How to become a volunteer

To voluntarily pay contributions, you need to register with your territorial Social Insurance Fund.

The procedure is simple. We submit a package of documents, and within three working days we receive notification of registration from the fund.

Now documents can be submitted not only during a visit to the fund itself, but also to the MFC or electronically through the State Services portal.

What documents will be needed:

- Application (form from Appendix No. 1 to the order of the FSS of the Russian Federation dated April 22, 2019 No. 216);

- Passport.

The fund will see all other information in the application and check it itself (registration in the Unified State Register of Individual Entrepreneurs, TIN). If desired, the individual entrepreneur can provide copies of the tax registration certificate and a sheet from the Unified State Register of Individual Entrepreneurs, but this is not necessary.

If an individual entrepreneur sends documents by mail or transfers them to the fund through a proxy, a copy of the passport must be certified by a notary.

Step-by-step instructions for registering individual maternity leave for yourself

If an individual entrepreneur wants to get maternity leave, she will have to take a number of actions. An agreement on voluntary social insurance must first be signed. When the document is in hand and the necessary contributions have been made in full, you will need to contact the FSS unit. You must have with you a package of documents confirming your right to receive payment.

You must contact the same branch of the government agency to which the transfers were made. A decision on a received application is made within 10 days. You will be able to receive your IP payment no later than the 26th of the next month. If the application for maternity funds is approved, payment can be transferred using the following methods:

- through a bank;

- to a card account;

- by postal transfer.

The choice of method depends on the convenience of the citizen. A girl going on maternity leave must indicate the transfer method at the time of submitting the documentation.

Deadline for payment of voluntary contribution

Now comes the fun part.

The fee must be paid for the year. It can be done in one go, or in several payments. But this must be done before December 31 of the current year. Then next year the individual entrepreneur will be entitled to benefits.

That is, if you pay the fee before December 31, 2021, then when a cold or other illness hits you in 2022, you can take sick leave and apply for payment from social insurance. And this year you will have to support yourself at your own expense, even if the money has already gone to the fund’s budget.

If the individual entrepreneur does not pay the fee by the end of the year, then from January 1, the legal relationship with him will be terminated. The FSS will send the appropriate decision to the individual entrepreneur by January 20.

If the individual entrepreneur pays the fee only partially by December 31, the relationship with him will still be severed, and the money will be returned.

An entrepreneur can deregister on his own initiative, in which case the money paid will also be returned. The return period is one month from the date of deregistration.

Payment rules

In order for a female entrepreneur to receive maternity payments and other child benefits, two conditions must be met:

- The woman will have to go through the registration procedure with the Social Insurance Fund. You must contact the department of the institution located at the girl’s place of residence. As a fact confirming the start of interaction with the extra-budgetary fund, a corresponding agreement will be concluded.

- An entrepreneur must make timely transfers of insurance premiums. In this case, the established sizes and deadlines must be strictly observed.

If an individual entrepreneur makes a payment to the Social Insurance Fund this year, maternity benefits will be accrued only in the next period. To receive the payment, you must have an official sick leave certificate for pregnancy and childbirth. It must be drawn up in accordance with the current legislation of the Russian Federation. Only a medical institution that has a license has the right to provide sick leave.

IMPORTANT

2018 brings with it a number of changes. The procedure for calculating payments will not change, but there will be innovations in social legislation. Already in 2021, a legal act was adopted according to which the provision of social benefits is now regulated by Chapter 34 of the Tax Code of the Russian Federation. This means that the authority to transfer maternity and other payments fell to the tax authorities. To calculate the required benefits, contributions that were made to the Social Insurance Fund within 2 years will now be taken into account.

How to calculate the amount of sickness benefit

The real income of the individual entrepreneur is not included in the calculation. The benefit is calculated based on the minimum wage established on the day of sick leave.

The amount of the benefit depends on the length of insurance coverage. It includes:

- length of service for the period when the individual entrepreneur was employed as an ordinary individual;

- those years that the individual entrepreneur fully covered with voluntary contributions.

For example: Petrov P.P. worked under an employment contract for 7 years, and then received the status of an individual entrepreneur and paid voluntary contributions for two years (2019 and 2020). This means his length of service for calculating sick leave benefits in 2021 is 9 years.

The longer the insurance period, the greater the benefit will be:

- 60% of the minimum wage if the experience is 6 months or more. up to 5 years;

- 80% of the minimum wage with experience from 5 to 8 years;

- 100% of the minimum wage for more than 8 years of experience.

Now we calculate the average daily earnings. To do this, we divide the minimum wage by the number of days in the month in which the insured event occurs.

Let's say Petrov fell ill in January 2021. His average daily earnings will be: 12,792 rubles. / 31 = 412.65 rub.

Benefit amount = Average daily earnings * percentage of insurance period * number of sick days.

Petrov spent 11 days on sick leave, then:

Benefit amount = 412.65 rubles. * 100% * 11 days. = 4,539.15 rub.

Now let’s compare the amount of the benefit with the amount of the voluntary contribution.

fee 4,451.62 rubles. < allowance 4,539.15 rub.

What do we see? The voluntary contribution pays off when the individual entrepreneur remains on sick leave for at least 11 days throughout the year. And then provided that his insurance experience is more than 8 years. Otherwise, the game is not worth the candle.

Important: if an individual entrepreneur pays voluntary contributions and, while running his business, also works for hire, he has the right to receive benefits in two places: both as an individual entrepreneur and as an ordinary individual.

But there is a point when paying voluntary contributions can bring truly tangible benefits. We are talking about a female entrepreneur who is going on maternity leave.

The amount of maternity capital in 2014

The amount of maternity capital in 2014 was also indexed. Its amount increased by more than 20 thousand rubles and amounted to 429,400 rubles.

The size of regional maternity capital in the Tambov region did not change in 2014. As before, its size is 100 thousand rubles. You can use it if a third or subsequent child was born in your family after January 1, 2012.

Reposts 0

7

If you notice an error or typo in the text, highlight it with the mouse and press Ctrl + Enter

Benefits for individual entrepreneurs expecting a child

A female individual entrepreneur can count on the following payments:

1.Benefit for registration in early pregnancy.

The benefit amount from 02/01/2021 is 708.23 rubles.

This payment can be received upon registration for pregnancy up to 12 weeks. You can receive a payment even if the individual entrepreneur did not pay voluntary contributions.

2.Maternity benefit.

Usually paid for 140 days of maternity leave (70 days before childbirth, and 70 after). In the case of a complicated or multiple pregnancy, the duration of leave increases to 156 and 194 days, respectively.

You can receive benefits only if you pay voluntary contributions.

Example: a female individual entrepreneur paid voluntary contributions for 2021. On February 8, 2021, she went on maternity leave, where she will remain until June 27, 2021 (140 days).

The amount of the benefit will be 59,782.80 :

- February — 12,792 rub. / 28 days * 21 days = 9,594 rub.

- March - 12,792 rubles;

- April - 12,792 rubles;

- May - 12,792 rubles;

- June — 12,792 rub. / 30 days * 27 days = 11,512.80 rub.

Important : if a female individual entrepreneur is simultaneously employed, she has the right to two benefits: both as an individual entrepreneur and as an ordinary individual under an employment contract.

3.Benefit for the birth of a child.

The amount of payment from 02/01/2021 is 18,886.32 rubles.

You can receive this payment even if you do not pay contributions.

4.Child care allowance up to 1.5 years old.

From 02/01/2021 it is 7,082.85 rubles. monthly.

You can receive benefits even if you do not pay contributions. However, there is one caveat. If there were no voluntary contributions, the benefit is assigned from the day the child is born.

If the individual entrepreneur transferred contributions and received maternity benefits, then payments for the child will begin after the end of maternity leave (three months later). After all, the first three months of a child’s life will be “covered” by maternity benefits.

For example: To the individual entrepreneur from our example, the fund will accrue benefits for child care up to 1.5 years from June 28, 2021 to October 19, 2022 (the conditional date of birth of the child is 04/19/2021).

Let's estimate the benefits for individual entrepreneurs.

| Payments/contributions | The individual entrepreneur did not pay fees | Individual entrepreneur paid dues |

| Allowance for early registration | 708,23 | 708,23 |

| Maternity benefit | — | 59 782,80 |

| Birth benefit | 18 886,32 | 18 886,32 |

| Child care allowance up to 1.5 years old | 127 582,69 | 111 292,14 |

| Contribution for 2021 (RUB 12,130 * 2.9% * 12 months) | — | (4 221,24) |

| Total | 147 177,24 | 186 448,25 |

| Benefit | 39 271,01 | |

Thus, by paying contributions for 2021, an individual entrepreneur will be able to gain almost 40 thousand rubles.

We wish all entrepreneurs good health and suggest that you entrust all the fuss with taxes to us. Take the maximum from the state and give the minimum with Black Accounting

Law on maternity payments for individual entrepreneurs

Today there is no specific law regulating the calculation of maternity benefits for individual entrepreneurs. As a general rule, payments can be received by persons for whom employers make contributions to the Social Insurance Fund. At the same time, current legislation does not oblige entrepreneurs to make monetary contributions for themselves. A person has the right to perform an action voluntarily. Experts advise not to neglect this opportunity and transfer the required amount in a timely manner. In another situation, the girl risks being left without maternity leave. The entire payment procedure is regulated by the following regulations:

- Federal Law No. 212 of July 24, 2009;

- Federal Law No. 255 of December 29, 2006;

- Government Decree No. 790 of October 2, 2009, Chapter 34 of the Tax Code of the Russian Federation.

Before applying for maternity leave, individual entrepreneurs should familiarize themselves with the provisions of the above regulations.

Receiving payments

For the convenience of citizens, the state has developed several ways to receive funds. Capital can be transferred using:

- postal transfer;

- bank payments;

- crediting funds to the card account.

Attention

The choice of method directly depends on the wishes of the girl who receives maternity benefits. The individual entrepreneur must decide which method the funds will be transferred to before submitting the application. The document must already indicate a suitable method for transferring the payment.

Social insurance fee

The amount of contributions that individual entrepreneurs must pay to the Social Insurance Fund directly depends on the minimum wage. The calculation is made using a special formula. Thus, in 2021, the minimum wage amounted to 7,500 rubles. The entrepreneur had to pay the following amount to the Social Insurance Fund

7,500 x 0.029 x 12 = 2,610 rubles.

For your information

Funds can be transferred in a lump sum or divided into small parts. The choice depends on the convenience of the entrepreneur. However, the following rule must be observed: payments in full must be transferred before the end of the current year. Otherwise, the insurance contract will be automatically terminated.

Taxation

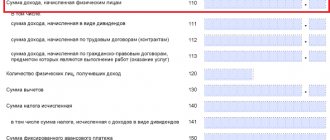

To obtain the right to maternity benefits, a person must register with the Social Insurance Fund. Then you have to make the necessary payments on time. Additionally, the entrepreneur is required to draw up a report on the funds received. It is filled out according to Form 4a-FSS and submitted by January 15.

All persons who pay contributions are required to submit reports. If an entrepreneur has voluntarily entered into a social insurance agreement, he is also obliged to perform this action. The form to be filled out consists of a cover page and two tables. In the first of them, it is necessary to enter information about payment orders, and in the second, the amounts of benefits that were paid on sick leave or provided in other situations established by law are recorded.

If a businesswoman goes on maternity leave, the activities of the individual entrepreneur are temporarily suspended. The features of contributions to the state are also changing. If the entrepreneur paid taxes:

- according to the simplified tax system for income, you will only need to pay insurance premiums for yourself;

- according to the simplified tax system, income minus expenses, you will again only need to pay insurance premiums for yourself;

- According to UTII, tax is calculated based on physical indicators. Therefore, contributions to the state will need to be made within the prescribed period. Insurance premiums for yourself are deducted in accordance with the established procedure.

It must be borne in mind that the above rules apply only if the girl does not have employees.