Source: Magazine “Income Tax: Accounting for Income and Expenses”

The organization acquired a security - an interest-bearing VTB promissory note - in order to receive income from it. As time passed, she handed over the bank draft (under the indemnity agreement for the debt under the service agreement) as payment for the services. How to reflect this operation in accounting and tax accounting, what documents should it accompany? What are the features of calculating income tax for such a case? How to fill out a return for this tax? We will try to answer the above questions. And let’s agree: we will not be interested in professional participants in the securities market; we are considering an ordinary organization that has transactions with securities that are not traded on the securities market (which includes bank bills). Yes, and one more thing: let our organization determine income and expenses when calculating income tax using the accrual method, and its reporting periods for income tax are the first quarter, half a year and nine months of the calendar year.

Accounting

In accounting, reflect the transfer of your own bill of exchange in payment for goods (work, services) in separate subaccounts to the settlement accounts. For example, this may be account 60 “Settlements with suppliers and contractors” subaccount “Settlements on bills issued” or account 76 “Settlements with various debtors and creditors” subaccount “Settlements on bills issued”.

This is due to the fact that an organization that pays a counterparty with its own bill of exchange does not recognize the bill itself as property (goods). Being in the ownership of the drawer, he does not certify any rights and obligations, and upon transfer only secures the debt, guaranteeing payment on it with a deferred payment. That is, for the drawer, his own bill of exchange is not a security, and there is no need to reflect it using account 58-2 “Debt securities”. This follows from articles 815, 823 and paragraph 1 of article 142 of the Civil Code of the Russian Federation, articles 1 and 75 of the Regulations approved by the resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341, and paragraph 3 of PBU 19/02.

Debt to the counterparty for goods (works, services), secured by your own bill of exchange, should be taken into account at the cost of goods (works, services). This follows from the systematic interpretation of the provisions of paragraphs 1 and 2 of PBU 15/2008 and paragraphs 6.2 and 6.3 of PBU 10/99.

When transferring your own bill of exchange when paying for goods (work, services), make the following entry in accounting:

Debit 60 (76) subaccount “Settlements for purchased goods (works, services)” Credit 60 (76) subaccount “Settlements for bills issued” - your own bill was issued to ensure payment for goods (works, services).

When repaying (paying) your own bill of exchange, make the following entry in accounting:

Debit 60 (76) subaccount “Settlements on bills issued” Credit 51 (50) – the presented bill is repaid (paid).

This scheme of accounting entries follows from the Instructions for the chart of accounts (accounts 60, 76) and paragraph 2 of the letter of the Ministry of Finance of Russia dated October 31, 1994 No. 142. It is this letter that explains the procedure for reflecting in accounting transactions with the organization’s own bills of exchange (clause 13 of the Government Resolution RF dated September 26, 1994 No. 1094). Although this document was adopted in pursuance of the old accounting legislation, its provisions can still be applied now with amendments to the new Chart of Accounts.

Situation: is it necessary to keep records of issued own bills of exchange on off-balance sheet account 009?

Yes need.

The issued own bill is security and confirmation of the obligation, which gives the organization the right to defer payment. This follows from Article 815 of the Civil Code of the Russian Federation, Articles 1 and 75 of the Regulations approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

The instructions for the chart of accounts to reflect the security issued by the organization provide for account 009 “Securities for obligations and payments issued.”

In addition, the need for such an accounting entry is confirmed by paragraph 8 of the letter of the Ministry of Finance of Russia dated October 31, 1994 No. 142. It is this letter that explains the procedure for reflecting in accounting transactions with the organization’s own bills of exchange (clause 13 of the Decree of the Government of the Russian Federation dated September 26, 1994 No. 1094 ). Although this document was adopted in pursuance of the old accounting legislation, its provisions can still be applied now with amendments to the new Chart of Accounts.

When using an off-balance sheet account in accounting, make the following entries.

– When issuing security:

Debit 009 – reflects the amount of collateral issued.

– When paying off debt:

Loan 009 – the amount (part of the amount) of the issued collateral is written off.

At the same time, the organization must reflect reliable information on the movement of bills of exchange in the context of analytical accounting according to balance sheet accounts (for example, 60, 76). In this case, there is no need to reflect transactions on the issuance and repayment of own bills of exchange on the balance sheet (on account 009) (clause 3 of Article 10 of the Law of December 6, 2011 No. 402-FZ).

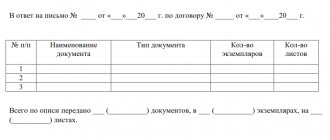

Confirm the fact of transfer of the bill of exchange with a primary document drawn up in any form; there is no unified form for this. For example, this could be an act of acceptance and transfer of own bills. Compile it taking into account the requirements for primary documents.

Situation: how to reflect in accounting the transaction of transferring one’s own bill for goods (work, services), if it is formalized by a novation agreement? The debt to pay for goods (works, services) has been converted into a loan obligation.

Reflect as security for the obligation under the loan agreement.

Article 818 of the Civil Code of the Russian Federation stipulates that by agreement of the parties, a debt can be replaced by a loan obligation. Such a replacement is recognized as a novation and is formalized as a loan agreement (Articles 414 and 808 of the Civil Code of the Russian Federation). From the moment an agreement is concluded on the novation of the debt to pay for goods into a loan obligation, the organization’s debt to pay for goods ceases and the organization’s obligation arises for a loan secured by a bill of exchange (clause 1 of Article 414 of the Civil Code of the Russian Federation).

Depending on the circulation period of your own bill of exchange, transactions with it are reflected in a separate sub-account (for example, “Settlements on bills of exchange issued”) to the account:

- 66 “Settlements for short-term loans and borrowings”, if the bill is issued for a period of less than one year;

- 67 “Calculations for long-term loans and borrowings”, if the loan (credit) is issued for a period of more than one year.

Make the following entries in your accounting:

Debit 60 (76) Credit 66 (67) subaccount “Settlements on bills issued” - the debt for payment for goods (works, services) has been converted into a loan obligation secured by its own bill.

This follows from paragraphs 1 and 2 of PBU 15/2008 and the Instructions for the chart of accounts (accounts 66, 67, 009).

For more information about recording borrowed obligations in accounting, see How to reflect transactions for obtaining a loan (credit) in accounting.

An example of reflecting in accounting transactions for the transfer and repayment of an organization’s own bill of exchange transferred as security for purchased goods

In February, Alpha LLC entered into a purchase and sale agreement for goods with Torgovaya LLC for the amount of RUB 3,540,000. (including VAT – 540,000 rubles). According to the terms of the agreement, to secure the obligation to pay for the goods, Alpha transfers its own promissory note with a nominal value of RUB 3,540,000. with a maturity date no earlier than March 18 of the current year.

In the same month, Hermes shipped goods to Alpha, and Alpha transferred the bill of exchange to Hermes under the transfer and acceptance certificate.

To reflect the transaction of transfer and repayment of his own bill of exchange transferred as security for purchased goods, the accountant opened a subaccount for account 60 “Settlements with suppliers and contractors” - “Settlements for purchased goods (work, .

In February, the following entries were made in the organization’s accounting records:

Debit 41 Credit 60 subaccount “Settlements for purchased goods (works, services)” – 3,000,000 rubles. (RUB 3,540,000 – RUB 540,000) – purchased goods are capitalized;

Debit 19 Credit 60 subaccount “Settlements for purchased goods (works, services)” – 540,000 rubles. – input VAT on purchased goods is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 540,000 rubles. – accepted for deduction of VAT on purchased goods;

Debit 60 subaccount “Settlements for purchased goods (works, services)” Credit 60 subaccount “Settlements for bills issued” – RUB 3,540,000. – own bill of exchange was issued to secure debt on purchased goods.

In March, Hermes presented Alpha's bill of exchange for payment. Alpha paid the debt in full.

Alpha's accountant reflected this operation as follows:

Debit 60 subaccount “Settlements on bills issued” Credit 51 – RUB 3,540,000. – the debt on purchased goods, secured by its own bill of exchange, was repaid.

Collection of bill debt

One of the advantages of a bill is the ease of assignment of the right to claim the debt under it. But its main attraction is that collection of a bill of exchange debt is possible in a simplified manner: not through a lawsuit, but through writ proceedings. Cases regarding the issuance of a court order are considered by a magistrate (subclause 1, clause 1, article 23 of the Code of Civil Procedure of the Russian Federation).

In case of evasion of payment on a bill of exchange, its holder must contact a notary office. The notary will present the unpaid bill to the debtor. And if this demand for payment is refused, then the notary draws up a deed in a special form called a “protest of non-payment.” Based on a notarial protest, the judge alone issues a court order, which has the force of an executive document (Article 121, Article 122 of the Code of Civil Procedure of the Russian Federation).

note

The drawer of the bill is not the owner of his bill. This document certifies his commitment. Therefore, the issuance of a bill of exchange is not considered a sale of a security (letter of the Main Directorate of the Bank of Russia for Moscow dated September 18, 1997 No. 05-1-20/1728, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 24, 2009 No. 9995/09).

Writ proceedings are conducted without trial and without summoning the parties to hear their explanations. A court order is issued within five days from the date of receipt of the application from the claimant (Article 126 of the Code of Civil Procedure of the Russian Federation). An application for a court order is paid with a state fee in the amount of 50 percent of the rate established for statements of claim (clause 2 of Article 123 of the Code of Civil Procedure of the Russian Federation). But this procedure has a vulnerable side. The judge sends a copy of the court order to the debtor, who, within ten days from the date of receipt of the order, has the right to submit objections regarding its execution. If objections are received from the debtor, the judge cancels the court order (Articles 128, 129 of the Code of Civil Procedure of the Russian Federation).

In this regard, you need to remember: with a simple bill, the drawer has the right to raise objections arising from the civil contract between them against the first bill holder’s demand for payment of the bill. For example, if a bill of exchange was issued instead of an advance under a supply agreement, but the delivery did not take place (clause 9 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 25, 1997 No. 18). There are also no grounds for collecting funds on a bill of exchange if the holder of the bill, when purchasing the bill of exchange, acted deliberately to the detriment of the debtor (clauses 17, 77 of Resolution No. 104/1341).

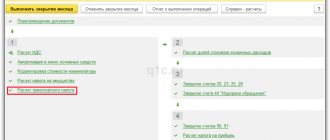

BASIC

Take into account purchased goods (works, services) secured by your own bill of exchange when calculating income tax, depending on the following factors:

- tax accounting rules that apply to the corresponding type of expenses;

- the method that the organization uses when calculating income taxes (accrual method or cash method).

This follows from articles 252, 272 and 273 of the Tax Code of the Russian Federation.

Input VAT on purchased goods (works, services) is deductible in the general manner - after the goods are accepted for registration, if there is an invoice and other necessary conditions are met (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation) . For more information about this, see How to pay VAT when paying by bill of exchange.

Capital contribution

You can make your own bill of exchange as a contribution to the authorized capital. This will provide the company with significant authorized capital without transferring real resources. Such contributions can be made by both legal entities and individuals.

On a note

The market value of a bill of exchange depends not only on its face value, but also on who is the person obligated on the bill of exchange, the timing of the fulfillment of the bill of exchange obligation and other circumstances (clause 8 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 24, 2002 No. 69).

Do you have any doubts? In vain, since such contributions are a reality (resolutions of the FAS of the Volga-Vyatka District dated 05/28/2007 in case No. A28-10704/2006-171/11 and FAS of the Central District dated 10/12/2011 in case No. A14-12036/2010). And the participant can even sell the share paid for with his own bill of exchange at par on a general basis (resolution of the Federal Antimonopoly Service of the North-Western District dated 10/05/2007 in case No. A26-6867/2006-29, supported by the decision of the Supreme Arbitration Court of the Russian Federation dated 02/07/2008 No. 1071/08 ).

The Supreme Arbitration Court of the Russian Federation, by its ruling dated January 18, 2011 No. VAS-18074/10, directly explained to all those who have doubts: the legislation does not prohibit payment of the authorized capital of a limited liability company with its participant’s own bill of exchange.

However, do not forget that the assessment of the bill of exchange (the solvency of the drawer) must be confirmed by an independent appraiser. Example 8

The contribution of Bounty CJSC to the authorized capital of Twix LLC is its own promissory note with a face value of 100,000 rubles.

For this operation creates a financial investment. At the same time, it does not transfer its own assets. Based on clause 14 (paragraph 2) of PBU 19/02, the accountant made an entry: DEBIT 58 CREDIT 76 subaccount “Bill issued” - 100,000 rubles.

– the emergence of the asset due to the liability under the bill is reflected. The fact is that permission for certain types of activities can be obtained with a certain amount of authorized capital (clauses 2.1, 2.2 of Article 11 Federal Law of November 22, 1995 No. 171-FZ “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic beverages).” In a financial crisis, your own bill will help out. Although this method of paying for the authorized capital does not inspire much confidence in the company.

Elena Dirkova, editors of the magazine “Practical Accounting”

Have a question?

“Practical Accounting” is an accounting journal that will simplify your work and help you keep your books without errors. Get a guaranteed expert answer to your questions, as well as full access to all materials >>

If you have a question, ask it here >>

simplified tax system

The issuance of your own bill of exchange does not affect the calculation of the single tax, regardless of what object of taxation the organization applies. For tax purposes, this operation is a guarantee of payment for purchased goods (works, services) with deferred payment. That is, when issuing your own bill of exchange, there is no payment for purchased goods (works, services) or repayment of other obligations. This follows from Articles 815 and 823 of the Civil Code of the Russian Federation and Article 346.17 of the Tax Code of the Russian Federation.

At the same time, to calculate the single tax, take into account the peculiarities of accounting for certain types of expenses when simplifying. For example, purchased goods for which a bill of exchange was received must not only be paid, but also sold (subclause 23, clause 1 and clause 2, article 346.16, subclause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Features of bills of exchange as securities

What is a bill of exchange? A bill of exchange is essentially the ancestor of all securities. Unlike a stock, which is an equity security, a promissory note is a purely debt document.

Basic requirements for recognition of a bill:

- Unconditional nature of obligations;

- Indisputability - that is, the impossibility of deferring payment or changing the terms of payment;

- Exclusively monetary form of obligations;

- Possibility of existence only in paper form in a formalized form.

In essence, a bill of exchange is simply another means of payment between individuals (companies).

The simplest classification can be considered the division of bills into simple and transferable:

- A promissory note is essentially a promissory note issued by the immediate debtor.

- A transfer is a document obliging the debtor of the drawer to pay a certain amount to the holder of the bill.

Both promissory notes and bills of exchange can be commodity - that is, issued to confirm the debt under an agreement for the acquisition of goods and materials, or financial - the subject of the transaction is the bill itself. This characteristic affects which account will be used to account for bills of exchange.

OSNO and UTII

The procedure for accounting for goods (work, services) for which the organization paid with its own bill of exchange when combining UTII with the general taxation system depends on the type of activity for which the goods (work, services) were purchased, for which the organization issued its own bill of exchange to the counterparty.

If goods (work, services) were purchased to conduct transactions subject to UTII, transactions with your own bill of exchange will not affect the calculation of the single tax (Article 346.29 of the Tax Code of the Russian Federation).

If goods (work, services) were purchased for the organization’s activities on the general taxation system, take into account the costs for them when calculating income tax.

If goods (work, services) are purchased for both types of activities, the amount of expenses for their purchase must be distributed (clause 9 of Article 274 of the Tax Code of the Russian Federation). For more details, see What taxes to pay with UTII.