A free test drive of the 6-NDFL reporting seminar can be obtained by following the link.

Since 2021, a new form of regulated reporting on personal income tax has been introduced - this is 6-NDFL.

The report assumes reflection:

- total amounts paid to individuals;

- total amounts of personal income tax paid for the period from employee income;

- total amounts of deductions, if they were applied.

The introduction of the new declaration is justified by the state’s hopes that:

- increase personal income tax collections;

- bring unscrupulous taxpayers to justice;

- increase control over income.

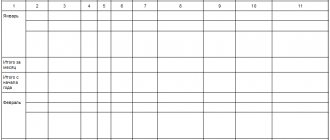

The declaration form has a title page and two sections:

- the first section contains the totals;

- the second section contains the dates of income (necessarily received actually), the dates of withheld tax, the dates of tax transfer and the corresponding amounts.

Who submits Form 6-NDFL

The Law “On Amendments to the Tax Code of the Russian Federation” dated May 2, 2015 No. 113-FZ established for tax agents paying income to individuals the obligation to quarterly report to the Federal Tax Service on the amounts of tax withheld from such income (clause 2 of Article 230 of the Tax Code of the Russian Federation in version of Law No. 113-FZ).

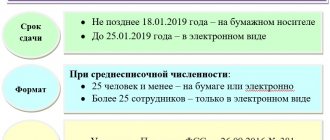

This regulatory act also provided for the procedure for approving reporting forms assigned to the Federal Tax Service of Russia. As a result, the Federal Tax Service of Russia issued an order dated 10/14/2015 No. ММВ-7-11/ [email protected] , which introduced Form 6-NDFL for Russian taxpayers, mandatory for use from 01/01/2016.

Since 2021, the form has been radically updated by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

ConsultantPlus experts in their review spoke in detail about the main changes in the 6-NDFL report from 2021. If you do not have access to the K+ system, get a trial demo access for free.

Date of signing of the 6-NDFL report

The date of signature of the report is an explicit parameter and the machine automatically uses the date indicated in your PC. The calendar number that is assigned on the title page mainly directly affects the auto-filling of calculations according to the form algorithm specified by the developers. This refers to line 080 of the first section of the reporting form, informing the user about the amount of income not withheld by the tax agent

Similar information is pulled up from the machine’s accounting registers, inclusive of the date of signing your report.

Formation of 6-NDFL in “1C: ZUP” (“Salaries and personnel management”)

1C developer specialists quickly responded to changes in legislation and supplemented the releases with a new reporting form. Like all other tax reporting forms in 1C, after the reporting period, 6-NDFL can be filled out automatically using software. Let's consider this process using the example of “1C: ZUP” (3.0).

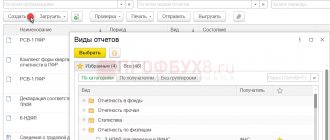

To generate 6-NDFL in 1C: ZUP in the main menu “Reporting. Certificates" you should select "1C - Reporting", then the "Create" item and in the drop-down menu "6-NDFL".

In the window that appears, to fill out 6-NDFL, you must select an organization and indicate the period for which the report is generated.

NOTE! Under the fields to be filled in in the 6-NDFL window you will see information about the edition of the form that the program will fill out. In the future, in case of changes, in order to create a correct report, you will need to track the correct edition of the form.

Press Enter and you will be taken to the form page. We check the data (in addition to information about the organization and period, the type of report (primary or corrective), date of signing, etc. will also be visible). Then click “Fill”, and “1C” transfers the data from the personal income tax accrual registers for the reporting period to the form. The draft report is ready!

It remains to check it. This can be done manually by generating a payslip for the same period in the same “1C”. If the report is filled out correctly, the indicators in lines 110 “Amount of accrued income” and 140 “Amount of calculated tax” in 6-NDFL must coincide with the totals in the columns “Total accrued” and “Total withheld” in the payroll statements for the same period.

Correcting errors for generating 6-personal income tax is a separate, extensive issue. In this article we will not dwell on it in detail. We only note that if discrepancies are found during reconciliation with the payroll sheet, then the 6-NDFL project has a line decoding function available. To do this, place the cursor on the desired line (for example, 110) and either double-click on it with the left mouse button, or press the right mouse button once and select “Decrypt” from the drop-down menu. It is convenient to check the resulting decoding with the payroll sheet to identify differences.

For information on sending a report to the Federal Tax Service via electronic communication channels, read the article “Is it possible to fill out form 6-NDFL online?” .

How to fill out the cover page of the 6-NDFL report

Filling out the form requires the user to be attentive, but does not create inconvenience or extreme difficulties in the work. At the top, indicate in the checkpoint field the reason why your company or its branch was registered in the form of a code at the place of registration with the Federal Tax Service. The TIN involves adding information about the tax agent.

The machine, according to the regulations, has the initial calculation settings for the report, which means submitting the form for verification to the regulator for the first time in this reporting period. Therefore, the correction number contains a zero code.

Know that the machine sets the submission deadline (code) and tax period (year) automatically, pulling it from the initial form. The position of submission to the tax authority (code) involves specifying the encoding in the form of a four-digit number of the Federal Tax Service where your company is registered and where you regularly send all reports. The location (accounting) field (this also refers to the code) is where you enter all other places where the tax agent sent miscalculations.

The position of the code according to OKTMO involves telling the encoding machine of the municipality where your company with all its branches is actually located.

All of the above information on the company and its divisions, which are on a separate balance sheet, is recorded in the directory of organizations in the section of the general settings of the company. Everything else is pulled from the organization’s directory, like:

- initials of the tax agent;

- his contact details;

- Company name.

It may happen that there will be empty fields in the report and you do not have the technical ability to enter them manually. The machine informs the user about this by filling the cells with yellow. This only means one thing: the machine was not initially given the initial parameters so that it would involve them in 6-personal income tax. It is possible to correct the current situation by entering informative information into the accounting registers and updating the data through the functionality.

Where to find and how to fill out 6-NDFL in “1C 8”

The standard place for 6-NDFL in 1C 8 is: “Reports” - “Regulated reports” - “6-NDFL”. Sometimes a report may suddenly get lost, then you should also look for it in the “Regulated Reports”, but in the general “Directory of Reports”. In the directory, check the box next to 6-NDFL and click “Restore” in the top menu. The report will return to its normal location.

The algorithm for creating and filling out a new report is similar to that described above for “1C: ZUP”.

Check whether you filled out Form 6-NDFL correctly with the help of explanations from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Setting up the program

Tax data

Before you start calculating personal income tax, as well as using most of the functionality, you need to configure it.

Select “Organizations” from the “Main” menu.

Select the organization you want to configure from the list and open its card. In the setup form, fill in the basic data and those located in the “Tax Inspectorate” subsection.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Setting up salary

In the “Salary and Personnel” menu, go to the “Salary Settings” item.

In the general settings, specify that payroll and personnel records will be kept in this program. Otherwise, the rest of the settings will simply not be displayed. Next, click on the “Salary Accounting Procedure” hyperlink.

In the list form, select the line corresponding to the organization whose settings you are making. The corresponding form will open in front of you. At the bottom of it, select “Setting up taxes and reports.”

In the window that opens, go to the “Personal Income Tax” section and indicate how these deductions will be applied to you.

Next, go to the “Insurance Premiums” section and adjust these settings.

Now let's move on to setting up the types of income and deductions used when calculating personal income tax. To do this, in the “Salary and Personnel” menu, select the item we went to earlier – “Salary Settings”.

Go to the “Classifiers” section and click on the “Personal Income Tax” hyperlink.

Check that the data that opens is filled out correctly, especially the “Types of personal income tax” tab.

If necessary, you can also set up a list of payroll accruals and deductions. Return to the salary setup form and in the “Salary calculation” section, select the appropriate item. As a rule, in a typical configuration delivery there will already be data there.

Nuances of 6-NDFL in “1C 7”

Initially, there were no plans to release updates to the “seven” at all in order to encourage users to switch to the “eight”.

As a result, in the “seven” 6-personal income tax is not automatically generated. That is, there is a report form and the ability to download it, there is data on payments and deductions entered into the general registers, but they need to be filled out and checked manually, in accordance with the explanations of the Federal Tax Service on filling out 6-NDFL, set out, among other things, in letters dated 12.02. 2016 No. BS-3-11/ [email protected] and dated 02/25/2016 No. BS-4-11/ [email protected]

Find out how to maintain a tax register for filling out 6-NDFL in the article “Sample of filling out a tax register for 6-NDFL” .

Features of filling out the first section of the 6-NDFL report

This section of the report shows the general indicators of the income of all individuals, as well as the calculated and paid income from it since the beginning of the year on a cumulative basis using the amount of deductions established at the legislative level. In a situation where there was a transfer of income to the treasury by the same company, but at different interest rates, the first section should be filled out line by line for each such percentage, in addition to positions 060-090.

The user must remember that the amounts of paid earnings are subject to income tax either partially or in full. All non-taxable income listed in the Tax Code of the Russian Federation should not be added here.

The amount of actual earnings received for work performed by an individual, that is, having a tax code of 2000, 2530, and all other material benefits, will refer to the last day of the month when the employer accrued such earnings. For all other types of income, a calendar date will be indicated, which implies such payment, indicated in the accounting documents for their calculation.

Based on such dates of earnings received, you have the right to determine the required month of the tax period and the reporting period itself to include the earnings received by an individual. This requirement is completely similar to the preparation of certificates in form 2-NDFL.

For example, we can cite the case of income taxation at a 35 percent rate as a material benefit from savings for the use of borrowed funds. No tax deduction can be applied to such interest, and as a result, in line 020 you enter the amount of income accrued by you, and on line 040 enter the amount of calculated income tax.

Reporting

The most frequently used reporting documents for personal income tax are: “2-NDFL” and “6-NDFL”. They are located in the “Salaries and Personnel” menu.

The 2-NDFL certificate is only necessary to obtain information and transfer it either to an employee or to the Federal Tax Service.

The formation of 6-NDFL relates to regulatory reporting and is submitted every quarter. Filling is done automatically.