Employer's responsibility

Forewarned is forearmed! Despite the fact that there are a small number of labor safety reports, administrative liability is provided for failure to provide at least one of them, including untimely, or for submitting false information under Article 13.19 of the Code of Administrative Offenses of the Russian Federation

in the form of fairly high fines:

- for officials (manager or responsible person) – from 10,000 to 20,000 rubles;

- for legal entities – from 20,000 to 70,000 rubles.

For repeated violations, fines will be several times higher:

- for officials – from 30,000 to 50,000 rubles;

- for legal entities – from 100,000 to 150,000 rubles.

Therefore, we recommend that you approach the issue of providing primary statistical data responsibly.

Let's take a closer look at the timing, where and how to send labor safety reports. Especially for our readers, at the end of the article we left a gift: forms of all necessary reports, as well as a table with detailed information on the reports. All documents can and should be used in your work!

QUESTION AND ANSWER: monitoring of remuneration of public sector employees

- home

- Blog

- QUESTION AND ANSWER: monitoring of remuneration of public sector employees

Here you can find answers to frequently asked questions on the topic “Monitoring the remuneration of public sector employees”, “Form for collecting information on the salaries of employees of state and municipal institutions”. The article will be updated with answers to your questions. QUESTION: Is it necessary to show for an employee the months in which he has no accruals and no hours worked

ANSWER: No, it is not necessary

QUESTION: Is it necessary to provide information on wages for all subordinate institutions? Even for those that do not have the specified categories?

ANSWER: All state, budgetary, autonomous institutions of a constituent entity of the Russian Federation, municipal institutions, and federal government institutions participate in monitoring. Data on employee salaries is not provided by:

- government departments;

- local government bodies (including those that are municipal government institutions);

- state extra-budgetary funds (Pension Fund of the Russian Federation, Social Insurance Fund of the Russian Federation and their territorial branches, Federal Compulsory Medical Insurance Fund, territorial compulsory medical insurance funds);

- courts;

- General Prosecutor's Office of the Russian Federation, prosecutor's offices of constituent entities of the Russian Federation and other prosecutor's offices;

- organizations that are not institutions (unitary enterprises, business societies).

Institutions employing persons with special ranks provide data only regarding civilian personnel in the manner established under the legislation on state secrets. Branches of organizations use a mechanism for submitting information similar to the mechanism for submitting reports to the Pension Fund.

QUESTION: Is it necessary to indicate the accruals of an employee dismissed in previous periods?

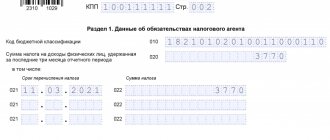

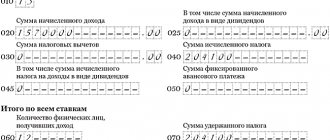

ANSWER: If an employee was dismissed in one of the previous reporting months (during 2021), and in the reporting month there were accruals as a result of recalculation (compensation, etc.), then these amounts are reflected in Section 1 of the form. In this case, the employee’s rate is set to the one the employee occupied by position before dismissal, the number of working hours according to the schedule is 0, and the number of hours actually worked is also 0.

QUESTION: How will it be possible to submit corrective/clarifying information to the Pension Fund of Russia?

ANSWER: If changes are necessary, the report must be submitted again, taking into account all corrections. This can be done until April 9. During aggregation, the latest report will be taken into account.

QUESTION: is there a procedure for reconciling the information provided (errors when filling out)?

ANSWER: On the official website of the Pension Fund of the Russian Federation in the section “Module of format-logical verification of reports” there is information about errors that may occur when filling out the form (more details: https://pfr.gov.ru/info/af/fsiozp)

QUESTION: if there are errors in the file after validation on the Pension Fund’s side, will the entire file be returned or will the records be accepted by the Pension Fund in part?

ANSWER: If there are errors in the file, the entire file will be returned indicating the errors

QUESTION: how do developers plan to solve the problem of the lack of uniform classifiers and reference books? Will a solution for the correspondence table be developed for each individual institution?

ANSWER: Classifiers have been developed and are reflected in the instructions for filling out the form. The form also provides for filling out reference books.

QUESTION: is section 2 “Information on the wage fund” of the form subject to completion in relation to the wage fund of employees of institutions holding positions for which special titles are assigned; whether Section 3 “Information on the salaries of managers, deputy managers and chief accountants of the institution” of the form must be completed in relation to the heads of branches of institutions, as well as if these positions are classified as positions for which the assignment of special titles is provided.

ANSWER: Persons who are awarded class ranks, diplomatic ranks, military and special ranks are not employees with whom an employment contract has been concluded in accordance with the Labor Code of the Russian Federation, therefore information on them is not provided in sections 2 and 3. Regarding the inclusion of branch managers, information on them is not included.

QUESTION: Is information required (section 3 of the form) on the maximum level of salary ratio for dismissed managers (deputy managers, chief accountants) during 2021 or only for those in effect as of 12/31/2020?

ANSWER: Yes, it is necessary, including for those dismissed

QUESTION: Is information provided on federal civil servants?

ANSWER: Information on federal civil servants is not provided

QUESTION: When generating reporting, are all employees of the organization taken into account or only those who work at their main place of work?

ANSWER: All employees are counted

QUESTION: To what type of organization (the code directory is presented) should the employees of the subordinate FKU, which is engaged in civil defense, be classified?

ANSWER: 6.0

QUESTION: Is it necessary to provide reporting for all employees of the Rosatom State Corporation, including subsidiaries?

ANSWER: It is necessary to provide information about subsidiaries if they are state municipal institutions

QUESTION: is it necessary to fill out data on employees of territorial bodies - service personnel, categories of NSOT

ANSWER: If the government body is not subordinate, but a separate territorial body, then it is not taken into account when forming monitoring

QUESTION: How are columns 13, 14, 15 filled out for teaching staff whose wages are paid depending on the teaching load? Working time standards for them are determined by order of the Ministry of Education and Science dated December 22, 2014 No. 1601 and depend on the number of hours per week.

ANSWER: Must be indicated per month

QUESTION: after November 1, 2021, incentive payments to medical and social workers in connection with the pandemic were paid to the Social Insurance Fund, how should these payments be loaded?

ANSWER: They are not taken into account

QUESTION: The qualification category of a teaching worker is taken into account in the official salary. Should I highlight it separately when filling out the form?

ANSWER: The qualification category is indicated separately, the salary remains in the accrual column for salaries/tariff rates

QUESTION: Do I need to report wages paid from income-generating activities?

ANSWER: Yes, similarly for all payments (salary - in column 16 - accruals at tariff rates, official salaries, piece rates or as a percentage of revenue in accordance with the forms and systems of remuneration accepted by the taxpayer, rubles, etc.)

QUESTION: Are data reflected for employees on parental leave?

ANSWER: Yes, they are reflected

QUESTION: How to distribute wages through paid services to teachers (payment based on the cost of an hour, on the terms of additional work and formalized by an additional agreement to the employment contract)?

ANSWER: In section 2 of the form, information is filled out not for individual employees, but for the entire institution as a whole from the sources of the wage fund.

QUESTION: total work experience (column 9) - when requesting information on total work experience, personnel workers often do not have this data. What to do in this case?

ANSWER: The value must be set to 0

QUESTION: is information about the payroll fund in section 2 filled out depending on the form of ownership of the institution? Those. State institutions of a constituent entity of the Russian Federation shall fill in expenses for personal wages at the expense of budget funds at all levels in columns 7, 8; municipal - 9, 10, or do you mean the source: in the accounting of BU and AU there is no data in the context of sources (FB, OB)?

ANSWER: This means the source.

QUESTION: How to fill out the form for institutions liquidated in 2021?

ANSWER: If the organization is completely liquidated and has not changed its legal form, then there is no need to provide information about it

QUESTION: in accordance with paragraph 3 of instruction 1, is it necessary to fill out information on employees working under an employment contract in the reporting month (if an employee quit in December 2021, and was paid a bonus in January 2021, should such employee be indicated in January 2021?) .

ANSWER: No, such data does not need to be reflected.

QUESTION: How should xml be generated - separately for each month of 2021 or for the entire 2021 (for all months) in one file?

ANSWER: The file must be one per institution. Inside there is information on all months and persons.

QUESTION: who generates the report for branches of institutions? The parent organization or the branch itself?

ANSWER: The report is submitted according to the same principles as all reporting on personal records of the Pension Fund of Russia within the framework of Federal Law No. 27-FZ. Which organization today submits SZV-M, SZV-STAZH, etc. to the Pension Fund of Russia, it also submits this report.

QUESTION: Is it necessary to report on GPC (civil law) agreements?

ANSWER: There is no need to report under such agreements .

QUESTION: if a recalculation for January was made in February, should it be included in January?

ANSWER: Recalculation is included in the accrual period.

QUESTION: Should vacation pay be divided according to columns, or should it be completely included in “Other payments?”

ANSWER: Vacation payments are indicated in the column “Other payments”

Consultation with specialists from Computer Service - 8 (8142) 55-55-05,

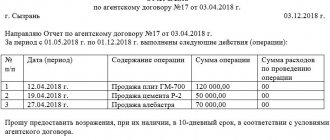

Settings for the “Analysis of accruals and deductions” report for ZUP/ZGU 3.1 Promo

Accounting Salary Salary v8 v8::SPR WKSU3.0 ZUP3.x Personal Income Tax Compulsory Medical Insurance Fund, Pension Fund, Social Insurance Fund Subscription ($m)

Several useful settings for the “Analysis of accruals and deductions” report for salary edition 3.1. The composition includes settings: Summary by taxation, Summary data for statistics, Register of benefits, Payroll payroll, Summary by financing, Deviations from the operating mode, Summary of wages by the Federal Tax Service, Accruals with detailed absences, Personal accounts of employees, Distribution vacations, Cost summary

2 startmoney

05/03/2018 46305 299 the1 45

Sample of filling out the unified form T-12

The unified form T-12 contains two sections:

- Working time tracking;

- Payment of wages to personnel.

The timesheet records all working hours worked and unworked by the employee in hours/minutes. You can fill out the timesheet using one of the following methods:

- Filling out attendance and absence records.

In this case, in column 4 on the day when the employee, for example, worked overtime (on a day off), it is necessary to indicate the normal duration of work time and the time of overtime work in one cell separated by a slash or in parentheses. To do this, in the top cell you write “I/S”, and in the bottom cell – “8/3”, where “8” is the normal length of the working day, which is established for the employee and worked by him, and “3” is what worked overtime. In addition, you can add additional lines in column 4 opposite the employee’s last name and initials in order to display overtime hours there. Please note that to add to the lines, you do not need to issue an order to change the details of the forms. - Recording in the time sheet only deviations from the normal duration, that is, absences, hours worked overtime, etc. In this case, on the day when the employee worked overtime, the letter code “C” must be noted in the top lines of column 4. Under this code, in the lower lines, the duration of overtime work should be indicated.

In columns 5 and 7 it is required to reflect the number of hours worked for half the month (first and second). At the end of the month, you need to fill out the following on your timesheet:

- column 8, indicating in it the total number of days that the employee worked for the month; column 9, where note the total number of hours worked by the employee per month, taking into account overtime hours;

- columns 10, 11 and 12. They separately show the overtime hours worked per month;

- column 14 - it is for the total number of all employee absences for the month (hours (days));

- in columns 15 and 16, enter the code for the reason for absence and the amount of days/hours of employee absence;

- column 17, where all weekends and holidays for the month are summed up.

If the company records hours worked and calculates wages separately, then section 2 of the timesheet does not need to be filled out. In this case, section 1 of the report card will be used as a separate independent document (see sample filling).

A report card in the T-12 form is issued one copy per month for all employees in the company. A responsible person is responsible for its preparation - for example, an employee of the human resources department. The final document is signed by the head of the department or company and the HR department employee, after which the completed timesheet is sent to the accounting department.

Sample of filling out the unified form T-12:

Download the current T-12 form:

One of the functional responsibilities of employees of accounting and economic services is the preparation of statistical reporting on labor.

Let's consider the composition and role of statistical reporting on labor, the forms of which are approved by the National Statistical Committee, as well as the most common issues that arise during its preparation.

Legislation 2017

Statistical reporting on labor allows you to monitor the state, current trends and changes in the labor market, and reveal employment problems.

The data on wages reflected in it makes it possible to analyze its changes over the years, the differentiation of the level of wages in various sectors of the public sector, by individual types of activity and by region of the country.

The average wage, calculated on the basis of the average number of employees, is used to determine the average wage of workers in the Republic of Belarus, which is a significant indicator when calculating benefits for temporary disability, pregnancy and childbirth, and the cost of vouchers.

When compiling reports by employees of accounting and economic services of budgetary organizations, unfortunately, mistakes are made:

- in calculating indicators on the number and movement of workers, incorrect attribution of individual payments to the wage fund;

- in the calculation of payroll and average headcount indicators.

As a rule, this happens mainly due to poorly established primary accounting, inattention and negligence of the performers when filling out the report.

In such cases, the object of the offense is relations related to the procedure for presenting state statistical reporting data, as well as their reliability. These actions (depending on the sanctions of the relevant parts of Article 23.18 of the Code of Administrative Offenses) entail a fine in the amount of 20 to 200 basic units.

To correctly generate statistical indicators for labor reports (their list is given in the table), it is necessary to follow the Instructions for filling out statistical indicators for labor in state statistical observation forms, approved by Resolution of the Ministry of Statistics dated July 29, 2008 No. 92 (hereinafter referred to as Instructions No. 92).

Currently, the National Statistical Committee has approved the following list of forms of state statistical observations of statistical indicators on labor, submitted by organizations, including budgetary ones, for which data collection and processing is carried out by state statistical bodies.

Forms of centralized state statistical observations on labor statistics, generated by accounting and economic services

| No. | Form name, index, presentation order | Registration number and date of the approval act of the resolution of the National Statistical Committee | Submission deadline | To whom it appears | Frequency of presentation |

| 1 | 1 | 2 | 3 | 4 | 5 |

| 1 | Labor report (12) (submitted as an electronic document or on paper) | No. 63 from 08/19/2013 | 12th day after the reporting period | Main Statistical Office of the City of Minsk; Department of statistics in the district (city) of the main statistical office of the region | Month |

| 2 | Labor report 12th (consolidated) | No. 196 of 08/29/2011 | 14th day after the reporting period | National Statistical Committee | Month |

| 3 | Labor report 1st (summary) | No. 149 of 08/12/2013 | 20th of March | National Statistical Committee | 1 time per year |

| 4 | Report on overdue wages 12 (debt) (submitted as an electronic document or on paper) | No. 40 from 05/08/2014 | 1st of the month | Main Statistical Office of the City of Minsk; Department of statistics in the district (city) of the main statistical office of the region | Month |

| 5 | Report on the distribution of the number of employees by the amount of accrued wages 6-(salary) (submitted as an electronic document or on paper) | No. 61 from 06/13/2016 | 18th day after the reporting period | Main Statistical Office of the City of Minsk; Department of statistics in the district (city) of the main statistical office of the region | 2 times a year (for May, for November) |

| 6 | Report on the number and distribution of civil servants by gender, age, education and length of service in civil service 6-(gs) (submitted as an electronic document or on paper) | No. 21 from 04/28/2015 | July 8 | Main Statistical Office of the City of Minsk; to the statistics department in the district (city) of the main statistical department of the region (If there is no statistics department at the respondent’s location in the district (city), to the main statistical department of the region.) | 1 time every 2 years |

| 7 | Report on the composition of the wage fund and other payments 6-(submitted as an electronic document or on paper) | No. 120 dated July 28, 2014 | April 8 | Main Statistical Office of the City of Minsk; Department of statistics in the district (city) of the main statistical office of the region | 1 time every 2 years |

| 8 | Salary report for managers 2nd (managers) (submitted as an electronic document or on paper) | No. 195 dated July 29, 2011 | 20th day after the reporting period | Main statistical office of the region (city of Minsk) | Half year |

| 9 | Report on wages of employees by profession and position 6 (professions) (sample state statistical observation) | No. 122 from 07/28/2014 | December 1 | Main Statistical Office of the City of Minsk; Department of statistics in the district (city) of the main statistical office of the region | 2 times every 5 years (in the first and penultimate years of the five-year plan) |

12 practice questions

Question : Is one-time remuneration paid to employees who have reached retirement age included in the wage fund ?

Answer: A one-time remuneration paid to employees who have reached retirement age is included in the wage fund if the employment relationship with the employee is extended (subclause 63.2.5 of Instructions No. 92).

At the same time, a one-time benefit (remuneration, including the cost of gifts, financial assistance) upon retirement (retirement) is not included in the wage fund (subclause 70.3 of Instructions No. 92).

Question : Are the amounts of bonuses , remunerations accrued to the heads of organizations for a quarter , half-year or other period in the wage fund , including bonuses for the achievement of certain quantitative and qualitative performance indicators by the institutions they manage ( for example , bonuses for the export of services ) and other bonuses ?

Answer: Bonuses and rewards refer to regular incentive payments and are included in the wage fund (subclause 63.1.3 of Instructions No. 92).

Question : Are remunerations for anniversaries , holidays , special events ( including the cost of gifts and financial assistance ) subject to inclusion in the wage fund ?

Answer: The listed payments refer to one-time incentive payments and are included in the wage fund (subclause 63.2.5 of Instructions No. 92).

After completing compulsory military service , the employee was hired at his previous place of work .

Question : Is one -time financial assistance an accepted employee after completing compulsory military service included in the wage fund ?

Answer: Financial assistance paid to an employee hired to his previous place of work after completing military service is a one-time payment of an incentive nature and relates to the wage fund (subclause 63.2.8 of Instructions No. 92).

Question : Should the average number of employees include persons on maternity leave , in connection with the adoption of a child under the age of 3 months , or caring for a child until he reaches the age of 3 years ? _

Answer: The average number of employees does not include employees on maternity leave, in connection with the adoption of a child under 3 months of age, or to care for a child until he reaches the age of 3 years (subclause 10.1.1 of Instructions No. 92).

Question : When calculating the average number of employees , are persons on leave without pay due to obtaining education in educational institutions , as well as for passing entrance examinations for admission to educational institutions for secondary specialized , higher and postgraduate education , to be included ?

Answer: The named persons are not included in the calculation of the average number of employees (clause 10.1.3 of Instructions No. 92).

Question : Are remunerations accrued to employees on the payroll of an organization with whom civil contracts have been concluded to perform work in the same organization included in the wage fund ? _ Are they subject to reflection in the average number of citizens who performed work under civil contracts in the labor report (12 - t ) ?

Answer: Remuneration to citizens who, in addition to their main work, performed work under civil law contracts, is reflected only in line 02 “Wage fund for listed and unlisted employees and external part-time workers” of the labor report (12-t) (subclause 62.21 of Instructions No. 92) . In this case, the data on the salary of such an employee must be summed up.

In the average number of citizens who performed work under civil contracts, employees who are on the payroll of an organization (including separate divisions) and who entered into a civil contract to perform work in the same organization (including separate divisions) are not included (clause 12 paragraph four of Instructions No. 92).

Such employees are reflected once for their main job in the payroll and average number of employees of the organization. This category of workers is not subject to reflection in columns 3 and 4 of Section II “The average number of employees on the payroll for the period, the average number of citizens who performed work under civil contracts, and external part-time workers,” since they are employees on the payroll who entered into civil contracts. legal agreements with the same organization.

Question : Is compensation paid to an employee in exchange for notice of impending dismissal included in the wage fund ?

Answer: Severance pay (compensation) paid in the event of termination of an employment agreement (contract) is not reflected in the wage fund (subclause 70.1 of Instructions No. 92).

In the organization , after the dismissal of a pensioner, he was awarded a bonus based on the results of his work for the quarter .

Question : On which line the labor report ( 12- t ) should the amount of the accrued bonus be reflected ?

Answer: If cash payments are accrued with a delay after the dismissal of retired employees (bonuses, remunerations based on the results of work for a month, quarter, year), then they relate to the wages of persons not on the payroll and are reflected on line 04 of the labor report (12- t) (subclause 62.23.5 of Instructions No. 92).

The organization paid cash assistance to a young specialist who had received a higher education for the rest period before starting work .

Question : Is this payment included in the wage fund ? _

Answer: This payment relates to other payments and expenses not reflected in the payroll fund (subclause 70.15.4 of Instructions No. 92).

Question : Should financial assistance provided to individual employees upon their personal application be included in wage fund of the labor report ( 12 - t ) , if the application states “ due to difficult financial situation ” without specifying a specific reason ?

Answer: In this case, a difficult financial situation is equated to negative family circumstances (natural disaster, fire, injury, serious illness, etc.). This kind of financial assistance provided to individual employees upon application should not be included in the wage fund reporting in Form 12-t. It is taken into account in other payments and expenses that are not reflected in the wage fund (subclause 70.21 of Instructions No. 92).

Question : How to correctly reflect in the labor report ( 12- t ) the financial assistance provided to employees : parents with children who are students , to prepare for the start of the school year ; in connection with the birth of a child ; due to the death of close relatives , serious illness and other family circumstances ?

Answer: The wage fund does not include the named types of financial assistance, including:

- financial assistance provided to parents at the birth of a child (subclause 70.4 of Instructions No. 92);

- financial assistance to parents with student children to prepare for the start of the school year (subclause 70.6 of Instructions No. 92);

- financial assistance provided to individual employees in connection with the death of close relatives, serious illness and other family circumstances (subclause 70.21 of Instructions No. 92).

Lyudmila Eskova, associate professor, candidate. econ. sciences

What kind of report is this

For the last few years, employers have been reporting on the state of working conditions at the enterprise and compensation paid for work in hazardous and (or) hazardous industries. Order No. 412 of Rosstat dated July 24, 2020 approved the labor report and instructions for filling it out, which should be used to transmit data for 2020.

The report traditionally contains the following data:

- about harmful factors that exist in employees’ workplaces;

- on guarantees and compensation provided to workers engaged in hazardous and (or) hazardous work.

If you previously reported, update the report form. Although officials made minor technical changes, the law requires reporting on current forms, and old ones cannot be used.

Types of reports:

Organizations report to state supervisory authorities and statistical departments within certain deadlines and in established forms.

Thus, reporting in the field of labor protection for an organization consists of three forms:

- Statistical report in form 1-T (working conditions) “Information on the state of working conditions and compensation for work in harmful and (or) dangerous working conditions”;

- Statistical report in form 7-injuries “Information on injuries at work and occupational diseases”;

- Financial report in form 4-FSS.

Note:

- If the company has separate divisions in its structure, then the report is submitted to the territorial statistics department at the location of each branch. For example, an enterprise has its head office in Moscow, and a separate division in Tver. In this case, the branch submits a report on its data to the Rosstat department for the city of Tver, and the main office reports in the capital without information on the work of the branch in order to avoid duplication of information.

- If the deadline for submitting a report falls on a weekend, the usual postponement rule applies: the due date is postponed to the next working day.

Let's take a closer look at each report.

Form 1-T (working conditions)

Form 1-T (working conditions) is one of the statistical reports that contains information about the presence of hazardous production factors at employers, guarantees and compensation provided to employees.

Who serves?

The report is provided by all legal entities, except for small businesses, whose main activity is (according to OKVED):

Who does not need to submit Form 1-T

How and where to submit?

In 2021, Rosstat updated Form No. 1-T “Information on the state of working conditions and compensation for work with harmful and (or) dangerous working conditions” by order No. 412 dated July 24, 2020. Therefore, for reporting for 2021, you must use the new form! It can be downloaded at the end of the article.

Attention: Order of Rosstat dated July 15, 2019 No. 404 was declared invalid: the form established by it cannot be used.

There are two ways to submit a report to Rosstat (Clause 7, Article 8 of Federal Law No. 282-FZ dated November 29, 2007):

- on paper at the place of actual activity of the organization or separate division, by personal visit or by sending by registered mail;

- in electronic form on the website of the regional branch of Rosstat.

When to serve?

The report in Form No. 1-T is submitted annually to Rosstat before January 21 of the year following the reporting year.

So, for 2021, statistical data must be provided by January 21, 2021.

Report structure

Structure, Form 1-T

What are the design requirements?

If you submit information on paper, then any corrections are prohibited. Handwriting must be legible and only black or blue ink may be used.

Form 1-T (working conditions) is filled out based on the results of a special assessment of working conditions (SOUT): it is necessary to indicate the number of workers employed in work with harmful and (or) dangerous working conditions, and data on the guarantees and compensation provided to them.

Form 7-injury

This report is intended to inform statistical authorities about cases of injury to workers and/or the development of occupational diseases. The Federal State Statistics Service (Rosstat) needs this information to form a holistic picture of risk levels in different sectors of activity in Russia.

Who serves?

Everyone must report

legal entities, except for small businesses (SMB), extraterritorial organizations and enterprises of the following types of activities (according to OKVED):

Who does not need to submit a report, Form 7-injury

How and where to submit?

Rosstat offers several options for providing a report: in paper or electronic form using form 7-injury.

In 2021, the reporting form was updated by Rosstat order No. 326 dated June 22, 2020

: Attached to the document are both the form and instructions for filling out the report.

You can download Form-7 at the end of the article.

Attention!

Order of Rosstat dated June 21, 2021 No. 417 has lost force: the form established by it cannot be used.

If you filled out a paper report, you can take it in person

to the territorial division of Rosstat or send it by registered mail.

When preparing an electronic version of the report, send it via telecommunication channels (through your operator or using web collection). Other ways to transmit the report electronically can be found on the official website of Rosstat.

When to serve?

Information on injuries and occupational diseases at work is submitted to the territorial division of Rosstat at the location of the organization or individual entrepreneur once a year - no later than January 25 of the year following the reporting year.

So, for 2021, the report must be submitted by January 25, 2021.

Report structure

Structure, Form 7-injury

What are the design requirements?

If you submit information on paper, then any corrections are prohibited. Handwriting must be legible and only black or blue ink may be used.

All information about industrial injuries can be obtained from accident reports (Form N-1, approved and filled out in accordance with Resolution of the Ministry of Labor dated October 24, 2002 No. 73). Amounts spent on labor protection are reported using accounting data. If there is no such data, then put “0” in the corresponding section.

Instructions for filling out the state statistical reporting form 12 “Labor Report”

Chapter 1 General provisions

1. State statistical reporting in form 12 “Labor Report” (hereinafter referred to as the report):

1.1. present:

1.1.1. commercial organizations:

legal entities with an average number of employees per calendar year of more than 100 people, their separate divisions with a separate balance sheet;

small organizations with an average number of employees per calendar year of 16-100 people, subordinate (part of) state bodies (organizations), as well as organizations whose shares (shares in authorized funds) are state-owned and transferred to the management of state bodies (organizations) ); their separate divisions with a separate balance sheet;

banks (regardless of the number of employees);

1.1.2. non-profit organizations:

government bodies, regardless of the number of employees, with the exception of those listed in paragraphs two and three of subclause 1.2 of this clause;

legal entities with an average number of employees per calendar year of 16 people or more, their separate divisions with a separate balance sheet, with the exception of those listed in paragraph five of subclause 1.2 of this clause;

1.2. do not represent:

rural, town and city (cities of regional subordination) Councils of Deputies and executive committees;

Ministry of Internal Affairs of the Republic of Belarus, State Border Committee of the Republic of Belarus, State Security Committee of the Republic of Belarus and organizations subordinate to them; Ministry of Defense of the Republic of Belarus, State Committee for Forensic Examinations of the Republic of Belarus and non-profit organizations subordinate to them; Department of Financial Investigations of the State Control Committee of the Republic of Belarus, Investigative Committee of the Republic of Belarus, Security Service of the President of the Republic of Belarus, Operational and Analytical Center under the President of the Republic of Belarus;

peasant (farm) farms;

non-profit organizations - legal entities without departmental subordination with an average number of employees per calendar year of 16-100 people inclusive;

consumer cooperatives (except for unions of consumer societies and consumer societies);

public, religious organizations (associations);

owners' association.

2. Submission of the report in the form of an electronic document is carried out using specialized software, which is placed along with the necessary instructional materials for its deployment and use by the National Statistical Committee of the Republic of Belarus on the global computer network Internet

A necessary condition for submitting a report in the form of an electronic document is that a legal entity, its separate division with a separate balance sheet (hereinafter, unless otherwise specified, the organization) has electronic digital signature facilities received upon registration as a subscriber of the certification center of the republican unitary enterprise " Information and Publishing Center for Taxes and Duties" or a subscriber of the republican certification center of the State public key management system for verifying electronic digital signatures of the Republic of Belarus of the republican unitary enterprise "National Center for Electronic Services".

The organization submits a report on paper to the state statistics body at its location (state registration) by mail or courier.

3. Legal entities, their separate divisions that have a separate balance sheet, draw up a report, including data on the divisions included in their structure that do not have a separate balance sheet, located on the same territory (regional district, city of regional subordination, Minsk city).

Legal entities, their separate divisions that have a separate balance sheet, in the structure of which there are divisions that do not have a separate balance sheet, located in another territory (regional district, city of regional subordination, the city of Minsk), draw up a separate report for all structural divisions that do not have a separate balance sheet located within the same territory, while in the details “Information about the respondent” in the line “Territory of location of the structural unit” the actual location of these units is indicated (name of the district, city of regional subordination, the city of Minsk).

4. Departments (departments) of education, sports and tourism, ideological work, culture and youth affairs of urban (cities of regional subordination), district executive committees and local district administrations in cities draw up a separate report in relation to the apparatus and separate reports in relation to subordinate organizations, financed from their budget, for which accounting services are provided. At the same time, in relation to these subordinate organizations, a separate report is submitted on the types of economic activities related to section P “Education”, and a separate report on the types of economic activities related to section R “Creativity, sports, entertainment and recreation” of the national classifier of the Republic of Belarus OKRB 005 -2011 “Types of economic activity”, approved by the resolution of the State Committee for Standardization of the Republic of Belarus dated December 5, 2011 No. 85 “On approval and implementation of the national classifier of the Republic of Belarus” (National Register of Legal Acts of the Republic of Belarus, 2012, No. 43 , 8/24941) (hereinafter referred to as OKRB 005-2011).

The main departments of justice of the regional (Minsk city) executive committees draw up a separate report in relation to the apparatus and a separate report as a whole for the region (Minsk city) in relation to the compulsory enforcement departments, including district (inter-district), city, and city district compulsory enforcement departments.

In general, for the region (the city of Minsk), reports, including primary statistical data for structural units that do not have a separate balance sheet, are submitted (at the same time, a separate report is compiled for the regional apparatus located in the city of Minsk) in relation to:

regional (Minsk city) departments of the Ministry of Emergency Situations of the Republic of Belarus;

main departments of the Ministry of Finance of the Republic of Belarus by region (city of Minsk);

ships;

legal advice;

main statistical departments of regions and the city of Minsk;

regional and interdistrict inspections for the protection of flora and fauna of the State Inspectorate for the Protection of Fauna and Flora under the President of the Republic of Belarus;

regional (Minsk city) committees of natural resources and environmental protection;

prosecutor's offices of regions and the city of Minsk;

regional (Minsk city) departments of the Social Protection Fund of the Ministry of Labor and Social Protection of the Republic of Belarus;

regional (Minsk city) departments of the Department of State Labor Inspection of the Ministry of Labor and Social Protection of the Republic of Belarus;

regional state inspections for seed production, quarantine and plant protection;

regional branches of the Transport Inspectorate of the Ministry of Transport and Communications of the Republic of Belarus;

regional (Minsk city) departments of the Republican Center for Health Improvement and Sanatorium Treatment of the Population;

branches of republican unitary agricultural enterprises for breeding.

5. Data on separate divisions located outside the territory of the Republic of Belarus are not reflected in the report.

6. In column 3 of the details “Information about the respondent” the code of the organization attribute is indicated: budgetary - 1, non-budgetary - 2.

Budget organization is an organization created (formed) by the President of the Republic of Belarus, state bodies, including local executive and administrative bodies, or another state organization authorized by the President of the Republic of Belarus to carry out managerial, socio-cultural, scientific, technical or other functions of a non-profit nature, the functioning of which is financed from the corresponding budget on the basis of budget estimates and accounting of which is maintained in accordance with the chart of accounts approved in the prescribed manner for budgetary organizations, and (or) taking into account the peculiarities of accounting and reporting in accordance with the law .

7. When filling out the report, you should be guided by the Instructions for filling out statistical indicators on labor in the forms of state statistical observations, approved by the Decree of the Ministry of Statistics and Analysis of the Republic of Belarus dated July 29, 2008 No. 92 (National Register of Legal Acts of the Republic of Belarus, 2008, No. 222 , 8/19374) (hereinafter referred to as Labor Instructions).

8. If during the reporting period there was a change in the methodology for calculating labor statistics, then the data for the reporting period and for the corresponding reporting period of the previous year are presented based on the methodology adopted in the reporting period.

Download full instructions using the button below:

Summary report on average earnings. ZUP 3.1

Salary Accounting v8 v8::SPR ZUP3.x Russia BU Subscription ($m)

The report displays the final average earnings for employees. To calculate average earnings, all three options were used, depending on the report settings. The total earnings for calculation are broken down by type of earnings. The amount of time taken into account when calculating the average is displayed. The report allows you to set the “depth” of the average calculation. The publication has been tested and works on version: 3.1.11.153

1 startmoney

11/23/2019 7377 186 DrZombi 13

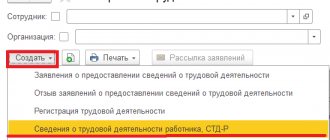

When to submit SZV-TD

In 2021, a report in the SZV-TD form must be submitted no later than the 15th day of the month following the month in which:

- there were personnel changes;

- the employee submitted an application to continue maintaining a work record book in paper format under Art. 66 Labor Code of the Russian Federation;

- the employee declared the choice of information about work activity in accordance with Art. 66.1 Labor Code of the Russian Federation.

The employee must write an application before December 31, 2020.

If in 2021 there were no personnel changes in relation to the employee and he did not submit an application to choose the format for maintaining a work record book, the employer must provide information about the work activity of such an employee as of 01/01/2020 until February 15, 2021.

From 2021, you need to submit a report only if there are personnel movements in the company before the 15th day of the month following the reporting month.

Filling out SZV-TD upon dismissal

The dismissal of an employee means the termination of the contract between the individual and the employer. The contract can be either labor or civil law, and the employer can be a legal entity or an individual entrepreneur.

If a civil contract has been concluded with an employee, then information about this has not previously been entered into the work book and is not still being entered, therefore, there is no need to submit information to the Pension Fund of the Russian Federation about termination of contracts with such employees. For details, see the material “SZV-TD and civil contracts”. We will find confirmation of this in paragraph 1.4 of Resolution No. 730p and Art. 15 Labor Code of the Russian Federation.

If a standard employment contract is concluded with an employee, then information on it is necessarily included in the SZV-TD. Part-time workers and telecommuters are no exception.

All organizations and individual entrepreneurs are required to submit a SZV-TD when dismissing employees with whom the employment relationship is terminated. Of course, provided that an employment contract was concluded with them.

See an example of filling out the SZV-TD form upon dismissal.