Tax deduction

is a benefit provided to citizens of the Russian Federation and is expressed either in the return of part of the funds spent on certain needs (purchase of housing, payment for treatment, education, etc.), or in a reduction in the amount of tax payable to the budget on certain grounds (sale of property, calculation of personal income tax for individual entrepreneurs on the OSN).

Tax deduction in the form of a refund

Engineer Petrov I.A. received an official income of 600,000 rubles in 2021.

(the tax base).

From these 600,000 rubles. he paid income tax in the amount of RUB 78,000.

(RUB 600,000 x 13%).

In the same year, Petrov I.A. paid 120,000 rubles for my education at the institute.

He can return the amount spent on training in the form of a social tax deduction.

The maximum amount of social deduction for the costs of your education is 120,000 rubles. Thus, Petrov will be able to return 15,600 rubles to his hands.

(120,000 x 13%).

Tax deduction in the form of reducing the tax base

Petrov in 2021 sold a one-room apartment, which he had owned for less than 3 years, for RUB 4,000,000.

On the income received, he must pay income tax in the amount of 520,000 rubles.

(4,000,000 x 13%).

Petrov can reduce the amount of this payment by using a tax deduction in the amount of funds spent on the purchase of an apartment (if there are supporting documents), or in the amount of 1,000,000 rubles.

(if there are no documents confirming the purchase, for example, they were lost or missing altogether).

Let's say the apartment was inherited and there are no purchase documents.

Petrov can reduce the income received from the sale only by the amount of the tax deduction of 1,000,000 rubles. Thus, personal income tax payable to the budget will be 390,000 rubles.

(4,000,000 – 1,000,000) x 13%.

Personal income tax deductions for children in 2021. Who is entitled to the child benefit in 2021?

Personal income tax deductions for children in 2021 are provided by tax agents when paying income taxed at a rate of 13%. The employee must submit an application and documents confirming the right to the deduction. We will tell you more about these documents below.

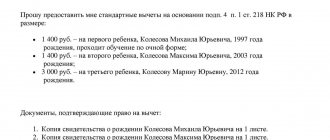

Look at a sample application for a personal income tax deduction for children in 2018.

Important! An employee can receive a standard tax deduction for a child only from a tax agent, i.e. at your employer. There is no need to apply to the Federal Tax Service for such a deduction.

Deductions for children in 2021 are available to the following citizens:

- Parents and their spouses (adoptive parents, stepfather, stepmother);

- Parents, if the marriage was dissolved or was not concluded, but they financially provide for the child;

- Adoptive parents, guardians, trustees.

Income tax benefits for employees

The standard deduction is a tax benefit that is available exclusively to working individuals on their income.

This is a non-taxable amount of income by which you can reduce your accrued wages before tax, thereby reducing the tax burden and the transferred income tax.

Read about calculating personal income tax on wages in this article.

Not all employees have the right to deduction. Listed below are three types of benefits that are currently available. If the taxpayer does not fit into any category, he has the right to preferential taxation; personal income tax will be calculated and withheld from the entire amount of wages.

Based on the provisions of the norms reflected in Art. 218 of the Tax Code of the Russian Federation, the following are considered standard deductions for personal income tax:

- in the amount of 3000 rubles;

- in the amount of 500 rubles;

- for children.

The first two types of benefits are entitled to receive only a limited number of workers who fall into a specific category that enjoys special social support from the state.

Standard personal income tax deductions for children are available to all working citizens, subject to a number of conditions.

Who is entitled to 3000 rubles?

- In accordance with paragraph 1 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation, this amount of standard tax deduction for income tax is provided for taxpayers who:

- relate to those injured during the Chernobyl accident or due to the elimination of its consequences;

- became disabled while eliminating the consequences of the Chernobyl accident;

- eliminated the consequences of the Chernobyl accident in 1987;

- are (or were) in military service at the time of eliminating the consequences of the Chernobyl disaster;

- served in the military at the Shelter facility;

- became injured or disabled due to the accident at Mayak;

- tested nuclear bombs in the atmosphere until December 31, 1963;

- tested nuclear bombs underground during emergency situations;

- eliminated the consequences of radiation-type disasters;

- carried out nuclear explosions underground, and also collected and buried radioactive substances;

- are disabled during the Second World War;

- became disabled due to participation in military disputes while serving in the armed forces of the USSR and Russia.

Who can apply 500 rubles?

In accordance with paragraph 2 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation, a standard personal income tax deduction in the amount of 500 rubles is provided monthly for taxpayers who:

- Heroes of the USSR, Russian Federation;

- have the Order of Glory of 3 degrees;

- served in military organizations and law enforcement agencies created during the Second World War;

- have the status of WWII veterans, as well as defenders of the Soviet Union in armed conflicts;

- survived the Leningrad blockade, have the status of “prisoner of fascism”;

- are disabled from birth (if there are 1st and 2nd groups);

- were sick with radiation sickness and other diseases due to radiation;

- how medical staff eliminated the consequences of the Chernobyl disaster and are victims;

- acted as bone marrow donors to save the lives of others;

- were workers, employees and military personnel, as a result of which they acquired occupational diseases due to radiation after the Chernobyl accident;

- eliminated emergency consequences at the Mayak enterprise;

- were evacuated in 1986 from areas that were contaminated with radiation due to the Chernobyl disaster;

- are mothers and fathers, as well as spouses of military personnel who died due to injuries received during the defense of the USSR, the Russian Federation, as well as during participation in other serious conflicts during military service;

- are mothers and fathers, as well as spouses of civil servants who died while performing their work duties;

- are participants in hostilities in the region of Afghanistan and hot spots on Russian territory.

For children

In accordance with paragraph 3 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation, a tax deduction for personal income tax for children is provided to parents, trustees, and guardians.

The benefit amount has certain differences:

- 1,400 rub. – if we are talking about the first and second child (for each – separately);

- 3,000 rub. – if we are talking about the third and each subsequent child;

- 12,000 rub. – for a child if he received the status of a disabled person before reaching adulthood. Also, a similar deduction is provided to the parents of a child who is a full-time student up to the age of 24 and is a disabled person of the 1st or 2nd group. Of course, to receive a deduction, you must provide relevant documents - evidence that the child actually has serious health problems. That is, certificates and medical reports on the child’s health condition must be provided.

- 6,000 rub. received by persons in the status of guardians. Legislative provisions do not provide for changes in the amounts of deductions in the near future.

How are double amounts provided to the taxpayer?

It is worth noting the following important point: issuing standard deductions for personal income tax for children in the current year in double amount is possible if the parent, guardian or trustee is the only one.

If the only parent is a single father or a single mother gets married, the right to double deduction for calculating personal income tax is lost.

Also, the registration of a double deduction when calculating income tax can be carried out by one of the parents, subject to the following condition: the second must provide a waiver of his right to receive the corresponding deductions, executed in the proper form.

In addition to the refusal from the second parent’s place of work, a 2-NDFL certificate must be provided monthly, which will indicate the amount earned, confirming the right to a standard personal income tax benefit, which the employee refuses in favor of the husband or wife.

The amount of the double deduction exceeds the specified amounts of the child benefit by 2 times.

The right to receive an increased size must be documented.

Up to what salary amount does it apply?

What salary must be earned to receive the child tax credit?

Payment of standard benefits when calculating personal income tax on wages is possible only if the taxpayer has received no more than 350,000 rubles since the beginning of the year.

Once total year-to-date wages exceed 350,000, the standard child deduction is no longer available for the rest of the year.

If an employee is entitled to a large number of deductions, or there were few days worked in a month, then a situation may arise in which the accrued salary is less than the amount of deductions - what to do in this case?

Personal income tax deductions for children in 2021. Up to what amount is the deduction limit for children in 2021?

An employee has the right to receive a deduction:

- from the month of birth

- from the month of adoption of the child;

- from the month of establishment of guardianship/trusteeship;

- from the month of concluding the agreement on the transfer of the child to a family for upbringing.

The child deduction is provided monthly throughout the calendar year until the employee’s income reaches a certain limit. In 2021, personal income tax deductions for children are provided until the employee’s income reaches the limit of 350,000 rubles.

Important! The limit for deductions for personal income tax in 2021 is RUB 350,000.

This means that once income reaches this amount, the employer no longer provides a deduction for the child or children. This limit does not depend on the number of children in the family. It is the same for all employees.

conclusions

Standard tax deductions are benefits that apply only to employed individuals. They reduce the amount of wages before tax, thereby reducing income tax withholding.

Not everyone has the right to benefits; specific categories of persons are listed in the Tax Code of the Russian Federation. To receive it, you must apply at your place of work; the employer will apply deductions in the current year. To receive a personal income tax refund for previous years, you should contact the tax authority.

No changes to tax legislation regarding the application of these types of benefits have been developed in 2021.

Personal income tax deductions for children in 2021. Amounts of deduction for children in 2018

The amount of the deduction in most cases depends on the type of child (first, second, third, etc.). We have compiled a table that shows the dependence of the size of the deduction on the number of children and on the status of the child.

| Who is the deduction for? | Conditions for providing a deduction | To whom is it provided? | Monthly deduction amount |

| First child | up to 18 years of age or full-time student, graduate student, resident, intern, student, cadet under the age of 24 years | Parent, parent's spouse, adoptive parent, guardian, custodian, foster parent, foster parent's spouse | 1 400 |

| Second child | 1 400 | ||

| Third and every subsequent | 3 000 | ||

| Disabled child | up to 18 years old | Parent, parent's spouse, adoptive parent | 12 000 |

| Disabled child of group I or II | Full-time student, graduate student, resident, intern, student under the age of 24 | ||

| Disabled child | up to 18 years old | guardian, trustee, adoptive parent, spouse of the adoptive parent | 6 000 |

| Disabled child of group I or II | Full-time student, graduate student, resident, intern, student under the age of 24 |

The deduction for the third and each subsequent child is provided regardless of whether the deduction is given for the 1st and 2nd child. This means that if older children have reached 18 years of age or are no longer students, then a deduction is provided for the youngest child in the amount of 3,000 rubles.

Important! A deduction for a disabled child is provided both by order of birth and by disability. For example, if a disabled child is the third in a row, then he is entitled to a deduction in the amount of 15,000 rubles. (12,000 rub. + 3,000 rub.).

Please note that not only common children are counted. For example, if a couple has a child, and they each have one child from their previous marriage who lives with them, then the common child will be the third one for personal income tax deduction.

Legal regulation

The main document that regulates all issues regarding strategic offensive arms is the Tax Code of the Russian Federation. Additionally, it is worth paying attention to the following acts:

- Letter from the Ministry of Finance No. 03-04-05/33263 (05/17/2018), explaining issues related to reducing the personal income tax rate and providing standard deductions to people with disabilities since childhood, groups 1 and 2.

- Letter of the Ministry of Finance No. 03-04-05/30997 (05/08/2018) on the provision of documents when obtaining START for children;

- letter of the Ministry of Finance No. 03-04-05/9654 (02/15/2018), regarding issues of deduction for a child if the parent was on leave without pay.

Personal income tax deductions for children in 2021. How to get a double deduction for personal income tax in 2021

A double deduction can be received by:

- sole parent, adoptive parent, guardian or trustee;

Divorce of marriage is not the basis for the emergence of the right to a double deduction on the basis of a single parent. For such a right to arise, the second parent must be declared dead or declared missing.

- one of the parents (adoptive parents), if the other refuses the deduction in his favor.

There is a list of situations when the second parent cannot refuse the deduction in favor of the second:

- If he or she is not working;

- If she is on maternity leave;

- If he or she is on parental leave for up to 1.5 years;

- If he or she is registered with the employment center.

Personal income tax deductions for children in 2021. What documents are needed to receive a child benefit?

In addition to the application, the employee must provide the employer with documents confirming the right to deduct personal income tax in 2021.

| Situation | Documentation |

| Mandatory documents for everyone |

|

| For a single parent (additional set of documents) |

|

| For a guardian or caregiver (additional kit) | A copy of the document on guardianship or trusteeship of the child |

material Deductions for children under personal income tax in 2021, up to what amount is the limit