Standard tax deduction.

According to paragraphs. 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation when determining the size of the tax base in accordance with paragraph 3 of Art. 210 of the Tax Code of the Russian Federation, the taxpayer has the right, in particular, to receive a standard tax deduction for a child. This tax deduction for each month of the tax period applies to the parent, spouse of the parent, adoptive parent, guardian, custodian, foster parent, spouse of the foster parent who is supporting the child.

From 01/01/2012 to 31/12/2015, this deduction was provided in the following amounts:

- 1,400 rub. – for the first child;

- 1,400 rub. – for the second child;

- 3,000 rub. – for the third and each subsequent child;

- 3,000 rub. – for each child if a child under the age of 18 is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II.

Moreover, this deduction was provided until the month in which the taxpayer’s income (with the exception of income from equity participation in the activities of organizations received in the form of dividends by individuals who are tax residents of the Russian Federation), calculated on an accrual basis from the beginning of the tax period (in respect of which the tax rate is provided , established by clause 1 of Article 224 of the Tax Code of the Russian Federation (13%)) by the tax agent providing this deduction, exceeded 280,000 rubles. Starting from the month in which the specified income exceeded 280,000 rubles, this tax deduction was not applied.

The tax deduction in 2021 from 01/01/2016 has a number of changes made to Art. 218 of the Tax Code of the Russian Federation by Law No. 317-FZ[1]. One of the main innovations is the size of the tax deduction provided in 2016, taking into account the division of taxpayers into categories. So, the tax deduction in 2021 for each month of the tax period applies to:

a) for the parent, spouse of the parent, adoptive parent, on whose support the child is, in the following amounts:

- 1,400 rub. – for the first child;

- 1,400 rub. – for the second child;

- 3,000 rub. – for the third and each subsequent child;

- 12,000 rub. – for each child if a child under the age of 18 is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II;

b) for a guardian, trustee, adoptive parent, spouse of an adoptive parent who is providing for the child, in the following amounts:

- 1,400 rub. – for the first child;

- 1,400 rub. – for the second child;

- 3,000 rub. – for the third and each subsequent child;

- 6,000 rub. – for each child if a child under the age of 18 is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II.

The second change is an increase in the income limit before which this tax deduction is granted. So, the tax deduction is valid until the month in which the taxpayer’s income (with the exception of income from equity participation in the activities of organizations received in the form of dividends by individuals - tax residents of the Russian Federation), calculated on an accrual basis from the beginning of the tax period (in respect of which the tax rate is provided, established by clause 1 of Article 224 of the Tax Code of the Russian Federation, - 13%) by the tax agent providing this tax deduction, exceeded 350,000 rubles. Moreover, starting from the month in which the specified income exceeded 350,000 rubles, the tax deduction is not applied.

The procedure for providing such a tax deduction in 2021 has not changed.

Personal income tax for non-residents

The personal income tax rate on dividends received by non-residents of the Russian Federation is higher than for residents and amounts to 15%. A common misconception is to believe that all Russian citizens are recognized as residents. This is wrong. The concept of a resident of the Russian Federation is given in Article 207 of the Tax Code of the Russian Federation, from which it follows that he is an individual who was actually in the territory of Russia for at least 183 calendar days over the next 12 consecutive months. There is no indication of citizenship in this definition, so a foreigner can also be a resident of the Russian Federation.

That is, the mere presence of Russian citizenship does not automatically give tax resident status. To avoid paying personal income tax at a rate of 15%, track the number of days you are outside of Russia. But if you were absent for more than 183 days for valid reasons, such as treatment or training, then the days of such absence are not counted.

In addition, regardless of the time spent in Russia, Russian military personnel serving abroad and civil servants sent abroad are recognized as residents. True, this clarification has no special relation to personal income tax on dividends, because military personnel and civil servants, in principle, cannot engage in business, combining it with service.

Otherwise, we must remember that the personal income tax rate for non-residents is higher than for residents, and for income tax on dividends the difference is relatively small - 15% versus 13%. But, for example, personal income tax on sold real estate for non-residents is as much as 30%, and not 13% for those who were in Russia.

Social tax deduction.

According to paragraphs. 2 and 3 clauses 1 art. 219 of the Tax Code of the Russian Federation when determining the size of the tax base in accordance with paragraph 3 of Art. 210 of the Tax Code of the Russian Federation, the taxpayer has the right to receive the following social tax deductions:

- in the amount paid by him in the tax period for his studies in educational institutions - in the amount of actually incurred expenses for training, taking into account the limitation established by clause 2 of Art. 219 of the Tax Code of the Russian Federation, as well as in the amount paid by the taxpayer-parent for the education of their children under the age of 24, by the taxpayer-guardian (taxpayer-trustee) for the education of their wards under the age of 18 on a full-time basis in educational institutions - in the amount actual expenses incurred for this training, but not more than 50,000 rubles. for each child in the total amount for both parents (guardian or trustee);

- in the amount paid by the taxpayer in the tax period for medical services provided by medical organizations, individual entrepreneurs engaged in medical activities, to him, his spouse, parents, children (including adopted ones) under the age of 18, wards under the age of 18 years (in accordance with the list of medical services approved by the Government of the Russian Federation), as well as in the amount of the cost of medicines for medical use (according to the list of medicines approved by the Government of the Russian Federation), prescribed by the attending physician and purchased by the taxpayer at his own expense.

Until January 1, 2016, the above social deductions were provided to the taxpayer when he submitted a tax return to the tax authority at the end of the tax period (Clause 2 of Article 219 of the Tax Code of the Russian Federation).

Article 1 of Law No. 85-FZ[2] in paragraph 2 of Art. 219 of the Tax Code of the Russian Federation were amended. Let us note that the provisions of this law came into force from the date of its official publication (04/07/2015), with the exception of Art. 1, which came into effect no earlier than one month from the date of its official publication and no earlier than the 1st day of the next personal income tax period, that is, 01/01/2016 (Article 4 of Law No. 85-FZ).

According to Art. 216 of the Tax Code of the Russian Federation, the tax period is a calendar year.

So, from 01/01/2016, according to the amendments made to paragraph 2 of Art. 219 of the Tax Code of the Russian Federation by the above law, social tax deductions provided for in paragraphs. 2 and 3 clauses 1 art. 219 of the Tax Code of the Russian Federation, are provided to the taxpayer:

- or when he submits a tax return to the tax authority at the end of the tax period;

- or when contacting the employer before the end of the tax period. So, he must submit a written application to the employer - tax agent. In addition, the taxpayer must submit a notice confirming his right to receive social tax deductions. This notice is issued to the taxpayer by the tax authority in a form approved by the federal executive body authorized for control and supervision in the field of taxes and fees. The taxpayer's right to receive the specified social tax deductions must be confirmed by the tax authority within a period not exceeding 30 calendar days from the date the taxpayer submits to the tax authority a written application and documents confirming the right to receive social tax deductions provided for in paragraphs. 2 and 3 clauses 1 art. 219 of the Tax Code of the Russian Federation.

For your information

On January 1, 2021, Order of the Federal Tax Service of the Russian Federation dated October 27, 2015 No. ММВ-7-11/ [email protected] , which approved the form of notification confirming the taxpayer’s right to receive social tax deductions provided for in paragraphs. 2 and 3 clauses 1 art. 219 of the Tax Code of the Russian Federation.

Let us note that the social tax deductions in question are provided to the taxpayer by the tax agent starting from the month in which the taxpayer applied to the tax agent to receive them in the manner established by paragraph. 2 p. 2 art. 219 of the Tax Code of the Russian Federation. This paragraph states that if, after the taxpayer applied to the tax agent in the prescribed manner to receive the specified social tax deductions, the tax agent withheld the tax without taking these deductions into account, then the amount of excess tax withheld after receiving a written application from the taxpayer shall be returned to him in the manner established by Art. 231 Tax Code of the Russian Federation.

For your information

The refund of the overly withheld amount of tax to the taxpayer is made by the tax agent at the expense of the amounts of this tax subject to transfer to the budget system of the Russian Federation on account of upcoming payments both for the specified taxpayer and for other taxpayers from whose income the tax agent withholds this tax, within three months from the date the tax agent receives the corresponding application from the taxpayer (Article 231 of the Tax Code of the Russian Federation).

If, at the end of the tax period, the amount of the taxpayer’s income received from the tax agent was less than the amount of social tax deductions established by paragraphs. 2 and 3 clauses 1 art. 219 of the Tax Code of the Russian Federation, the taxpayer has the right to receive these deductions in the manner provided for in paragraph. 1 clause 2 of this article, that is, by submitting a declaration to the tax authority.

Transfer of personal income tax from sick leave and vacation pay

For the payment of personal income tax on temporary disability benefits (including benefits for caring for a sick child) and vacation pay, legislators have provided a special rule. The personal income tax withheld from these payments will need to be transferred no later than the last day of the month in which they were paid (new edition of clause 6 of Article 226 of the Tax Code of the Russian Federation). This provision will also come into force in 2021.

Please note that currently the deadline for paying tax on these payments is not specified in the Tax Code. The explanations from the official bodies boil down to the fact that personal income tax should be transferred from benefits and vacation pay not at the end of the month (as from salary), but on the day the money is received from the bank or transferred to the employee’s card. For more information about this, see “The Ministry of Finance announced when it is necessary to transfer personal income tax from wages, vacation pay and benefits” and “The Ministry of Finance announced at what point it is necessary to transfer personal income tax from vacation pay.”

Property tax deduction.

In accordance with paragraph 1 of Art. 220 of the Tax Code of the Russian Federation when determining the size of the tax base in accordance with clause 3 of Art. 210 of the Tax Code of the Russian Federation, the taxpayer has the right to receive property tax deductions provided taking into account the specifics and in the manner provided for in Art. 220 Tax Code of the Russian Federation.

On January 1, 2016, the changes introduced by Law No. 146-FZ[3] in paragraphs came into effect. 1 clause 1 and pp. 2 p. 2 art. 220 Tax Code of the Russian Federation. The list of grounds for providing a property tax deduction has been expanded. Before this date, this deduction was provided only in the case of the sale of property, as well as a share (shares) in it, a share (part thereof) in the authorized capital of an organization, upon assignment of rights of claim under an agreement for participation in shared construction (under an investment agreement for shared construction or another agreement associated with shared construction).

From 01/01/2016, the above-mentioned tax deduction is provided in addition to the above cases:

- upon leaving the company's membership;

- when transferring funds (property) to a participant in a liquidated company;

- when the nominal value of a share in the authorized capital of the company decreases.

To which inspection will the calculations need to be submitted?

Quarterly calculations and reporting for each individual based on the results of the tax period will need to be submitted to the Federal Tax Service at the place of registration of the tax agent. At the same time, the commented law clarifies:

- Russian organizations with separate divisions will be required to submit reporting documents to the inspectorate at the location of the separate divisions;

- the largest taxpayers will report to the inspectorate at the place of registration or to the inspectorate at the place of registration for the corresponding separate division (separately for each);

- individual entrepreneurs who are registered at the place of their activity in connection with the use of UTII and (or) the patent system will submit reports regarding their employees to the inspectorate at the place of their registration in connection with the implementation of this activity.

For information on the procedure for submitting current personal income tax reporting, see “Tax officials recalled the rules for submitting information on Form 2-NDFL for 2014.”

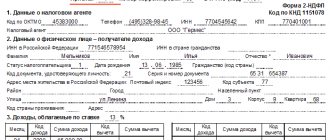

Reporting in form 2-NDFL.

According to paragraph 1 of Art. 230 of the Tax Code of the Russian Federation, tax agents keep records of income received from them by individuals in the tax period, tax deductions provided to individuals, calculated and withheld taxes in tax registers. In this case, tax agents submit to the tax authority at the place of their registration information on the income of individuals of the expired tax period and the amounts accrued, withheld and transferred to the budget system of the Russian Federation for this tax period of taxes annually no later than April 1 of the year following the expired tax period, according to form, formats and in the manner approved by the federal executive body authorized for control and supervision in the field of taxes and fees (clause 2 of Article 230 of the Tax Code of the Russian Federation). Also, tax agent organizations issue to individuals, upon their applications, certificates of income received by individuals and amounts of tax withheld in the form approved by the federal executive body authorized for control and supervision in the field of taxes and fees (clause 3 of Article 230 of the Tax Code of the Russian Federation) .

In addition, paragraph 5 of Art. 226 of the Tax Code of the Russian Federation provides that if it is impossible to withhold from the taxpayer the calculated amount of tax, the tax agent is obliged, no later than one month from the date of the end of the tax period in which the relevant circumstances arose, to notify in writing the taxpayer and the tax authority at the place of his registration about the impossibility of withholding the tax and the amount of tax . In this case, the form of such a message and the procedure for its submission to the tax authority are approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

So, in all of the above cases, the tax agent organization must use Form 2-NDFL.

[email protected] came into force , which approved the form of information on the income of an individual, the procedure for filling it out and the format for submitting this form in electronic form. Let us draw your attention only to the innovations that have appeared in the 2-NDFL form:

1) in the “Adjustment number” field:

- when preparing the initial certificate, the value “00” is entered;

- when drawing up a corrective certificate to replace the previously submitted one, a value one greater than that given in the previous certificate (“01”, “02”, etc.) is indicated;

- when drawing up a cancellation certificate, the value “99” is entered instead of the previously submitted one;

2) in the field “TIN in the country of citizenship” the taxpayer’s TIN (or its equivalent) in the country of citizenship is reflected - for foreign persons if the tax agent has the relevant information;

3) in the “Taxpayer Status” field, enter the taxpayer status code:

- “1” – if the taxpayer is a tax resident of the Russian Federation;

- “2” – if the taxpayer is not a tax resident of the Russian Federation;

- “3” – if the taxpayer, a highly qualified specialist, is not a tax resident of the Russian Federation;

- “4” - if the taxpayer is a participant in the State program to assist the voluntary resettlement of compatriots living abroad in the Russian Federation (a crew member of a ship sailing under the State flag of the Russian Federation) and is not a tax resident of the Russian Federation;

- “5” – if the taxpayer is a foreign citizen (stateless person), recognized as a refugee or granted temporary asylum in the Russian Federation, and is not a tax resident of the Russian Federation;

- “6” – if the taxpayer, a foreign citizen, carries out employment activities in the Russian Federation on the basis of a patent.

If during the tax period the taxpayer is a tax resident of the Russian Federation, the number “1” is indicated (except for taxpayers who are employed in the Russian Federation on the basis of a patent);

4) in section 4, in addition to standard, social and property tax deductions, information about investment tax deductions provided by the tax agent is reflected;

5) in the fields “Notification confirming the right to a social tax deduction”, “Notification confirming the right to a property tax deduction”, fill in the number and date of the notification, as well as the code of the tax authority that issued the notification, if the taxpayer was provided with the corresponding deduction. If the notification is received more than once, the tax agent fills out several lines to reflect the relevant details;

6) in the field “Notification confirming the right to reduce the tax on fixed advance payments” indicate the number and date of the notification, as well as the code of the tax authority that issued the notification, if the tax agent received a notification confirming the right to reduce the calculated amount of personal income tax by the fixed amounts paid by the taxpayer advance payments.

In addition, since November 29, 2015, Order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11/ [email protected] “On approval of codes for types of income and deductions” has been in effect. The list of codes that was previously used is no longer valid. Thus, when submitting information on Form 2-NDFL, it is necessary to use the new approved reference books of income and deduction codes.

Personal income tax 2021 changes.

The requirements regarding the submission of form 2-NDFL have changed. On January 1, 2016, the amendments introduced by Law No. 113-FZ[4] to paragraph 2 of Art. 230 Tax Code of the Russian Federation. Now a document containing information about the income of individuals for the past tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation is submitted by tax agents in electronic form via telecommunication channels. If the number of individuals who received income in the tax period is up to 25 people, tax agents can submit the specified information and calculate the tax amounts on paper. Previously, tax agents could submit them on paper if the number of individuals who received income during the tax period was up to 10 people.

Submission on paper of information on the income of individuals - more than 25 taxpayers - is not provided for by tax legislation.

Responsibility of tax agents: fines and suspension of account transactions

From the very name of the law under comment it is immediately clear that it is aimed at increasing the responsibility of tax agents.

From the explanatory note to the bill:

“By not transferring taxes, tax agents actually use budget funds free of charge and illegally. Relatively low tax sanctions, the possibility of lengthy court challenges to decisions of tax authorities on the collection of taxes and fines, as well as the lack of quarterly information from tax authorities on accrued income, calculated and withheld tax amounts and other unresolved aspects of tax administration hinder the increase in tax collection.”

Now, let us remind you that for late submission of 2-NDFL certificates, the agent faces tax liability in the form of a fine: 200 rubles for each certificate (clause 1 of Article 126 of the Tax Code of the Russian Federation). But due to the entry into force of the new law, tax liability will become stricter, namely:

- for failure to submit quarterly personal income tax calculations on time - a fine of 1,000 rubles for each full or partial month from the date established for its submission. This means that the longer the calculation is not submitted, the greater the fine will be;

- If the tax authorities do not receive the calculation within 10 days after the expiration of the deadline for its submission, then they will have the right to suspend the tax agent’s operations on bank accounts and electronic money transfers.

In addition, a new article 126.1 will appear in the Tax Code, providing for a fine of 500 rubles for each tax agent document in which tax officials find false information. This fine can be applied both to quarterly calculations and to reporting based on the results of the tax period.

At the same time, liability in the form of a fine of 200 rubles for each unsubmitted document will also remain (Article 126 of the Tax Code of the Russian Federation).

Reporting according to the new form 6-NDFL.

[email protected] came into force , which approved the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL), the procedure for filling it out and submitting it, as well as the format for its presentation in electronic form (hereinafter referred to as Procedure No. ММВ-7-11/ [email protected] ).

We note that in accordance with the amendments made by Law No. 113-FZ to Art. 230 of the Tax Code of the Russian Federation, which came into force on January 1, 2016, tax agents are required to submit to the tax authority at the place of their registration a calculation of the amounts of personal income tax calculated and withheld by the tax agent for the first quarter, half a year, nine months no later than the last day of the month following the corresponding period , and for the year - no later than April 1 of the year following the expired tax period, in the form, formats and in the manner approved by the federal executive body authorized for control and supervision in the field of taxes and fees. In this case, this calculation must be sent in electronic form via telecommunication channels. However, if the number of individuals who received income in the tax period is up to 25 people, tax agents can submit the specified information and calculate the tax amounts on paper.

note

According to clause 5.2 of Procedure No. ММВ-7-11/ [email protected], the date of submission of the calculation is considered to be:

- the date of its actual presentation when submitted personally or by a representative of a tax agent to the tax authority;

- date of sending the calculation by mail with a description of the attachment when sent by mail;

- the date of its dispatch, recorded in the confirmation of the date of dispatch in electronic form via telecommunication channels of the electronic document management operator.

In this case, the calculation on paper is presented only in the form of an approved machine-oriented form, filled out by hand or printed on a printer (clause 5.3 of Procedure No. ММВ-7-11/ [email protected] ).

From the editor.

An example of filling out Form 6-NDFL is presented in the section “To help an accountant” on page 66.

Dates of tax transfer and receipt of income

Important changes have been made to the procedure for calculating and transferring taxes. Starting from 2021, taxes must be transferred to the budget no later than the day following the day the taxpayer pays income.

Thus, from 2021, the date of transfer of tax to the budget by the tax agent does not depend on when he receives money from the bank for payment (if payment is made in cash). The only thing that matters is when it actually pays out the income.

At the same time, for two types of income (income in the form of payment for vacations and sick leave), it is directly determined that the tax must be transferred no later than the last day of the month of payment of income. This innovation will significantly reduce the hassle of accountants. Let us recall that previously tax on vacation pay had to be transferred on the day when they were paid or when the company received money to pay them from the bank (see, for example, letters of the Ministry of Finance of Russia dated April 10, 2015 No. 03-04-06/20406, dated January 26 .2015 No. 03-04-06/2187, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/07/2012 No. 11709/11). The same procedure was applied to sick leave.

Now personal income tax on vacation and sick pay must be transferred no later than the last day of the month of payment of income, and the date of receipt of income for business trips will be the last day of the month in which the advance report is approved after the employee returns from a business trip.

The procedure for determining the date of actual receipt of income for certain types of income has changed. In particular, for income on which personal income tax is assessed in connection with sending an employee on a business trip, the date of receipt of income will be the last day of the month in which the advance report is approved after the employee returns from the business trip. This means that, for example, if an employee is paid excess holiday pay, such income is considered received at the end of the month.

A significant change has occurred in the taxation of material benefits from interest savings. Previously, we recall that such income was recognized as received on each date of payment of interest (clause 3, clause 1, article 223 of the Tax Code of the Russian Federation as amended). With interest-free loans, according to the explanations of the Ministry of Finance, the financial benefit had to be calculated on each date of repayment of the loan (letters dated October 28, 2014 No. 03-04-06/54626, dated March 26, 2013 No. 03-04-05/4-282, etc.) .

From 2021, income is determined as the last day of each month during the period for which borrowed (credit) funds were provided.

Thus, now, regardless of whether the borrower paid interest (or the principal amount of the loan - for an interest-free loan), income in the form of financial benefits must be recognized on the last day of each month. This means that the lender will have to withhold monthly (if possible) tax from any cash income of the borrower. We would like to add that the law contains no transitional provisions. This means that the new procedure will apply to all loans and credits, including those issued before 2021.

Intensive workshop “Personal Income Tax Reporting for 2015” with a 25% discount

To learn more