Relevance of accounting business

Before you open an accounting firm, you should think about the feasibility of such a step. The provision of accounting services as a separate, actively developing type of business is a promising channel for generating profit. Nowadays it is no longer customary to employ a staff of accountants if you just need to make a few monthly reports. This is why outsourcing, that is, transferring some functions (for example, accounting) to other organizations, has become popular.

For the head of a developing company, it is irrational to devote part of his precious working time to reporting, but it is also costly to hire an accountant for full-time employment. For these reasons, the provision of accounting services as a business is a particularly relevant type of income-generating activity.

How many OKVED codes can be indicated in the application?

As much as you like, it is not forbidden to include at least the entire classifier in the application (the only question is how much you need it). In the sheet where OKVED codes are indicated, you can enter 57 codes, but there can be several such sheets, in this case the main type of activity is entered only once, on the first sheet.

Please note that if the OKVED code you have chosen relates to the field of education, upbringing and development of children, medical care, social protection and social services, children's and youth sports, as well as culture and art with the participation of minors, then you will need to attach a certificate of registration to the application for registration absence of a criminal record (clause 1(k) of article 22.

The law stipulates this requirement only for individuals (that is, individual entrepreneurs), and when registering an LLC such a certificate is not required.

Services

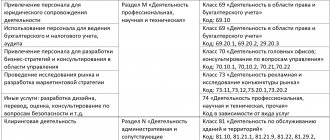

Among the accounting services provided that will be in demand, it is worth highlighting the following:

- registration of an enterprise, change of ownership;

- preparation of documents (invoices, certificates of work performed, applications to tax authorities);

- preparation of reports (balance sheet, “zero” report, payroll statements);

- conducting financial transactions, opening an account;

- registration services (for example, check book registration);

- preparation and submission of reports to the tax office;

- restoration of accounting;

- consulting services (consulting assistance on accounting issues);

- obtaining certificates from statistical and other government bodies;

- preparing an organization for an audit or tax audit;

- balance support.

Where to indicate and where to get

In tax returns, on the first sheet you can always find the following details:

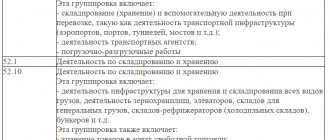

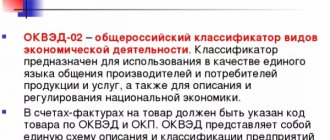

The value of this code is taken from the All-Russian Classifier of Types of Economic Activities. Abbreviated as OK 029-2014 (NACE Rev. 2). It was approved by order of Rosstandart dated January 31, 2014 No. 14-st.

Please note that from mid-2021, for the purposes of state registration (Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs) and tax registration, this reference book is used in the 2nd edition, which is given above.

Also see “OKVED codes from 07/11/2016: what will be affected by their update.”

Algorithm for opening an accounting firm

To open a company or become an individual entrepreneur in the field of activity in question, you must first create a business plan for the provision of accounting services. This document will help you understand how much money to invest and when to expect your first profit.

Business registration

Making the venture official and legal is the first step to making a profit from the provision of accounting services. To do this, you need to select a suitable organizational form for the future company and submit an application to the tax office, paying the state fee.

It should be accompanied by:

- copies of passports of the founders (founder), identification numbers;

- a letter of guarantee from the owner of the premises regarding the lease (if you plan to immediately rent an office);

- charter in two copies (required for companies that have chosen the LLC form).

Important! If the company will have the form of a legal entity, it is also necessary to draw up and attach to the package of documents the minutes of the meeting of founders.

What to choose: LLC or individual entrepreneur?

To provide accounting services, a form such as an LLC (limited liability company, that is, a legal entity) or an individual entrepreneur (individual entrepreneur, that is, an individual) may be suitable.

Let's look at some of the features of these two options:

| Parameter | OOO | IP |

| Authorized capital | needed, size – 10,000 rubles | not required |

| Office | necessary, since registration with government agencies will be carried out at the address of this premises | is not needed, since an individual entrepreneur registers a company at his official address (in an apartment or in a private house) |

| Expenses for furniture, office equipment and rental premises | need to be budgeted for when opening an accounting firm | not required if you start working from home as a freelancer |

| Customer perception of the company | a company that is a legal entity is taken more seriously by clients than an individual - an individual entrepreneur | not all company managers who need one-time or ongoing outsourcing services will trust an individual entrepreneur |

| Responsibility for errors in work | large, as are the fines imposed | minimum |

| Accounting for your company | needed | no need to lead |

| Registration process | more complex and voluminous than for individual entrepreneurs | as simple as possible |

Licensing and operating rules

Accounting services are an attractive business for those who have not previously been the manager or founder of a company, because you do not need to obtain any licenses for this. The most important thing for accounting services is to have experience, skills and sufficient knowledge in the field of accounting and related issues.

So, the director and employees of an accounting firm need to know:

- Russian law on accounting;

- chart of accounts;

- provisions on accounting and document flow;

- tax code;

- guidelines explaining certain points in accounting.

Office rental

The area of the premises for the work of an outsourcing accounting firm depends on the number of employees hired. If we provide space for accountants, directors and negotiations, the smallest recommended value would be 40 m2. To minimize costs, it is advisable to rent an office that has already been renovated.

The ideal location for the company would be the city center. However, when taking into account the cost of renting commercial real estate, this will be a waste of money. Try to find a room located next to the tax office, in which case the process of obtaining certificates or filing reports will speed up.

It is important! Get ready for the fact that you will have to pay from 500 to 1000 rubles for renting each square meter of office. (of course it all depends on the city in which the business is organized

Recruitment

The most important thing in any successful company is qualified, professionally trained personnel.

In an accounting company it usually has the following composition:

- chief accountant;

- assistant accountant (to begin with, it is enough to hire two people for this position);

- director;

- premises cleaner.

Naturally, the most important requirement for the first two positions is excellent knowledge of accounting. Experience is only required for the chief accountant, because inexperienced (but quickly trained) assistants can be hired. This way you can save on their wages.

You will be the director yourself, although if you wish, you can delegate the management of the company to another person. If the business owner has experience working with accounting documents and related software, he can take the position of chief or ordinary accountant. The main thing to remember is that when recruiting personnel, each employee must ultimately be in the right place so that orders are completed on time and with high quality.

Purchase of equipment and furniture

When organizing the work of an accounting firm and opening an office, the main expenses go towards purchasing furniture and equipment.

Here is a list of what you may need:

- tables;

- chairs for workers and chairs for visitors;

- cabinets or racks for storing papers;

- laptops or computers;

- cash register (not needed if payments to clients will be made non-cash);

- MFP (Multifunctional device - a device that combines the functions of a printer, scanner, fax machine, copier module.);

- stationery.

Note! Renting a furnished office or purchasing used goods will help you save on the purchase of furniture and equipment.

Software costs

Programs for carrying out accounting operations, drawing up reports, and balance sheets must be licensed, which means that you will have to pay for them. However, at the initial stage of the company's work, you can use their free, smaller versions. It is also worth paying attention to services that operate via Internet resources and use cloud technologies to store information, rather than a specific computer.

For reference! The most popular paid program for accountants is still 1C-Accounting.

Here is an example of several free accounting programs and services:

- "Sky";

- “Taxpayer Legal Entity”;

- "My business";

- "Info-Accountant";

- "Circuit";

- "Info-enterprise".

Company advertising

Disseminating information about your company, that is, advertising it, will allow potential clients to learn about the existence of such a useful company. Marketing at the beginning of the enterprise should be done especially carefully, because the success of the undertaking and the number of clients will depend on it. For advertising to be effective, you need to use all available promotion methods.

Thus, outdoor or offline advertising will consist of posting information on billboards, distributing business cards, flyers and other printed materials. You can also send out advertising brochures and brochures and leave them in places where potential clients are concentrated who may need accounting services. It is also a good idea to find an opportunity to print information about the organization in thematic magazines, directories and newspapers.

Internet advertising includes:

- creation of a landing page and its regular promotion;

- creating groups and communities on social networks and popular instant messengers with posting useful information and integrating native advertising;

- publication of information about the company in online accounting publications.

If you still have some kind of telephone database from your previous place of employment, you can make “cold” calls and make appointments with potential clients. It wouldn't hurt to have staff participate in business events.

What an individual entrepreneur cannot do

There is no separate list of activities prohibited for individual entrepreneurs. Some types of activities have a high level of public danger, therefore the law establishes special requirements for their conduct: a certain amount of capital, availability of production space, permits from government bodies. The individual entrepreneur cannot fulfill these requirements, therefore, he does not have the right to engage in such types of activities.

- Types of activities that an individual entrepreneur cannot engage in:

- Production of any alcohol and sale of alcoholic beverages (except beer);

- Provision and operation of aviation equipment;

- Trafficking and production of weapons;

- Space activities;

- Medicine production;

- Transportation of passengers and cargo by air;

- Tour operator activities.

Important information

If prohibited OKVED codes are indicated in the application for registration of an individual entrepreneur, the tax office may not refuse registration, but in practice the entrepreneur will not be able to conduct such activities.

- Licensed types of activities

- Detective activities;

- Some types of educational activities;

- Transportation of goods and passengers by water, sea and road transport;

- Pharmaceutical activities.

If you have a license, an individual entrepreneur can carry out:

Important information

Indicating the code of the licensed activity when registering an individual entrepreneur does not oblige you to obtain a permit. Obtaining a license is necessary only before starting the activity.

Licenses are issued by the authorized authorities: in the field of education - the Federal Service for Supervision in Education and Science, in the field of transport - the Federal Service for Supervision in the Sphere of Transport, for pharmaceutical activities - the Federal Service for Supervision in Healthcare. Article 14.1. The Code of Administrative Offenses of the Russian Federation provides for administrative liability in the form of a fine and confiscation of property for carrying out activities without a license.

Financial plan

Let's consider an approximate financial plan for opening an accounting firm:

- authorized capital – 10,000 rubles;

- payment of duty - 4,000 rubles;

- rent of office space – 30,000 rubles;

- furniture, equipment, stationery – 350,000 rubles;

- advertising – 45,000 rubles;

- other (unplanned) expenses - 10,000 rubles.

In total, when opening a company you will need ~449 thousand rubles.

In the process of functioning of an accounting company, regular (monthly) expenses will also appear: salaries of employees (minimum 110,000 rubles), payment of taxes (will amount to 6% of income under a simplified system), insurance contributions (25,000 rubles), consumables (2 000 rubles), office rent (30,000 rubles). Monthly costs will be 167,000, not including tax.

Let's calculate the possible profit that is planned to be received after three to six months of work. If the average price of one accounting service is 7,000 rubles, and there are 50 clients per month, the monthly income will be 350 thousand rubles. If you subtract monthly expenses (RUB 167,000) and tax (RUB 21,000) from this number, you get RUB 162,000. Whether you will be able to achieve these estimated values will depend on the advertising and the quality of the services provided.

Code of security services according to OKVED or OKDP

Until recently, several types of classifiers were actively used on the territory of the Russian Federation, necessary for the general regulation of business activities, including international economic relations. This situation has often caused confusion and confusion in various industries.

In particular, only for the activities of private security companies it was necessary to use at least three key classifiers - OKVED 45.31 for the installation of alarm systems, OKVED 67.20 for services in the field of mediation in resolving financial and insurance issues, and OKVED 74.60 for conducting investigations and providing services in the field of security.

Possible risks

Among all the possible risks that may hinder the development of the business, it is worth highlighting two main ones. This is the presence of high competition and difficulty in finding clients. A clear focus on results, a thorough study of the client base and the weaknesses of competitors, as well as constant improvement of the quality of service can help to avoid such problems.

Based on the above, the business of accounting services is promising and profitable. Even without making significant investments, you can start making money by preparing balance sheets and preparing other accounting documents.

Article read: 329

New OKVED

For organizations, the procedure for notifying about changes in OKVED codes will depend on whether the relevant types of activities are indicated in the Charter. Please note that if the list of types of activities contains an indication of “... other types of activities not prohibited by law” (or something similar), then there is no need to make changes to the Charter. Changes in OKVED codes without changing the Charter are reported using form P14001.

If the new codes do not come close to the types of activities already specified in the Charter (for example, production is indicated, and you decide to engage in trade), and phrases about other types of activities that do not contradict the law are not spelled out in it, then use form P13001. In this case, you will also have to pay a state fee of 800 rubles.

Main tasks of accounting services

- Prevention of negative indicators as a result of the economic activities of an enterprise or individual entrepreneur.

- Identification of internal reserves to ensure the financial stability of an enterprise or individual entrepreneur.

- Control over compliance with legislation in the process of business activities.

- Monitoring the availability and movement of property and fulfillment of obligations.

- Monitoring compliance of activities with approved standards, norms and estimates.

- Control over the use of financial, material and labor resources.

That is, any business transaction must be:

- reflected in the report: issuing salaries, obtaining a loan, purchasing office glue, calculating depreciation;

- documented: act, invoice, agreement, accounting card, etc.;

- reflected in the debit and credit of the corresponding accounting accounts.

Personnel accounting

Personnel accounting and maintenance of personnel documentation is carried out in accordance with the Labor Code of the Russian Federation. Mandatory and recommended personnel documents can be divided into:

- local labor acts: staffing schedule, internal labor regulations, vacation schedule, regulations on personal data and permission to process them, etc.;

- documents that are drawn up when registering labor relations: accounting of personnel, working hours and calculations, as well as personal documents of employees.