Bill debt is not a simple issue. A documented monetary obligation is called a bill of exchange. Today, this form of relations between counterparties is not very popular, so the participants in the process are not aware of many legal subtleties. There is a whole section in the legislation devoted to this issue; it regulates the relationship of the parties, and also describes the collection of debt on a bill.

Our lawyer in civil proceedings will advise you, draw up a statement of claim, and also take part in the court and at the stage of execution of the court decision.

Characteristic

A bill of exchange is a type of security that gives the holder the right to demand funds from the owner within the time period established by the document. It is important to understand that a bill of exchange does not relate to debt transactions and does not imply the conclusion of a separate agreement and the emergence of third-party obligations. In simple terms, a promissory note is evidence of the existence of an outstanding debt and an instruction from the debtor to repay it by a certain point.

The issuer or drawer is the creditor who issues the security. The claimant who has received a bill of exchange for limited use is the bill holder. According to Art. 128, 130 of the Civil Code of the Russian Federation, bill forms are recognized as movable property and belong to the objects of civil legal relations. The procedure for issuing and transferring bills of exchange is regulated by Federal Law No. 39 of April 22, 1996, No. 48 of March 11, 1997.

Let us list the distinctive features of bill transactions:

- The obligation has only a monetary value and is not related to the main subject of the transaction and the terms of the basic agreement.

- The requirements are unconditional and must be satisfied in full.

- Responsibility is shared jointly among all participants in the paper issuance procedure.

- The media exists in paper form with security elements and is taken into account as a strict reporting form.

A bill gives its owner the right to collect debts

Release order

Current legislation limits the right of organizations and citizens to issue bills of exchange and use them to conduct mutual settlements with counterparties. Individuals can become issuers of this type of paper only upon attaining full legal capacity under civil law, that is, after reaching adulthood. Legal entities repay debts to creditors with a bill of exchange within the framework of their legal capacity.

Municipal entities and state executive authorities are deprived of the opportunity to draw up and use promissory notes in their activities.

Classification

There are four types of bills:

- Simple.

- Translated.

- Named.

- Warrant.

The first type is the most popular and involves a direct transfer of obligations from the debtor to the claimant. A bill of exchange (draft) is essentially also a simple form, but it involves replacing the person in the obligation. The drawer repays the direct debt to the holder and transfers to him the accounts payable of his counterparty. The procedure is possible only with the consent of the latter.

The defaulter can issue a bill, indicating on the form the specific name of the holder, then only he will be able to present the document for execution. If the paper does not contain the name of the creditor, the owner can use it at his own discretion: cash it out within the prescribed period or transfer it to pay off debts to another counterparty.

Bills of exchange can be of various types

A registered bill of exchange can be re-qualified as an order bill by affixing a special inscription (endorsement) on the reverse side. In this case, the previous owner of the form indicates information about the new holder and expresses consent with a handwritten signature.

Additionally, treasury, friendly, bronze, and counter bills participate in financial turnover. Depending on the use of collateral, secured (aval) and unsecured bill forms are distinguished. According to the method of calculating interest, there are discount, interest, and interest-free debt forms.

Indication of several places of payment entails the invalidity of the bill of exchange

The place of payment can be indicated by a specific locality or in the form of a specific address (clause 23 of resolution No. 33/14). This is an optional detail. If it is not specifically noted in the promissory note, then the place of payment is considered to be the place where the document was drawn up. And if it is not indicated, then the address indicated next to the name of the drawer (Article 75 of Regulation No. 104/1341). If there is no place of payment in the bill of exchange, the address indicated next to the name of the payer is recognized as such (Article 2 of Regulation No. 104/1341).

Thus, a bill is invalidated due to the lack of a place of payment only if this place is not indicated in the document and there are no addresses that can fill it. Such situations are rare.

More often, another error occurs: when the bill indicates several places of payment (that is, the holder of the bill can present it at one of the addresses specified in the document). This deficiency can no longer be corrected by referring to the place where the bill was drawn up or the address of the payer. That is, the bill is considered defective in form, and therefore invalid (clause 23 of resolution No. 33/14). But if the drawer or payer simply corrected one address originally indicated in the bill to another, then this is not considered a plurality of places of payment and a defect in the bill (decision of the Ninth Arbitration Court of Appeal dated 02/08/08 in case No. 09AP-140/2008-GK).

We cover debts with promissory notes

The security must contain the following mandatory details:

- Name.

- Amount of liability.

- Place and date of compilation.

- A promise to repay a debt within a specified time frame and amount.

- Details of the drawer.

- Debtor's signature.

- If the form is personal, the recipient’s contact information must be indicated.

Many drawers issue the form exclusively on special paper or use their own form with a bounding box. The border is necessary to protect the media from corrections. It is allowed to include additional fields, notes and other details necessary to settle the relationship under the transaction.

A sample of a promissory note is shown in the figure:

In financial practice, bills of exchange are used to solve the following problems:

- Guarantee of unconditional payment by the buyer for goods supplied, services rendered, work performed.

- Elimination of advance payments and factoring when conducting transactions.

- The form is a means of payment for making payments between legal entities and individuals (including loans, advances, etc.).

- It is recognized as a separate object of the contract and serves as collateral.

- Issuing a commercial loan on mutually beneficial terms.

Replacement of obligations

By agreement, the parties to the current relationship come to a decision to issue and accept a bill of exchange in payment of the debt. The document is valid only if it indicates the procedure for calculating repayment periods: a specific time, day, number of months from the date of transfer or upon presentation. The latter type involves returning the form to the drawer throughout the year to fulfill obligations.

The period for cashing out paper is shifted when the endorsement is issued. It is important to understand that the terms of the transaction may limit the creditor from early repayment of accounts payable with the received bill of exchange. The deadline for closing obligations that falls on a weekend or holiday is postponed to the next working day. The period of validity of the document includes calendar days, but all operations with it, presentation and protest are carried out only on weekdays.

Promissory notes are used to formalize loan obligations as a reliable alternative to promissory notes. Financial and credit institutions issue forms to individuals in order to attract additional capital. Enterprises use securities to attract investment and increase working capital.

Before carrying out transactions on a bill of exchange, you must first verify its authenticity

Regulations for closing debts

Let us describe the basic stages of securities turnover:

- Issue of the form.

- Drawing up a transfer and acceptance certificate or a bill of exchange agreement.

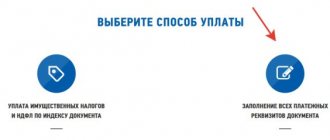

- Presentation for payment.

- Expertise.

- Repayment or refusal.

- Protest or return according to the act of the issuer.

If settlements are carried out with the participation of representatives of the parties to the relationship, it is necessary to present a power of attorney for the transfer of powers. The drawer is obliged to analyze the presented form in the shortest possible time using any possible method.

The claimant must have time to file a protest in case the debtor refuses to pay. When transferring a document by mail or courier service, it is recommended that you keep a notarized copy of the form. Such measures will avoid the risk of loss of documents and refusal to satisfy claims in court.

So, after confirming the authenticity of the bill, the payer makes a non-cash transfer of funds or offers to take ownership of other property or rights. The holder of the bill has the right to act at his own discretion: refuse offers of assets other than finance, or accept them as compensation.

The debtor's refusal to repay the debt is expressed in writing by drawing up a receipt. Having received this document, the holder of the bill can appeal to the notary with a protest. It is impossible to refuse to satisfy the claimant's demands if the form has not lost its active billability, and defects do not deprive it of readability. Under bill law, the holder is issued a court order allowing the forcible collection of the debt from the defaulter through a bailiff.

After making the payment, the appropriate mark is placed on the form. To eliminate the possibility of repeated presentation, cuts or other defects are made on the paper. For example, on a savings bill, after the bank has repaid its obligations, the name symbols are cut out. The payer may require a receipt from the recipient to confirm the payments made.

An approximate diagram of the movement of bills is shown in the figure:

Accounting

The table shows typical entries for transactions with bills of exchange:

When a company receives a third party's promissory note to pay off a debt, the accountant makes similar entries. If interest accrues under the terms of a new transaction, the specialist uses an account to record it. 76. It is important that it will not be possible to obtain a VAT deduction from a bill of exchange received as an advance payment (Article 171-172 of the Tax Code of the Russian Federation).

When transferring a bill of exchange to pay for upcoming deliveries, a company using the simplified tax system does not take into account expenses in the taxable base until the actual repayment of the debt and fulfillment of obligations. A similar picture arises when transferring or selling a bill of exchange to a third party: until payment is credited, income does not increase.

Debt on bills of exchange issued to suppliers and performers is accounted for in a separate subaccount account 60 and increases the company's liability, and the forms received are taken into account in the accounting department as part of assets. In the balance sheet, the first group is reflected on line 1520, the second - 1230, 1240.

BASIC

Take into account purchased goods (works, services) secured by your own bill of exchange when calculating income tax, depending on the following factors:

- tax accounting rules that apply to the corresponding type of expenses;

- the method that the organization uses when calculating income taxes (accrual method or cash method).

This follows from articles 252, 272 and 273 of the Tax Code of the Russian Federation.

Input VAT on purchased goods (works, services) is deductible in the general manner - after the goods are accepted for registration, if there is an invoice and other necessary conditions are met (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation) . For more information about this, see How to pay VAT when paying by bill of exchange.