The birth of a little person is not only a joyful event in any family, but also a responsible step for it. The burden of worries about the moral and physical development of the baby falls on the shoulders of parents. The question of how much they give for a second child becomes very relevant, since the income of a family in which only one parent works is invariably reduced, while expenses for two children make up the lion's share of the family budget. And therefore, regardless of what assistance the state offers, taking advantage of the benefits provided by payments upon the birth of a second child is your legal right. After all, even a small amount, which mothers say is only enough for diapers, can significantly save your family budget over the course of a year.

Indexation of benefits for the second child in 2021

It was in 2021 that the system of increasing cash subsidies stabilized, which will now be carried out annually from February 1, based on actual inflation data over the past year. That is, benefits issued as of January 2021 may differ in amount from similar payments issued later. After all, it was from February that, in accordance with the actual rise in prices, payments for the second child in 2017 were indexed. To be fair, it is worth clarifying that the increase in actual inflation this year was small, only 5.4%, which had a minor impact on the amount of all subsidies due. Since many payments depend on the minimum wage, changes in the minimum wage directly affect the size of payments. Until June 30, 2017, the minimum wage was 7,500 rubles, and from July 1, 2017 it was increased to 7,800 rubles, that is, indexed by 4%. However, this rule did not apply to maternity capital, the indexation of which is not provided for in the coming years. The amount of the certificate remains equal to 453,026 rubles, and the situation will not change until 2021 in accordance with the law on freezing maternity capital, adopted in December 2021. Each year brings small changes not only in the amount of benefits, but also in their quantity, depending on the region of residence and the conditions for issuing different types of material support.

There was indexation in February

The “children’s” benefits given in the table above are subject to annual indexation. In 2021, indexation was planned by 1.54% from February 1, 2021 (Resolution of the Government of the Russian Federation dated January 26, 2017 No. 88). In this regard, the amounts of some “children’s” benefits have increased since February.

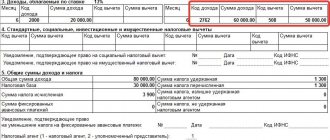

| Amounts of child benefits from February 1, 2017 | |

| Benefit | Size in January 2021 |

| Benefit for registration in early pregnancy | 613, 14 rub. (RUR 581.73 x 1,054) |

| One-time benefit for the birth of a child | 16,350, 33 rub. (RUB 15,512.65 x 1,054) |

| Minimum size for child care up to 1.5 years | Care for the first child - 3065.69 rubles. (RUR 2,908.62 x RUR 1,054) Caring for a second child—RUR 6,131.37 (RUB 5,817.24 x 1,054) |

Regional coefficients

In districts and localities where regional coefficients for wages have been established, “children’s” benefits (both in January 2021 and from February 1, 2021) will be higher - they must be additionally increased by the amount of the increasing coefficient (Article 5 of Law No. 81 -FZ).

Payment upon registration in a residential complex before the 12th week of pregnancy

An expectant mother who is registered at a antenatal clinic or a hospital institution closest to her place of residence with a pregnancy period of no more than 12 weeks is entitled to receive a subsidy in the amount of 581 rubles 73 kopecks. This amount is paid either through the employer or through social security, but in fact this benefit is provided to expectant mothers by the Social Insurance Fund. Officially employed women who conduct business activities with deductions to the Social Insurance Fund (SIF) can receive this small, but still not extra money. Full-time students of educational institutions are given a scholarship.

Maternity benefit

The most significant cash payment is the maternity benefit. It is issued in one amount for maternity leave, these are the so-called maternity benefits. Both working women, full-time students, and unemployed mothers receive it; women fired due to the liquidation of an enterprise also fall into this category, but the difference in payments to these categories of women is very significant. The calculation is made in the amount of the woman’s full average earnings for the previous 2 years, starting from the 30th week of pregnancy. However, it is worth considering the fact that this payment is made only during the leave of the same name (in the event that the expectant mother continues to work, she does not receive benefits, and wages are calculated as usual). As soon as a woman goes on leave of the same name, payment of wages stops and benefits are accrued. The benefit comes into force 70 days before the birth and the same number after upon presentation of a sick leave certificate. In this case, maternity payments for the second child in 2021 until June 30, 2017 will be no less than 34,520 rubles and no more than 248,164 rubles, and if they go on maternity leave after the first of July, when the minimum wage has increased to 7,800 rubles, the minimum payment will be 35 901.37, and the maximum allowable payment is 266,191.80 rubles. But how much do they give non-working mothers for their second child? For the unemployed and non-working, calculations are made based on the minimum wage (minimum wage), and therefore equal to the minimum level acceptable for this payment. Unemployed mothers receive maternity benefits from the social security agency. The amount of the BiR benefit does not depend on how many children are in the family, but when switching to BiR leave from leave to care for a previous child, the years preceding the first leave are used for calculation. A detailed calculation of the benefit can be seen in the article on our website dedicated to this particular benefit.

What is “child benefit”

Let us say right away that such a concept as “children’s benefits” is not directly disclosed in the legislation. However, in practice, accountants usually understand child benefits as payments that are associated with the birth and upbringing of children. Such benefits are generally required to be paid by the employer. “Children’s” benefits include:

- benefits for registration in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly allowance for child care up to 1.5 years;

- maternity benefits (“maternity benefits”).

At the same time, we note that in some regions of the Russian Federation a pilot project is underway to pay benefits (including “children’s”) directly from the Social Insurance Fund budget. FSS units in the experimental regions themselves calculate and pay benefits to insured persons (employers only transfer some documents to the fund). Also see “Participants in the FSS pilot project.”

However, in 2021, the amount of child benefits has changed several times. In this regard, we consider it appropriate to tell our readers about this. In particular, we will tell you in detail how the amounts of child benefits have changed since July 1, 2021.

One-time benefit for the birth of a child

When a baby is born, the family budget is replenished with another lump sum payment - a childbirth allowance. After indexation, the amount of this payment for the second child in 2021 is 16,350 rubles. This money is given in cash to the mother or father of the newborn, provided that one of them is a citizen of the Russian Federation. The payment is due to both working citizens and the unemployed, but in the first case it is paid by the employer, and in the second case, if both parents do not work, they should contact the social security department or a multifunctional center.

Maternal capital

For several years in a row, maternity capital has been a support for many young spouses who have decided to give birth to or adopt another baby. For many years, this payment for the second child has been the most significant state assistance, which is issued at the birth of a second child in the form of a certificate for a certain amount. The certificate is received by a family with two children, one of whom must have been born after 2007, and the mother and father are Russian citizens. In recent years, despite rumors that these payments would stop at the birth of a second child, the government decided to extend the maternity capital program until 2021, however, as stated above, there will be no indexation of the certificate amount. As of 2017, the amount is 453,026 rubles.

Payments to the pregnant wife of a conscript

In connection with the introduction of amendments to the legislation on conscription, deferments were canceled for conscripts whose wives were in a position for more than 26 weeks or had children under 3 years of age. The state assumed compensation due to the temporary absence of the breadwinner. The pregnant wife of a serviceman is assigned a one-time subsidy, for 2021 its amount is 25,892.45 rubles. In the area of residence of the spouse in which the regional coefficient is applied, this amount will be equal to its multiple. To receive this cash benefit, the wife of a conscript soldier must be in the third trimester of pregnancy for at least 180 days, confirmed by a certificate from that medical organization. In which he is registered.

Minimum amount of maternity payments in 2021 and maximum

In accordance with this, the minimum amount of maternity benefits in 2021, taking into account the average daily earnings calculated according to the minimum wage, is:

- RUB 34,520.55 - during normal childbirth (140 days);

- RUB 38,465.75 — during complicated childbirth (156 days);

- RUB 47,835.62 - in case of multiple pregnancy (194 days).

Although in 2021 its size is 755 thousand rubles, when calculating the benefit, the insurance base for the two previous years is taken - 2015 and 2016 (670 and 718 thousand rubles, respectively), based on which the maximum amounts of maternity payments will be:

- RUB 265,827.63 - during normal childbirth;

- RUB 296,207.93 - during complicated childbirth;

- RUB 368,361.15 - during multiple pregnancy.

Regional payments for the second child in 2021

In addition to state support, regional authorities provide incentives to families who decide to have a second child. The amounts and payment procedures vary greatly depending on the region of residence of the family. The most tangible support from municipal authorities is felt in the main cities of Russia, while in the outback regional payments are either minimal or absent. Let's go over the main known payments for a second child, and they will be discussed in more detail in the corresponding article.

What does a second child deserve in Moscow?

The capital of Russia, not in words, but in deeds, is concerned about increasing the birth rate. Being the largest metropolis in the country, Moscow also ranks first in terms of living standards, which includes increased costs. The so-called Luzhkov benefits help increase the social security of young families. One of them applies to young spouses under thirty years of age with two children. As a result, a young Moscow family is given 121,100 rubles for their second child, regardless of the income of the husband and wife. Parents have the right to receive them if one of them lives in Moscow and is a citizen of Russia, or a single mother registered in the capital. This category also includes an adoptive parent living in Moscow with the child taken into the family. You can apply for a subsidy without leaving your home on the government services portal. But the Moscow region rewards parents much more modestly - only 20,000, but they will not be superfluous in a family where two children are growing up.

Payments for a second child in St. Petersburg

Peter also takes care of its residents, especially young families, and tries to keep up with the official capital. The subsidy for the birth of a second child in a family is almost 34,984 rubles, which is issued at the regional multifunctional service center at the place of registration. The money is transferred to the social card of the Children's Bank of St. Petersburg, and you can spend it in most hypermarkets and children's stores on children's products.

Governor's payments in Russia

Regional or gubernatorial benefits are established in the subjects of the Federation by local social protection departments and multifunctional centers. One of the parents just needs to write an application and indicate the method of receiving money - cash or non-cash. By the way, it should be noted that the amount and conditions for receiving subsidies vary greatly in different regions of the country. To find out how much they pay for a second child in the region, you need to contact the appropriate authority. For example, in Kaliningrad this amount will average 5,000 rubles, Kostroma - from 3,500 to 6,000 rubles, Voronezh - two subsistence minimums. There is no point in blaming the regions for lack of attention to large families; everything depends on the economic potential of the region, and the authorities strive to ensure that the amount of incentives for families with children increases.

An increase in the minimum wage to 7,800 rubles from July 1, 2021, in certain situations will affect the calculation of sick leave, maternity and child benefits. But it is worth noting that no indexation of benefits will occur from July 1, 2021; simply, due to the increase in the minimum wage, there have been changes in the calculation and minimum values. Let's take a closer look.

Minimum benefits have increased since July 1, 2021. The minimum earnings for calculating benefits for two billing years will be 187,200 rubles. (7800 rub. * 24 months) or 256.44 rub. per day (RUB 187,200 / 730 days). This change will affect the calculation of sick leave and maternity leave in two cases:

-if the employee did not have any earnings during the billing period;

- if the average earnings calculated for the specified period, calculated for a full calendar month, are below the minimum wage on the day the insured event occurred.

Another basis for payment of the minimum benefit is if an employee, during a period of incapacity for work due to his own illness, while on sick leave, violated the regime prescribed by the doctor.

The new minimum wage will also change the amount of child care benefits from July 1, 2021.

Minimum maternity benefit

Let us recall that maternity leave is a legally established paid period of 140, 156 or 194 days, which is entitled to every woman to give birth to a child and restore her health.

Until July 1, 2021, the minimum wage was set at 7,500 rubles, and if maternity leave began in 2021 (from February 1 to June 30), then the minimum average daily earnings for calculating maternity benefits should be taken equal to 246.575342 rubles . (RUB 7,500 * 24 months / 730). This value is used for further calculation of benefits if it turns out to be greater than the actual average daily earnings of the employee. The minimum amounts of maternity benefits until June 30, 2017 will be as follows:

RUB 34,520.55 (246.575342 rubles * 140 days) – in the general case;

RUB 47,835.62 (246.575342 rubles * 194 days) – in case of multiple pregnancy;

RUR 38,465.75 (RUR 246.575342 * 156 days) – for complicated childbirth.

From July 1, 2021, the minimum amount of maternity payments must be calculated from the new minimum average daily earnings of 256.438356 rubles. Here are the new values of minimum maternity benefits from July 1, 2021 for different lengths of leave:

RUB 35,901.37 (256.438356 * 140 days) – in the general case;

RUB 49,749.04 (256.438356 * 194 days) – in case of multiple pregnancy;

RUB 40,004.38 (256.438356 * 156 days) – for complicated childbirth.

Let's look at the changes using examples.

Example 1. Kurochkina O.N. wishes to go on maternity leave from July 28, 2021. The billing period is from January 1, 2015 to December 31, 2021. There was no earnings during the billing period. Insurance experience – 7 months. The regional coefficient does not apply. The minimum average daily earnings is 256.438356 rubles. (7800 rubles * 24 months) / 730. Daily allowance – 256.438356 rubles. (RUR 256.438356 * 100%). As a result, the amount of benefits to Kurochkina O.N. for 140 calendar days of maternity leave, calculated from the minimum wage in the minimum allowable amount, will be 35,901.37 rubles. (RUR 256.438356 * 140 days).

At the start of maternity leave, a woman’s work experience may be less than six months. This happens, for example, if this is your first job. Then maternity leave for a full calendar month should not exceed the minimum wage (Part 3, Article 11 of Federal Law No. 255-FZ of December 29, 2006). In areas with regional coefficients - in an amount not exceeding the minimum wage, taking into account such coefficients.

Example 2. Ivanova S.P. Starting June 21, 2021, she will go on maternity leave. It will end on November 8, 2017. In the billing period from January 1, 2015 to December 31, 2016, she has no income. Insurance experience – 5 months and 1 day. The regional coefficient does not apply.

Let's determine the average daily earnings based on the minimum wage that was applied at the beginning of maternity leave (that is, in June). The average daily earnings will be 246.58 rubles. (RUB 7,500 * 24 months / 730 days). Accordingly, the daily allowance will be 246.58 rubles. (RUR 246.58 * 100%).

The maximum daily benefit depending on the number of calendar days is as follows:

in June – 250 rub. (7500 rub. / 30 calendar days);

July, August and October – 251.6129 rub. (7800 rub. / 31 calendar days);

September and November – 260 rub. (7800 rub. / 30 calendar days).

Now let’s compare the amount of the daily allowance from the minimum wage with the maximum daily allowance for each month of maternity leave. And it turns out that the daily benefit based on the minimum wage does not exceed the maximum daily benefit in all months of maternity leave:

RUR 246.58 < RUR 250;

RUR 246.58 < RUB 251.6129;

RUR 246.58 < 260 rub.

Thus, the accountant has the right to calculate the benefit from the daily allowance calculated from the minimum wage - 246.58 rubles. As a result, the amount of S.P. Ivanova’s benefit for 140 calendar days of maternity leave will be 34,520.54 rubles. (246.58 rubles * 140 days), where 140 days is the duration of maternity leave.

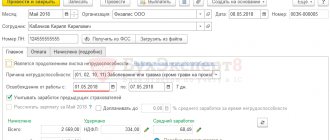

Minimum child care allowance

The employer must pay child care benefits to the employee monthly in an amount equal to 40% of average earnings, but not less than the minimum amount (Clause 1, Article 11.2 of Federal Law No. 255-FZ of December 29, 2006).

The amount of the minimum benefit (for the first child) from July 1, 2017 cannot be less than the amount calculated from the new minimum wage, namely 3,120 rubles (7,800 rubles * 40%). However, the new value should only be used if maternity leave began on or after 1 July 2017. At the same time, the “minimum wage” for caring for the second and subsequent children does not change. It remains in the amount of 6131 rubles before and after July 1.

Example 3. An employee goes on maternity leave in the summer to care for her first child. The billing period is 2015-2016. During this time, she was credited with 122,907.72 rubles. There were no excluded periods. The monthly allowance based on actual earnings will be: 142,901.12 rubles / 731 days. * 30.4 days * 40% = 2044.54 rub. Let's consider two situations. The first is that maternity leave begins before July 1. Let's calculate the amount of the monthly benefit based on the previous minimum wage: 7,500 rubles * 40% = 3,000 rubles. This is the employee's first child. This means that the benefit amount cannot be less than 3065.69 rubles. This amount is due to the employee for a full month, since it is more than both 2044.54 rubles and 3000 rubles. The second situation is that the vacation begins on July 1 or later. The amount of benefits from the new minimum wage will be: 7800 rubles * 40% = 3120 rubles. This is more than 3065.69 rubles. Therefore, in this case, charge the employee 3,120 rubles. per month.

Rolling benefits from July 1, 2021

If an employee gets sick or the employee goes on maternity leave before July 1, the new minimum wage should be used only if the amount of the benefit was limited to the minimum wage, that is, in a situation where the length of service is less than six months.

This is due to the fact that they are calculated based on the following rule: the amount of the monthly benefit cannot exceed the minimum wage. Law No. 255 does not say on what date the minimum wage must be taken to calculate benefits (Part 6, Article 7 of Law No. 255-FZ), so benefits must be recalculated by month if they have different minimum wages.

Example 4 (sick leave). The employee was sick from June 28 to July 4, 2021 inclusive (seven calendar days in total). The calculation period is 2015–2016. The employee works full time; regional wage coefficients have not been established in the region. During 2015–2016, the employee had no income. At the time of illness, his insurance coverage was less than six months. This means that the amount of the benefit cannot exceed this amount: 7,500 rubles / 30 days. * 3 days + 7800 rub. / 31 days * 4 days = 1756.45 rubles, where 30 days. and 31 days – the number of days in June and July, and 3 days. and 4 days – number of sick days in these months. Now let's determine the minimum benefit amount. To do this, let’s take the minimum wage as of the date of illness – June 28: 7,500 rubles* 24 months. / 730 days * 60% * 7 days. = 1035.62 rub. This amount is less than 1756.45 rubles. This means that the employee needs to be credited 1035.62 rubles.

Example 5 (maternity leave). The employee went on maternity leave from June 5 to October 22, 2021 inclusive. She joined the company in February 2021. This is the first place of work. This means that at the time of going on maternity leave, her work experience is less than six months. The employee works full time; regional wage coefficients have not been established in the region. Before the maternity leave, the accountant calculated the amount of the benefit as follows. The calculation period is 2015–2016. The employee had no income at that time. In this case, the minimum amount of daily earnings will be 246.58 rubles. (RUB 7,500 * 24 months / 730 days). But since the length of service is less than six months, the amount of the benefit cannot be more than one minimum wage for a full calendar month. With daily earnings of 246.58 rubles. the amount of the benefit will exceed the minimum wage in those months in which there are 31 days (246.58 days * 31 days = 7643.98 rubles). That is, in July and August. This means that for these months you need to pay 7,500 rubles. In addition, 31 days are also in October. Let's calculate the benefit for this month, as well as for other months in which maternity leave falls:

246.58 days * 26 days = 6411.08 rub. (for June);

246.58 days * 30 days = 7397.40 rub. (for September);

7500 rub. / 31 days * 22 days = 5322.58 rub. (for October).

As a result, the amount of maternity benefits will be:

6411.08 rub.

+ 7397.40 rub. + 7500 rub. * 2 + 5322.58 rub. = 34,131.06 rub. From July 1, the minimum wage increased to 7,800 rubles, which means that the amount of benefits for the period from July 1 needs to be recalculated. Maternity pay for July, August and October now does not exceed the minimum wage. The employee needs to pay the following amount: (RUB 7,643.98 – RUB 7,500) * 2 + RUB 246.58. * 22 days – 5322.58 rub. = 390.22 rub. Leading audit specialist

A.V. Minaeva

Monthly allowance for child care up to one and a half years old

This benefit is paid by the Social Insurance Fund either through the employer to officially employed family members, or through the MFC or social services to unemployed citizens. Every family member or close relative has the right to care for a child up to one and a half years old. At the same time, he will receive 40% of his salary, which is calculated from his official income for the past two calendar years. However, even if the family member caring for the baby received an extremely high salary, the maximum threshold for this monthly benefit is 23,120.66 rubles at the time of 2021. How much do unemployed citizens pay for a second child? A very small amount, which, after indexing from February 1, is no longer 5,817.24 rubles, but a little more - 6,131.37 rubles. The benefit is accrued starting from the month the newborn is born. You can apply for a subsidy at the department of social protection of the population or at the MFC.

Monthly benefit from one and a half to three years

Many mothers stay on maternity leave for up to three years, but the money that significantly helps the family live stops being paid after the baby is one and a half years old. However, at the federal level, a benefit is fixed, which is no longer paid by the Social Insurance Fund, but directly by the employer - 50 rubles per month. The amount has not been indexed for a very long time and now looks ridiculous, but if we multiply 50 rubles by 18 months, we get 900 rubles. An amount that a young mother will probably find somewhere to spend - after all, you can agree with the employer so that he pays it in a lump sum, or just let it “drip” onto the card - after all, giving your employer your money is somehow excessively generous. But in order to receive this benefit, you must write a corresponding application to the accounting department.

Benefit amounts from February 1: table

The table shows the benefit amounts from January 1, 2021 and February 1, 2021. Using this table, it will be more convenient for an accountant to understand what exactly has changed in connection with the February indexation.

| Comparative table of benefit amounts | ||

| Type of benefit | from January 1, 2021 | from February 1, 2021 |

| Benefit for registration in early pregnancy | RUB 581.73 | 613, 14 rub. (RUR 581.73 x 1,054) |

| One-time benefit for the birth of a child | RUB 15,512.65 | 16,350, 33 rub. (RUB 15,512.65 x 1,054) |

| Minimum monthly allowance for child care up to 1.5 years | • care for the first child - 3000 rubles; • care for the second child 5,817.24 rub. | • care for the first child – 3065.69 rubles. (2908.62 rub. x 1.054) • care for the second child - 6131.37 rub. (RUB 5,817.24 x 1,054) |

| Maximum monthly allowance for child care up to 1.5 years | RUB 23,120.66 | RUB 23,120.66 |

| Minimum amount of maternity benefit | • 34,521.20 rubles - in the general case; • 47,835.62 rub. - during multiple pregnancy; • 38,465.75 rub. - during complicated childbirth. | • 34,521.20 rubles - in the general case; • 47,835.62 rub. - during multiple pregnancy; • 38,465.75 rub. - during complicated childbirth. |

| Maximum amount of maternity benefit | • 266,191.8 rub. - in general; • 368,865.78 rub. - during multiple pregnancy; • 296,613.72 rub. - during complicated childbirth. | • 266,191.8 rub. - in general; • 368,865.78 rub. - during multiple pregnancy; • 296,613.72 rub. - during complicated childbirth. |

Due to the indexation of benefits by a factor of 1.054 for January 2017, employees do not need to pay anything extra. If you need to recalculate and pay extra, then only from February 1, 2017.

Children of conscripts

A subsidy of ten and a half thousand when the child reaches the age of 3 helps military wives avoid financial difficulties. From the first of February, after the next indexation, the amount increased to 11,096.77 rubles. In some cases, it may be assigned to another relative of the baby who is caring for him. In the event of the loss of a breadwinner, children of military personnel and employees of services equivalent to the military can receive compensation for the loss of a breadwinner from the local department of social protection; payments for the second child in 2021 will amount to 2,279.47 rubles. The benefit will be issued upon reaching working age, or until the age of 23 in the case of studying at a higher educational institution.

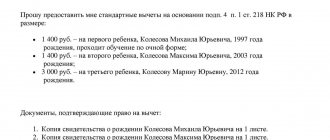

Other benefits and benefits

The state subsidy complements other benefits and is not the only assistance. For example, reduced tax deductions from the wages of officially working parents will allow the family to save from 2,000 to 18,000 rubles. There are often monthly payments available in the regions aimed at low-income families. For example, in St. Petersburg, 3,768 rubles are transferred to a low-income family’s social children’s card for the maintenance of a second child up to one and a half years old, and from the age of 1.5 to 7 years, a little less - 848 rubles, but this is also noticeable for a family with two children. The Social Code of St. Petersburg stipulates that a family is considered low-income if each member has less than one and a half times the minimum subsistence level. From the local budget, 3,768 rubles are transferred monthly to the Children's bank card, and it can only be used in specialized stores. Such assistance measures are also available in other regions of Russia, and you can find out more about them at the regional MFC by asking the operator how much they currently give for a second child in your specific region. In total, benefits and payments provide tangible support to young parents when a new baby appears in the family. Let us be grateful to the state for its help and do not be lazy in processing the payments due to you.

New increase in child benefits from 2021 from Putin: size and timing of increase

President Vladimir Putin, during his address to the Federal Assembly, announced an increase in child benefits and an expansion of the number of recipients.

From July 1, 2021, organizations and individual entrepreneurs are required to pay employees wages of at least 7,800 rubles (not less than the new minimum wage). The new minimum wage is established by Article 1 of Federal Law No. 460-FZ dated December 19, 2016. Before this, the minimum wage was 7,500 rubles.

The increase in the minimum wage from July 1, 2021 in some situations will affect the calculation of sick leave, maternity and child benefits. Let us explain in more detail what exactly is affected by the increase in the minimum wage.