Increasing the scope of work in accordance with the Labor Code of the Russian Federation

Increasing the volume of work involves assigning an employee work in his own specialization. It is assumed that this work is not specified in the original employment contract. The procedure is regulated by Article 60.2 of the Labor Code of the Russian Federation. Additional load is assigned if the following conditions are met:

- No separation from core activities.

- Performing duties within the standard working hours (based on Part 1 of Article 60.2 of the Labor Code of the Russian Federation).

Article 60.2 of the Labor Code of the Russian Federation stipulates additional conditions for increasing the scope of work:

- Obtaining written consent from the employee.

- Carrying out activities in another or original position.

- The manager is obliged to pay the employee extra for additional assignments.

An increase in the scope of work is introduced based on the worker’s application.

IMPORTANT! The employer needs to know what exactly is meant by an increase in the volume of work. As part of this procedure, the manager can assign an employee work performed within the boundaries of his position, the volume of which is greater than standard. If the worker is assigned another job, the design will be slightly different. For example, in case of internal part-time work, the employer needs to draw up an additional employment contract.

Assignment of duties without additional payment

For example, you can make an offer to combine positions. At the second stage, they begin to draw up the order itself. Here they write about the validity period of the document, describe the responsibilities themselves that you will have to face. It is impossible to do without determining the amount of remuneration. The order is registered using a special journal, where the document is assigned a separate number.

The employee must be familiarized with the document against personal signature. About additional responsibilities within one position The regulatory documents do not contain clear recommendations for drawing up job descriptions. There are only special recommendations from Rostrud. Therefore, paperwork remains an entirely voluntary matter for employers.

The form of such documentation remains arbitrary.

How to formalize the assignment of duties to a temporarily absent employee?

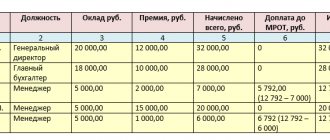

Let’s assume that the organization’s staffing table provides for the following positions: - chief accountant (1 unit); - senior accountant (1 unit); - accountant (2 units); - cashier (1 unit); - head of the personnel department (1 unit). .); - senior personnel inspector (1 unit).

The following options for filling positions may be established in the internal labor regulations.

Positions of temporarily absent employees for which replacement is allowed Acting duties of a temporarily absent employee Chief accountant Senior accountant Senior accountant Accountant Accountant Senior accountant, accountant Cashier Accountant Head of the HR department Senior HR inspector Also in a local regulatory act, you can also prescribe general rules for determining the amount of additional payments for performing the duties of temporarily absent employees workers.Step 2.

Is it possible to assign responsibilities without additional payment: details of registration

Such officials include:

- Typically, the responsibilities of a manager going on vacation, including signing authority, are assigned to his deputy.

In this case, no additional payments will be made. If you spell out this condition in the job description, then with the deputy. the director will not have to enter into an additional agreement each time.

- The same replacement procedure applies to a chief accountant going on vacation.

Initially, responsibilities are transferred to his deputy without additional payments.

One worker on two chairs

Sometimes this method is more optimal than redistributing responsibilities. However, leaders are extremely reluctant to agree to it. It's all about finances.

A newly hired employee will have to pay the entire salary, while for a full-time employee even half is enough. This results in serious savings in funds. There is also such a nuance as an introduction to the matter.

A new person is unfamiliar with the intricacies of production. Consequently, his work will limp and let others down. Temporary assignment of duties can be carried out for a period of up to one year or until the main employee leaves. In case of transfer, the person retains his place of service.

How are the duties of a temporarily absent employee performed?

In addition, it guarantees safety when it comes to government inspections. The first stage is to obtain consent from the employee in writing.

How to register temporary performance of duties by another employee

After all, the employee will not have to be released from performing his own duties. Therefore, we want to talk about how to properly arrange and pay for the replacement.

We come to an agreement with the employee So, the employee, along with his main job, will perform additional duties within the working hours established for his main job by compressing his work during the working day.

He may be entrusted with both work similar to the one he performs (increasing the volume of work, expanding the service area), and work in a different position/profession (combining).

We advise the manager Substitution is the most convenient way to assign the responsibilities of a temporarily absent employee to another employee. After all, the employee performs additional duties along with his own during the working day.

Order on assignment of duties: subtleties of the issue

The administration may offer the employee a part-time job, that is, he will work for two people for some time. Another way is translation. In this case, the employee is relieved of his main duties.

For example, if the boss’s secretary goes on vacation or gets sick, a courier can be hired in his place. At the same time, the administration should consider whether this person will be able to perform his previous duties.

If he manages to fit into working hours, then a part-time job is used, otherwise a transfer is used. The assignment of duties to a temporarily absent employee must be properly formalized and additional payments must be taken into account.

It is also necessary to keep in mind that in post-Soviet countries, whose legislation in the field of labor relations is based on the previous code, changes have occurred. This means that personnel officers should look for a solution based on the national regulatory framework.

All documents that the deputy will sign must indicate the position (“deputy manager” (“deputy chief accountant”)), his last name, first and middle initials and signature.

If during this period the deputy does something, then it is he who will bear disciplinary (Article 192 of the Labor Code of the Russian Federation), material (Articles 232, 243, 277 of the Labor Code of the Russian Federation), administrative (Article 2.1 of the Code of Administrative Offenses of the Russian Federation) and even criminal liability (Article 24 of the Criminal Code RF).

The heads of the organization, their full-time deputies, as well as heads of structural divisions, as a rule, are not paid additional payment for the period of substitution. The Russian Ministry of Health and Social Development explained to us what this practice is based on.

Someone else's work for a while If one of the employees is absent from the workplace for some time, then his duties for this period are assigned to another member of the team. This usually occurs due to illness, vacation or business trip.

There are two possible solutions to this issue:

- Temporary transfer to the position being replaced. The employee is set a salary for the new profession with all additional payments retained (with the exception of personal allowances). As a result, the amount should in no case be lower than his average salary at his previous place of work.

- Temporary performance of duties along with the performance of their main work.

Assignment of duties to an absent employee without additional payment

When going on vacation while you are away, a replacement may be required. The duties of the person who went on vacation will be performed by another employee.

There are different methods of replacement: temporary, combining positions, increasing the volume of tasks. The employer assigns the duties of the temporarily absent person to another employee.

- How to assign the responsibilities of a temporarily absent employee under the Labor Code of the Russian Federation? Sample memo for the execution of affairs of the main employee

- Sample statement of consent

- Sample order

How to assign the responsibilities of a temporarily absent employee under the Labor Code of the Russian Federation? Management can use any convenient method to replace vacationers.

Performing the duties of an absent employee without additional payment

An order to assign duties to an employee has recently become commonplace in almost any enterprise. It is not difficult to draw up such a document. You just need to strictly follow a certain sequence of actions and not violate the Labor Code.

Reasons for issuing an order There are situations when one of the employees is absent from the workplace for one reason or another. But the enterprise should not change its usual rhythm of work or stop altogether during this time. The way out of this situation would be an order to assign the duties of this employee to someone else.

But before this, the employer must decide by whom and in what way these duties will be performed.

Is it possible to assign duties without additional payment?

Early termination of temporary substitution Can an employee prematurely refuse to perform work within the framework of temporary substitution? An employee has the right to early refuse to perform additional work, and the employer has the right to early cancel an order to perform it. The employee must be notified in writing no later than three working days in advance of early termination of work as a temporary replacement. If an employee wishes to refuse to perform additional work early, he must also notify the employer in writing three working days in advance. This procedure is provided for in Part 4 of Article 60.2 of the Labor Code of the Russian Federation. Ivan Shklovets, Deputy Head of the Federal Service for Labor and Employment 2. Judicial practice: THE SUPREME COURT OF THE RUSSIAN FEDERATION DECISION dated March 11, 2003

Vote:

Labor Code of the Russian Federation on the right of an employee to receive wages in accordance not only with his qualifications, but also with the complexity of the work, the quantity and quality of the work performed.

The reference by the representative of the Ministry of Labor and Social Development of the Russian Federation to the fact that if a manager is absent for a long period of time (more than 1 month), the difference in salaries is actually paid to his replacement employee cannot be taken into account when resolving this dispute, which consists in standard control, while that the disputed provisions of the clarification themselves do not say anything about the need for such payment in the event of a long-term replacement of a manager by an employee (more than 1 month).

in a calendar year).

Rules for registration of additional work

IMPORTANT! A sample order for establishing additional payment to an employee for increasing the amount of work from ConsultantPlus is available at the link

In order to correctly process the additional payment, you need to correctly document the increase in the scope of work. Each stage involves drawing up a corresponding document.

Application for increasing the scope of work

The application is drawn up in a standard form: “header”, title, text itself, date and signature. Let's take a closer look at the list of information that needs to be included in the document:

- Manager's position and place of work.

- Full name of the head.

- The employee's position and full name.

- Title of the application (“on consent to perform the work”).

- Request for an increase in the scope of responsibilities.

- Content and scope of work, duration of their implementation.

- Amount of surcharge.

At the end of the application there must be the position of the manager and his signature.

How to specify the condition on the amount of additional payment in an additional agreement to an employment contract on increasing the volume of work?

Service memo

Based on the application, a memo is drawn up. It is sent from the head of the company to the director. Let's consider the information that needs to be mentioned in the memo:

- The title of the manager's position, his full name, and the name of the company.

- The employee's position and full name.

- Document's name.

- A request to assign additional work to an employee and its justification (for example, one of the employees going on vacation).

- A request for additional payment in the established amount.

- The position of the sender of the note and his signature.

The form of the memo is also not established by law.

Order on the introduction of work and additional agreement

After receiving consent from the employee, an agreement should be drawn up, which is attached to the employment contract. The document contains the following information:

- The content of the work.

- The period of its introduction.

- Amount of surcharge.

Based on this agreement, an order is drawn up. It contains the following data:

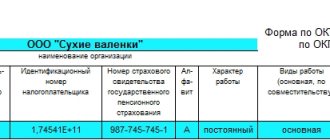

- Name of the organization.

- The name of the document and its number.

- Date of preparation.

- An order to assign additional work with reference to the relevant articles of the Labor Code of the Russian Federation (in particular, articles 60.2, 151).

- Manager's signature.

The employee must be familiarized with the order and signed. Without this, the document will not be valid.

Is it possible to assign responsibilities without additional payment: paperwork

Labor legislation does not imply serious restrictions when assigning additional work responsibilities to employees. But if the employer makes a mistake when preparing documents, then questions and sanctions from the authorities exercising control are possible. Often an employer has a question about whether it is possible to assign duties to an employee without additional payment.

Assigning additional responsibilities to employees

Additional responsibilities: how to assign an employee

Here it is worth referring to Article 60 of the Labor Code. According to this rule, employees cannot be required to fulfill obligations that are not contained in the original agreement between them and their employers.

Each enterprise draws up special job descriptions that describe in detail the range of responsibilities. Often it is wide enough without additional loads.

The employee must familiarize himself with this document, as well as with his responsibilities, on the day he signs the agreement with the other party.

The following options are available if additional work is required:

- Standard registration of combined positions. In this case, it is recommended to rely on the provisions of Article 60.2 of the Labor Code of the Russian Federation. This means that an additional agreement is signed to the current contract.

- The employee is hired as an internal part-time worker for another position. Here the main support is Article 60.1 of the Labor Code of the Russian Federation. Then another Labor Agreement is drawn up.

In any case, it is impossible to do without paying the employee additional remuneration.

The Labor Code does not regulate the issue of payment in any way. That’s why the manager himself and his subordinates do this. It is important to come to a compromise that suits everyone.

New responsibilities without extra pay: is it possible?

Is it possible to assign duties without additional payment?

And here you can find a solution, but it is permissible to use only two methods.

Indication of relevant information in the employment contract. It should be written that during the absence of an employee with similar functions, his work can be performed by other team members. It is separately reported that there is no additional charge for such situations.

But this method is relevant only in the temporary absence of an employee. And in the case when the functions are really similar. This option cannot be used if the relevant information is initially missing from the Employment Contract.

Making changes to job descriptions. In this case, a change in the citizen’s labor function is assumed. This means that the employment contract itself changes, for which an additional agreement is drawn up.

The main thing is to indicate exactly which document and in which edition now becomes the main one. It is impossible to use such a solution without the consent of the worker.

The company's management must decide for itself which option would be more appropriate.

Temporary transfer and combination: features

This translation is one of the most convenient design options in such situations. The timing of temporary transfers usually depends on the reason.

For example, you can establish that the performance of new duties ends when the main employee returns from vacation. In some cases, this does not even require consent from the employee. For example, when there is a general production need.

Combinations are usually formalized if key employees go on maternity leave or long vacations. This is where Article 60.2 of the Labor Code comes to the rescue.

It is assumed that the part-time worker performs both his main job and additional work. This period is usually also associated with the following concepts and phenomena:

- Recalculation of wages, upward.

- Significant expansion of the service area.

- Increasing the direct volume of work.

In case of oral agreements

Verbal agreement to assign responsibilities to an employee

An oral agreement allows you to avoid many formalities. The manager will not have to spend a lot of time on documentation.

But such agreements protect the employee least of all from a legal point of view. After all, the job description is not adjusted, and the salary is not recalculated.

That is, an employee has two staff units at once. And he has no additional remuneration.

An employee has every right to refuse to take over the duties of someone who is currently on leave. But it often happens that after a refusal, the employer threatens to fire you.

But in such a situation, the law is on the side of the subordinates. If dismissal does occur, then you have every right to go to court in order to protect your rights. If the outcome of the case is positive, the citizen is reinstated to his position without any problems.

Replacement of managers: some features

Any manager is the most important person on whom the further successful activities of the enterprise depend. Therefore, the replacement procedure requires a responsible approach.

An experienced director always agrees in advance with who will replace him. For this purpose, all documents are drawn up and specifics are specified.

The peculiarity is the need to issue a so-called power of attorney to replace and perform duties. It should be separately said that the deputy has the right to sign documents, use company stamps and seals if necessary.

Source: https://naimtruda.com/otnoshen/mozhno-li-vozlozhit-obyazannosti-bez-doplaty.html

How to determine the amount of surcharge?

The amount of additional payment is determined, as a rule, on the basis of an oral agreement between the employer and employee. The legality of the agreement between participants in the labor process is established by part 2 of article 151 of the Labor Code of the Russian Federation. When calculating the amount, the following factors are taken into account:

- Content and scope of new responsibilities (Article 151 of the Labor Code of the Russian Federation).

- Qualification of the employee, complexity of the work, volume of work and its conditions (Articles 129, 132 of the Labor Code of the Russian Federation).

- The obligation to introduce equal pay for work of equal value (paragraph 6, part 2, article 22 of the Labor Code of the Russian Federation).

The surcharge can be entered either as a flat amount or as a percentage. The law is silent on the exact amount of (minimum/maximum) remuneration.

Question: How to reflect a one-time payment to an employee for an increase in the volume of work and service areas: as a bonus or as an additional payment? How to apply for such a job? Is it included in income tax expenses? View answer

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Legal consultations » Labor disputes » On payment for the work of an employee involved in working on a day off in his main position with a combination of work in another position

Question

1) An employee is assigned to work on a day off in his main position, the order states that he is combining work in another position. Do I need to be paid for combined work on a day off?

2) Another employee is also involved in working on a day off in his main position. When working during the main time, he combines work in another position and receives additional payment for this. When going to work on a day off, should a combination of duties be included in the double pay?

Lawyer's answer

In response to the first and second questions, we report the following.

The norms of the Labor Code of the Russian Federation do not directly guarantee additional payment in an increased amount to employees for combined work when working on weekends. Therefore, it is advisable to resolve this issue by adopting relevant local regulations in the organization (individual entrepreneur) or by concluding a specific agreement (agreements) between the employer and employee.

In accordance with Art. 60.2 of the Labor Code of the Russian Federation, with the written consent of the employee, he may be entrusted with performing, during the established duration of the working day (shift), along with the work specified in the employment contract, additional work in a different or the same profession (position) for additional pay. The period during which the employee will perform additional work, its content and volume are established by the employer with the written consent of the employee. Combination requires written consent between the employee and the employer and is usually formalized by an additional agreement to the concluded employment contract for the main job.

For performing the combination, the employee is paid additionally (Article 151 of the Labor Code of the Russian Federation). The amount of additional payment is established by agreement of the parties to the employment contract, taking into account the content and (or) volume of additional work (Article 60.2 of the Labor Code of the Russian Federation). This additional payment refers to compensation payments for work in conditions deviating from normal (Part 2 of Article 135 of the Labor Code of the Russian Federation).

Remuneration of workers on weekends and non-working holidays is regulated by Art. 153 Labor Code of the Russian Federation. According to Part 1 of Art. 153 of the Labor Code of the Russian Federation, work on a day off or a non-working holiday is paid at least double the amount:

for piece workers - no less than double piece rates;

employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

for employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if work on a day off or a non-working holiday was carried out within monthly standard working time, and in an amount of at least double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly standard working time.

The provisions of this article do not guarantee an increased additional payment for combined work when working on weekends. In Part 2 of Art. 153 of the Labor Code of the Russian Federation contains only rules that specific amounts of payment for work on a day off or a non-working holiday can be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of workers, or an employment contract. Thus, an analysis of the norms of labor legislation allows us to conclude that the employer has no obligation to take into account the additional payment for combining work on a day off. Therefore, this issue, in the absence of relevant local regulations, can be resolved within the framework of a written agreement concluded between the employee and the employer. If the employer is against increasing the amount of additional payment for combining work when the employee performs work on a day off, then the employee has the right to early refuse to perform additional work by notifying the other party in writing no later than three working days in advance (Article 60.2 of the Labor Code of the Russian Federation).

{Question: The employee received an internal job with an additional payment in the amount of 1/3 of the official salary for the position being shared. The employee was brought to work on a day off. At the same time, he also performed work in a combined position. Do I need to take into account the additional payment for combined work when paying for work on a day off? (Expert Consultation, 2012) {ConsultantPlus}}

Since in Art. 153 of the Labor Code of the Russian Federation does not contain instructions on the procedure for paying for work on a day off, if an employee is involved in such work in a combined position, we believe that payment for work on a day off can be calculated in the following ways:

- based on the salary for the combined position;

- based on the amount of additional payment established for combination.

In any case, it is advisable for the employer to agree on the amount of payment for work on a day off in advance and record the agreement in an agreement or order on hiring people to work on a day off.

{Question: Our employee holds multiple positions. The employer hired him to work on a day off in a dual position. How to pay for such work? (“HR department of a commercial organization”, 2014, N 12) {ConsultantPlus}}

Selection of documents (see appendix):

Question: A combination of jobs has been issued for the employee. From time to time he is called upon to work on weekends. Should an additional payment for combined work be taken into account when paying for work on weekends? (Expert Consultation, 2011) {ConsultantPlus}

Question: Our employee holds multiple positions. The employer hired him to work on a day off in a dual position. How to pay for such work? (“HR department of a commercial organization”, 2014, N 12) {ConsultantPlus}

The explanation was given by Igor Borisovich Makshakov, legal consultant of LLC NTVP Kedr-Consultant, March 2018.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE ().

How to remove additional payment for increasing the volume of work?

To remove the additional payment, you need to remove the employee’s responsibilities for performing the assigned work. The manager needs to issue an order to stop accrual of remuneration. Based on this document, the accounting department stops payments.

IMPORTANT! The increase in the scope of work can be stopped after the deadline for its introduction has expired. For example, an employee is assigned additional responsibilities for the period from June 1 to June 20. Payments stop on June 21. The manager must draw up an order in any case.

The increase in the scope of work may be terminated early. The formalization of this depends on whose initiative the termination of the previous agreement occurred. If this is the initiative of the worker, then a statement is drawn up, if the initiative of the employer is a notification, which must be familiarized to the employee against signature. The document is sent to the interested party three days before the load is reduced. For example, if it is expected that the employee’s duties will be removed on July 23, the application must be sent on July 20.

Additional questions

Is information about the increased workload entered into the employee’s work book? No, you do not need to provide any additional information. This is relevant even if the employee combines several positions at once.

Is it possible to introduce an increase in the scope of work without additional payment? This is only possible if the corresponding provision is contained in the employee’s job description. For example, the document may indicate that the employee must perform the functions of an employee going on vacation without receiving remuneration. In this case, the absence of additional payments will be completely legal. This is due to the fact that the employee will perform work within the framework of the concluded contract. The corresponding rule is in the Letter of the Ministry of Health and Social Development dated March 12, 2012 No. 22-2-8970.

IMPORTANT! If the job description does not oblige the employee to completely replace an absent employee, a partial additional payment may be established.

Employer's liability for lack of payments

The employer, unless otherwise provided by law, is obliged to pay additional payments to employees. If he does not do this, he can be brought to administrative responsibility. In particular, the employer is issued a fine in the amount of 1,000-5,000 rubles. The amount of the fine is established by Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

How to hold an employer accountable? You can contact the labor inspectorate. Upon the employee's application, the company is checked. An alternative option is to file a claim in court. The second option is more preferable. When contacting the labor inspectorate, you need to understand that the inspection will not be carried out immediately. As a rule, it is carried out within a month. During this period, the conflict that has arisen may no longer be relevant. Moreover, it is quite difficult to detect an offense during an audit.