation where you pay with the same supplier either in cash or by bank transfer. And you want to have correct data for calculations, for example, to generate a reconciliation report. Then invoices and invoices received from this supplier on the day of purchase for cash can be carried out separately from the advance payment using the Receipt document (acts, invoices), and in the advance report reflect the PKO details, i.e. payment document on the Payment tab.

After posting the document, you can view the postings. The amount of the advance report was 10,180 rubles, i.e. the overexpenditure of 180 rubles will have to be issued from the cash desk after approval of the advance report.

Figure 30. Postings according to the advance report of accounting and accounting records

Figure 31. JSC - VAT deductible

Payment by payment cards

acquiring in other words, is a currently widespread method of payment for goods or services. Let's consider the procedure for carrying out such an operation in 1C.

Menu path: Bank and cash desk => Cash desk => Payment card transactions.

Figure 32. Menu path - Payment card transactions

By clicking the Create , three document options are possible. We select Payment from the buyer, because... this document is configured to reflect payments from legal entities and individual entrepreneurs. Retail payment card transactions are beyond the scope of this article.

Figure 33. Selecting a document option

We fill out the document, everything is quite simple here.

Figure 34. Completed Payment Card Transactions document

Let's look at the wiring. Cash is reflected in account 57.03.

Figure 35. Postings according to the Transactions on payment card document

To reflect the receipt of funds to the current account, you can create a document Receipt to the current account based on the transaction performed.

Figure 36. Creating a document Receipt to current account

Without a bank commission, payments are unlikely to be made, so we break the payment into the payment amount and the bank commission, and indicate the cost account for this commission.

Figure 37. Completed document Receipt to current account

Let's look at the wiring.

Figure 38. Postings according to the document Receipt to the current account