1C 8.3 Accounting 3.0 implements a simplified mechanism for adjusting past periods and correcting errors of the past period. Actions when an error is detected vary depending on the impact of the error on tax:

- The tax is underestimated - the previous period is adjusted;

- The tax is not underestimated – adjustment of the current period.

Important! If the accountant plans to make adjustments to the previous period and the tax is not underestimated, then the tax data in 1C 8.3 is adjusted manually.

Adjustment of receipts of the previous period

Let's look at an example.

Let’s say that the Confetprom company discovered a technical error in March when providing communication services for December 2015; the amount of costs was exceeded by 30,600 rubles.

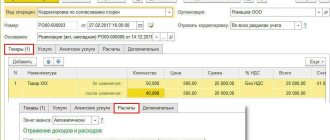

The receipt of communication services in 1C 8.3 was documented with the document Receipt (acts, invoices) from the Purchases section. An invoice was also immediately registered:

An invoice was also issued:

and VAT was accepted for deduction:

A corrective document, Receipt Adjustment, was issued for this receipt.

It is important to determine the reason for the adjustment (type of operation):

- Correcting your own error - if a technical error is made, but the primary documents are correct.

- Correction of primary documents - if the conformity of goods/services and other things does not coincide with the primary documents, there is a technical error in the supplier’s documents.

Let's look at this example in these two situations.

Own mistake

In this case, a technical error was made in the amount by the accountant, so we select Correct our own error:

When editing a document from a previous period, in the Item of other income and expenses field, Corrective entries for transactions of previous years are set. This is an income/expense item with the item type Profit (loss) of previous years:

On the Services tab, enter new data:

When posting, the document generates reversal entries downward if the final amount is less than the corrected amount. And additional transactions for the missing amount in the opposite situation:

In addition, when adjusting the previous period in 1C 8.3, adjustment entries for profit (loss) are created:

The Purchase Book displays the adjusted VAT amount:

After correcting the previous period in 1C 8.3, it is necessary to make a Reformation of the balance sheet for the last year in the Operations section - Closing the month in December.

How to correct a mistake if you forgot to enter an invoice, how to take into account “forgotten” unaccounted documents in terms of tax accounting when calculating income tax in 1C 8.3, read our article.

Technical error in supplier documents

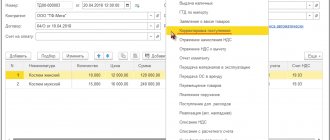

If a mistake is made by the supplier, Type of operation is set to Correction in the primary documents. We indicate the correction number for both the receipt and the invoice:

On the Services tab, indicate the correct values:

The document makes similar entries with the correction of its own error in adjusting the previous period. You can also print the corrected printed documents.

Bill of lading:

Invoice:

To reflect the corrected invoice in the Purchase Book, you need to create the document Generating Purchase Book Entries from the Operations section by selecting Regular VAT transactions:

In addition to the main sheet in the Purchase Book:

The correction is also reflected in the additional sheet:

Document “Adjustment of receipts” in 1C 8.3

After purchasing the goods, the adjustment is made through the “Receipt Adjustment” document in “Purchases”.

You can create it directly from the receipt using the “Create based on” button, or you can also add it to the list of documents manually. In the new implementation change document, it is necessary to indicate the delivery document from which it is created to correct the data.

In this case, receipt information is automatically filled in from the delivery document, which simplifies the work. Also, documents “based on” can be created from a receipt document.

Some data will be copied to the “Before changing” line of the “Products” tab and cannot be edited. The “After change” line is also filled in automatically, but remains available for editing. Here you can change data such as the quantity of the product or its price - this may be necessary if it has changed while the product was being delivered, or if the operator for issuing invoices entered incorrect data into the system.

When the documents that document the receipt are changed, the changes also affect mutual settlements with suppliers. It should be remembered that the corresponding adjustments must also be made to VAT accounting.

So, if in the end less goods were received, you should check the box as shown in the following screenshot. As a result, the previously taken into account VAT will be restored, and the program will add the required entry in the sales book. To do this, select the operation highlighted in the screenshot. In “Goods” in the situation under consideration, the VAT rate cannot be changed.

The document may indicate whether changes should be reflected in all sections, or whether they should be made only for VAT accounting. The postings reflect the restoration of VAT and information about cost adjustments.

To make adjustments to the primary document, you need to select the “Correction in primary documents” operation. You can change the data in any column of the tabular section, as well as generate adjustment movements for VAT - shown in the pictures below.

Then you can generate an “Invoice received”. To enter data, click the “Create based on” button.

If the cost of purchased goods has increased, you need to create a document “Creating purchase ledger entries” and also enter data in the “VAT deduction” tab.

Adjustment of sales of the previous period

Let's look at an example.

Let’s say that the Confetprom company discovered a technical error in March when selling communication services for December 2015; the amount of income was underestimated by 20,000 rubles.

The implementation of communication services in 1C 8.3 was formalized by the document Sales (acts, invoices) from the Sales section. An invoice was also immediately registered:

A corrective document Implementation Adjustment was issued for this implementation. The type of operation in case of a technical error is selected Correction in primary documents. On the Services tab, you need to make corrective changes:

It is also necessary to issue a corrected invoice:

Corrective entries are reflected in the movements:

The corrected implementation is reflected in an additional sheet of the Sales Book. To create it, you need to go to the Sales – Sales Book page:

How to correct an error in receipt or shipment documents that affects primary documents, as well as special tax accounting registers, is discussed in our next article.

Example of registration of a downward adjustment of receipts

For example, let’s take the document “Receipts (acts, invoices)”. Adjustments to the implementation in 1C 8.3 are absolutely similar to those received. Let's say that two months ago we issued a document where we receive some goods worth 8,997.76 rubles.

After arrival we begin to sell the goods.

After some time, we discovered an error in the receipt document. The price should be different, for example, 223 rubles. The amount, respectively, is 9,143 rubles.

Discrepancies arise:

- in mutual settlements;

- in VAT accounting.

To record and correct this situation, there is a document “Receipt Adjustment”.

Adjustment can be of two types:

- Correction in primary documents.

- Adjustment by agreement of the parties.

The differences are that in the first case we simply correct our error found in the primary document. In this case, all columns of the tabular section are available for editing. You can generate a correction invoice.

When making adjustments by agreement of the parties, that is, when the parties agreed that the terms of delivery change (the price or quantity changes), the column with the VAT rate cannot be edited. But you can check the “Restore VAT in the sales book” checkbox and also create a corrected invoice in 1C 8.3.

An example of adjusting receipts for the previous period downward:

In addition, it is possible to choose where the adjustment will be reflected:

- in all sections of accounting;

- only for VAT accounting;

- only in printed form (if the original document is corrected).

Let's look at the postings that the adjustment document created in 1C:

As you can see, the document corrects the difference in invoice 60.01 and VAT (invoice 19.03). Moreover, if after the change the amount decreases, the VAT is reversed, and the 60th account is posted as a debit.

If the amount increases, account 60 is posted to the credit in both cases.

The cost of lower-level sales, unfortunately, is not recalculated or adjusted, but I would like to see this.

Cancellation of an erroneously entered document

There are situations when a document is entered by mistake, for example, a duplicate is created in the 1C 8.3 database.

For example, the Confetprom company in March discovered a non-existent document for the receipt of communication services for December 2015.

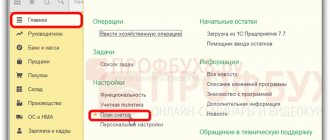

Cancellation of an erroneously entered document in 1C 8.3 is carried out manually using the Cancellation operation in Operations entered manually from the Operations section.

In the Reversing document field, select the erroneously entered document. This reversal document reverses all transactions, as well as VAT charges:

To enter a reversal transaction into the Purchase Ledger, you must create a VAT Reflection for deduction from the Transactions page:

- It is necessary to check all the boxes in the document;

- Be sure to indicate the date of recording of the additional sheet:

On the Products and Services tab:

- Fill in the data from the payment document and set a negative amount;

- Make sure that the Event field is set to VAT submitted for deduction:

You can check whether the cancellation of an erroneous document is correctly reflected in the Purchase Book - section Purchases:

How to reflect the implementation of the previous period

Let's look at an example.

Let’s say that in March the Confetprom company discovered unrecorded sales of communication services for December 2015.

To reflect the forgotten implementation document in 1C 8.3, we create the Implementation (acts, invoices) on the date the error was found. In our case, March, not December:

In the invoice document we indicate the date of correction (March) and the same date is indicated in Issued (transferred to the counterparty):

To reflect VAT in the previous period, you must check the Manual adjustment box and correct it in the Sales VAT register:

- Recording an additional sheet – set to Yes;

- Adjusted period – set the date of the original document. In our case, December:

Erroneously forgotten document when creating the Sales Book from the Sales page:

We recommend watching our seminar, which discusses how to correct VAT amount errors that affect the tax calculation and how to correct “technical” errors that do not affect the tax calculation:

You can study in more depth the mechanism for adjusting past periods and correcting errors of the past period in 1C 8.3, as well as the necessary actions when an error is detected, at our master class “ Correcting errors and adjustments in accounting .”

Give your rating to this article: (

4 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?