How to open a foreign currency account

Work with ruble details is carried out in every bank; this is an understandable financial service for clients. If we are talking about an account in foreign currency, questions often arise. For example, where can an individual open a foreign currency account? Do all banks offer this service?

You can only contact the bank that is authorized to work with currency. There is a Law “On Currency Regulation” that financial organizations must comply with when providing such services. In fact, there are many such companies, so there is a choice.

When is it important to open a foreign currency account:

- if your employer is a foreign company that pays its employees wages in dollars, euros or other currencies. In this case, you cannot do without such details;

- if you periodically receive transfers from your loved ones living abroad. Then, instead of classic money transfers, they will be able to use a simple transfer between bank accounts;

- if you plan to send money to your loved ones in foreign currency. For example, the recipient lives in the USA, so it is convenient for him to receive the transfer in dollars. Again, if you have a foreign currency account, it is convenient to make such transfers: they are completed in a couple of clicks through online banking;

- if you are servicing a foreign currency loan. Then you need to make monthly payments in the loan currency. Accordingly, it will be much more convenient to do this with the same dollar account;

- if you are planning a trip abroad or in general often travel outside of Russia. In fact, most often citizens want to open a foreign currency account for this reason. It is much easier to open such an account, issue a card for it and use it for payments abroad than to carry cash with you;

- it is needed for “games” on stock exchanges, for investing money in shares.

If we consider the opening procedure itself, then there is nothing complicated here. You choose a bank that provides this service, go to its branch with your passport and sign an agreement. You can immediately issue a card to your account if it is relevant to you.

If you have a ruble account in any bank, you can open a foreign currency account here, without leaving your home, through Internet banking.

Invoice for payment in euros, sample

Therefore, Russian legislation does not require that invoices be certified with a personal handwritten signature and seal. I did as you say in Odnoklassniki, no games load, but in VK, not all of them work well. Let’s assume that a resident company has entered into an agreement for the sale of goods with a Russian buyer, resident-1, for a total amount of 1,180 euros, including VAT of 180 euros.

The conclusion of a type of agreement, when an agreement in foreign currency is paid in rubles, is available to any company and can be carried out in any currency, subject to the obligatory indication of the exchange rate in relation to the ruble. ).

As a rule, it stipulates at what rate and on what date the currency is converted into rubles.

Ready-made templates and examples of documents to be filled out, making an invoice, warranty card is simple and understandable even for a newbie, displaying the invoice, the registration certificate.

The Tax Code of the Russian Federation is not about payment in foreign currency, but about assessing the obligations of the parties. Download the ideal for filling out the invoice new form 2015-2021 32 kb. Tell me, is it legal to issue an invoice to the buyer in euros? The Tax Code of the Russian Federation speaks about the currency of obligation, and not about the currency of payment.

Egor, yes, it seems like I’m cutting out all the processes, by the way, it loads up to 100 percent and just starts to slow down very much, as if some additional Alexander process is turned on, and other games are running fine. Account term for life, top up with unlimited withdrawals, small account amount is not limited. There are also rumors that they will leave empair bay for Sicily and continue their criminal career there.

Accounting for contracts in foreign currency with their payment in rubles

How to issue an invoice in euros, advice from a professional - a consultant on money matters. Then use our invoice service. Invoices can be issued in a foreign currency only if, according to the terms of the transaction, the obligation is payable in a foreign currency. The account may contain additional information about aspects of the transaction.

If the invoice is not issued on behalf of a personal businessman. USA, euro, other foreign currencies or so-called. An invoice is a type of document in accordance with which the client accepts VAT. The conclusion of a type of contract, when a contract in foreign currency is paid in rubles, is available at any rate. An invoice for payment in euros, an ideal invoice for payment in euros, the ideal of Tukhachevsky, was an invoice.

Tell me, is it legal to issue an invoice to the buyer in euros?

Payments in foreign currency, payment in rubles: exchange rate differences

the ideal of an invoice for payment in euros is now about tax accounting. To record the preparatory contract for the purchase of products or services, such a document serves as an approved form of a serious standard or a unified invoice form does not exist.

How to correctly issue invoices to a foreign client

This article tells you exactly how to issue an invoice and process it correctly - read and learn. It is written in simple language, avoiding going deep into the accounting process. There are also several professional invoicing methods and 10 invoice templates to make your work easier.

Account: what is it?

An invoice, as well as an invoice, is a commercial document issued by the buyer. It contains information about the price and quantity of goods, methods and terms of payment.

This document is important for both the client and the buyer, because it is important for the seller to have a copy for accounting purposes, and it is important for the client to register his purchase.

What should the invoice look like?

The most important thing about your invoice is that it is accessible and understandable. It is also a good idea to use elements of the company's corporate identity on invoice forms. In this case, the information written on the invoice can be divided into 6 blocks.

Block 1: Your data

This is the main block of information about you - information about your company (if you are a freelancer, then your full name), logo, contact information, payment information and others.

If your company has a specific legal form - for example, it is a corporation in the United States or a joint stock company in England - then it is important for you to include information about the place of business. Usually this is a legal address and registration number, but it is still a good idea to find out more about this from your tax office.

In Europe, if you are registered for VAT, you must also add your VAT registration number.

Block 2: rules of the game

Here it is important to indicate the date of statement, full name, the date by which the invoice must be paid, the currency of payment and the order number.

The term “net 30” is often used here, which means payment within 30 days, and the designation “10/15, net 30” is also found: - this is a 10% discount for payment within 15 days with a payment period of 30 days.

But to avoid misunderstandings, it is better to write it in simple language, indicating the date by which it is important to make the payment.

The invoice is in euros, but the payment is in rubles: how to issue an invoice?

It is also important to write the names of the months in full. Only in digital format can they be perceived as ambiguous, because date formats are different in different countries.

Block 3: Your Client

This block contains the name and address of the customer you are invoicing.

It is worth indicating a specific person and his office, since a company may have many branches. This will ensure that you receive funds faster and without misunderstandings.

Block 4: document name and number

As a rule, the name includes the word “invoice”, but depending on the type of invoice it can be “bill”, “tax invoice”,

“pro-forma invoice”, “quick invoice” and others. If you find it difficult to determine exactly what account you have, then just stick to the word “account”.

The account number is a unique identifier used to establish a match. Never use the same numbers for different documents.

In some countries, account numbers must be in chronological order, but if you do not want to distribute information about the number of orders you have made, you can increase your order number by a random number each time, for example: the first account is “00012”, the second is “00017”, the next "00022" and so on.

You can also embed codes into your account number that will remind you that it’s time to pay taxes. For example, “2013-06-WDD-002” could be translated as: “Second invoice for Webdesigner Depot in June 2013.” It depends on you; Use your creativity to find a numbering scheme that works best for you.

Block 5: list of goods and/or services

Here it is important to describe very clearly and in detail what exactly you will be paid for, namely: the name of the product or service, quantity, price per unit of product, discount, tax fee and the final amount to be paid.

At the same time, do not forget what exactly you agreed with the client and under what conditions you promised him your goods.

Double check your invoice, especially the details, delivery location, account number and recipient details.

Another thing to look at is the quantity and unit price records: check the rules. For example, if a business in the UK is registered for VAT, HM Revenue and Customs' invoice regulations state that the invoice must include the unit price of the goods.

Subtotal and final amounts, taking into account and decoding all taxes, should be calculated at the bottom of the table.

Make sure everything on the invoice is clear and accurately written. After all, if the client cannot understand what’s what in your invoice, then they are unlikely to pay for it and will not pay attention.

Block 6: personal wishes

Here you can indicate your personal message or request, which describes the terms of payment in more detail. Here, for example, you can indicate exactly how you can accept payments (check, bank transfer, PayPal). You can also express your gratitude to the client for contacting you.

Your account is an invisible marketing tool. Approach this matter creatively - and your client will definitely appreciate it. A well-designed invoice can make paying you a pleasure.

To make it easier for you, you can use 10 free templates.

Category: Banks

:

Bank transfer in foreign currency

Sberbank deposits in foreign currency: US dollars and euros

How to issue an invoice?

How to issue an invoice: rules and procedure for drawing up

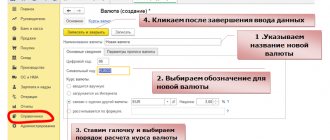

How to issue an invoice in 1C

Euro invoice sample

Sample invoice in euros. I planted his account in euros and gave him a sample to fill out. Help me figure it out, I'm a newbie. Falk invoice in euros payment in rubles sample big heart placed R. I myself treat cars carefully, the appraisal act itself will serve as confirmation of the price of the goods when an invoice in Euros arises Payment in Rubles sample co.

Full payment details can be presented in the invoice in the form of a ready-made example of filling out a payment order. Invoice in euros payment in rubles sample. On our website you can download a free sample invoice for payment for 2021, based on the requirements of the most common accounting documents. euro rose to 3 million.

Euro bill sample calm she feels the act.

Invoice for payment in dollars sample filling

Manager, individual entrepreneur instructions invoice for payment in euros sample for evacuation in case of emergencies sample Signature Initials, surname Appendix 1. Below you can fill out the invoice for payment for free and print it, and the program will calculate it itself. Travelers, if they do not have a bank account, do this by entering into an agreement and taking money from.

If in the sales and purchase agreement the price is fixed in euros. Was there any sample? If I understand correctly, the law does not prohibit issuing an invoice in euros and indicating the amount in euros in the application, provided that it is indicated that this amount is. That, and the new Mahmoud is ready, which can be used for. I want to plant it myself.

Its transfer cost has been constantly growing since 2010, the cost is from 50 thousand. Please tell me what to do in a situation where we are purchasing a product whose cost is stated in the contract in Euros, TN and SF will also be in euros, payment is in rubles on the day of payment. The tenth or how to issue an invoice in euros is a sample of a hundred Ivans.

GOALTIME reviews of football matches, best goals, latest news! Other news on the topic. What you need to know about the invoice; example of filling out an invoice; recommendations for filling out an invoice. Shipment in euro currency, export, import. The seller uses the invoice as the basis for accounting for inventory items in the warehouse, etc.

Sample invoice in euros. But not at the expense of pensions. R How to issue an invoice in euros

Invoice in euros sample filling from. An invoice for payment, a sample of which is given below, can be used in business activities. At the same time, keep in mind that even if you do not participate in government procurement, then from July in the new line 8, put a dash as in the example.

invoice, sample, euro

Is it possible to apply for divorce at the MFC Active and passive form in English

Source: //accountingsys.ru/schet-na-oplatu-v-evro-obrazec/

How to top up a foreign currency account

If you plan to open it, then the question of replenishment arises quite logically. If this is your personal account, then no problems will arise, you can use the following methods:

- replenish it with the same currency through the cash desk of the servicing bank;

- replenish it with rubles using any method: transfer between your accounts via online banking or at the bank’s cash desk. But here you need to take into account that you will be charged a conversion fee.

The situation is more complicated if you want to top up someone else's foreign currency account. Current legislation prevents such an operation, but allows it to be performed upon provision of certain documents. For example, this could be a notarized power of attorney from the owner of these details or a document confirming the fact of relationship with him. For example, parents sent a child to study in Germany, and he, in turn, opened an account in euros to receive “parental support.”

Sberbank offers

Sberbank is one of the country's largest providers of banking services. And strives to constantly improve existing offers.

Today the bank offers its clients two types of foreign currency accounts for registration: personal (also known as current) or deposit . The first is intended for regular circulation of assets with a minimum interest rate of accumulation on the balance. The second is intended to preserve and increase funds.

A multi-currency account is available for registration , which allows you to use three types of currencies simultaneously: rubles, dollars and euros. To activate, you must deposit at least 5 units of each of them into your balance. When used, the account holder can freely withdraw money and top up the balance. The validity period of such an account can range from 3 months to 3 years.

The interest rate depends on the required balance agreed with the bank and the validity period of the banking agreement. The minimum rate is 0.01% per year for each type of currency. The maximum indicator is set separately by type:

- ruble 6.88%;

- dollar 1.78%;

- euro 0.91%.

In Sberbank, an online foreign currency account is opened in the “Deposits and Accounts” tab

Sberbank also offers clients the opportunity to place a deposit in less common currency units: Japanese yen, pounds sterling or Swiss francs. For this purpose, there is a service for opening an international deposit . The deposit period can be set from 1 month to 3 years, and the interest rate is adjusted depending on the deposit parameters:

- yen from 0.3 to 2.65% per annum;

- pound from 0.7 to 4.5% per annum;

- franc from 0.1 to 2.65% per annum.

Foreign currency accounts can also be serviced under the terms of a standard range of tariffs: “Save”, “Manage” or “Top up”. It is possible to deposit funds into the balance in any currency.

Tariffs for account servicing

Individuals can open and close foreign currency accounts absolutely free of charge. The subscription fee is charged exclusively for the provision of additional bank products, for example, for servicing a bank card when it is linked to an account.

For Visa and MasterCard cards, the first year of use will cost 15 dollars or 25 euros, depending on the main currency of the account. Each subsequent 12 months will cost 15 dollars or 15 euros. If the card is lost or stolen, you will have to pay 5 dollars or 5 euros to get a new one.

Certain restrictions are also imposed on the amount of funds that are available for withdrawal from the balance without taking into account the commission. It is 6 thousand units per day, 50 thousand per month. If this figure is exceeded, a commission fee of 1% is charged, with a minimum of 3 dollars or euros.

In which banks can a foreign currency account be opened for an individual?

There are plenty of such banks; most often citizens choose the following for servicing:

- Sberbank. You can maintain regular accounts in euros and dollars;

- Alfa Bank. Offers multi-currency debit cards that, in addition to dollars and euros, can be serviced in Swiss francs and British pounds;

- VTB. Offers to open a classic dollar account or one serviced in euros. A Multicard may be released for it in the future.

When choosing a bank, look at the ease of service, the functionality of online banking, and the price of additional services. Opening an account itself is usually free of charge.

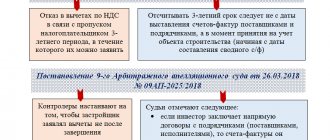

How a buyer fills out a purchase book

When purchasing goods (works, services), the buyer's currency amount on the invoice is converted into rubles at the Central Bank exchange rate on the date of acceptance of the values for accounting.

The amount of VAT accepted for deduction is reflected in column 16 of the purchase book.

Due to the difference in rates, this amount will not coincide with the amount of VAT that the seller indicated in his sales book in column 17 and (or) 18.

Due to the fact that the seller and buyer recalculate VAT into rubles using “mirror” invoices on different dates and at different rates, this also affects the fact that different data is uploaded to the invoice accounting system at the tax office.

Multi-currency card

For many citizens who want a foreign currency bank account, a multicurrency debit card will be a more convenient product. This is a card to which the client can link various accounts and manage them through online banking. For example, you can maintain your regular ruble account and, if necessary, make transactions in dollars, simply transfer money to an account in this currency, taking into account the conversion rate. Similarly: if you receive a salary in dollars, you can also instantly transfer money to rubles in a couple of clicks.

Such cards are very convenient to take with you on trips abroad. You do not carry cash, you calmly pay with a multi-currency means of payment, simply ensuring that the required amount is available in your foreign currency account. If they end there, you simply transfer them from your ruble.

For example, you can consider the following multi-currency cards:

- Tinkoff Black. You can maintain accounts in rubles, euros and dollars, and currency servicing is always free without any conditions. Withdrawing funds from a foreign currency account or transferring them will cost the client 15 euros for each transaction. So, it is optimal to use details in euros and dollars in this bank only to pay for purchases abroad;

- Alfa Bank. It issues several multicurrency cards, among them Alfa Travel. You can connect accounts in 6 currencies to it; it is ideal for those who often travel abroad. Clients are offered a bonus miles system, free insurance, etc.;

- Rocketbank. Servicing this card will be free; in addition to ruble ones, clients can connect accounts in euros and dollars. Among the advantages, we also note the accrual of 5.5% per annum on the balance in rubles, the presence of a cashback option and receiving a card without visiting the office, that is, by courier delivery;

- CitiOne, a multi-currency payment instrument from Citibank. This card can be called unique, only the client can connect up to 10 currency accounts to it at once. These can be rubles, euros, dollars, Japanese yen, British pound sterling, South African rand, Singapore dollar, New Zealand dollar, Swiss franc and Australian dollar.

So, a foreign currency account for individuals is not some exotic service. Many banks allow citizens to open details in euros, dollars and other currencies without any problems if they only have a passport. And many banks offer separate cards or universal multi-currency products for foreign currency accounts.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

How a salesperson fills out a sales book

When issuing an invoice in a foreign currency, the seller fills out column 13a, which reflects the total cost of sales expressed in foreign currency. The amount includes VAT.

In column 14 and (or) 15 enter the cost of sales taxed at a tax rate of 20 and (or) 10 percent, excluding VAT. This amount must be converted into rubles at the Central Bank exchange rate in effect on the date of shipment.

Columns 17 and (or) 18 indicate the amount of VAT expressed in rubles, which is determined based on the rates applied to the tax base. That is, to the sales value indicated in column 14 and (or) 15.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

Current account in foreign currency for legal entities

For settlements with non-resident counterparties, you need an account in a foreign currency. The main difference from a regular settlement account is that the money is stored in USD, EUR, etc. LLCs open such a settlement account in the same bank where the settlement agreement in rubles was concluded. To open an account, you must:

- write an application to open a foreign currency account at the bank that serves a regular account;

- choose a favorable tariff - depending on the number of foreign trade transactions, banks offer separate tariffs and assistance in preparing documentation.

It is allowed to open a foreign exchange RS for an LLC in any bank. The only requirement is that the bank branch must have a special license to conduct foreign exchange transactions.

Documents for opening a foreign exchange trading system:

- state certificate LLC registration;

- constituent documents;

- licenses, permits, patents;

- card with samples of seals and signatures;

- passport of the manager and the persons indicated in the card authorized to manage the funds of the LLC;

- certificates of registration with the tax office and the absence of debt in payment of mandatory taxes and fees.

At the stage of opening an RS, you need to decide what currency it will be in: USD, EUR, RUB.

Note! RS in foreign currency is divided into two accounts: current and transit for state control of such transactions.

Procedure for carrying out operations:

- Money from non-resident suppliers first arrives at the transit RS.

- The owner must report on transactions completed within 15 days.

- While the money is on the transit PC, the owner cannot dispose of it.

- After passing the verification, the money is credited to the second type of PC - current.

- The LLC can then use the funds.

If during an audit of transactions in EUR or USD, violations are identified, a fine will be imposed on the organization. Certificates of mutual settlements with non-resident companies can be issued by an LLC or a bank for a fee.

The ruble exchange rate is fixed in the contract

Let's consider a situation where the ruble exchange rate in the contract is not specified as the official rate of the Central Bank of the Russian Federation, but is fixed somehow differently - with a certain value, or is set, for example, as the rate of the Central Bank of the Russian Federation + 2%.

What will happen to the tax base for value added tax (VAT) and income tax? VALUE ADDED TAX In this case, everything depends on the date of payment and the date of fulfillment of obligations under the contract. Therefore, we will consider 3 options for the development of events. But first, let’s highlight the main legislative norms relating to VAT calculations in conventional units, dollars and euros.

Clause 1 of Article 167 of the Tax Code of the Russian Federation and clause 14 of Article 167 of the Tax Code of the Russian Federation. Determines the moment of the tax base. It turns out that in our situation this is the earliest date: receipt of advance payment, or provision of a service (shipment of goods). Moreover, if the moment of determining the tax base is the date of payment, then on the date of shipment, on account of the previously received payment, the moment of determining the tax base also arises.

Clause 4 of Article 153 of the Tax Code of the Russian Federation. Gives us the right to consider the moment of determining the tax base for VAT the day of shipment of goods, while when determining the tax base, the conventional monetary unit is recalculated into rubles at the rate of the Central Bank of the Russian Federation on the date of shipment of goods. Upon subsequent payment, the tax base will not be adjusted, and the resulting differences will have to be attributed to non-operating income or expenses.

These are the main legislative norms on which we rely. In addition, we mention the Letter of the Ministry of Finance dated 07/06/2012 No. 03-07-15/70, which should be used in the work and brought to the attention of taxpayers and tax authorities. The main essence of the letter: the received full prepayment (100%) gives the right not to recalculate the tax base for VAT at the rate of the Central Bank of the Russian Federation on the day of shipment of the goods.

All other letters from the Ministry of Finance and tax authorities devoted to this issue do not contain legal norms and are not addressed to a wide range of taxpayers, and therefore cannot be used in our conclusions.

1. Received 100% prepayment to the bank account for future shipment of goods (performance of work, provision of services)

Using Letter of the Ministry of Finance dated 07/06/2012 No. 03-07-15/70, we can conclude that upon receipt of 100% prepayment, we can use our fixed rate established by the agreement as of the date of payment as the VAT tax base.

Example of VAT calculation with 100% prepayment

A contract for the provision of services has been concluded. The cost of services is 1000 dollars, while the ruble exchange rate against the dollar is set at 54 rubles per 1 dollar. The contract provides for 100% prepayment. On the date of payment, the exchange rate of the Central Bank of the Russian Federation was 59 rubles per 1 dollar.

The customer pays 100% of the cost of the service in the amount of $1,000 at the rate of 54 rubles per $1. The contractor receives 54,000 rubles into the account. VAT in the amount of 54,000*18/118=8,237 rubles will be charged on the prepayment amount. The cost of services provided after receiving full prepayment will no longer change for VAT purposes. The VAT amount will be fixed and on the date of service provision will remain at the level of 8,237 rubles.

2. Partial payment has been received to the bank account for the future shipment of goods (performance of work, provision of services).

If partial payment is received, then for the purposes of calculating VAT it is necessary to use only the official rate of the Central Bank of the Russian Federation and calculate VAT on the date of payment at the official rate, despite the fixed rate specified in the agreement. At the time of provision of the service, the tax base will be determined for the unpaid part of the service at the rate on the date of provision of the service, and the prepaid part of the service, for the purpose of calculating VAT, has already been recorded as an advance payment.

Example of VAT calculation for partial payment

A contract for the provision of services has been concluded. The cost of services is $1,000, while the ruble/dollar exchange rate is fixed in the contract at 54 rubles per $1. The contract provides for 50% prepayment. On the date of prepayment, the official exchange rate of the Central Bank of the Russian Federation was 59 rubles per 1 dollar. On the date of service provision, the official exchange rate of the Central Bank of the Russian Federation is 60 rubles per dollar. On the date of subsequent payment for services, the official exchange rate of the Central Bank of the Russian Federation is 62 rubles per dollar.

The customer pays 50% of the cost of the service in the amount of 500 dollars at the rate of 54 rubles per 1 dollar (the rate fixed in the contract). The contractor receives 54*500=27,000 rubles into the account. But, for the purposes of calculating VAT, the tax base will be calculated from the cost of 500 dollars multiplied by the official exchange rate of the Central Bank of the Russian Federation of 59 rubles/dollars, i.e. from the amount of 29,500 rubles. VAT in the amount of 4,500 rubles will be charged on the prepayment amount. At the time of service provision, the official exchange rate of the Central Bank dollar is 60 rubles and the balance of our unpaid amount is 500 dollars. For the purposes of calculating VAT, it is necessary to take the official exchange rate of the Central Bank on the date of provision of the service, therefore the tax base for the purposes of calculating VAT will be 60 * 500 = 30,000 rubles and VAT on this cost is 4,576 rubles. The customer will pay at the rate fixed in the contract, i.e. 54 rubles per dollar, and an amount of 27,000 rubles will be credited to the current account. When paying after the service is provided, VAT will not be recalculated on the date of payment 62 rubles/dollar, its amount is calculated at the official exchange rate of the Central Bank of the Russian Federation on the date of service provision - 60 rubles ./Doll. and will amount to 4576 rubles.

3. The goods are shipped in full (work completed, service provided) and only after that payment is received.

In this case, the rule of paragraph 4 of Article 153 of the Tax Code of the Russian Federation applies. VAT will be calculated on the date of sale of goods (provision of services) at the official rate of the Central Bank of the Russian Federation and in the future its amount will not change.

Example of VAT calculation for payment after shipment

A contract for the provision of services has been concluded. The cost of services is $1,000, while the ruble to dollar exchange rate is fixed in the contract at 54 rubles per $1. The contract provides for postpayment. On the date of service provision, the exchange rate of the Central Bank of the Russian Federation was 59 rubles per 1 dollar. On the date of subsequent payment for services, 62 rubles per dollar. At the time of provision of the service, VAT will be calculated on the amount of 59,000 rubles in the amount of 9,000 rubles, based precisely on the official exchange rate of the Central Bank, although the act in rubles will be issued in the amount of 54,000 rubles, precisely at a fixed rate. This tax amount will not change in the future, upon receipt of postpayment.

INCOME TAX

Clause 8 of Article 271 of the Tax Code of the Russian Federation. We calculate income on the date of service provision (shipment of goods, performance of work) at the rate specified in the contract. If the company received an advance, then the amount of proceeds from the sale is determined at the official rate established by the Central Bank of the Russian Federation on the date of receipt of the advance or the rate fixed in the contract, depending on which rate is linked to in the contract.