What is a bill of exchange and why is it needed?

Lawyers highlight the dual nature:

- security

- obligation.

Scientific interpretation is more informative. This is an unconditional obligation of the debtor to pay the holder a specified amount within a certain period after presentation.

In our state, a document of a clearly established form, recording the transition of one obligation to another, giving the holder of the bill the right to demand a specified amount of money from the debtor. By debtor we primarily mean the drawer. However, if the bill is transferable, the debtor will be any named person.

Issue to bearer is possible - where the drawer is the person presenting the security to the debtor. In Russia, the issuance of bearer obligations is prohibited.

Procedure for issuing a bill of exchange

The release should be considered carefully. The bill of exchange requires strict adherence to the statutory form. Otherwise, it will be a promissory note - the unconditionality of fulfillment of the specified obligation will be lost.

There is a developed form in Russian legislation. Its use is discretionary (free) in nature. There are also no additional requirements for payment of duties and registration of this security.

On the one hand, this is undoubtedly another advantage; on the other hand, it forces drafters to be more attentive to the procedure for issuing an obligation. Many people try to work on printed forms that correspond to the form developed by the legislator and are protected. This form is sold in banks and treasury organizations.

Published on paper, the content is written in or printed.

The following details are required for entry:

- Name

- obligation

- payment details

- amount of payment

- payment term

- place of fulfillment of the obligation

- date and place of creation of the paper

- drawer's signature.

Release Features

Russian legislation defines several advantages for the bill holder.

The provision “On promissory notes and bills of exchange” provides some additional details with additional features. The place where the bill was drawn up and the payment was made, the deadline for fulfilling the obligation may not be entered into the form immediately when writing, but can be filled in later without any problems. In fact, this creates conditions when these details lose their mandatory nature.

Accounting for own bills

An ordinary citizen can keep securities at home. You can also use the services of a bank.

In the case of a bank, it is possible for the bill holder to transfer a security to a credit organization in order to receive the bill amount before the date of fulfillment of the obligation. For such accounting, the bank charges an amount as a percentage of the obligation specified in the form. In fact, the bank simply purchases paper.

Legal entities, in addition to actual storage, must take into account the securities on their balance sheet (both the holder and the debtor). If the document was purchased at a discount, then the company must pay taxes.

The acquisition of an obligation by a third party makes it a security. The laws of the Central Bank market begin to apply to him.

Closing a bill of exchange

As a rule, obligations are issued with a maturity date “at sight” or “at sight after a certain date.” The closure of a bill of exchange is carried out by the debtor after presentation of the security to him, and a presentation act is drawn up indicating the required details.

After payment, if the debtor was a legal entity, the bill with notes on repayment remains in the accounting archive and is destroyed within the established time frame. An individual drawer can simply destroy the previously issued paper.

Advance payment by bill of exchange

Buyers are afraid to make an advance payment for undelivered goods, and suppliers do not always risk sending products without payment. Issuing a commitment (guarantee of payment) by the buyer will solve the problem.

Redistribution of funds

In business, different situations arise. Somewhere there is an excess of funds, somewhere there is a shortage. If companies are controlled by a single entity, redistribution seems convenient. Transfer of funds is possible using bills of exchange. It is fast, reliable and requires a minimum of bureaucracy.

When making such a redistribution, a discount of 1-3 percent per annum should be provided. This is done so that the tax inspectorate does not regard the movement of funds as a gratuitous loan and does not charge additional taxes for it.

When interacting within the commission, the committent sometimes issues a bill of exchange and sends it to the commission agent for the purchase of goods. The commission agent, using an endorsement, transfers the securities to the supplier. This scheme allows the commission agent to be released from tax obligations on the transaction, and for the committent these amounts will not be included in the VAT base until the date of payment.

Purchase procedure

The current rules of Sberbank state that only individual entrepreneurs and legal entities have the right to become owners of bills. The purchase of bills can be carried out on the basis of long-term or one-time contracts. To execute a contract, you must be present at one of the bank branches.

When drawing up a contract, a specialized application must be attached to it, which specifies the main parameters of the bill. As soon as the client’s finances are transferred to the account of the banking structure, he will be able to receive the ordered security.

Please remember that you cannot pay for these securities in cash; this is prohibited by current rules. The exact date of crediting money to the account of the banking structure acts as the date of issue of the described security. The date of release of the boat cannot be earlier than the date of signing the contract. If a simultaneous issue of these securities is carried out, then the amounts of their denominations must necessarily be equal to the amount of finances that the client transferred to the Sberbank account.

Pitfalls of own bills

Difficulties in applying obligations arise when they are sent to third parties. Since the tax service requires the division of VAT between taxable and non-taxable activities, there is a division of the bill between the main activity and the turnover of securities, which carries significant risks of non-payment of fees by the organization.

A bill of exchange is a convenient way to organize financial flow. By issuing it, entities face a minimum of restrictions on attracting borrowed funds.

This concludes the review for today. See you!

A promissory note is a security that is based on an obligation to pay the holder a certain amount of money. There are several types of bills of exchange, and depending on what qualities they are endowed with, accounting of these securities is carried out.

Features of bills of exchange as securities

Being an unconditional debt document, a bill of exchange can be:

- Simple, i.e. drawn up between two persons and having the nature of a promissory note of the direct debtor;

- Transferable – a document, the preparation of which takes place with the participation of a third party (used to formalize the transfer of receivables).

Both a simple and a bill of exchange can be:

- Someone else's or your own;

- Discount – interest rate, i.e. providing for an interest rate at which interest will be calculated on the amount of the bill, or interest-free.

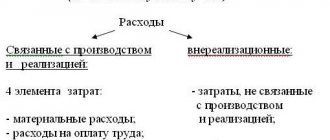

Both types of bills of exchange can be commodity, i.e., confirm the debt under a contract for the supply of goods and materials, or financial. In this case, the subject of the transaction is the bill itself. The difference in the purpose of using bills of exchange affects the accounting accounts that will be used to account for bills of exchange.

Accounting for bills of exchange: postings

Often, a promissory note in a buyer-seller relationship plays the role of a promissory note, since it arises in a situation where the buyer cannot pay for the goods with available funds, and the seller agrees to accept the bill. Such a commodity bill is not considered a security until it is transferred to a third party. To account for such bills, the buyer has an account. 60 open a subaccount 60/3 “Bills issued”, and the seller opens a subaccount 62/3 “Bills received”.

Transactions with it are recorded on both sides in the settlement accounts by postings:

| Operation | D/t | K/t |

| Accounting entries for bills issued | ||

| Reflected delivery debt | ||

| Security for future payment issued (behind balance) | ||

| If the bill is interest-bearing, then the buyer’s debt will increase by the amount of accrued interest | ||

| Repayment of a debt | ||

| Writing off the bill after payment | ||

| Accounting entries for bills received | ||

| The debt on the shipped goods is reflected | 62/ 3 | |

| Payment security received | ||

| Interest income from the bill | ||

| Received payment for goods secured by a bill of exchange | ||

| Writing off a bill after receiving payment | ||

Example 1

Blitz LLC, to secure payment obligations under the supply agreement, Atrium LLC issued a promissory note in the amount of RUB 236,000. including VAT RUB 36,000. The accounting records of both organizations will reflect:

| Operation | D/t | K/t | Sum |

| At Blitz LLC | |||

| Debt to supplier for goods | 200 000 | ||

| VAT | 36 000 | ||

| A bill of exchange was issued | 236 000 | ||

| The bill is included in the balance sheet | 236 000 | ||

| Amortization | 236 000 | ||

| Writing off a bill | 236 000 | ||

| At Atrium LLC | |||

| Revenue reflected | 236 000 | ||

| VAT charged | 36 000 | ||

| The cost of goods is written off | 100 000 | ||

| Bill received | 236 000 | ||

| The bill is included in the balance sheet | |||

| Payment for goods and materials received | 236 000 | ||

| Writing off a bill | 236 000 | ||

Accounting efficiency

In the process of using bill of exchange accounting, a number of tasks can be solved:

- Creation of favorable conditions for the timely receipt of funds from the sale of goods offered, when performing a number of works and services provided. You can execute a transaction using a security, so it is not necessary to make an advance payment for the placed order. Trust between the customer and the supplier increases, and commodity-monetary communications are strengthened.

- Promoting the development of loans on a commercial basis. You can carry out transactions without using funds, and also set deadlines for payments made. Both parties independently come to a decision regarding the time frame for payment.

- A valid bill of exchange can be used as an alternative to monetary assets when paying for services of legal entities and individuals. In this case, the requirements of both parties must be taken into account.

- The paper can be sold and bought, and it can also act as collateral for obtaining a loan from a banking organization. It helps to get a discount, a loan, and conduct financial transactions.

This is an alternative means of helping to strengthen the relationship between two parties to a commodity transaction. Proper accounting of bills of exchange will help to establish order in document reporting at the enterprise, as well as control the status of debts and manage clients who purchase goods on credit.

Bills of exchange in accounting as financial investments

If an enterprise, having free money, invests it in the purchase of bills issued by banks and capable of generating income, then we are talking about financial investments. Such bills are the object of purchase and sale, they are recorded in subaccount 58/2 “Debt securities”. Let's figure out how bills of exchange are accounted for in accounting. Postings:

| Operation | D/t | K/t |

| Purchase of a bill of exchange | 76 (60) | |

| Acceptance for registration | 76 (60) | |

| The difference between the purchase price and the face value is reflected |

Example 2

On January 25, 2018, the company acquired a bank bill with a face value of RUB 2,000,000, issued on January 25, 2018, with a payment due date at sight, but not earlier than May 5, 2018. Interest accrual is 8% per annum. On 04/05/2018, the company executed a compensation agreement with the condition of transferring the bill of exchange to the counterparty who performed the work worth RUB 2,000,000. without VAT. It was accepted as payment for the work. The transaction was formalized by an agreement for the transfer of a promissory note.

Accounting entries:

| Operation | D/t | K/t | Sum |

| Bill paid | 2 000 000 | ||

| The bill is included in financial investments | 2 000 000 | ||

| Accrual of interest on the bill for January 2,000,000 x 8% / 365 x 6 days. | |||

| Interest accrued for February (2,000,000 x 8% / 365 x 28) | 12 274 | ||

| Interest accrued for March (2,000,000 x 8% / 365 x 31) | 13 589 | ||

| The work performed was accepted for accounting | 2 000 000 | ||

| Interest accrued for April (2,000,000 x 8% / 365 x 5) | |||

| The contractor was given a bill of exchange to repay the mortgage | 2 000 000 | ||

| The nominal value of the bill has been written off | 2 000 000 | ||

How does accounting work?

A debenture gives the right to collect the amount of the debt. But besides this, the circulation of bills can take such forms as purchase by third parties or organizations. This process is called accounting.

Sometimes it is necessary to receive money before the expiration of the period specified in the document, then the securities can be sold to the bank. A credit institution buys debt obligations at a discount using the following formula:

- D—discount amount;

- B - the amount specified in the obligation;

- T is the number of days until the maturity date;

- I is the bank's discount rate.

A similar formula can be used as a cheat sheet to understand how profitable it is to sell a debt obligation to a bank.

Accounting for own debt obligations

Ownership is usually simple when there are two parties involved. For example, when one party cannot pay for goods or services with money, it issues a bill of exchange. In accounting entries they are indicated as collateral issued and received. When accounting, these papers will be written off from the accounts. Debt securities recorded at par are not subject to tax.

Accounting for other people's bills of exchange as part of financial investments

For borrowed securities to be considered financial investments, they must generate a profit. Discount or interest obligations meet these conditions. An example would be bills received as follows:

| Methods of obtaining | Lines in the ledger |

| Purchase | Dt 58-2 Kt 76 |

| Payment by third party bill | Dt 58-2 Kt 62 |

| Contribution to the authorized capital | Dt 58-2 Kt 75 |

| During property exchange transactions | Dt 58-2 Kt 91, Dt 91 Kt 10 |

| Gratuitous | Dt 58-2 Kt 91 |

The discount or interest received in such an acquisition scheme is taxable.

Accounting for other people's bills that are not financial investments

Those securities that do not generate income are not taken into account on the balance sheet as financial investments. These are, first of all, non-interest bearing obligations, as well as those purchased at par or above par. Receipt is reflected in account 76; when writing off securities, only their value is taken into account.

Accounting for commodity bills

In the case of accounting for goods, a discount card is issued, which takes into account the amount for the goods and the overpayment for the duration of the debt obligation. This data is recorded in different lines of the accounting books: main - in debit 51, credit 62, discount - in debit 51, credit 91-1.

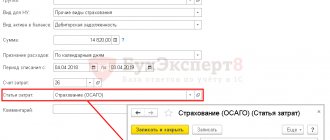

Issue of own bill: accounting entries

Companies can issue their own promissory notes. Most often, they are issued not at face value, but with a discount, or interest is calculated on the amount of the bill, and the difference between the book value and the purchase price or the amount of interest calculated will become the income of the holder. Let's look at how the sale of your own bill is accounted for.

Example 3

LLC "Lama" sold LLC "GROT" a bill of exchange at a discount, its nominal value is 200,000 rubles, the discount is 20,000 rubles. The due date for payment is no earlier than 10 months. The operation is considered as receiving a loan. Let's consider what records the accountants of both companies will use to record bills of exchange in accounting. Postings:

| Operation | D/t | K/t | Sum |

| At LLC "Lama" | |||

| A loan was received under a bill of exchange sale agreement | 66/bills issued | 180 000 | |

| The discount is taken into account in accordance with the adopted accounting policy using one of the options: | |||

| — one-time (discount is accrued upon presentation of the bill) | 66/interest on bills issued | 20 000 | |

| — gradually throughout the entire period until presentation of the bill (interest is accrued based on the circulation period (20,000 / 10 months)) | |||

| — gradually with expenses of future periods (discount is accrued when issuing a bill of exchange) | 20 000 | ||

| Monthly write-off of discount share | |||

| The debt on the bill has been paid | 66/bills issued | 180 000 | |

| The discount on the bill has been paid | 66/interest on bills issued | 20 000 | |

| At LLC "GROT" | |||

| A loan was issued, secured by a bill of exchange | 180 000 | ||

| Discount accrued on the bill | 20 000 | ||

| Monthly accrual of operating income (for 10 months) | |||

| The bill is presented for payment | 200 000 | ||

| The value of the bill has been written off (face value) | 200 000 | ||

| Payment received | 200 000 | ||

Procedure for issuance and circulation of bills

2.1. The basis for the issuance (sale) of a bill of exchange is the purchase and sale agreement of a promissory note of the Bank (hereinafter referred to as the agreement). The agreement is drawn up in two copies, one of which remains with the Bank, and the second is transferred to the first owner of the bill.

2.2. The bill of exchange is sold:

2.2.1. Legal entities, including branches - residents of the Russian Federation.

2.2.2. Individuals - citizens of the Russian Federation.

2.2.3. For non-residents - with the permission of the Rates Committee of Sberbank of Russia.

2.3. The bill is issued:

2.3.1. A legal entity (branch) that has transferred funds from its account to the Bank’s account, which may be located in the Bank or in another credit institution.

Cash payment for bills of exchange from legal entities (branches) is not accepted.

2.3.2. An individual who transferred funds from his account to the Bank's account or deposited cash.

2.4. The bill of exchange is issued to the recipient of the bill only after the full amount of funds specified in the agreement has been received into the Bank's account.

2.5. Several bills of exchange may be issued to the purchaser of a bill under one agreement. The sum of the denominations of all interest-bearing bills or the sales prices of all discount bills must be equal to the amount of funds transferred under the agreement for the purchase of the bill (bills) to the Bank's account.

2.6. To determine the amount of income on a discount bill or the interest rate indicated in the interest bill for each of those issued in accordance with clause 2.5. of this Bill of Exchange Regulations, interest rates are applied, determined on the basis of marginal interest rates, for the amount of funds actually transferred to the Bank’s account. All bill of exchange details determined by the agreement and entered into the bill of exchange form, including the payment period, the name of the first bill holder, the date of preparation, and the interest rates of bills issued in this way, must be the same.

2.7. A bill of exchange can be repeatedly transferred by endorsement to any person - legal (including a branch) or individual, including an entrepreneur, except for cases provided for by the legislation of the Russian Federation.

2.8. The endorsement may be of the following form:

2.8.1. Personal endorsement. The personal endorsement contains:

— full name and bank details of the endorser of the legal entity;

— full name and bank details of the entrepreneur’s endorser;

- last name, first name, patronymic, passport details and account information of the endorser - an individual.

The absence in the endorsement of its serial number, bank details of a legal entity or individual, as well as passport data of an individual does not entail its invalidity.

2.8.2. Bearer endorsement. The bearer endorsement contains the inscription “Pay to the order of the bearer of this bill” or another inscription that does not contradict the specified inscription.

2.8.3. Blank endorsement. A blank endorsement does not contain an indication of the person in whose favor it is made, or consists of one signature of the endorser (for a legal entity - a signature and seal, and for an individual - one signature).

2.8.4. If the last endorsement on a bill is in blank, then the holder of the bill can perform the following actions with it:

1) fill out the endorsement either with your own name or with the name of some other person;

2) transfer, in turn, the bill either under a new blank endorsement or under an endorsement in the name of some other person;

3) transfer the bill to a third party without filling out a blank endorsement or making another endorsement.

2.8.5. The endorsement must be written on the reverse side of the bill or on an additional sheet (allonge) attached to it in such a way that it begins on the bill itself and ends on the allonge.

It is permissible to accept a bill of exchange for payment when a new endorsement begins entirely on the allonge, but in this case the sequence of completed endorsements must be strictly observed.

2.8.6. The endorsement is filled out on a typewriter, using computer technology, or by hand in legible handwriting. Seal impressions must be clear and distinct and correspond to the name of the legal entity.

2.9.7. The endorsement is signed by an authorized representative and certified by the seal of the endorser - a legal entity or the signature of the endorser - an individual.

The endorsement may not be certified by the seal of a legal entity.

2.8.8. The person holding the bill is considered to be the legal holder of the bill if he bases his right on a continuous series of endorsements, even if the last endorsement is in blank.

2.8.9. If a mistake was made when filling out the last transfer inscription, then the entire inscription should be crossed out and the next one should be filled out.

2.8.10. Crossed out endorsements are considered unwritten and have no legal force.

2.8.11. Since all Banks are part of a single legal entity - Sberbank of Russia, they are prohibited from making endorsements to each other.

back to contents

How to issue a bill yourself and what difficulties you may encounter

At first, your own enterprise requires constant additional investments. One way to get money to develop a business is to issue a promissory note.

I will tell you how to do this, what needs to be taken into account, what are the advantages and disadvantages of such debt obligations.

This debt document is paid at the end of the term. A person can use such paper to pay for goods or transfer it to another.

Often bills of exchange are used for mutual settlements between subsidiaries of the same holding company, so as not to transfer money between their companies and not pay taxes. If a business cannot pay suppliers or employees (for example, when accounts are garnished), it can write a promissory note to continue operating.

There are 4 options for payment terms:

- to a specific date;

- by the time of compilation;

- when presented;

- by the time of presentation.

If the time of return is tied to the date of presentation, the issued financial document is sold at par upon issue, but it indicates interest that accrues until the return date. In other cases, when issued, such a receipt costs less than its face value, which is determined by the amount of interest.

Release procedure

To issue a bill, you do not need to register it or pay fees. It is important that when compiling the following details are indicated:

- the word "bill" in the text;

- a promise to pay a certain amount without conditions;

- the organization that will pay (in this case the bill of exchange is called “transferable”);

- due date;

- place of payment;

- date and place of compilation;

- signature of the legal entity that issued the document.

If all the necessary attributes are present, then the bill does not have to be drawn up on stamp paper. However, there are special forms that can be ordered from a printing house or purchased from the treasury.

When selling a financial instrument, a transfer and acceptance certificate is drawn up. It specifies the details and describes the transaction under which it was issued.

They are commodity and financial. The first are given as confirmation that the buyer owes the supplier money for the goods. The second is when the subject of the transaction is the debt obligation itself. A financial promissory note can be either from the issuer (the legal entity that issued the promissory note) or from another company.

Typically, an organization issues such securities not at par value, but with a discount or interest. They are accounted for in the same way. The issuer's expenses (and the holder's income) of the discount variety will be the difference between the face value and the purchase price. If we are talking about an issued interest-bearing bill, the amount of interest.

Often the maturity date is stated “at sight, but not before” a certain date. To pay off a debt, they draw up an act of presenting a promissory note and indicate all the details of the document, its denomination and the full amount that the drawer will pay. When the legal entity that issued the document has paid the debt, it transfers the receipt to the archive, along with the rest of the financial documentation.

A loan letter is a convenient way to make an advance payment. Neither the supplier nor the buyer will fear that they will be deceived. An additional advantage is that the buyer will have time to make a profit, and the supplier can immediately sell the note and return the money for the goods.

If two companies belong to the same holding company, and one does not have enough funds, and the other has more than it needs, the first can issue a second financial bill. This method is also convenient for covering internal debts of one subsidiary to another. But it is better to add a small discount to the document so that the tax office does not consider this operation as a gratuitous loan.

Preparation of contract

A promissory note loan agreement has the only difference from a regular loan agreement. It consists in the fact that instead of cash or other things, the lender gives the borrower a bill of exchange.

From the legal side, a bill of exchange can be defined as property that has generic characteristics, that is, number, series, and so on.

However, in practice, this definition has not taken root, since under the agreement the holder of the bill does not acquire property, but the right to receive the specified amount within a specific period.

One of the most common attachments to a promissory note loan agreement is the interest payment schedule.

A loan agreement paid for by a bill of exchange must be completed with the following documents:

- an additional agreement in which the parties to the agreement regulate the accrued amounts of interest, the terms of interest repayment, and so on;

- a protocol of disagreements possible during the operation of the loan agreement;

- protocol for reconciling disagreements, that is, possible solutions when disputes arise.

The loan agreement itself, when paid with a bill of exchange, contains:

- details of the parties entering into the agreement;

- the subject of the loan agreement, which is a bill of exchange of a certain series, number, value and repayment period;

- the period of validity of the contract upon the occurrence of which the bill must be paid;

- the agreed procedure for paying interest and commissions accrued on the bill of exchange;

- rights and obligations, as well as liability of both parties to the loan agreement;

- resolution of disputes, including in the event of force majeure circumstances;

- signatures of the parties entering into a bill of exchange loan agreement.

A sample document is presented below.

Bills of exchange in settlements with the commission agent

The commission agent pays VAT on the commission fee. If, as such, he receives a debt paper of the committing organization and transfers it to the supplier, then he will not have to pay taxes until the issued document is repaid.

The main problem with such documents is that, according to the law, VAT must be divided between the main activities of the company and the income from the sale of the bill. However, this is only necessary if you are paying with paper from a third party. The legal entity that issued the document will not have such problems.

Such financial documents are a simple and cheap way to get money for the development of a company. They work even if the organization is currently experiencing losses or whose accounts are frozen.

How to arrange a bill of exchange loan between legal entities

Any enterprise has the right to independently issue bills of a certain value and make payments with them, or contact a credit institution (bank) and receive a bill of exchange loan.

In the first case, a legal entity is obliged to purchase bills of exchange of the developed sample and fill them out independently, taking into account all the features of the organization. With these securities, the company has the right to pay for any purchases to other legal entities.

The peculiarity is that the organization that issued the bills of exchange postpones payment for the acquired property until the time specified in the paper.

Thus, one company becomes a borrower, and the other becomes a lender.

In the second case, an organization wishing to obtain a bill of exchange loan from a bank is obliged to collect a package of necessary documents and submit them for consideration by the credit institution.

The bank will make a decision to issue a loan after considering the relevant application, which will be communicated to the client – a legal entity. Further, all relationships develop according to the previously indicated scheme.

Getting a bill of exchange loan from a bank is much easier than a regular loan. This is due to the fact that the bank bears virtually no risks and does not transfer its funds to the borrower.

A bill of exchange loan allows a legal entity:

- significantly reduce interest rates for the use of borrowed funds, thereby receiving the maximum possible amount of your own profit;

- carry out settlements with other legal entities, without withdrawing funds from their own turnover;

- obtain the right to a refund of a certain amount of previously paid value added tax;

- significantly reduce the risks associated with non-payments on certain transactions.

Find out what tax consequences await legal entities after debt forgiveness in the article: debt forgiveness under a loan agreement between legal entities. The rules and conditions for providing a loan from the E Finance company are in the table.