Unified forms of acceptance certificates for completed construction and installation works (CEM), which are currently used, appeared back in 1999. These forms and the procedure for filling them out were established by Resolution of the State Statistics Committee of Russia dated November 11, 1999 N 100 “Unified forms of primary accounting documentation for accounting works in capital construction and repair and construction works.”

This article discusses the general rules for filling out forms NN KS-6, KS-6a, KS-2, KS-3 and KS-11

What are the specifics of accounting in construction?

Features of accounting in construction are related to the specifics of its activities. Thus, accounting in construction for beginners requires paying attention to, among other things:

- individual characteristics of each construction project;

- territorial fragmentation of construction projects;

- natural specifics of construction (climatic, soil, seasonal and other conditions leading to additional and specific work and (or) costs);

- the need for lengthy preparatory work (development of projects, obtaining permits, etc.);

- variety of types of construction and installation works (CEM);

- multi-stage mutual settlements between construction subjects;

- other nuances.

Despite the specificity of accounting in construction, it is based on generally accepted principles and standard accounts. At the same time, builders:

- specific primary construction materials are used (acts, journals, estimates, certificates, etc.);

- a detailed object-by-object analytics is formed;

- there is often a need to register (deregister) separate divisions, which affects the nuances of taxation and accounting of housing construction;

- difficulties arise when conducting an inventory (related to the specifics of the materials used, the fragmentation of warehouses and facilities, etc.);

- due to the presence of specific construction expenses, there is a need to develop special accounting algorithms for accounting for certain types of expenses (uniform distribution of costs over time, the possibility of one-time inclusion in expenses, nuances of re-presentation of expenses, compensation, etc.);

- There are other accounting features.

Learn the features of accounting and tax accounting in construction with the help of explanations from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

We will talk about specific construction costs and the accounting entries used in this case in the next section.

International consignment note CMR - decoding of the abbreviation and purpose of the document

CMR is an abbreviation derived from the French full name of the Convention on the International Carriage of Goods by Road.

The CMR consignment note is an international document that is extremely important for international road transport. This is the final document reflecting the main information.

Thanks to the DEM, you can understand the following information:

- How many goods were there?

- Who exactly transported him?

- What route did he take?

- According to what documents the transportation was carried out,

- Who is the addressee and who sent the goods,

- How long did delivery take?

It also indicates what kind of goods arrived at customs, in what form, on what day and time, when exactly the sender accepted it and in what condition the goods were at the time of acceptance.

Participants in road transport must have their own duplicates of the DEM. In this case, we are talking about the Carrier who directly delivers the goods from point “A” to point “B”, the Addressee who receives the goods and, in fact, the Sender who sent the goods.

In what cases is a DEM needed?

A DEM is required when several conditions are met:

- Remuneration for transportation is provided;

- Loading and unloading locations are located in different countries;

- The CMR Convention is signed by at least one of the states whose residents are parties to the transaction;

- Cargo transportation is carried out using road transport.

It is important to understand that the number of digital transport invoices must correspond to the number of transport units.

If the cargo is dangerous, the sender must indicate this danger in the consignment note and describe its nature and precautions for the safe transportation of this cargo.

The DEM is essentially a factual confirmation of the implementation of a tripartite agreement, which is concluded between three parties, direct participants in the transportation of goods under the terms of the CMR Convention. And in the event of litigation, it is the CMR that is proof of timely fulfillment of the terms of the contract (or non-fulfillment).

All basic information from transport and shipping documents is combined into the CMR TTN. And the main point is that data from other documents and information in the DEM must match.

But cases when the data differs in the DEM and the packing list, or in the DEM and invoice, in the DEM and TIR, will bring you a lot of difficulties and problems. Such discrepancies can bring especially many troubles to those who carry out transportation. Therefore, the DEM must be carefully verified and checked, otherwise carelessness can be very costly.

The DEM contains two categories of information:

- The first category is information recorded in special columns of the invoice and containing basic information about transportation.

- The other category is no less important. It includes seals and marks, as well as handwritten notes about the transport and its progress.

In addition, there is such a mandatory requirement for the CMR form as the presence of a number.

If the cargo is not indicated in the CMR, then it is considered contraband.

Postings for specific construction expenses

Preliminary costs (before signing the construction contract)

It is not uncommon for a construction firm to incur costs under a construction contract that has not yet been signed.

NOTE! The opportunity to take into account as future expenses the costs incurred in connection with upcoming construction work is provided by clause 16 of PBU 2/2008 “Accounting for construction contracts”, approved by Order of the Ministry of Finance of Russia dated October 24, 2008 No. 116n. However, accounting in construction in 2021 has not undergone any changes.

For example, a construction company can take into account expenses paid in advance under a bank guarantee or a fee for participation in a competition (before signing a construction contract) in account 97 “Future expenses”.

Their recognition is possible evenly throughout the warranty period only after the construction agreement (contract) is signed.

At the time of expenses (before signing the contract), the following entry is made: Dt 97 Kt 76 - expenses for the bank guarantee are taken into account.

From the beginning of construction work, monthly entries are made in the contractor’s accounting (after signing the contract): Dt 20 Kt 97 - part of the costs for the bank guarantee is written off.

In which postings account 20 “Main production” can be involved, see the article “Postings Dt 20 and Kt 23, 10 (nuances).”

Subsequent expenses (for landscaping, environmental restoration, etc.)

Usually, upon completion of construction work, the developer, at the expense of the investor, carries out work to improve the territory adjacent to the completed construction site.

In this case, the costs of improvement carried out before the commissioning of the facility are included in the increase in construction costs of this facility: Dt 08 Kt 60 (10, 23, 25, 26, 69, 70, 76) - the costs of improvement are reflected in the cost of the construction project.

If landscaping work (landscaping, installation of sidewalks, etc.) had to be postponed due to weather and climatic reasons, expenses of this kind provided for in the construction estimate are included in the cost of the object under construction through the formation of an estimated liability (account 96 “Reserves for future expenses”). Write-off of subsequent work performed is carried out at the expense of this reserve.

In order to better understand how to organize accounting in construction, study the features of the formation and write-off of reserves using the materials posted on our website:

- “Write-off of the provision for doubtful debts - postings”;

- “Creating a reserve for vacation pay in accounting.”

EXPLANATIONS from ConsultantPlus: When recognized in accounting, created fixed assets are valued at their original cost, based on the total amount of actual costs associated with their creation. This follows from FSBU 6/2020 “Fixed assets” and FSBU 26/2020 “Capital investments”, which are mandatory for use from 2022, but by decision of the organization can be applied earlier. The conditions for recognizing objects as fixed assets and the list of actual costs on the basis of which their initial cost is formed do not coincide in accounting and tax accounting. Read about the nuances of applying new standards in construction in a ready-made solution from ConsultantPlus.

If you do not have access to the K+ system, get a trial online access for free.

Determining the price of work

During the execution of a construction contract, the contractor incurs expenses, which, along with the remuneration due to him, form the price of the contract (clause 2 of Article 709 of the Civil Code of the Russian Federation). As a general rule, the price of work under a construction contract is determined based on the estimate (clause 3 of Article 709, clause 1 of Article 743 of the Civil Code of the Russian Federation). The estimate drawn up by the contractor becomes valid and becomes part of the contract from the moment it is confirmed by the customer (paragraph 2, paragraph 3, article 709 of the Civil Code of the Russian Federation).

The price of the work (including that indicated in the estimate) can be approximate or fixed. Moreover, if the price is approximate, the condition for this must be directly stated in the contract (clause 4 of article 709 of the Civil Code of the Russian Federation).

If it follows from the terms of the contract that the price is fixed, the contractor has the right to demand an increase only in the event of a significant increase in the price of materials, equipment and services provided by contractors. Provided that such a rise in price could not have been foreseen when concluding the contract (clause 6 of Article 709 of the Civil Code of the Russian Federation).

The opposite situation may also arise when the contractor's actual expenses turned out to be less than those taken into account when determining the contract price (contractor savings). In such a situation, the contractor has the right to demand payment at the contract price, provided that the reduction in costs did not affect the quality of the work (clause 1 of Article 710 of the Civil Code of the Russian Federation).

Situation: is it possible not to prepare an estimate when concluding a construction contract?

The answer to this question depends on how the contractor is paid for construction and installation work.

It is mandatory that estimates be drawn up for capital construction projects financed from budget funds (subclause 11, clause 12, article 48 of the Town Planning Code of the Russian Federation).

If the object is being built through private investment and a fixed price is established in the contract, then it is not necessary to draw up an estimate to determine the contract price.

Situation: how to prepare a cost estimate for a construction contract?

The cost estimate is a document justifying the contractor's expenses under a construction contract (clauses 2, 3 of Article 709, clause 1 of Article 743 of the Civil Code of the Russian Federation). If the work is carried out in accordance with the estimate, then the estimate drawn up by the contractor becomes valid and becomes part of the contract from the moment it is confirmed by the customer (paragraph 2, paragraph 3, article 709 of the Civil Code of the Russian Federation).

The basic document in the field of estimate regulation in construction is the Methodology approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1. In accordance with it, estimated standards are divided into:

- state estimate standards (GSN);

- industry estimate standards (OSN);

- territorial estimate standards (TSN);

- branded estimate standards (FSN);

- individual estimate standards (ISN).

This is stated in paragraph 2.3 of the Methodology, approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1.

Recommended samples of estimate documentation are given in Appendix 2 to the Methodology, approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1. Among them are typical forms:

- local estimate;

- object estimate;

- estimates for design and survey work;

- summary estimate.

The procedure for drawing up estimate documentation is prescribed in Section IV of the Methodology, approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1.

Taxation in construction

The basic principle that construction companies must adhere to when organizing their tax accounting is the economic justification of expenses and their documentary justification. This is the main relationship between accounting and tax accounting in construction in 2021.

Taxation and accounting in construction should be organized in such a way that the information forming the tax base for taxes makes it possible to understand:

- ways for a construction company to determine its income and expenses;

- algorithms for the formation of tax bases for all types of taxes and fees paid by a construction company;

- reserve formation schemes;

- mechanisms for temporary distribution of expenses and transfer of part of them to subsequent periods;

- other tax parameters (amount of tax liabilities as of the reporting date, etc.).

The nuances of tax accounting and filling out tax returns will help you understand the articles posted on our website:

- “What is the procedure for filling out an income tax return (example)?”;

- “How is separate accounting for VAT carried out (principles and methods)?”

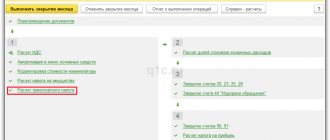

Issuance of SF for shipment to the buyer

The organization is obliged to issue an invoice within 5 calendar days from the date of shipment and register it in the sales book (clause 3 of article 168 of the Tax Code of the Russian Federation).

You can issue an invoice to the buyer by clicking the Issue an invoice document (act, invoice) .

Invoice data is automatically filled in based on the Sales document (act, invoice) .

- Operation type code : “Sales of goods, works, services and operations equivalent to it.”

Documenting

You can print the form of the completed invoice by clicking the button Print the document Invoice issued or the document Sales (act, invoice) . PDF

Sales Book report can be generated from the Reports – VAT – Sales Book section. PDF

VAT declaration

The amount of accrued VAT is reflected in the VAT return:

In Section 3 p. 010 “Implementation (transfer on the territory of the Russian Federation...): PDF

- the amount of sales proceeds, excluding VAT;

- the amount of accrued VAT.

In Section 9 “Information from the sales book”:

- invoice issued, transaction type code "".

Results

The organization of accounting in construction should be carried out in such a way that income and expenses for each construction project are grouped separately and allow the formation of a project-by-project financial result.

For tax accounting in construction, it is important that it gives a detailed understanding of the methods, methods and nuances of forming tax bases for the tax obligations of a construction company.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Legal basis for paid services

The legal basis for the provision of services is based on the concluded contract. In the new edition of the Civil Code of the Russian Federation, a separate chapter 39 is devoted to the contract for the provision of paid services. It regulates the relationship for those services whose result does not have a material expression (communications, information, medical, auditing, veterinary, consulting, training), with the exception of those falling under the scope of the chapters 37-38, 40-41, 44-47, 51.53.

In general, under the contract, the customer undertakes to pay, and the contractor, on the customer’s instructions, must fulfill his obligations. Some types of activities in the service sector are based on special regulations. For example, in the educational industry or in security activities.