Six major changes to invoices

Added product type code

Column 1a “Product type code” was added to the invoice. A similar column appeared in the adjustment invoice under number 1b. The column must be filled out in accordance with the unified product nomenclature of foreign economic activity of the EAEU (Appendix to the Decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54).

The codes are grouped into sections by type of activity, 21 sections in total. These columns 1a are not filled in by all taxpayers, but only by exporters who export goods from the Russian Federation to the territory of the EAEU countries.

Who will sign the invoice?

An individual entrepreneur (IP) now has the right to sign an invoice not only personally, he can delegate the corresponding authority to another person. To do this, you need to issue a notarized power of attorney. Let us recall that the corresponding norm has existed in the Tax Code of the Russian Federation since 2014, and now it has simply been included in the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

How to specify the counterparty's address

Addresses of counterparties are indicated according to the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs, and not by location, as was before. The address according to the Unified State Register of Legal Entities can be found by ordering an extract, for example, on the Federal Tax Service website egrul.nalog.ru. However, an error in the address should not be a reason for refusing a VAT deduction. Inspectors can identify counterparties by TIN and other details. This position was conveyed in letters of the Ministry of Finance of Russia dated April 2, 2015 No. 03-07-09/18318, dated November 15, 2017 No. 03-07-09/75380.

What to include on adjustment invoices

It is allowed to include details of the primary document in additional lines of adjustment invoices.

This can be done in 2 ways: 1. Add columns. You can adjust several invoices at once in one form. In this case, you can add lines before column 1 or columns after column 9, the main thing is that the invoice form is preserved (letter of the Federal Tax Service of Russia dated August 17, 2016 No. SD-4-3/15118).

2. Add data after line 5 without violating the invoice form (letter of the Federal Tax Service of Russia dated August 17, 2016 No. SD-4-3/15094). In an additional line, you can write down the agreement number for the contract under which the price of goods has changed.

Registration number instead of customs declaration number

Let us remind you that in column 11 of the invoice, the registration number of the customs declaration is indicated. The registration number has the established format (approved by decision of the Customs Union Commission dated May 20, 2010 No. 257):

customs authority code / date of registration of the declaration / serial number of the declaration.

The registration number is located in column A of the main and additional sheets of the customs declaration. The column is filled out even when selling imported goods in Russian packaging (letter of the Ministry of Finance of Russia dated 04/07/2017 No. 03-07-09/20667).

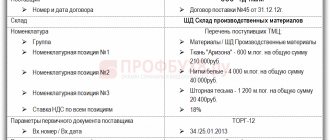

Preparation of invoices by freight forwarders and developers

The procedure for drawing up invoices for the acquisition of goods, works, services, property rights from two or more sellers on their own behalf by such persons has been established:

— forwarders;

— developers;

— customers performing the functions of a developer.

When issuing an invoice, all these persons adhere to an individual chronology (indicate their invoice number and date). In line 2 “Seller” of the consolidated invoice, enter your own name. In line 2a - your address, in line 2b - your tax identification number and checkpoint. Previously, it was not clear how to indicate the seller on such a form, since there is only one line, and there are several sellers.

In line 5, separated by a semicolon ";" list the dates and numbers of payment orders for the transfer and receipt of funds.

Column 1 lists all goods (services, works) from invoices for each seller. This means that products with the same names cannot be combined into one row if they have different sellers.

In columns 2-11, forwarders indicate the data of invoices issued by each of the sellers in the share presented to the buyer (client).

As for developers, they will indicate in columns 2-11 the total data of invoices issued:

— contractors for construction and installation works;

— suppliers for goods, works, services, property rights.

In both cases, the invoice data must be indicated in the share presented to the buyer (investor).

Rules for storing VAT documents

The procedure for storing VAT accounting documents (including when using electronic document management) has been clarified. Thus, invoices (including adjustments, corrected ones), confirmations from the EDF operator, notifications to the buyer about receipt of the invoice must be stored in chronological order:

- by date of issue;

- by the date of preparation or correction (when the invoice is not sent to the buyer or is not received by him);

- by date of receipt for the corresponding tax period.

The list of VAT accounting documents subject to storage has expanded.

These now include copies of paper invoices issued by the seller to the developer or forwarder. These copies are certified by the developer (forwarder) and transferred to the buyer (investor, client). The buyer (investor, client) also stores seller invoices received from the developer (forwarder), issued electronically. All these documents, along with others (listed in clause 11 of the Rules for filling out invoices, approved by Resolution No. 1137) must be stored for at least four years from the date of the last entry in the accounting journal or book.

The principal (principal) is obliged to keep copies of invoices issued by the seller.

If companies use electronic document management, then they can store documents in electronic form; it is not necessary to make paper copies.

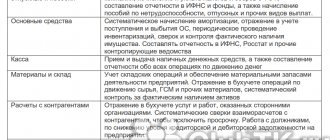

Primary documentation and reporting

Primary documentation is used to calculate accounting and tax reports. Therefore, the preparation of primary documents must be approached responsibly. During the inspection, regulatory authorities look at the formal component of the document (details, signatures), the correctness of filling out the main part of the document, which describes the transfer of inventory, the provision of services, the conditions and nuances of the implementation of the agreement, as well as the completeness of the “primary document”.

Only properly compiled documentation can confirm the fact of a business transaction. Otherwise, it (the operation) may not be recognized as such. Then you will need to redo the primary documentation, reports and pay a fine (especially if this is not the first violation).

What changes to watch for in purchase books?

General rules It

is allowed to register primary or consolidated accounting documents in the purchase book in the absence of invoices. For example, such a situation is possible if the company and the counterparty on a special regime refused invoices. It is also allowed to indicate, separated by a semicolon, several dates of registration of goods, works, and services.

It may turn out that the company received an advance payment, and an invoice was not issued in accordance with the law. Then, in the purchase book when VAT is restored, the payment previously reflected in the sales book is registered. Column 3 of the purchase book indicates its details. In the same order, you can reflect the details of the summary document for all advances received from customers.

Corrected invoices

The rules for registering corrected invoices have been clarified. Invoices with errors must be canceled and corrected documents must be registered in the same quarter (tax period) to which these documents relate. If the quarter has already ended, then additional sheets should be used.

Let us remind you that previously buyers could cancel an invoice and register a new one in the period when they received the corrected document. Now, due to supplier errors, you will need to submit an updated declaration.

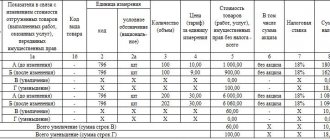

Unified adjustment invoices

The features of reflecting unified adjustment invoices in the purchase book are determined. When registering such an invoice, column 3 indicates its number and date, while column 4 is not filled in.

When the cost of goods (work, services) decreases, the seller in columns 9 and 10 of the purchase book indicates the buyer’s details (name, tax identification number) from a single adjustment invoice. Let us remind you that when registering in the event of a decrease in the cost of goods of a regular adjustment invoice, the seller’s details are indicated in the above columns.

When the cost of shipped goods (work, services) increases, the buyer reflects the seller’s details from a single adjustment invoice in columns 9 and 10 of the purchase book.

If the cost of goods changes

If the value of goods supplied by persons who are not VAT payers decreases, column 3 reflects the details of the document that confirms the supplier’s consent to the change in the value of the goods. Or details of an adjustment document containing summary data.

Attention to seller details

For certain operations (for example, refund of an advance payment, issuing an invoice to reduce the cost of goods), the organization must indicate its own details - name, tax identification number and checkpoint, and not its counterparty.

There are also cases in which the seller’s details (name, INN, KPP) are not filled in, in particular:

- registration of a consolidated invoice issued by the commission agent (agent);

- registration of an invoice issued by a tax agent purchasing goods, works, services from a foreign person;

- import operations.

When goods are imported into the Russian Federation

When importing goods, the registration number of the customs declaration is reflected in column 3 of the purchase book. By the way, it is now permissible to indicate several numbers of customs declarations separated by semicolons. The same numbers must also be entered in line 150 of section 8 of the VAT return.

If goods are imported from EAEU countries, then column 3 indicates the number and date of the application for import and payment of indirect taxes. Please note that in this situation, in column 3 you can indicate the details of only one application. There cannot be several of them, since VAT is deductible for each of the statements.

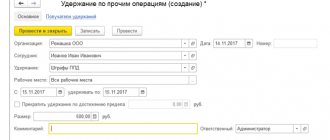

Can an AU do without these documents?

Formally, all organizations and institutions, when applying the traditional taxation system, are recognized as VAT payers (clause 1 of Article 143 of the Tax Code of the Russian Federation). At the same time, starting from 2014, the taxpayer is required to draw up an invoice, keep logs of received and issued invoices, purchase books and sales books only when performing transactions recognized as subject to VAT. Regarding transactions that are not subject to taxation (exempt from taxation) and referred to in Art. 149 of the Tax Code of the Russian Federation, this does not need to be done (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation as amended by Federal Law dated December 28, 2013 N 420-FZ). Thus, if an agency provides exclusively non-taxable services in the field of education, culture and art (Article 149 of the Tax Code of the Russian Federation), there is no need to draw up invoices, maintain a purchase book and a sales book (Letter of the Ministry of Finance of the Russian Federation dated March 19, 2014 N 03-07- 09/11822).

Another situation: an institution, due to small revenues, enjoys an exemption from the duties of a VAT payer (Article 145 of the Tax Code of the Russian Federation). In this case, the accountant of the AU, by virtue of clause 5 of Art. 168 of the Tax Code of the Russian Federation is obliged to issue payment documents and invoices with the inscription “Without VAT” (when providing services to legal entities) and register them in the journal of received and issued invoices (until January 2015), as well as in the sales book in the generally established ok. At the same time, you don’t have to keep a purchase book, since such “taxpayers” do not have the right to tax deductions for VAT (Letter of the Federal Tax Service of the Russian Federation dated April 29, 2013 N ED-4-3 / [email protected] ).

If the AU deals with transactions subject to VAT, then the accountant draws up and maintains all the listed documents in a general manner. At the same time, attention should be paid to electronic document management, since it has already become mandatory for VAT reporting (Letter of the Federal Tax Service for Moscow dated March 12, 2014 N 24-15/022540). For invoices, electronic document flow is still voluntary; it is possible by mutual agreement of the parties to the transaction and if they have compatible technical means and capabilities for receiving and processing invoices (clause 1.4 of the Procedure for issuing invoices in electronic form). Today, an increasing number of VAT payers are switching to electronic document management.

What changes to watch out for in sales books?

General rules

It is allowed to register primary or summary documents in the sales ledger that replace invoices. For example, when a product is sold to an individual, when the company and its counterparty refuse invoices under a special regime. In the same order, you can reflect the details of the summary document for all advances received from customers.

When an invoice is not issued in the cases provided for by the Tax Code of the Russian Federation, primary accounting documents or documents containing summary (summary) data on transactions for the month (quarter) are registered in the sales book. Registration of payment and settlement documents, including summary payment documents, as well as documents confirming the buyer’s consent to an increase in the cost of goods (work, services, property rights) is also permitted.

When goods are exported from the Russian Federation

When exporting goods from the territory of the Russian Federation to the territory of the EAEU countries, in column 3b of the sales book, you must indicate the code of the type of goods according to the Unified Commodity Nomenclature for Foreign Economic Activity of the EAEU.

Attention to buyer details

The cases in which the name, INN and KPP of the buyer in the sales book are not filled in have been clarified. For example, when reflecting data:

- according to an invoice drawn up by the principal to the commission agent who sells goods on his own behalf to two or more buyers;

- according to an invoice drawn up when selling goods to a foreign person who is not registered with the tax authority of the Russian Federation;

- according to a document containing summary data on the seller’s transactions;

- according to a document containing summary data on advance transactions.

Contribute to the authorized capital

When transferring property, intangible assets, property rights to the authorized (share) capital, the documents that formalize such a transaction are registered in the sales book. In this case, the VAT amount must be allocated. The fact is that this amount is subject to restoration. The recipient (receiving party), in turn, registers the same documents in the purchase book; they will serve as the basis for receiving a tax deduction.

This is an important innovation. Compliance with this procedure will allow the parties to the transaction to avoid discrepancies in transactions for making contributions to the authorized capital when reconciling these declarations with the tax authorities.

Unified adjustment invoices

The features of reflecting unified adjustment invoices in the sales book are determined. When registering such an invoice, column 3 indicates its number and date, while column 4 is not filled in.

When the seller reflects in the sales book data on a single adjustment invoice for an increase in cost, in columns 7, 8, the details (name, tax identification number, checkpoint) of the buyer from the same invoice are indicated.

When the buyer reflects data on a single adjustment invoice for a decrease in value in the sales book, columns 7 and 8 indicate the seller’s details from this invoice.

Let us remind you that when registering a regular adjustment invoice for a decrease in cost, the sales ledger indicates its own details in the named columns.

Why you may need a certificate of a reconciled tax system

A certificate of the applicable taxation system is required to confirm the company’s right to work with or without VAT. It allows other organizations to verify whether they can accept VAT as a deduction after paying for goods and services.

It is worth noting that tax legislation does not contain specific requirements for this certificate and, in general, does not assign the taxpayer an obligation to present it at anyone’s request.

Authorized authorities (for example, the prosecutor's office or extra-budgetary funds), if necessary, can obtain such information directly from the Tax Inspectorate.