The time wage system is used in most developed countries.

It implies that the employee receives a salary, the amount of which depends on the time actually worked by him, subject to the full performance of the labor functions assigned to him.

This payment method can only be used by a company if certain requirements are met.

This is the correct determination of the time actually worked by each employee, the awarding of salary categories corresponding to qualifications, as well as the assignment of official salaries depending on the duties actually performed.

Time-based payments can be simple, time-based - bonus, mixed or with a standardized task.

The main disadvantage of this payment system is that it does not take into account the amount of work performed by an individual employee.

The concept of a time-based wage system, its types

According to Article 135 of the Labor Code

The employee’s salary is determined by the employer, guided by the employment contract and the payment systems existing in the organization.

Payment systems must comply with the existing collective agreement and other regulations and agreements in force at the enterprise.

The approval of a certain labor system should be carried out only in agreement with the trade union body representing the interests of the employee.

Time pay is money received by an employee of a certain qualification for the time he works.

There are several types of time-based payment systems. This:

- Time-based simple pay is the employee’s salary for all the time he or she works. To calculate it, different periods can be used: a month, a certain number of days or hours. The basis for calculating wages here is the tariff rate.

- Time-based - the bonus system differs from the simple one in that, in addition to the basic salary, employees receive bonuses. The amount of bonuses depends on certain qualitative and quantitative performance standards. This method of payment can be quite effective, provided that premium indicators are correctly established and economically justified. The payment of bonuses is influenced by such indicators as the quality of the work itself or the goods produced.

- Time-based - bonus payment with a standardized task includes elements of time-based and piecework wage systems. It helps to ensure that tasks are completed at individual workplaces and throughout the entire structural unit. This system allows you to save material resources, promotes collective organization of work and improves the quality of products. Remuneration includes a time-based salary, taking into account actual time worked, and an additional bonus for standardized tasks completed according to plan.

- A mixed payment system means combining piecework and time-based payment.

Tracking the demand of professions as a tool for regulating wages

Wages are determined differently in different markets, including for warehouse workers (pickers, storekeepers, loaders, assemblers and others). Wages depend on the relationship between labor demand and supply in specific labor markets. This is how wage rates for warehouse workers are formed.

Wage rate is payment for labor per unit of time. Therefore, the level of wages depends on the demand for labor compared to the supply. Labor supply will depend on the share of the working-age population.

Thus, the following relationship arises: the more labor in the market for warehouse worker services, the lower the level of workers’ wages.

Time-based and piecework wages

Piecework is the payment of labor for the quantity of products produced or services provided in a certain period.

In this case, payment directly depends on the amount of work done.

A piece-rate payment system is appropriate when it is possible to measure the quantity of products produced in certain units of measurement.

It can be used where it is possible to increase the quantity of products produced without loss of quality and violation of safety regulations.

Unlike time-based payment, here the salary is calculated not according to the tariff rate, but taking into account the piece rate, determined according to production standards.

The main advantage of the piecework system is that wages directly depend on the quantity of products produced and the final results of labor.

This is beneficial for both the employer and the employee. The employee understands that his earnings increase as the volume of work he performs increases.

This motivates him, making him work more productively and increase productivity.

Piece payment has its disadvantages:

- Difficulties in taking into account factors that arise not through the fault of the employee, but interfere with work (equipment breakdown, etc.).

- Placing an emphasis on the quantity of products produced rather than on its quality.

- Taking into account only the individual performance indicators of an individual employee, and not the entire department or organization. Team efforts are not encouraged.

- Violation of equipment operating rules and its breakdown, non-compliance with safety regulations, excessive consumption of raw materials.

- Difficulty in determining production standards.

- Salary reduction due to high production.

The time-based wage system does not require unnecessary costs to control the quality of products.

The employee feels part of the team, and staff turnover at the enterprise is significantly reduced.

The work team acts unitedly.

But this also has its drawbacks. This:

- Lack of motivation to work more productively, since salary does not depend on the amount of work done.

- The need to constantly monitor production volumes.

- Employer costs associated with inconsistent performance.

- Lower wages.

Areas of use

As a rule, a time-based form of remuneration is used when wages are set for management staff, office employees, and employees serving the main production of departments. But this is not a complete list of areas of application of PSOT.

This mode of settlements with personnel is used precisely in those areas of activity that are focused on the quality of the work performed, and not on the quantity of products produced or services provided. This approach to the labor remuneration system encourages employees to constantly improve, raise their level of qualifications, and systematically take educational courses and trainings. After all, the higher the level of knowledge, the more earnings.

PSOT is mainly used in the following areas of activity:

- The work of a specialist is regulated by a certain rhythm or cycle.

- The work is carried out on production conveyor lines.

- Activities for repair and maintenance of equipment, machines, units.

- These types of work in which quality is more valuable than the volume of work performed.

- The type and areas of activity in which it is impossible to determine the quantitative factor of the work performed or the implementation of this procedure is irrational is difficult.

- A type of work, the result of which is not the main indicator of his work activity.

For example, PSOT is established in relation to medical workers, teachers and teaching staff, accountants, and personnel officers. In most cases, the salary of state and municipal employees is also determined according to this regime.

In simple words, it is quite difficult to calculate the quality of work of an accountant or personnel officer in the reporting month. After all, no one will count how many orders for the organization were prepared, how many reports were drawn up, how many documents were drawn up and how many transactions were recorded in accounting. Moreover, it is irrational to evaluate the quality of operations performed. This will take an incredible amount of time. In addition, it turns out that if in the reporting month there were fewer of the same orders, then earnings should be lower.

Necessary conditions for a time-based wage system

In the case of time-based payment, wages are calculated in accordance with the following documents:

- time sheet according to form No. T-13

; - time sheet and payroll report form No. T-12

; - the employee’s personal card, which contains all the information about the tariff rate and the amount of additional payments, in addition to the basic salary ( Form No. T-12

).

An employer may establish a time-based payment system provided that:

- compliance with the necessary time sheets of days or hours actually worked by the employee;

- tariffication of all employees receiving time wages in accordance with the regulatory documents in force at the enterprise;

- creation and application of rules and regulations in relation to employees of the time-based wage system;

- maintaining productivity-enhancing conditions.

Application of a time-based wage system

Time-based wages may be appropriate in industries whose primary activity is the provision of services.

Also, this system can be widely used in cases of forced operation, when carrying out repair work.

The work of engineers, specialists and managers is subject to time-based payment.

Hourly wages may apply to qualified professionals such as psychotherapists, lawyers and doctors.

Time-based payment can be applied to all personnel - both core and non-core.

About 80% of workers in the United States receive hourly wages, about 70% in economically developed countries.

In Russia, the share of workers receiving time wages is low and amounts to approximately 30%.

You will probably be interested in looking at the mental map “Employee Financial Responsibility”, which explains in detail the extent to which the employee is responsible to the employer

Or HERE you will learn about the lump sum system of remuneration

Concept and types of working time:

Briefly about the main thing

Thus, each payroll method has advantages and disadvantages. When choosing a system, you must first take into account the goals pursued by the company and the work characteristics of each warehouse employee. For example, if for a set goal it is necessary to complete a given number of tasks, then it is worth considering the piece-rate method of remuneration. If the company pursues the goal of quality rather than quantity, then it is worth paying for labor according to performance indicators. Read our article about how to choose the right warehouse workers.

Calculation of earnings using a time-based wage system

Payment is made in accordance with the following tariff rates:

- sentries;

- daytime.

Also, salary calculation can be carried out taking into account the employee’s salary.

Daily and hourly tariff rates are determined by the current regulations on remuneration of labor at the enterprise and are entered into the staffing table of Form No. T-3

.

To calculate the amount of time worked during a certain period, it is necessary to keep a time sheet.

In the case of simple time-based wages, the time that was worked (number of hours) is taken into account.

Salary is determined by multiplying hours actually worked by the hourly rate.

If the daily rate and the number of days worked are taken into account, the formula looks like this:

salary = number of days worked X daily rate.

The monthly salary is calculated depending on the number of days actually worked in the month.

To do this, the salary is divided by the number of working days per month and multiplied by the number of days actually worked.

Calculation of wages in a warehouse according to KPI

Another method of paying for warehouse labor is calculation, which is based on key performance indicators (KPIs). Thus, the remuneration of each employee individually depends on how effectively his practical work is performed. When developing and introducing key performance parameters in employee compensation, it is necessary to specifically formulate the goals pursued by the company. For example: reduce logistics costs by 15%.

There are two types of performance indicators:

- Operational. They fully reflect the ongoing work of the warehouse and allow you to perform tasks depending on conditions.

- Strategic. Based on them, the company’s work over the past working period is assessed, and changes are introduced to the plan for the next working period.

They are measured according to the following parameters:

- Costs, amount of expenses;

- Efficiency, which reflects the ratio of the total to the expenses incurred;

- Functioning. It is used to assess the compliance of the process with the established plan;

- Productivity, which reflects the relationship between the result and the time during which the goal was achieved;

- Result showing the final effect.

An employee’s salary according to key indicators consists of the following data:

- Salary

- How many hours worked during the period;

- What standard working hours is the employee required to work during the pay period;

- Payment for labor that does not depend on the hourly rate. It must be written down in the warehouse employee’s employment contract;

- Is the employee productive, that is, what indicators did the employee achieve during the pay period? Based on performance, the employee’s salary is calculated;

- An employee has the right to receive an advance at his own request or at the request of the manager. The advance payment can only be made available during the billing period, which is the main one for the warehouse employee.

From the above, the employee’s final salary minus the advance is added up.

The employee can also receive bonuses. They can be entered by the responsible person or employee independently. After which the allowances must be agreed upon by the employee responsible for control.

Examples of calculating various time payments

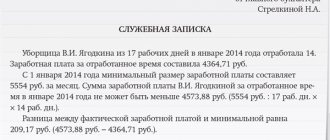

Accountant

An accountant is paid on a simple time basis.

His salary is 10,000 rubles.

The number of days he worked over the past month is 15.

The number of working days in that month is 20.

Salary = 10,000: 20 X 15 = 7,500 rubles.

Worker Ivanov

Worker Ivanov receives a salary at an hourly rate of 55 rubles per hour of work.

Number of hours worked per month – 184.

Salary = 55 X 184 = 10,120 rubles.