Information on the average number of employees (the sample form is unified) is submitted by business entities to the Federal Tax Service inspectorate. The mandatory nature of the procedure is enshrined in Art. 80 Tax Code of the Russian Federation. The tax inspectorate, based on the number of the specified number, will determine which commercial structures can submit reports in paper form, and which are allowed to submit documentation only within the framework of the electronic document management system. In addition, information about the average number of employees is important for small enterprises - if they are not submitted, you may not be included in the unified register of small businesses, because population data is one of the criteria for “getting” into this register.

Who should provide information on the average number of employees?

Average headcount is information about the average number of employees working in a company in a certain period of time.

This indicator must be calculated for each business entity that attracts employees. Moreover, when determining it, you can take completely different periods of time - one month, three (quarter), the whole year, etc.

However, despite the period for which the calculation must be made, the same methodology is used for all cases.

Attention! Entrepreneurs do not have to send information about the average number of employees. However, this rule only applies if the individual entrepreneur does not attract hired employees. This provision came into force in 2014.

One of the main ways to use the indicator is to divide business entities by their size. The average number is one of the criteria that allows the application of preferential tax regimes provided for by law. It is also used to calculate many other important statistics. For example, average salary.

Purpose of the report

As mentioned above, in addition to the general statistical indicators of a company, the number of employees can have a fundamental decision in a wide range of issues.

For example, by providing a report on the average number of its employees, a company can receive additional tax benefits or extend existing ones.

Also, a high-quality calculation of the number of workers allows the company’s management to develop medium-term development strategies (whether to reduce the number of workers or, on the contrary, increase it, in accordance with the current financial situation).

In addition to all of the above, each enterprise is legally required to provide the state with a report in electronic form to confirm its right to use a single tax on temporary profits.

Deadlines for submitting the average headcount report in 2021

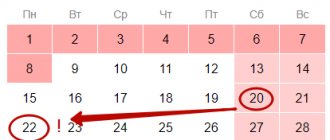

Based on the situation in which the headcount report is submitted, three deadlines are distinguished:

- On a general basis for existing organizations and entrepreneurs - until January 20 of the reporting year. If this date falls on a weekend or holiday, then the change is moved forward to the next working day; Thus, in 2021, the form must be submitted by January 22.

- The average number of employees when opening an LLC is also required to be calculated, as for long-established ones. Only in this case, according to the law, it is necessary to make calculations and provide information before the twentieth day of the month following the entry of information into the Unified State Register of Legal Entities. After this, new organizations must submit information on the average number of employees at the end of the year on a general basis. Thus, the KND form 1110018, containing the average number, is submitted by them twice in the first year.

- If a business or legal entity is closed, the report must be sent on the day of exclusion from the register.

Number calculation

Before filling out and submitting the certificate, you must directly calculate the average number of hired employees. This can be done using the following formula:

\(SRCHyear = \frac{SRCH1+SRCh2+...+SRCh12}{12}\), in which: SRCHyear is the value of the average payroll number for the year; SRCh1, 2…,12 – average number for each month (January, February…).

To find the average headcount for a month, you need to add up the payroll number for each day in the month, not omitting holidays and weekends, and then divide the resulting value by the number of days in the reporting month.

Where are reports submitted?

The legislation determines that a report on the average headcount of an organization is submitted to the Federal Tax Service that operates in the place of its location. If the company consists of external divisions or branches, then all data is combined into one report, which is sent by the parent company.

Entrepreneurs who have employees must send a report, form KND 1110018, to their registered or registered address.

Important! If an entrepreneur is engaged in activities on the territory of a different Federal Tax Service than the one where he was registered, then he still needs to submit information about the average number at the place where he received registration documents.

Nuances of calculating the number

There are some features of calculating indicators for the certificate we are considering:

- When calculating payroll numbers on weekends and holidays, the values that were recorded on the last working day are used.

- If the company does not have hired personnel, there is only a director, the number 1 is entered in the certificate of the average number of employees.

When calculating the number, the following are not taken into account:

- Owners of the company who do not receive a salary;

- External part-time employees;

- Maternity maids;

- Employees undergoing off-the-job training;

- Employees carrying out activities on the basis of the GPA.

Methods for submitting information

This report can be generated and sent either on paper or using special computer programs.

There are several ways in which you can send a report to the Federal Tax Service:

- Submit a completed paper form to the inspector yourself, or ask your representative, for whom the appropriate power of attorney has been issued. In this case, the report itself must be drawn up in two copies, one of which is marked with acceptance, and the second remains with the Federal Tax Service;

- By means of a registered letter with the described attachment;

- Using a special telecom operator in electronic form. This method requires a qualified electronic signature.

You might be interested in:

New form 2-NDFL from 2021: important changes, sample filling

In some regions, when submitting a paper version, the inspector also asks to provide a flash drive with the report file recorded on it.

From 2021, the procedure for calculating the average headcount will change

Since 2021, this form has been canceled - Federal Tax Service order No. ED-7-11/752″ dated October 15, 2021. Average list information will be reflected in the DAM.

average number of employees in 2021 (TIF template recommended by the Federal Tax Service of Russia)

average number of employees in 2021 (Adobe Reader (.xls))

average number of employees 2021 (Excel (.pdf))

Starting from 2021, the Average Payroll must include those who continue to work while on parental leave.

From 2021, it is necessary to include stateless persons in the Average List.

Attention! Since 2014 (and for 2017-2018), tax authorities require a new form. It is almost the same as the 2007 form, but in Adobe Acrobat pdf format, without a frame, samples can be downloaded above.

Annual

. If you submit the average payroll for the year in January, then the date should always be 01-01-XXXX of the year (on the 1st day of the 1st month).

While creating

. A newly created organization (no individual entrepreneur is needed), when submitting the SSC, must provide data and set the date to the 1st day of the month following the month in which the organization was created 01-XX-XXXX (Order of the Federal Tax Service of Russia dated March 29, 2007 No. MM- 3-25/).

Upon liquidation

organizations (no individual entrepreneur required) submit an average list as of the date of liquidation of the year XX-XX-XXXX (any date).

Information on the average number of employees (Excel (.xls)).

First, you need to calculate the monthly average. The number of workers for each calendar day is counted (on Saturday and Sunday the number that was on Friday is set), and everyone is counted - absentees, sick people, on vacation. Then everything is summed up and divided by the number of days of the month. The result is the number for a specific month (no need to round it).

If an organization (LLC, JSC, NPO) has no employees, only a director, then “1” is entered.

There is no need to round monthly averages. When calculating this indicator, only the final calculation result is rounded. Thus, if you need to calculate the average headcount for a month, it is rounded. However, when calculating the indicator for a quarter, half a year, 9 months or a year, the average headcount by month is not rounded.

For the reporting period (year) - sum up the average number of employees for the required number of months and divide by this number of months. The final result is rounded to whole numbers.

Employees under civil law contracts (contracts), external part-time workers, women on maternity and child care leave are not taken into account. Starting from 2021, the average payroll must include those who continue to work while on parental leave.

Internal part-time workers are included in the calculation once (clause 80 of the Instructions, approved by Order No. 498).

Example 1. An individual entrepreneur worked for an individual entrepreneur for 7 months during the year. (1*7+0*5)/12=0.58 round... TOTAL 1.

Example 2. An individual entrepreneur worked for an individual entrepreneur for 3 months during the year. (1*3+0*9)/12=0.25 round... TOTAL 0.

Example 3. The organization employed 3 people from June 15 to December, and 4 people in December. (0*5+3*15/30+3*6+4*1)/12=1.96 round... TOTAL 2.

Example 4. An organization was created on October 1 with one director (9*0+3*1)/12= round up...0.25 TOTAL 0.

For part-time workers, we calculate the average number of employees for the month:

(time worked by part-time employees for all working days of the month (in hours) / normal working day (in hours) / number of working days in the month).

For example, a person works half-time (22 working days per month). 88/8/22 = 0.5

How to fill out a report on KND form 1110018

Entering data into the report form KND 1110018 is simple. However, it is first necessary to calculate the average number indicator itself. More details on how to make the calculation are described below.

At the top of the form, the TIN and KPP of the subject submitting the form, as well as the page number, are affixed. Since this is a title page, “001” is placed here.

If the report is filled out by an organization, then its TIN contains only 10 digits, and the remaining two blank cells at the end must be crossed out. Entrepreneurs do not have a checkpoint code - they do not fill out this field and also cross it out.

Next, you need to write down in words the name of the inspection to which the form is sent, and put down its digital code.

Below is the full name of the organization or full name. entrepreneur. This must be done without abbreviations.

The next step is to record the date on which information about the number is submitted:

- If the report is submitted as planned, then it is usually entered on January 1 of the year in which the form is submitted.

- If this happens due to creation or liquidation, then the 1st day of the month that follows the month of organization (liquidation) is indicated here.

Below, under the date, the population indicator is written. Extra cells are crossed out.

The report is then divided into two parts; you only need to fill out the left one:

- If it is submitted by the manager himself, then his full name is recorded, the date of departure and the personal signature of the manager are indicated;

- If the report is submitted by an entrepreneur, he puts his signature and the date of sending, while the full name in the field is not filled in;

- If the report is sent by a representative, then full name must be entered. persons, or the name of the organization, signature and date of filing. Also below are the details of the power of attorney for submitting the report. It must be attached to the report as an attachment.

Sample of filling out a report in 2021 (number for 2021)

Now, using an example, we will show a specific example of filling out information on the average number of employees for 2021, which must be submitted no later than January 21, 2021. In your report, show:

- TIN and checkpoint;

- company name or full name individual entrepreneur;

- average number of employees (persons);

- data as of January 01, 2021;

- data of the manager or representative;

- date and signature.

A sample of filling out the main part of the form for information on the average number of employees for 2021 will look like this:

How to calculate the average number of employees

Typically, an accountant or a human resources worker is responsible for determining this indicator at an enterprise.

Due to the fact that the average number is of great importance, its calculation must be approached responsibly to ensure maximum accuracy of the calculation. After all, on its basis the right to use preferential treatment will be determined, for example. In addition, the regulatory authority itself can double-check it.

Initial information for calculation must be obtained from documents on recording working hours, issued orders for the hiring, transfer, dismissal of employees and others.

Computer programs for maintaining personnel or accounting records make it possible to make calculations automatically. However, in this case, you still need to check the sources of information used in this case.

The employee tasked with calculating the indicator must understand the entire algorithm for determining it, so that at any time he can double-check the data received.

Step 1. Calculate the number for all days of the month

At the first stage, the responsible employee must determine the number of employees who performed work duties in the company every day of every month. For a working day, this indicator is formed from the number of people with whom employment agreements have been concluded on that day, including all those who are on sick leave or on a business trip.

The following are excluded from the calculation:

- Part-time employees for whom this is not their main place of work;

- Performing work under contract agreements;

- Employees who are on maternity leave or maternity leave;

- Employees whose signed agreement provides for reduced working hours. However, if a short day is defined at the legislative level, then such an employee must be included in the calculation.

For weekends and workdays, the number of employees on that day is taken according to the number of employees on the workday preceding it. This means that if the employment agreement was terminated on Friday, then this employee will still participate in determining the average number on Saturday and Sunday.

Attention! If the organization on that day did not have a single employee with a valid employment agreement, then the number for him is taken as “1” - in any case, it is necessary to take into account the director, who is enshrined in the registration documents, even if his salary is not accrued.

Step 2: Determine the number of full-time employees for each month

This rate is calculated by adding the number of workers who have contracts for each day of the month and then dividing the result by the total number of days of the month.

You might be interested in:

Book of accounting of income and expenses for individual entrepreneurs on the simplified tax system: how to fill it out in 2020

WorkP=(Day1+Day2+..+Day31)/Number of days of the month,

Where D1, D2, etc. – the number of registered employees on each day of this month.

For example: There are 30 days in a month. From the 1st to the 14th, 21 people worked, from the 15th to the 21st - 18 people, from the 22nd to the 31st - 19 people.

The number of employees for this month will be: (14x21 + 7x18 + 10x19)/31 = 19.67 people.

Attention! According to the calculation rules, the final result must be rounded to the second digit after the decimal point.

Step 3: Determine the average number of part-time employees

First of all, at this stage, the number of hours attributable to the labor activity of part-time workers per calendar month is considered. In this case, the rule applies that the number of hours on vacation or sick leave is equal to the number of hours on the previous day of work.

After this, you can calculate the average number of such employees. For this purpose, the value obtained above must be divided by the number of hours of work for this month, which is defined as the product of days of work by working hours.

WORKCH=HOUR/(WORKDAY*WORKHOUR), where

RABch - average number of part-time workers;

HOURS - the number of hours actually spent on work by part-time workers.

RABDN – number of days of work in a month (norm);

WORKING HOUR - the duration of a full working day. For a 40-hour week this figure is 8 hours; for a 32-hour week it is 7.2 hours.

For example. Ivanova I.P. worked in July 2021 for 15 days, 7 hours each. The company has a 40-hour work week, the norm of working days in July 2021 is 21 days.

Calculation of average headcount:

(15*7)/(21*8)=0,63

In this case, the resulting value must be rounded to hundredths using the rules of mathematics.

Step 4. Calculation of the number of all employees per month

The average number of all employees is determined by summing the obtained values of the average number of employees for each type.

The determined result will need to be rounded to a whole number, taking into account the rule according to which the fractional part up to 0.5 is discarded, and above 0.5 is counted as 1.

RABM=RABP+RABh, where

RABM - average number of employees per month;

RABP - average number of full-time employees;

RABCH - the average number of part-time employees.

For example. Based on these previous examples, we determine the average number of employees per month:

19,67+0,63= 20,3

After rounding, the result will be 20.

Step 5. Calculate the average number of employees for the entire year

The annual figure is formed on the basis of the data obtained on the average headcount for each month of the year.

For this purpose, you need to add the average number of employees of the company for each month and divide by 12.

RABG=(RABM1+RABM2+…+RABM12)/12, where

RABG – average headcount for the year

RABM1, RABM2, etc. – average number for January, February, etc.

The resulting result is rounded according to the rules of mathematics.

The peculiarity of this calculation is that if the company began operating not at the beginning of the year, but, for example, in July, then the divisor in the formula will still be the number 12.

Attention! Often, in addition to the annual average number, it is necessary to determine the quarterly or average number of employees for six months. This algorithm for calculating this indicator is used, only the indicators for the required number of months are summed up, and the resulting total is divided by the corresponding number of these periods.

Which employees should be included in the headcount?

Recommendations for filling out information on the average number of employees are in the letter of the Federal Tax Service dated April 26, 2007 No. CHD-6-25/353. The categories of employees that need to be taken into account in the calculation are presented in the table. Do not count employees who are not on the list.

| Employee category | How is the number taken into account? | |

| Regular full-time employees (including probationary employees) | The number of such employees is fully taken into account | |

| Employees hired to replace absent employees (for example, a woman on maternity leave) | The number of such employees is fully taken into account | |

| Employees with fixed-term employment contracts | The number of such employees is fully taken into account | |

| Internal part-timers | Counted as one unit when calculating | |

| External part-timers | When calculating the average headcount, this indicator is not taken into account | The average number of such employees is determined in terms of full-time employment (by dividing the person-days worked by the number of working days according to the calendar in the reporting month) |

| Employees on sick leave | The number of such employees is taken into account in full (regardless of the actual time worked) | |

| Employees on leave (annual or additional) | The number of such employees is taken into account in full (regardless of the actual time worked) | |

| Employees who are on leave without pay (regardless of the length of leave) | The number of such employees is taken into account in full (regardless of the actual time worked) | |

| Employees who are: – on maternity leave; – on leave in connection with the adoption of a newborn child; – on maternity leave | Do not take into account the number of such employees when calculating. Exception: employees who are on parental leave if they work part-time or from home while maintaining the right to receive benefits | |

| Seconded employees, if they maintain average earnings (including for short-term business trips abroad) | The number of such employees is fully taken into account | |

| Homeworkers | The number of such employees is fully taken into account | |

| Employees who are required by law to have reduced working hours (minors, disabled people of groups I and II, employees of hazardous industries, etc.) | The number of such employees is fully taken into account | |

| Employees who are employed part-time or part-time (in accordance with the employment contract or with their consent) | When calculating the average headcount, such employees are taken into account in proportion to the time worked | The average number of such employees is determined in terms of full-time employment (by dividing the person-days worked by the number of working days according to the calendar in the reporting month) |

| Employees transferred to part-time work at the initiative of the administration (without written consent) | The number of such employees is fully taken into account | |

| Employees temporarily sent from other organizations (if they do not retain the average salary at their main place of work) | The number of such employees is fully taken into account | |

| Full-time employees with whom civil law contracts have additionally been concluded | When calculating the average headcount, such employees are taken into account once | When calculating the average number, such employees are not taken into account |

| Freelance employees with whom contracts and other civil contracts have been concluded | When calculating the average headcount, such employees are not taken into account | When calculating the average number, such employees are taken into account for each calendar day as whole units throughout the entire period of the contract, regardless of the period of payment of remuneration |

| Entrepreneurs with whom contracts for construction, paid services and other civil law contracts have been concluded | Do not take into account the number of such employees when calculating | |

| Employees who combine work and study and are on study leave while maintaining their average earnings | The number of such employees is fully taken into account | |

| Employees who combine work with training and are on vacation at their own expense | Do not take into account the number of such employees when calculating | |

| Employees who have been granted leave at their own expense in connection with passing entrance exams to a university, college, etc. | Do not take into account the number of such employees when calculating | |

| Employees sent for training (upgrading their qualifications, acquiring a new profession) outside of work (if they maintain average earnings) | The number of such employees is fully taken into account | |

| Citizens (military personnel and persons serving sentences of imprisonment) recruited for work under special contracts with government organizations for the provision of labor and included in the average number of employees | When calculating the average number of employees, such employees are taken into account as whole units based on the days they report to work. | When calculating the average number, such employees are not taken into account |

| Employees transferred to work in another organization if their salary is not maintained, as well as those sent to work abroad | Do not take into account the number of such employees when calculating | |

| Citizens with whom a student agreement for vocational training has been concluded (with a scholarship) | Do not take into account the number of such employees when calculating | |

| Employees who submitted a letter of resignation and stopped working before the expiration of the notice period or stopped working without warning the administration | When calculating, do not take into account the number of such employees from the first day of absence from work. | |

| Owners of an organization who do not receive a salary | Do not take into account the number of such employees when calculating | |

| Members of the cooperative who have not concluded employment contracts with the organization | Do not take into account the number of such employees when calculating | |

| Lawyers | Do not take into account the number of such employees when calculating | |

| Military personnel in the performance of military service duties | Do not take into account the number of such employees when calculating | |

| Owners of an organization receiving a salary | The number of such employees is fully taken into account | |

| Full-time employees who actually showed up for work (including those who did not work due to downtime) | The number of such employees is fully taken into account | |

| Employees who did not show up for work due to the performance of state or public duties | The number of such employees is fully taken into account | |

| Employees with special titles | The number of such employees is fully taken into account | |

| Students and students of educational institutions working in organizations during practical training, if they are enrolled in jobs (positions) | The number of such employees is fully taken into account | |

| Employees who were: – idle (both at the initiative of the employer and for reasons beyond the control of him and the employee); – on unpaid leaves at the initiative of the employer | The number of such employees is fully taken into account | |

| Employees who took part in strikes | The number of such employees is fully taken into account | |

| Employees working on a rotational basis | The number of such employees is fully taken into account | |

| Employees under investigation pending a court decision | The number of such employees is fully taken into account | |

| Employees temporarily absent from work due to the fact that the administration granted them time off for overtime | The number of such employees is fully taken into account | |

| Employees temporarily absent from work due to absenteeism | The number of such employees is fully taken into account | |

Penalty for failure to submit information about the average number of employees

Tax legislation establishes administrative liability if the KND form 1110018 was sent in violation of the established deadlines, or was not submitted at all.

A business entity faces a fine of 200 rubles for failure to timely submit a report to the Federal Tax Service.

There is also a punishment for the responsible person in the organization for drawing up and submitting the report, who violated the deadline for sending the report. For him, the fine can vary from 300 to 500 rubles.

At the same time, it is necessary to take into account that the application of penalties to violators does not relieve the company of the obligation to send a report on the average number to the tax office.

Attention! The norms of the Tax Code of the Russian Federation provide for repeated failure to submit this report to punish both the company and its responsible persons with double fines.

Example of calculation using the formula

To most clearly demonstrate the specifics of calculating the average headcount, it is worth solving a small problem, i.e., calculating the number of employees of the Zvezda enterprise.

The calculation is carried out for the month of July (thirty-one days) taking into account a full eight-hour day.

Task. There are twenty employees on staff, one of whom works part-time. At the end of the month, only sixteen employees were able to work a full month, including one part-time worker.

Wherein:

- One employee was on sick leave;

- One employee was on prescribed leave for eleven days;

- One was on leave to care for a newborn child;

- One employee worked on half wages.

During the calculation process, the worker who was on sick leave will be included in the report as a full unit.

A company specialist who was on a business trip for eleven days will also be included in the report, but only for twenty days. A part-time worker, as well as one who was on vacation (caring for a newborn child), will not be included in the report at all.

A worker who performs duties part-time is counted only in the amount of time worked.

Solution. The average number of workers for July = 15 +1+20/31+4*31/8/31 = 15+1+0.7+0.5 = 17.2 people.

If you are an individual entrepreneur, then you should be familiar with such a document as an extract from the Unified State Register of Legal Entities. It can be useful when opening a bank account or when certifying certain documents by a notary. Extract from the Unified State Register of Legal Entities online - how to obtain a document via the Internet?

You will find proven business ideas with minimal investment in this section.